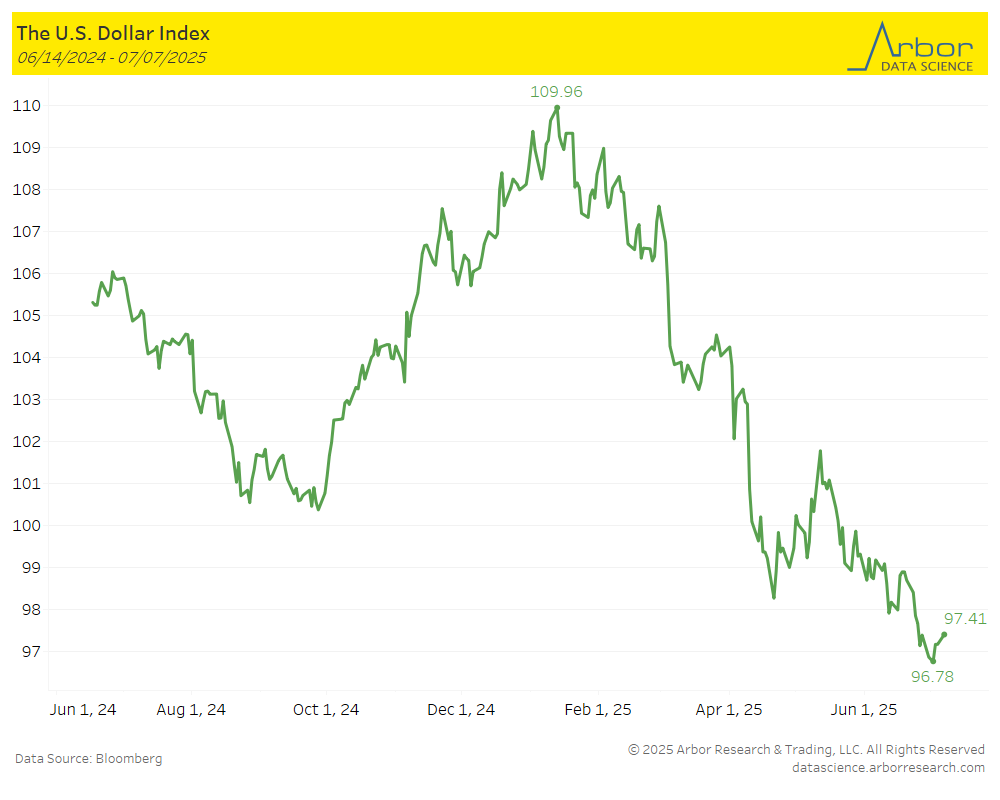

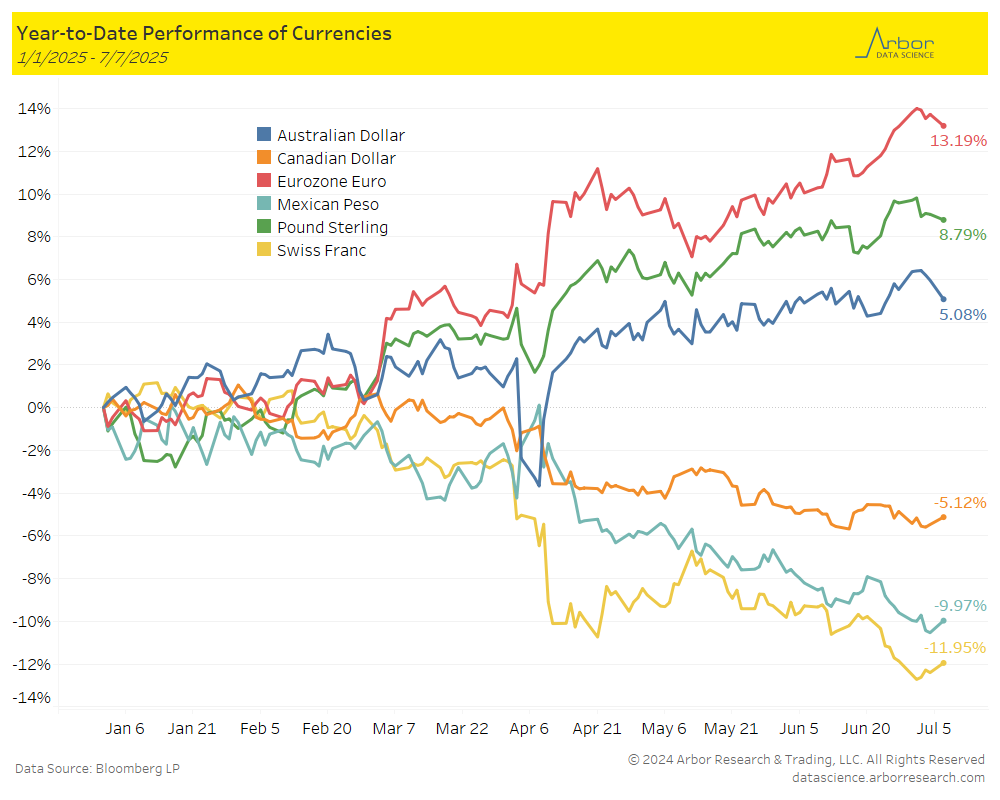

The dollar remains in a strong bear trend. Although I was slightly early in December, my call for a weaker U.S. dollar has largely played out. The repricing of dollar demand and tariffs has mostly been absorbed by the market. The Fed’s dovish tilt is now reflected in front-end rates, while yield differentials versus Bunds and Gilts have narrowed. In addition, some mildly softer economic data has begun to show up in the mix.

Below is a chart of the Dollar Index over the past year, along with the relative performance of G10 currencies.

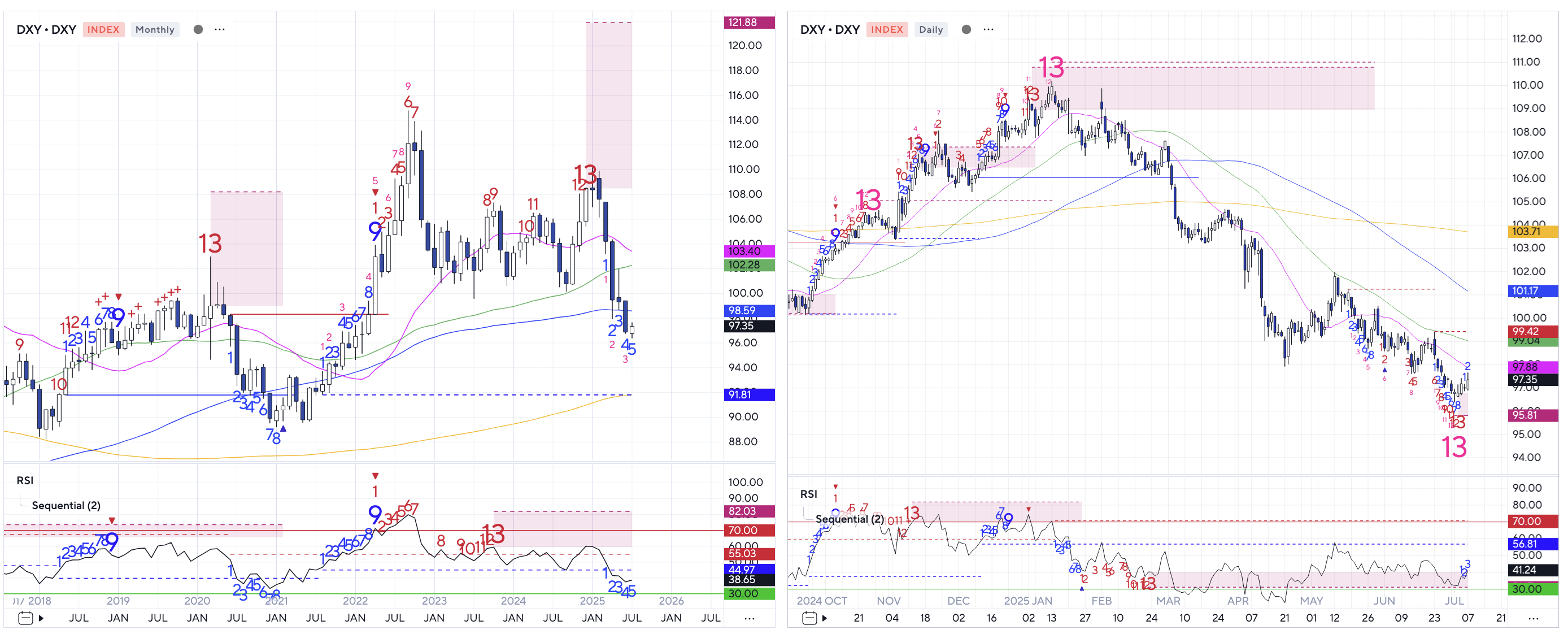

Historically, some of the strongest trends have been manifested in currencies. FX trend trading has been one of the main macro vehicles for expressing views over the past 50 years. To time these ideas, I continue to rely on DeMark indicators, coupled with a quantamental overlay. We had a monthly 13 sell Sequential coming into the year, and we knew the administration was low-dollar oriented, among other factors. This trade was really that simple.

But who’s selling dollars now?

We have active daily 13 buy Countdowns, as well as a forming 9 buy Setup on the weekly chart. As I mentioned in the intro, I believe most of the meat of this move has already been priced in. Those shorting the dollar in hopes of further weakness may be slightly late here.

Is there a reason for the dollar to rally significantly? I try to keep things politically neutral, as I consider myself tribe-less — neither left nor right. But let’s hypothetically consider the implications of the administration’s plans to bolster the U.S. economy over the coming years. If they succeed, could the dollar be undervalued relative to where it was before the election? I believe so.