Household Credit Card Debt Totaled $1.21 trillion in Q2 2025

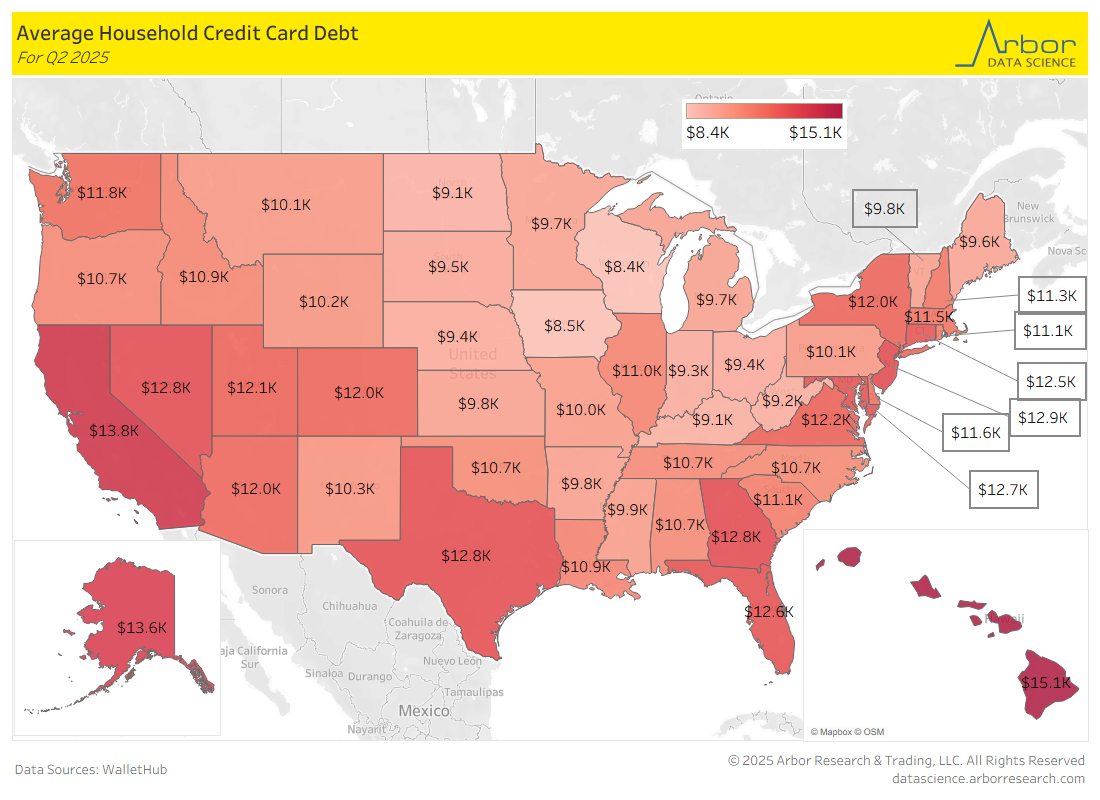

- The chart below outlines the average household credit card debt by state in Q2 2025.

- The states with the largest credit card debt were: Hawaii at $15,052, followed by California at $13,847 and Alaska at $13,630.

- The states with the smallest credit card debt were: Wisconsin at $8,424, followed by Iowa at $8,480 and Kentucky at $9,124.

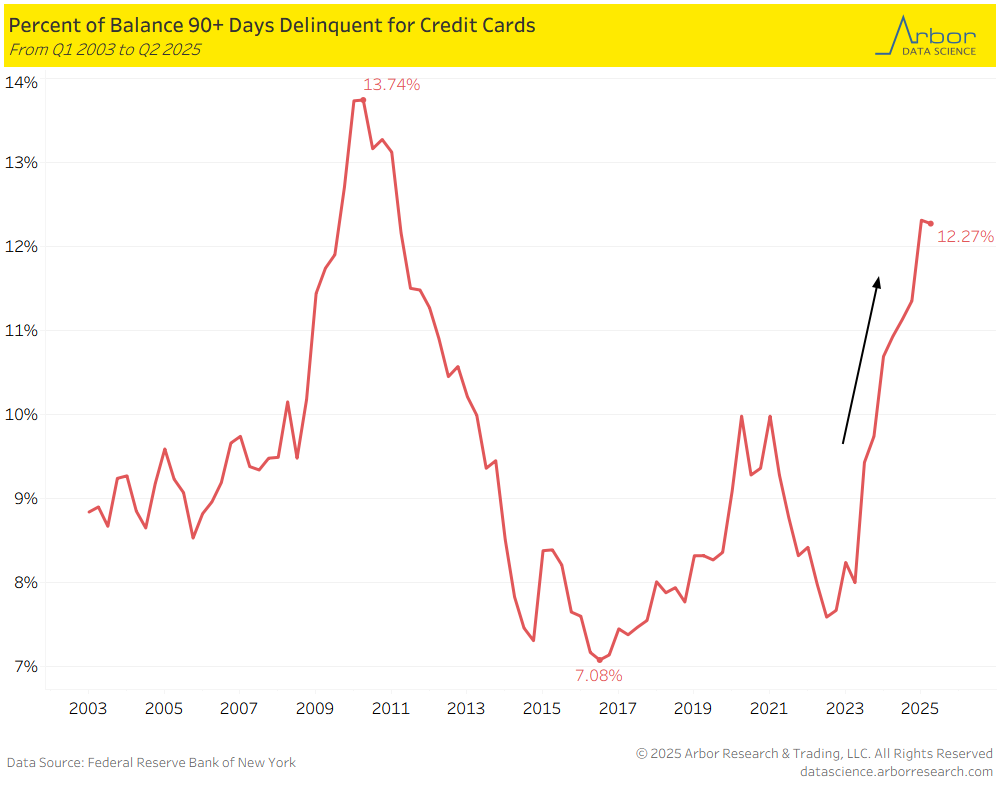

Credit Card 90+ day Delinquencies Declined Slightly in Q2 2025

- Credit Card 90+ day delinquencies have been trending higher since Q2 2023 when they were at 7.6%. They declined slightly in Q2 2025 to 12.27%. For perspective, delinquencies remain below the peak (for the time period 2003 – 2025) of 13.7% in Q1 2010.

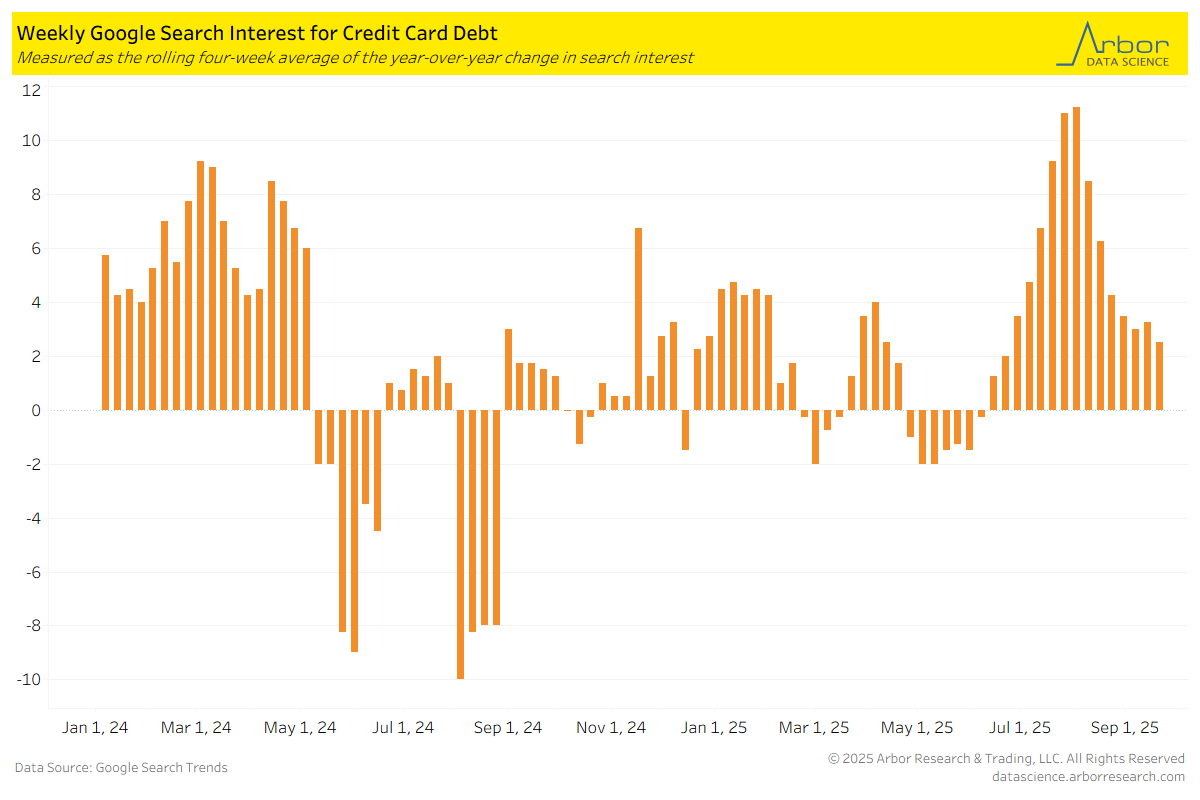

Google Search Trends for Credit Card Debt

- We utilize google search trends to gain insight into consumers’ searches for credit card debt, expressed as a rolling four-week average of the year-over-year change in hits (0-100).

- For the week ended on 9/28/2025, the term credit card debt had a positive year-over-year change in the number of hits at 2.5.

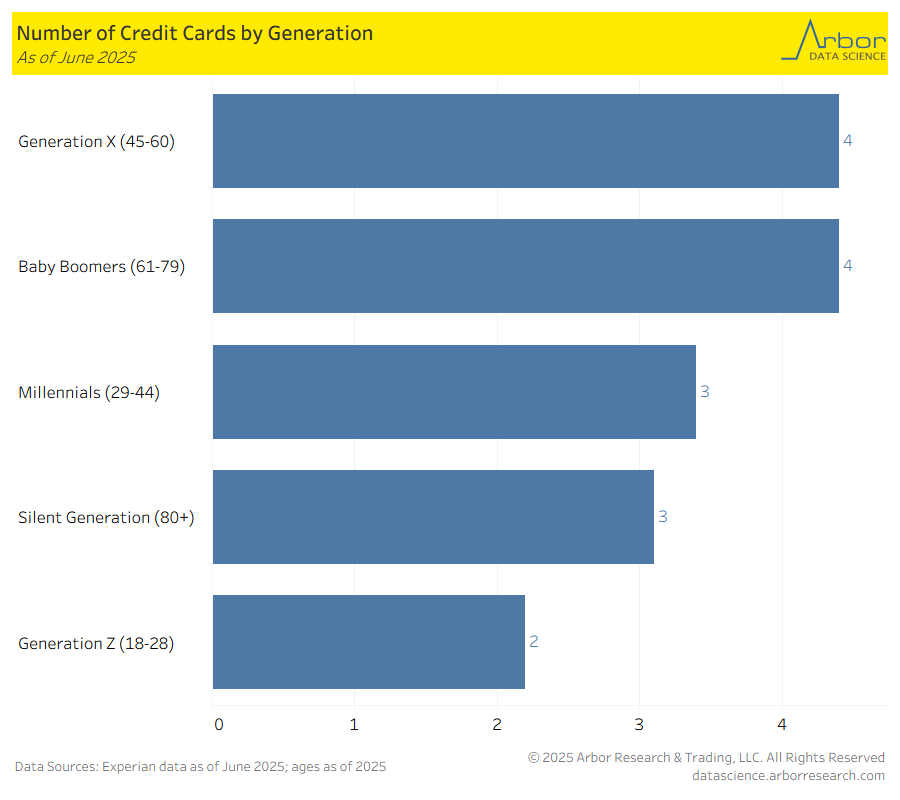

Baby Boomers and Generation X had the Largest Average Number of Active Credit Cards

- Generation X (ages 45-60): 4

- Baby Boomers (ages 61-79): 4

- Millennials (ages 29-44): 3

- Silent Generation (80+): 3

- Generation Z (18-28): 2

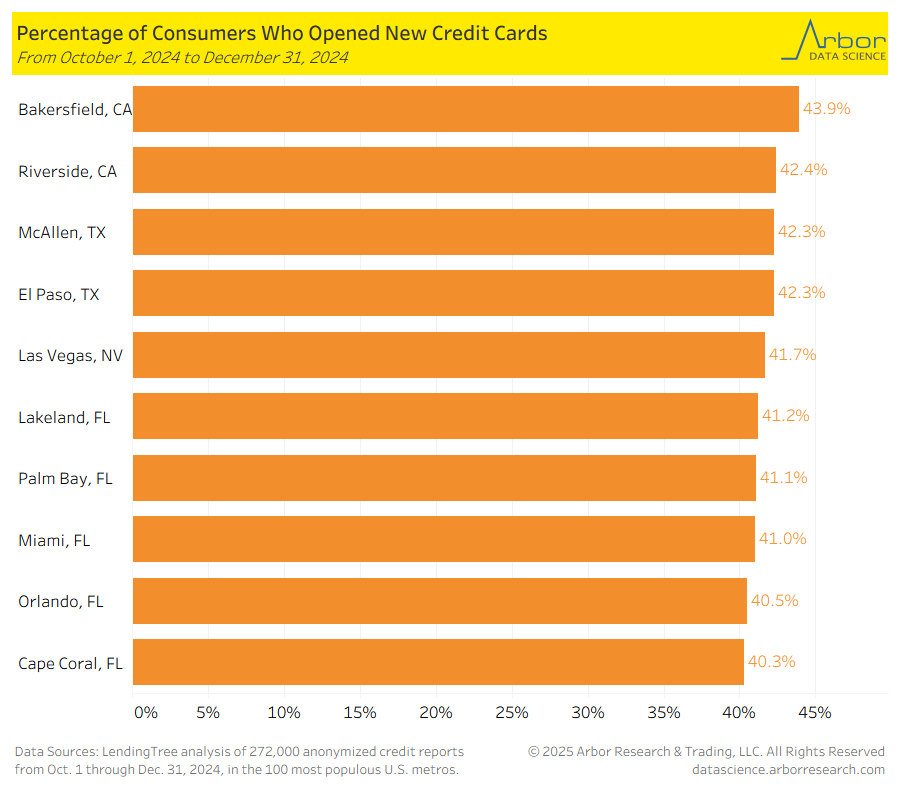

Metros with the Highest Percentage of Consumers Who Opened Credit Cards

- The last chart below outlines the metros with the largest percentage of consumers who opened a new credit card from 10/01/2024 to 12/31/2024.

- Bakersfield, CA had the largest percentage of consumers who opened a new credit card at 43.9%.