In an effort to gauge the current pulse of the consumer, we utilize data from Edelman Financial Engine’s 2024 report: Deloitte’s State of the US Consumer: August 2024 report and Everyday Wealth in America in the charts below.

We begin by revisiting egg prices as a proxy to examine the financial well-being of the consumer, along with largest stressors impacting financial security. Finally, we illustrate the amount of wealth that is expected to be inherited by generation.

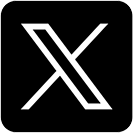

First off, do you remember the spike in egg prices last year?

- Eggs are a very good indicator of food shoppers’ priorities at the grocery store.

- Although egg prices retreated after peaking on January 1, 2023, egg prices remain above the historical average, as illustrated in the chart below, which outlines the US CPI Egg Index. Egg prices have continued to increase the past consecutive four months hitting 333 in August 2024.

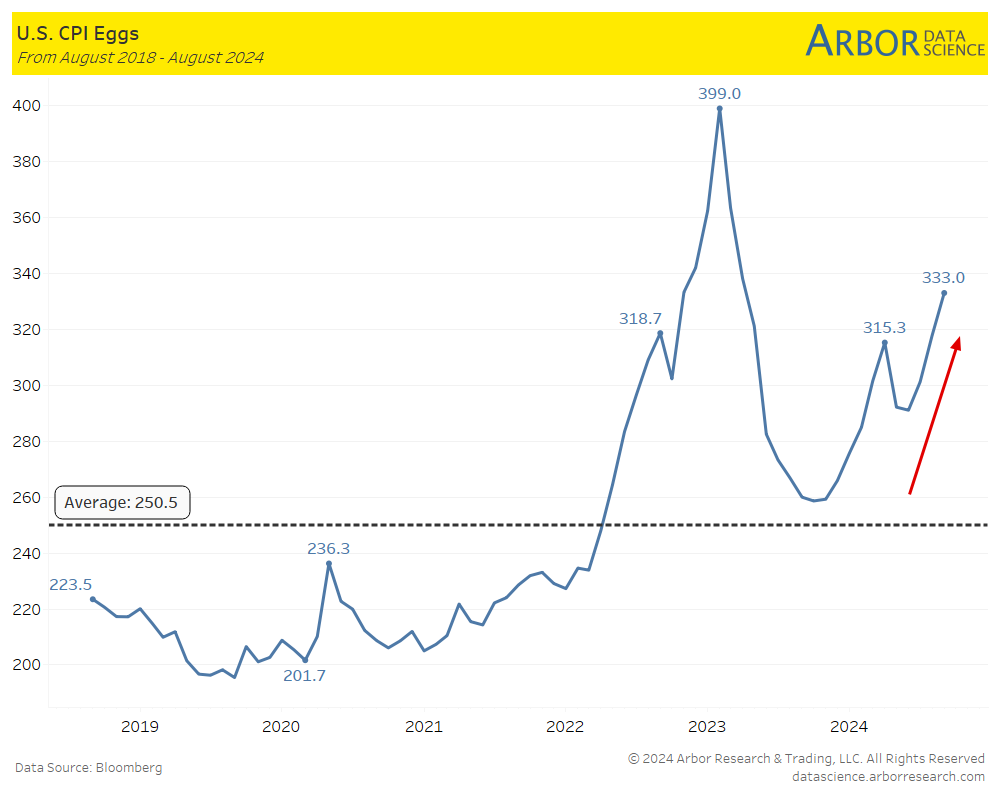

Financial Well-Being Index

- The first chart illustrates Deloitte’s financial well-being index which captures changes in how consumers feel about their current financial health and future financial security. Higher values suggest stronger financial well-being.

- The green line represents the global index. It is defined as the average of 8 of the top 10 global economies according to World Bank, using 2022 GDP. It decreased in August 2024 to 103.7 from 104.5 in July 2024.

- The blue line represents the U.S. index, which has been below the global index since October 2022. It declined in August 2024 to 99.3 from 102.6 in July 2024.

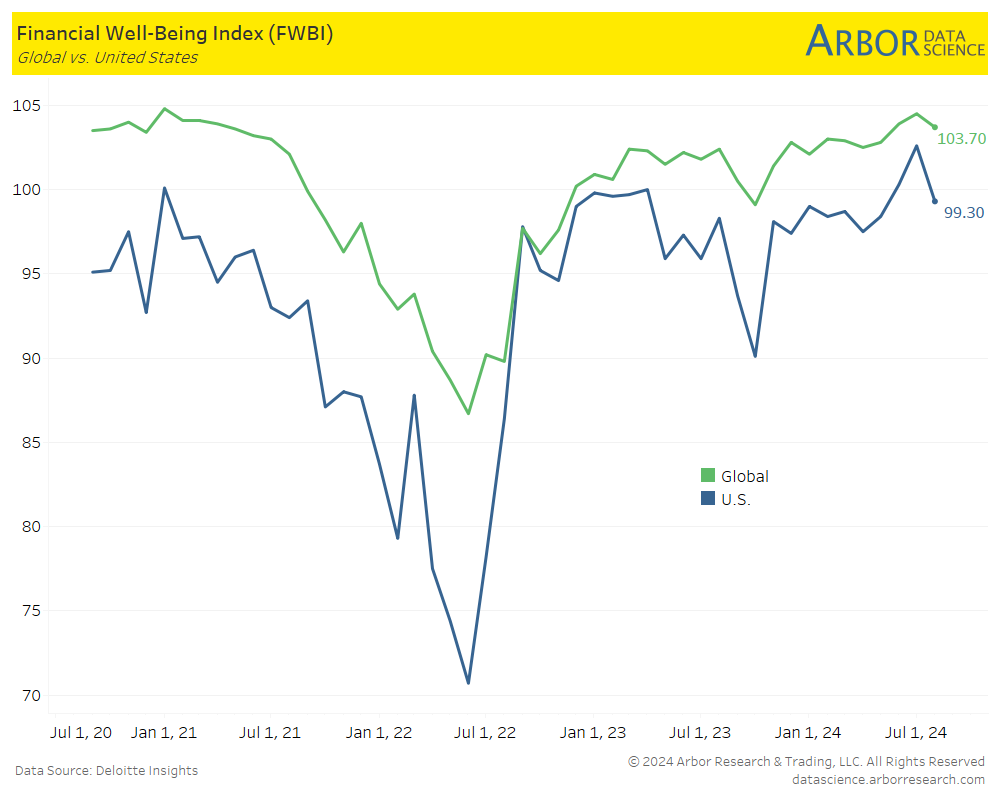

- The next chart illustrates the Financial Well-Being Index along with U.S. Headline Inflation (red line), which declined to 2.5% in August 2024.

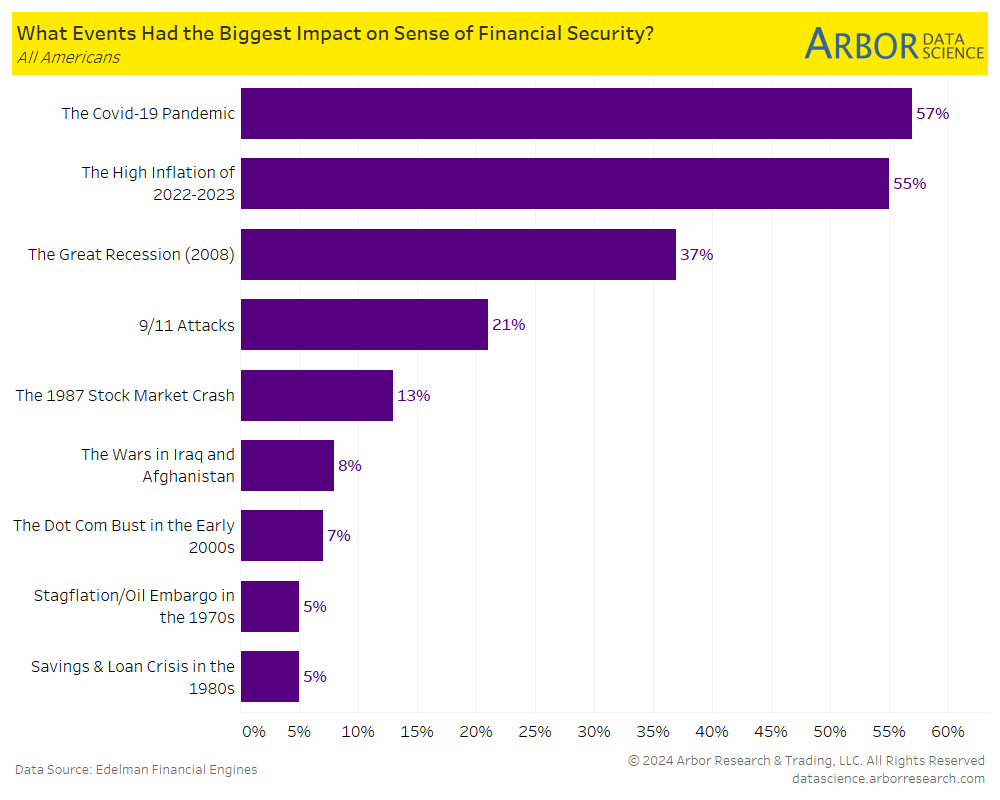

What Events Have Had the Greatest Impact on Consumers’ Financial Security?

Pandemic cited as having caused greater concern for financial security than the Great Recession of 2008

- 57% of consumers responded that the Covid-19 pandemic had the biggest impact on their sense of financial security according to Edelman’s: Everyday Wealth in America. This compared to 55% who said the high inflation of 2022 – 2023 had the biggest impact and 37% who responded the Great Recession.

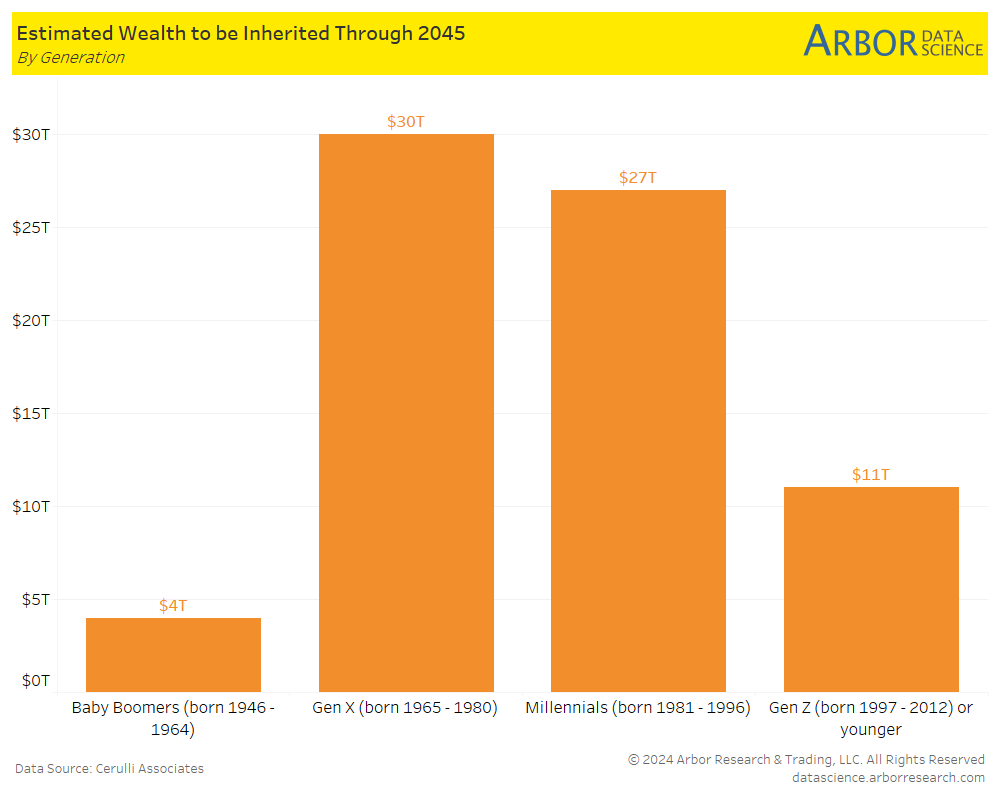

Money Changing Hands… The Greatest Wealth Transfer in History

- Over the next two decades, approximately $84 trillion in assets is projected to flow to next generations, according to Cerulli Associates. The largest share of $30 trillion is expected to flow to Gen X, followed by $27 trillion to Millennials.

- How will this impact the Financial Well-Being?