Not too long ago, inflation was the dictating factor of monetary policy. The FOMC’s policy function was heavily tilted away from employment and toward prices. That made sense as the economy was running near full employment. Now, the FOMC has pivoted its policy decisions away from inflation to a focus on employment. That creates a bit of a conundrum.

But, it is not as though inflation is meaningless. It could – in fact – be argued that the FOMC’s decision to downplay inflation ironically makes inflation more important now. The reason? Employment is showing signs of weakening, but inflation is showing signs of resilience. Not the type of inflation seen in the 2021 -2022 time frame. But inflation has not been broken. That means rate cuts may be perceived as further stoking inflation, and that will lead to consequences.

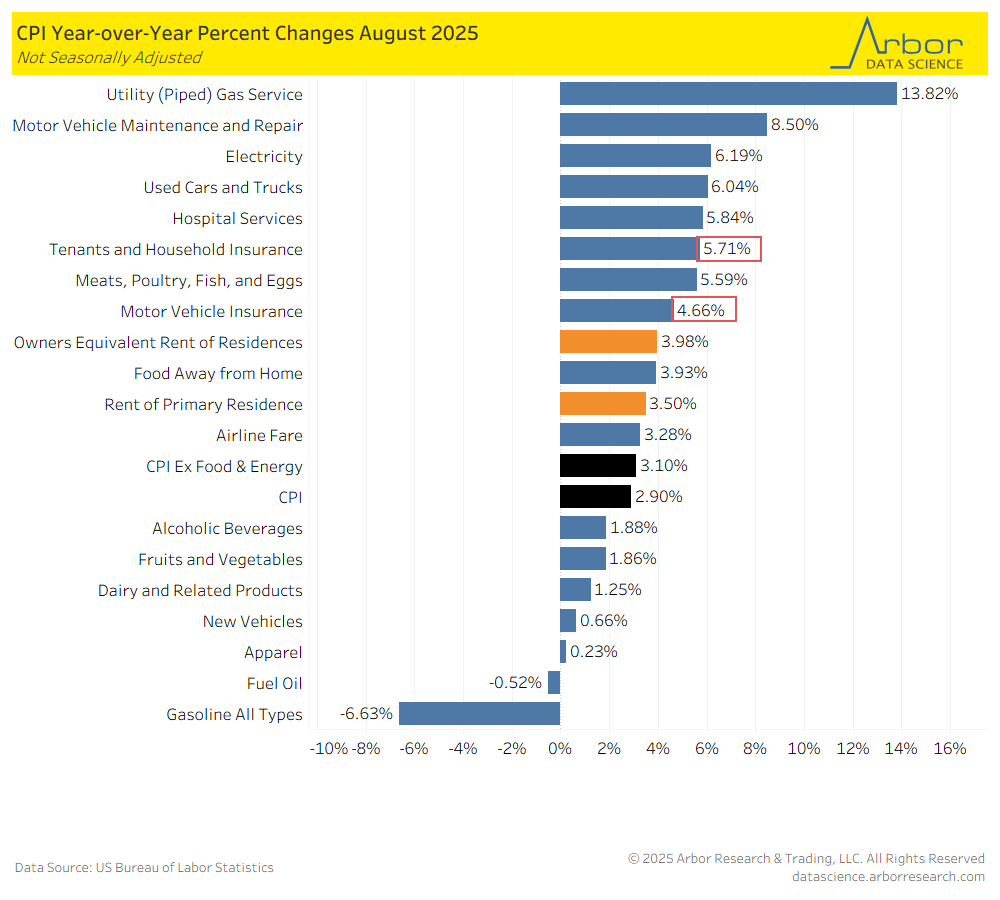

Encouragingly, many of the inflationary lines are not things to be too worried about in the longer-run. We have seen the used car cycle before. The most encouraging sign on that front is the continued decline in motor vehicle insurance costs. That has been a troublesome spot for years. It waning is important.

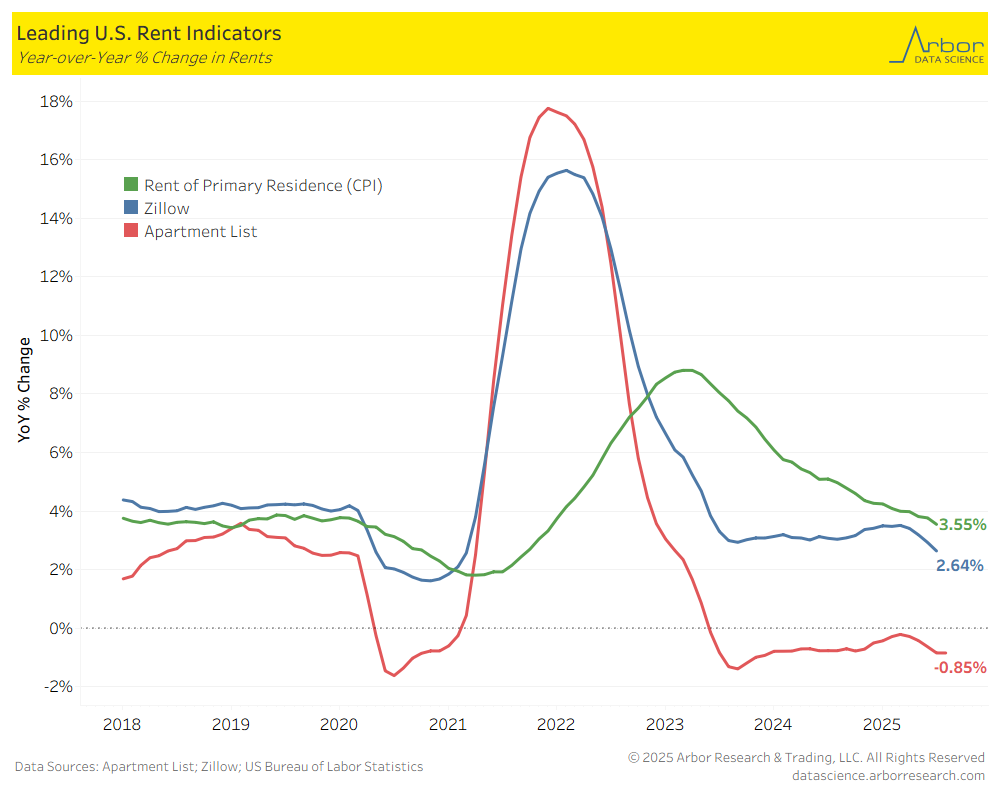

And there remains a bit of an oddity in housing. Rents are not rising, and the continuation of the official data showing this is strange. Rents are struggling due to significant supply coming on. Not to mention the old saying, “rents are too … high” to begin with. That makes the comparables increasingly difficult to roll over. At some point, there will be a natural correction in the figures. Apparently, that was not this month. Yes, there is disinflation. No, there is not enough to make it matter. Yet.

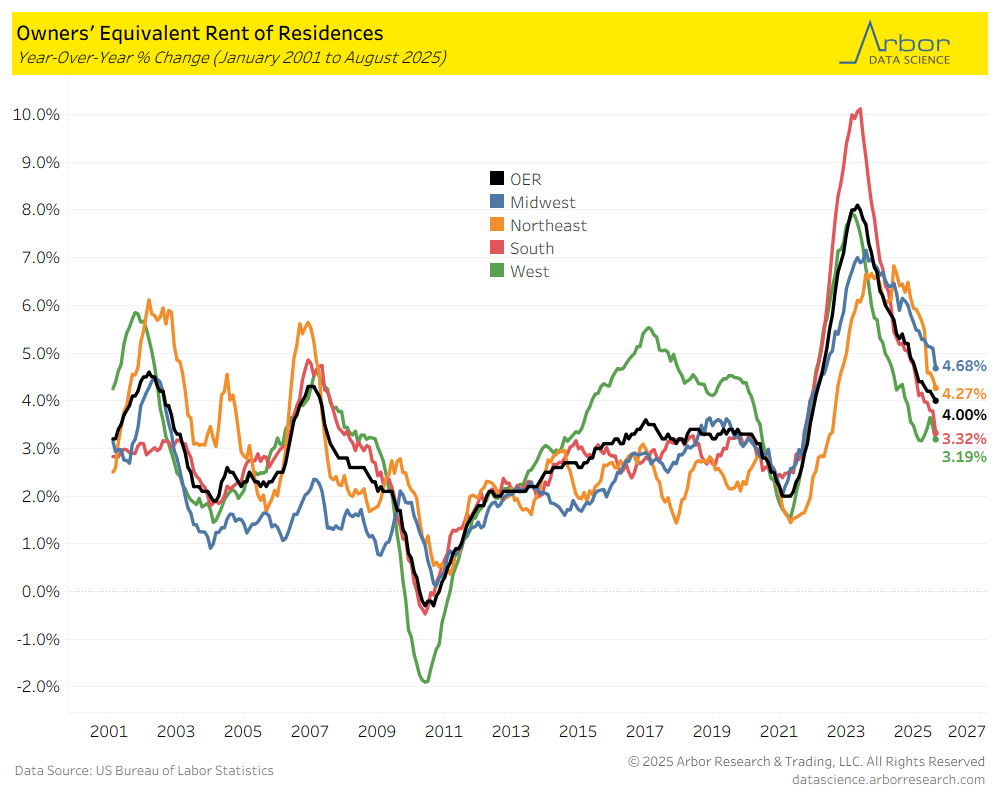

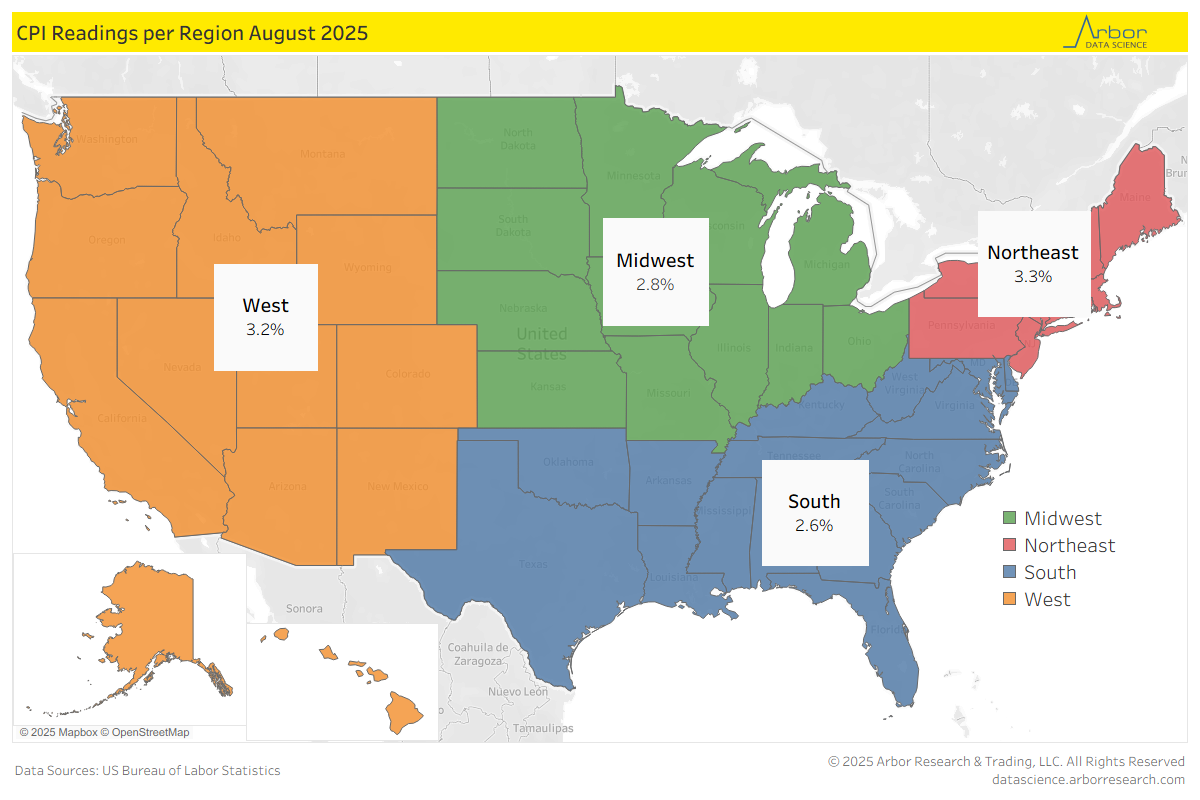

When it comes to the primary residence metric, it is not all that different. The story is the same as the past few months. The South is leading the disinflation theme. But, every geographical area is heading lower. That was not the case months ago. Then the story was the South driving the numbers lower. Now it is everywhere in tandem. And that is consequential.

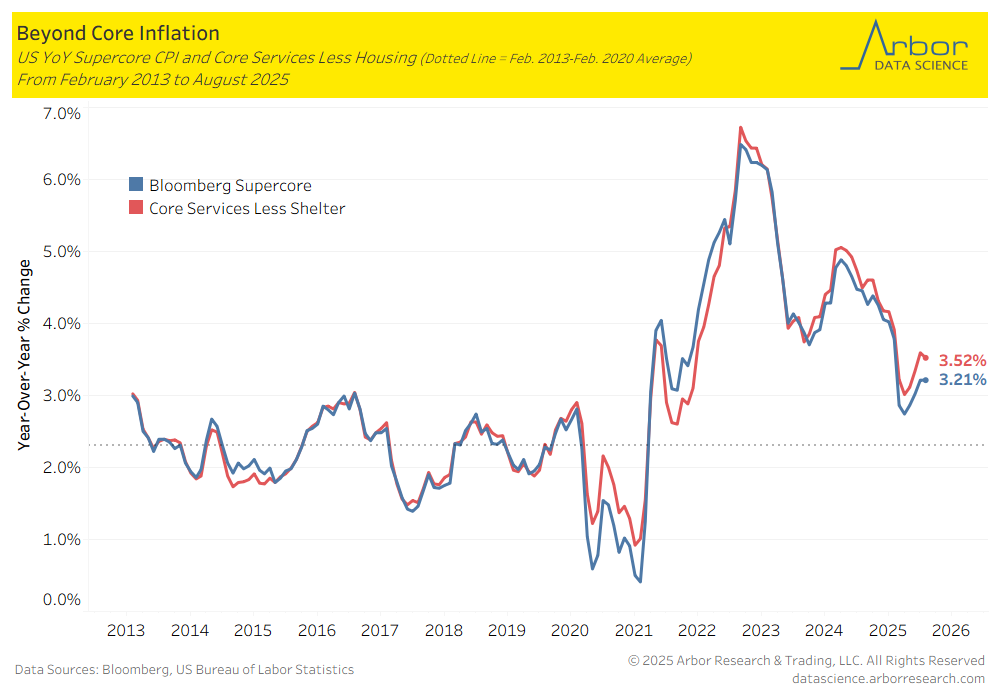

The supercore readings had their seasonal bounce (which does not seem to be adjusted out properly). And it was not as dramatic as the prior year. That suggests lower readings going forward, and that would make FOMC cuts both more probable and justified.

There is a regional issue though. The West and Northeast are not seeing deflation in the same way as the South and the Midwest. That might be an issue going forward. But it is not an issue for today. The FOMC is going to begin cutting rates, and inflation is a minor part of the calculus. But inflation is not dead. Instead, it is only slowly fading.