Average Credit Card Debt by State in Q1 2025

- Utilizing data from LendingTree, we constructed the heatmap below which outlines the average credit card debt in Q1 2025 (most recent data available).

- The states with the largest credit card debt were: New Jersey at $9,382, followed by Maryland at $9,252 and Connecticut at $9,201.

- The states with the smallest credit card debt were: Mississippi at $5,221, followed by Kentucky at $5,237 and Arkansas at $5,245.

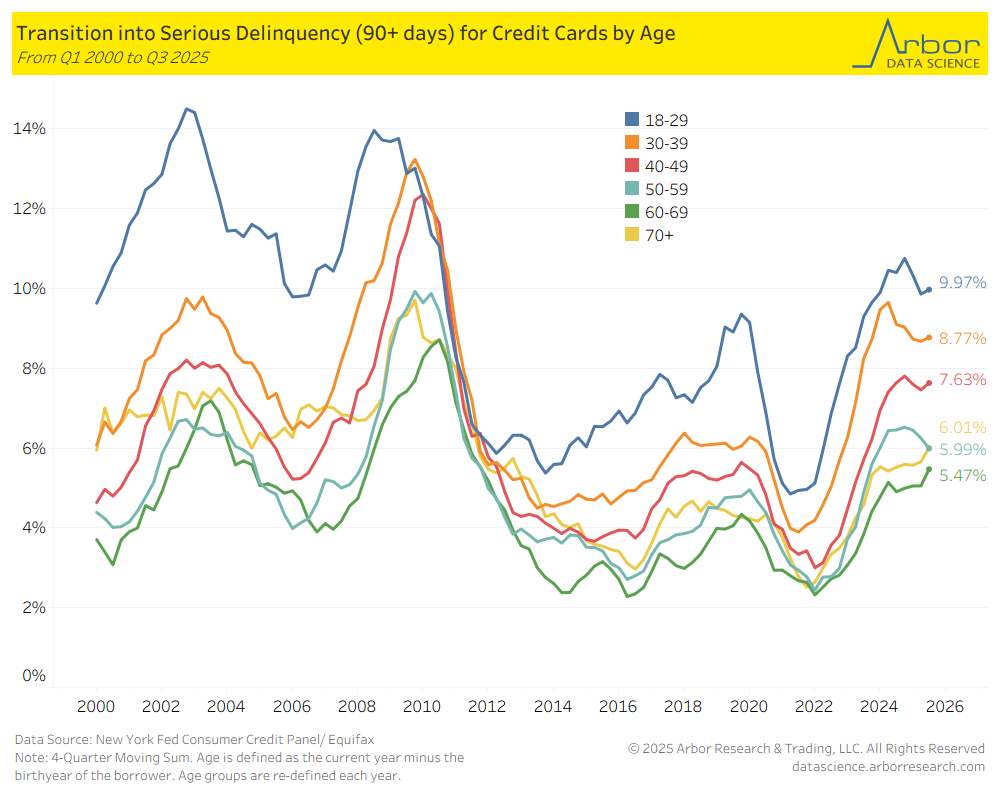

The Serious Delinquency Rate for Credit Cards Moved Higher for the Majority of Age Groups

- The chart below outlines the serious delinquency rates (90+ days) for credit cards by age group from Q1 2000 to Q3 2025. All age groups had a uptick in delinquency rates in Q3 2025 from Q2 2025, while the age group 50-59 year olds had the only decline in Q3 2025 from Q2 2025.

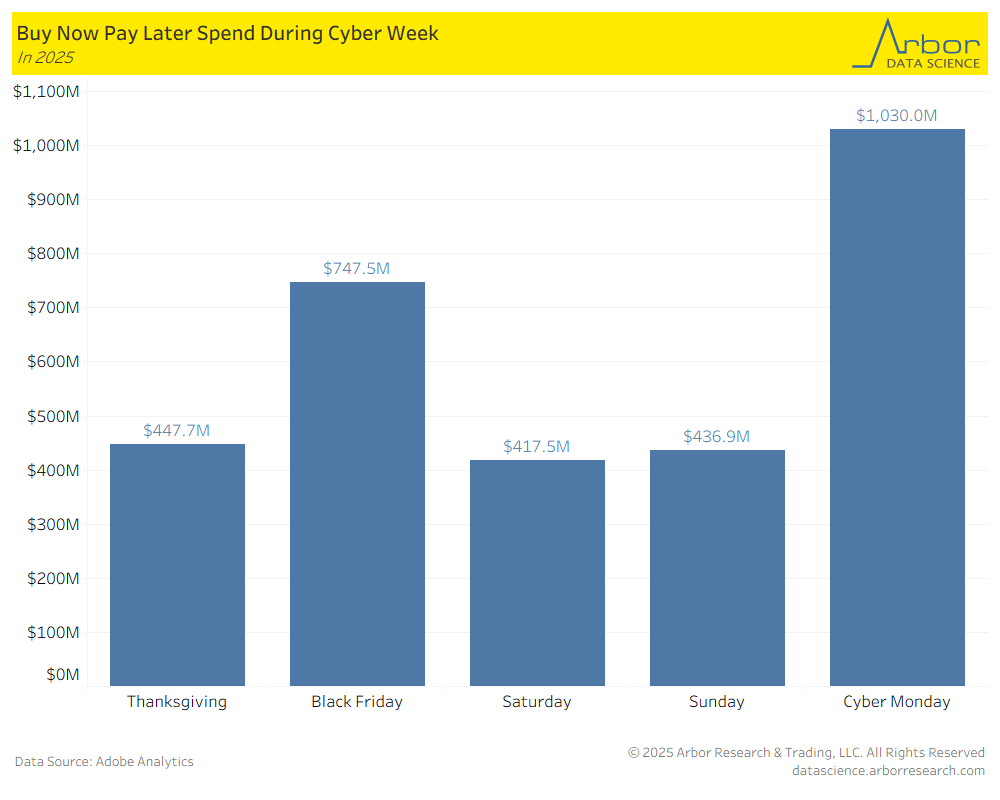

BNPL Spend Surpasses $1 Billion During Cyber Monday in 2025

- Utilizing data from Adobe Analytics, the chart below highlights the buy now pay later (“BNPL”) spending during the week of Thanksgiving in 2025. BNPL users used this payment method to spend over $1 billion during Cyber Monday in 2025.

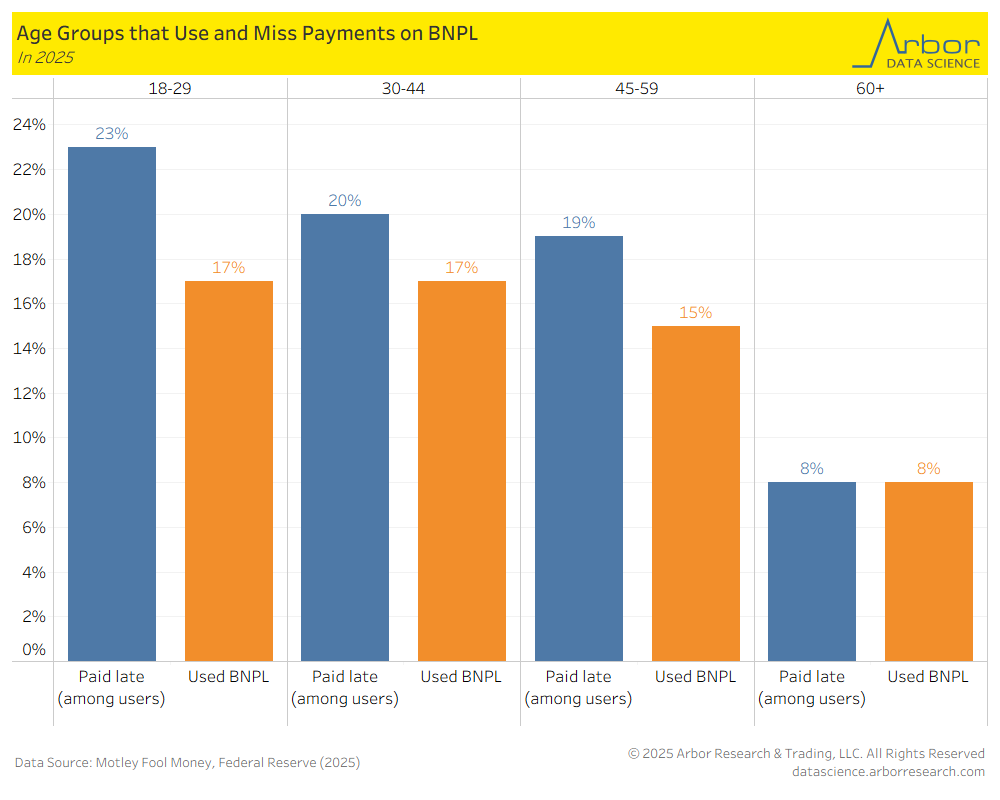

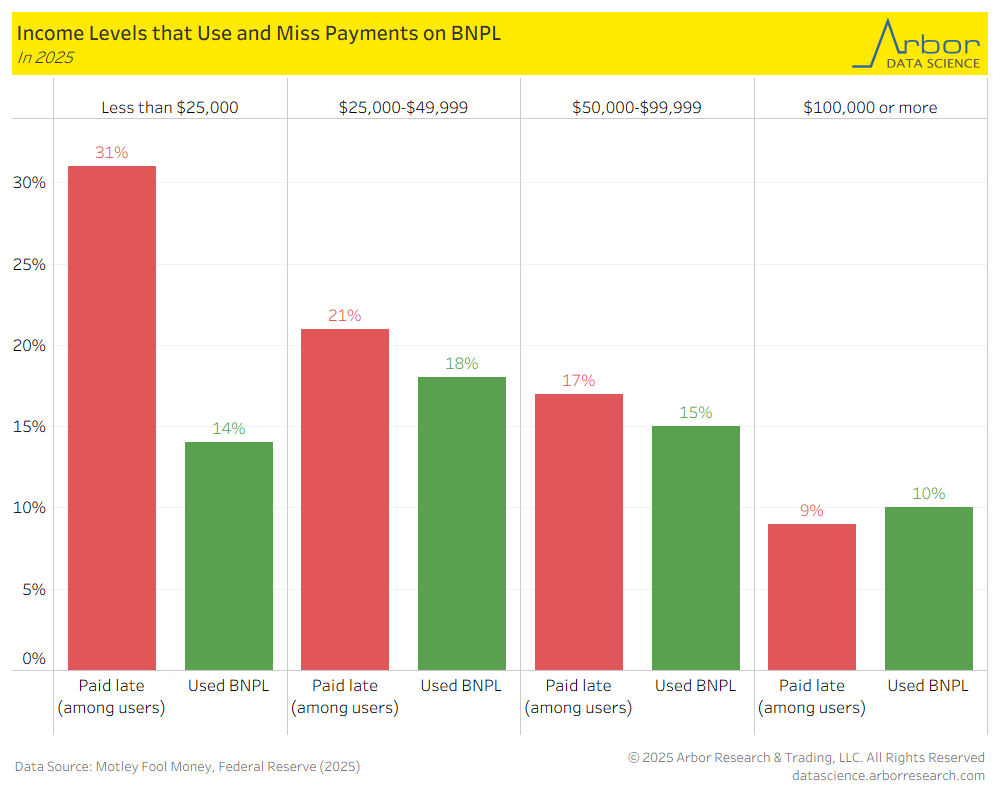

Age Groups and Income Levels Who Use BNPL

The next two charts look at who uses BNPL by age. We highlight those who have missed payments through BNPL by age group and by income level in 2025.

- The age groups who used BNPL the most were 18-29 year olds and 30-44 year olds at 17% each. To note, 23% of the 18-29 year olds who use BNPL paid late.

- There were 18% of those making $25,000 to $49,999 who have used BNPL.

- 31% of those making less than $25,000 have paid late on a BNPL payment.

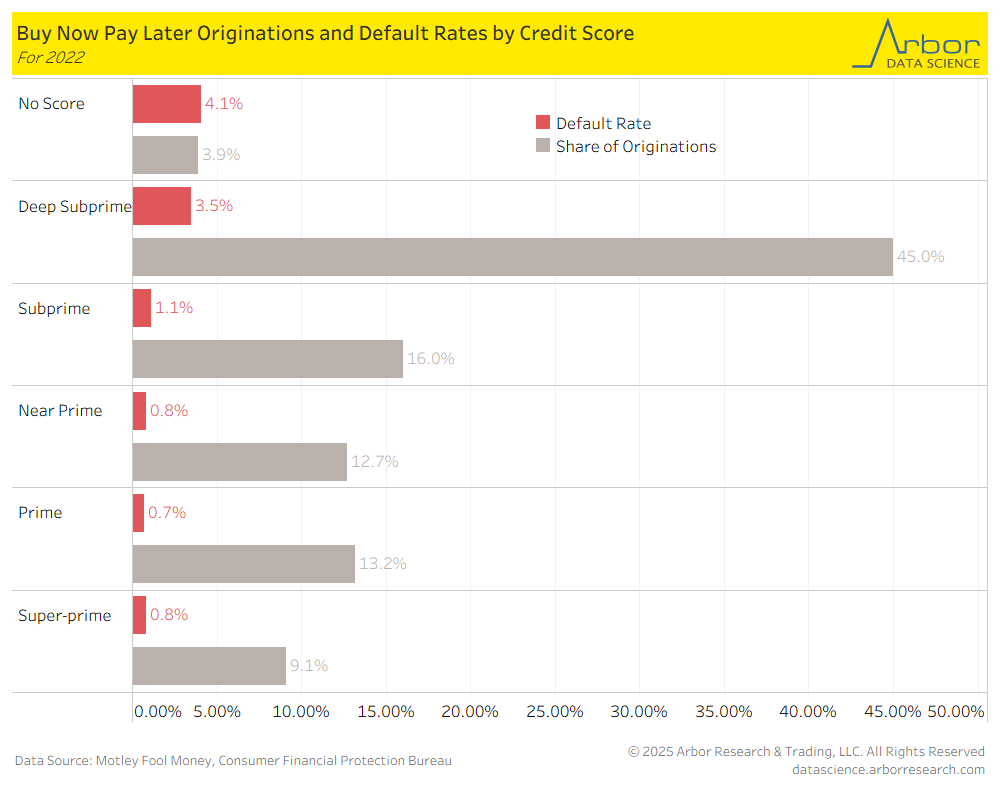

Default Rates for Buy Now Pay Later Loans

- Utilizing data provided by the Consumer Financial Protection Bureau, the chart below examines the BNPL originations and default rates by credit score in 2022 (most recent data available).

- 45.0% of borrowers with deep-subprime credit score used BNPL, and 3.5% of those borrowers defaulted on those payments.

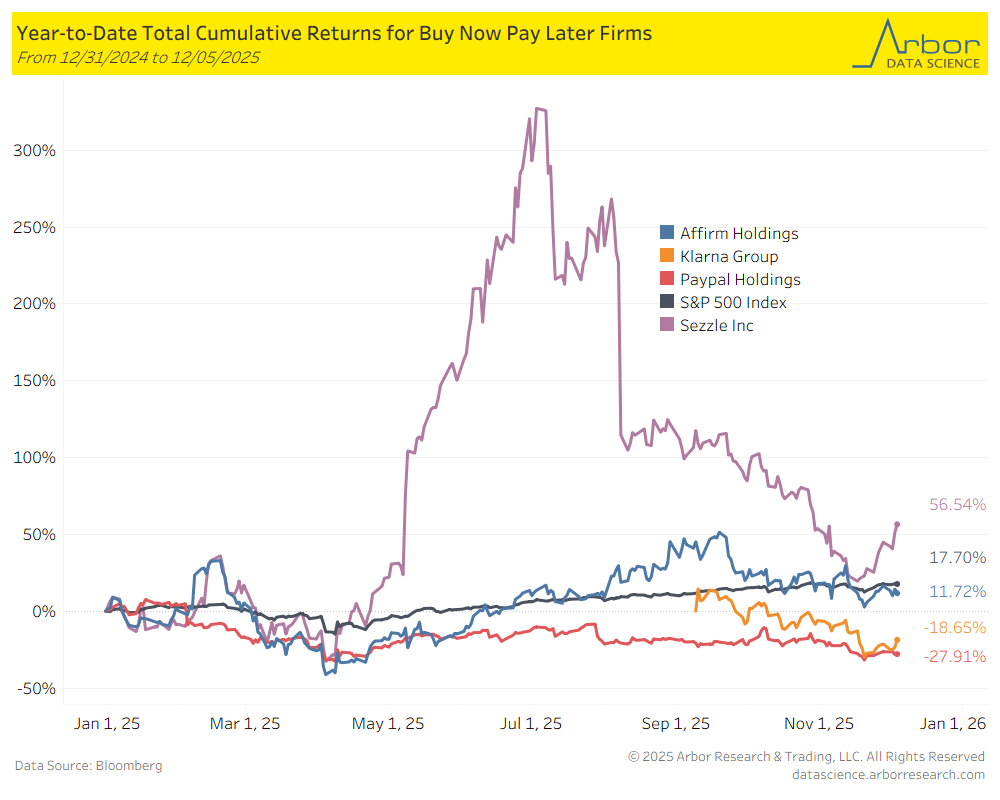

How Are the Buy Now Pay Later Companies Doing?

- As of 12/04/2025, Sezzle Inc. had the largest year-to-date return at 56.54%, and Affirm Holdings at 11.72%. Klarna Group and Paypal Holdings both had a negative year-to-date return at -18.65% and -27.91%, respectively.

- For reference, the S&P 500 had a return of 17.70% as of 12/04/2025.