This post utilizes speeches from five Central Banks to examine their outlook on the economy. Note that date of the most recent available data may vary for each of the Banks.

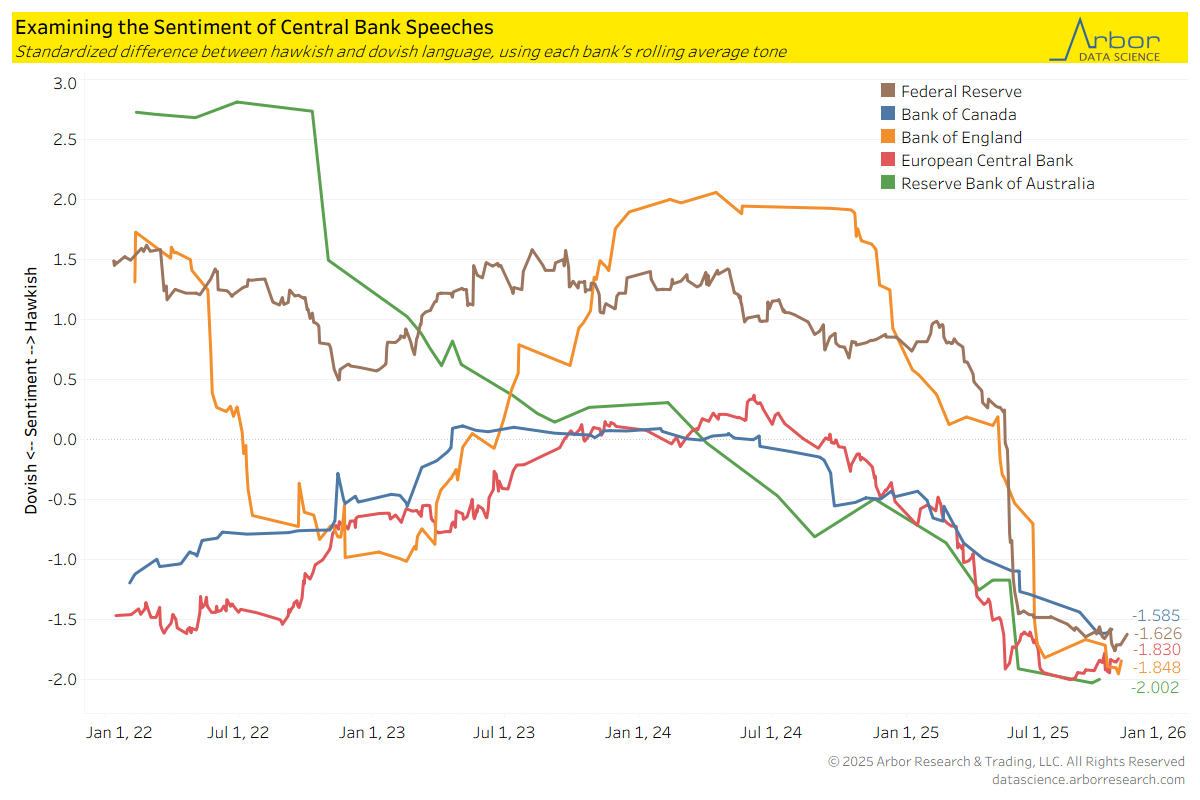

Hawkish-Dovish Sentiment

- This most recent update illustrates that the Reserve Bank of Australia was the most Dovish of these five Central Banks, while the Federal Reserve was the least dovish as measured by the difference between hawkish and dovish language in speeches.

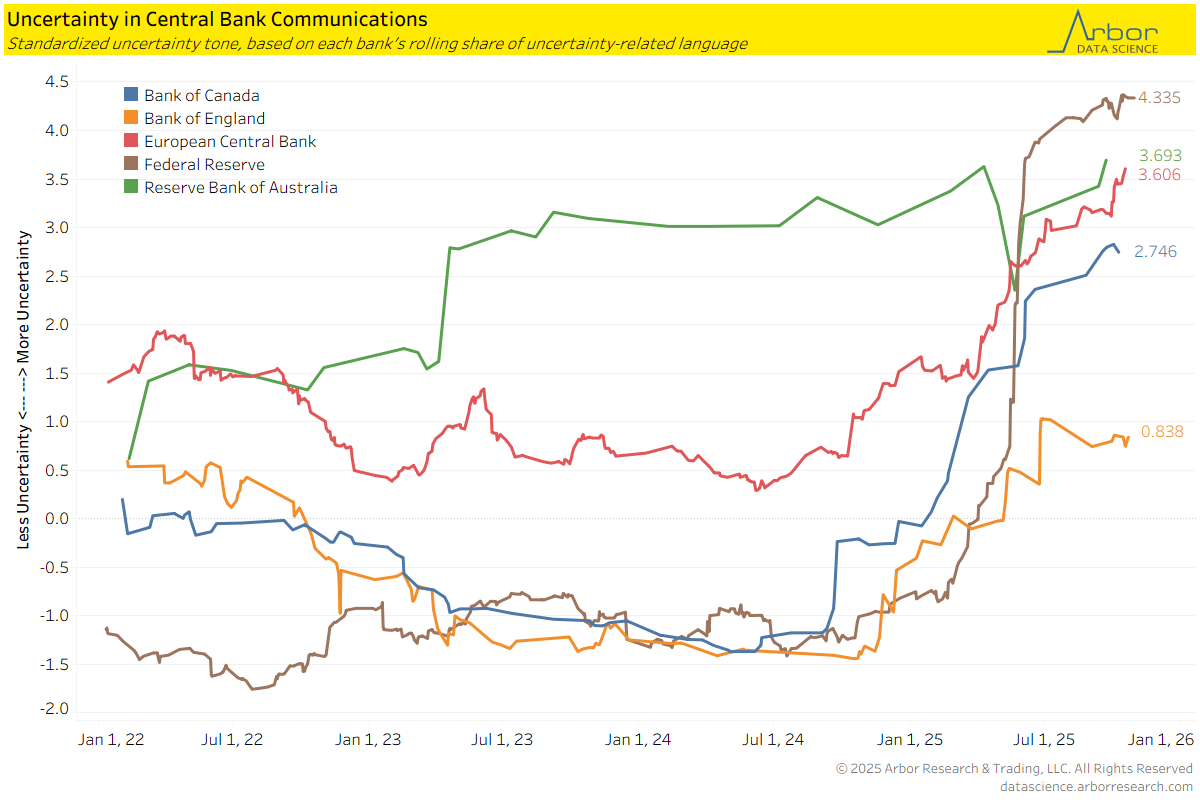

Uncertainty on the Rise

- With data through 10/30/2025, the Federal Reserve had the highest measure of uncertainty in their speeches based on the relative use of uncertainty-related language. The Federal Reserve had the lowest levels of uncertainty to start 2025.

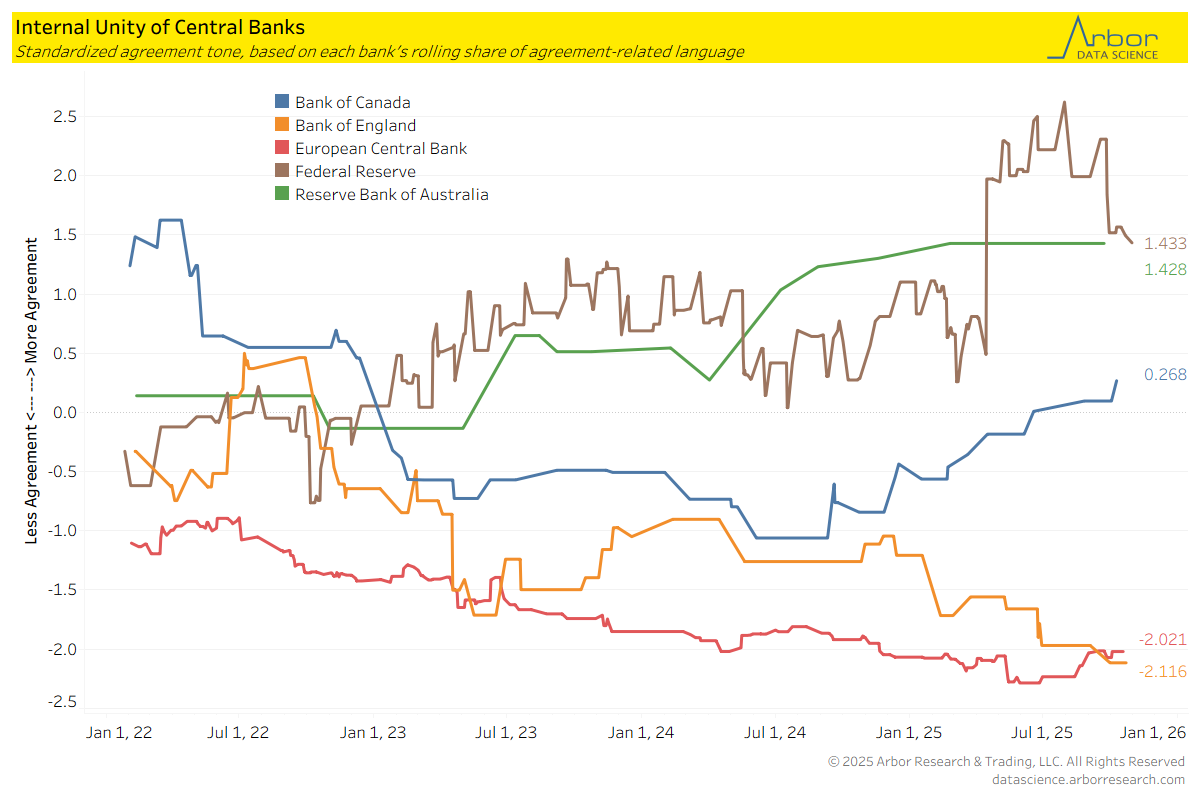

Unity within the Central Banks

Unity within the Central Banks

- Despite a difference of opinion at recent FOMC meetings, the Federal Reserve has had the highest levels of agreement in its speeches based on agreement-related language in their speeches when compared to its peers.

- The Bank of England and the European Central Bank have lower levels of agreement in their speeches.

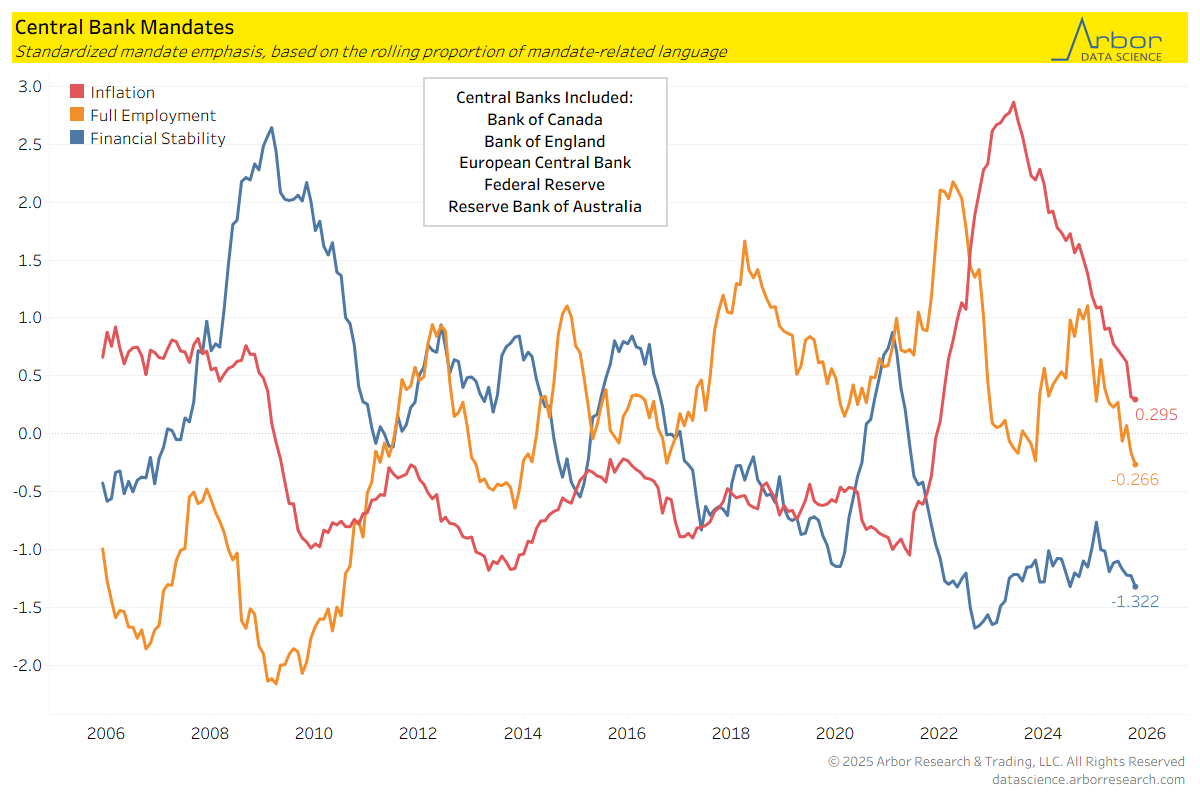

How these Banks are Balancing Inflation and Employment

- As of October 2025, inflation was still the main focus in speeches for these five Central Banks. However, the proportions of discussions around inflation have decreased since its peak in the pandemic.