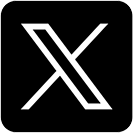

Despite the dollar continuing to surge higher, the price of gold is still near its all time high. The dollar’s strength was largely built on the backdrop of a stronger US economy expected for the next administration. However, yesterday’s news that tariffs might not be at full tilt as expected sent the dollar backwards off its highs.

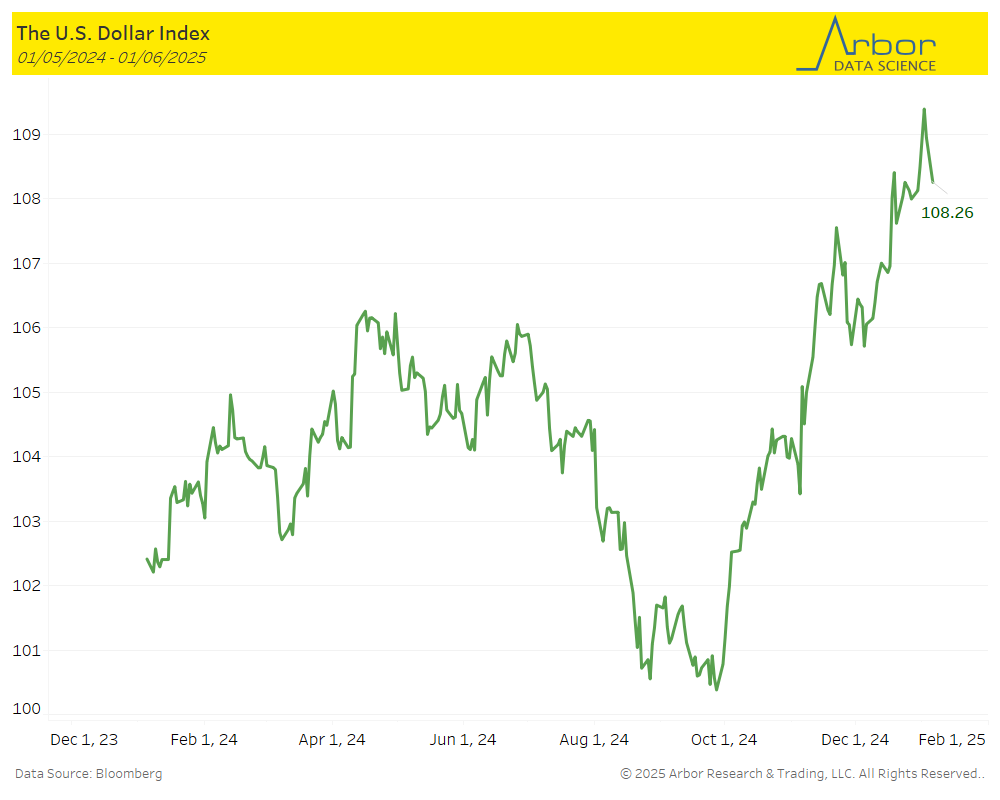

Overall, commodities have been flat since the election rally. The only meaningful mover in the commodity space has been natural gas, which was propelled by an unexpected cold surge in the United States.

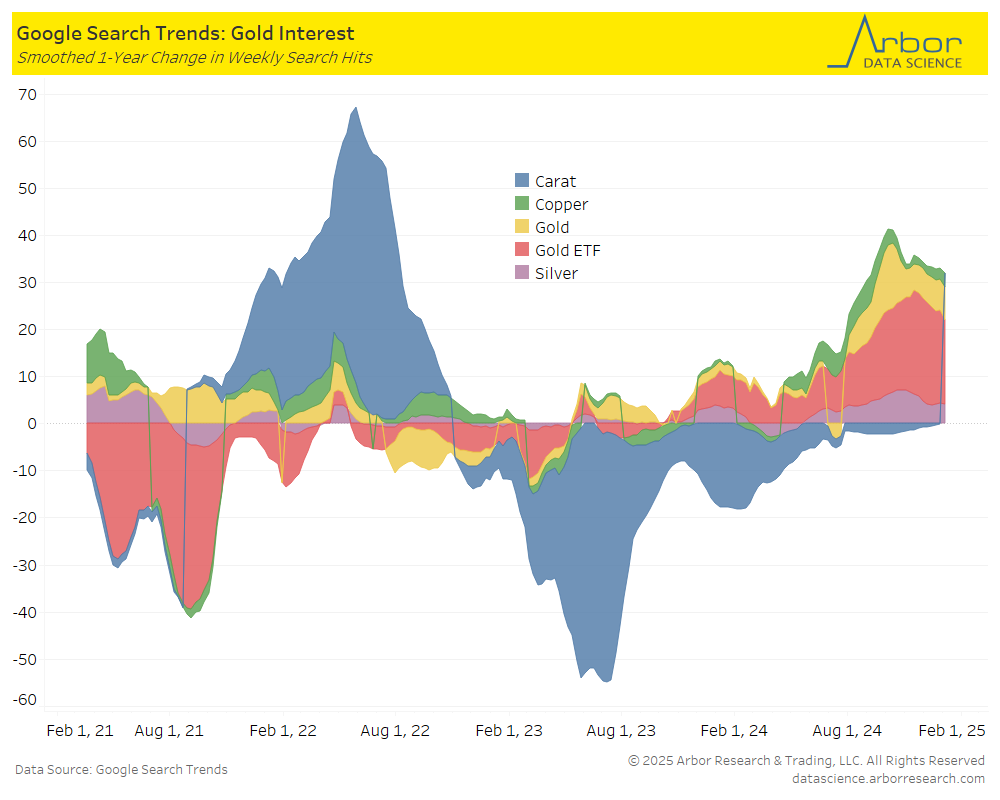

Sentiment-wise, gold and precious metal related searches continue to hold interest and we have not seen a material drop in searches related to the metal.

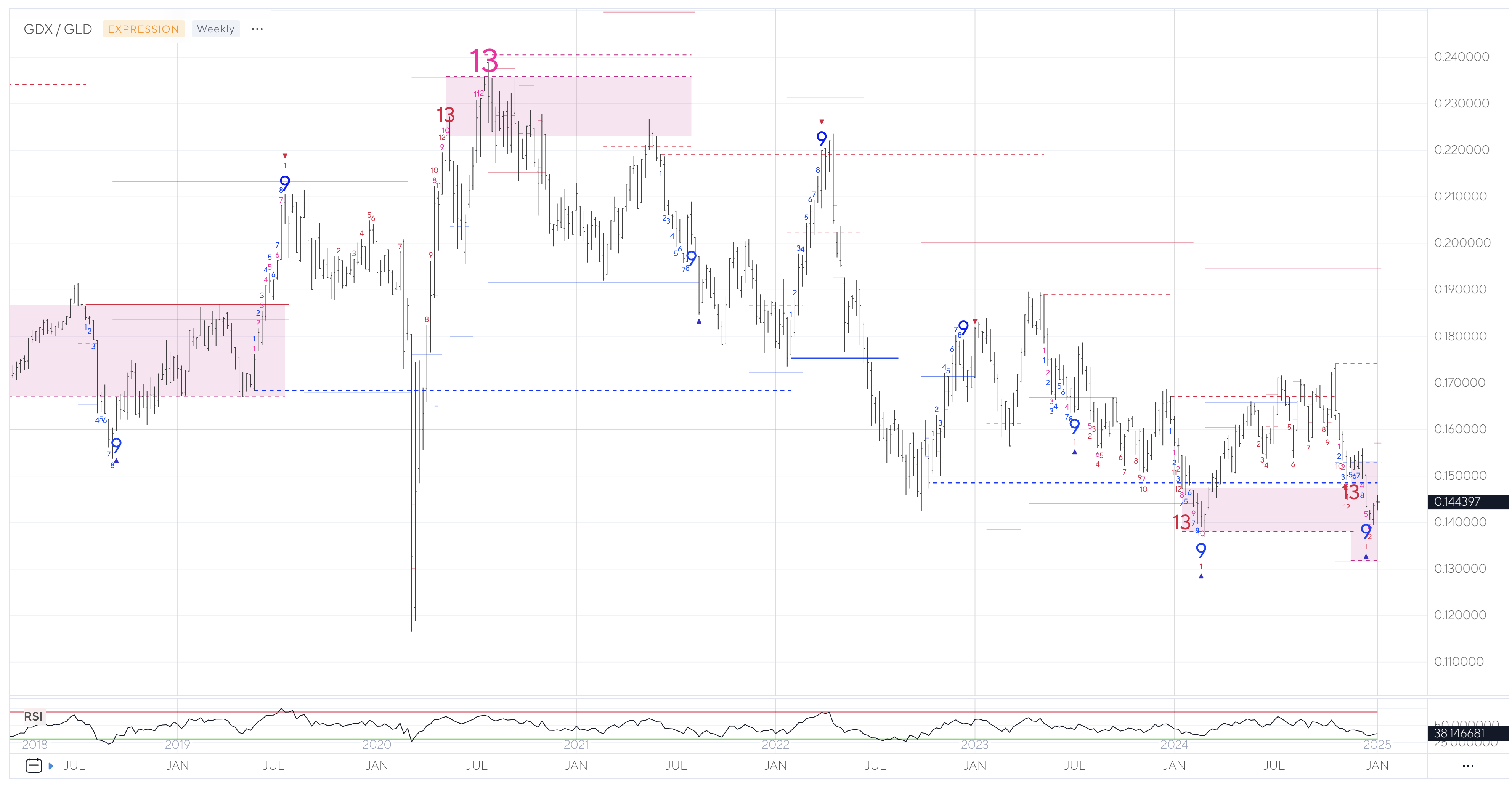

In terms of the technicals, we are still seeing a sideways consolidation after a new all time high in the spot prices of gold. What is very interesting to me is actually the differential between gold mining stocks and the underlying. We have seen GDX (the gold mining ETF) been lackluster despite a new all time high in gold. According to the DeMark analysis, we should see a reversal of this against these weekly lows below.