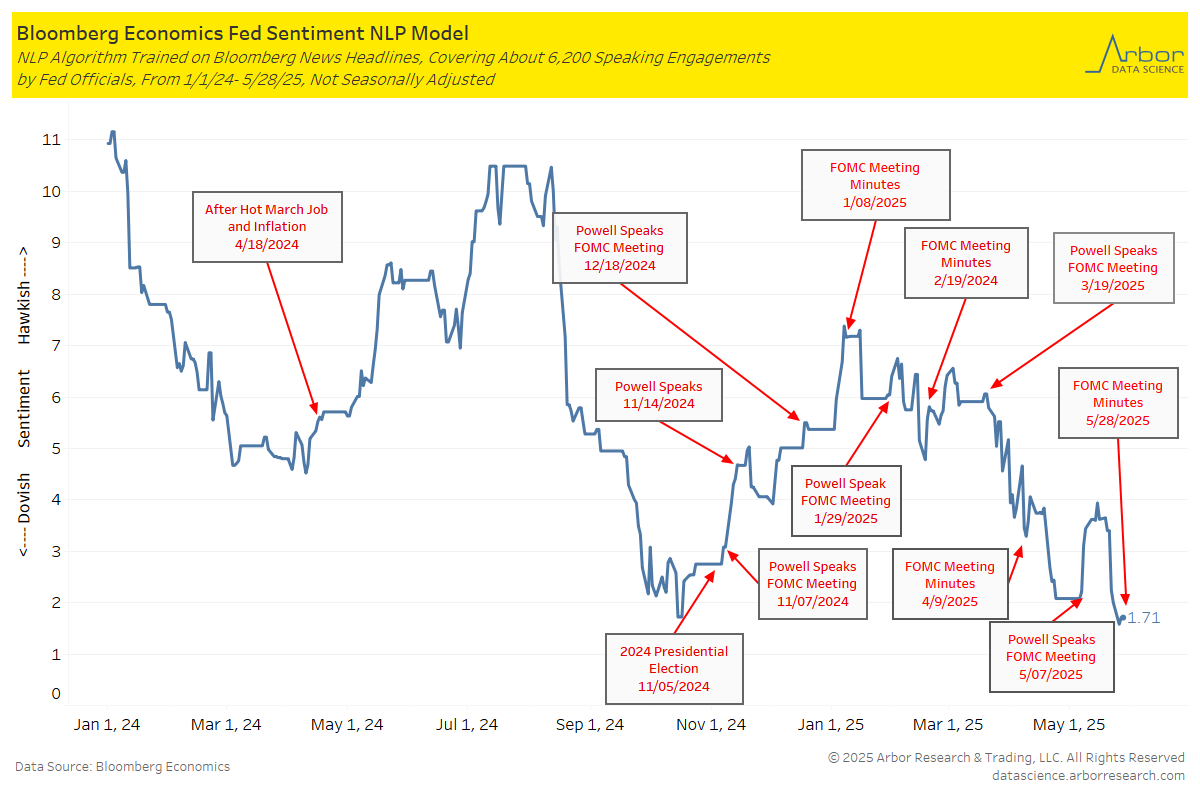

Bloomberg’s Economic Fed Sentiment Natural Language Processing Model Indicates Dovish Sentiment

We illustrate Bloomberg’s Economic Fed Sentiment Natural Language Processing Model in the chart below (expressed as an index) for the period 1/1/2024 to 5/28/2025. The lower the number indicates more Dovish sentiment, and the higher the number, indicates more Hawkish sentiment.

- The value of the index on 5/28/2025, which was the date that the FOMC meeting minutes were released, was 1.71. This was a increase from 1.49 on 4/09/2025, which was the last FOMC meeting minutes, indicating a Dovish sentiment.

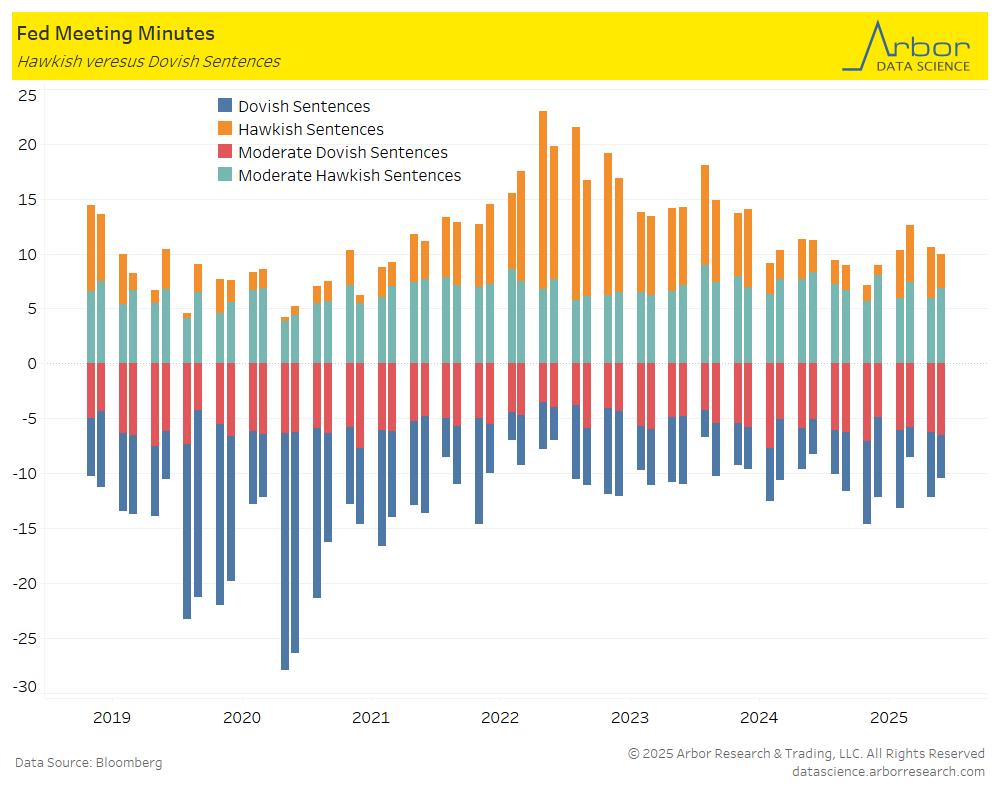

Breaking Down Fed Sentiment by Sentence Scores

The next chart illustrates Bloomberg’s Fed Minutes Sentence scores from Fed meetings for the period 10/31/18 – 5/28/25. The most recent Fed minutes (released 5/28/25), had a total sentence score of 9.95 for Hawkish sentences and a total score of -10.46 for Dovish sentences. This indicates a more Dovish sentiment.

- Moderate Hawkish Sentences: 6.83

- Hawkish Sentences: 3.12

- Moderate Dovish Sentences: -6.53

- Dovish Sentences: -3.93

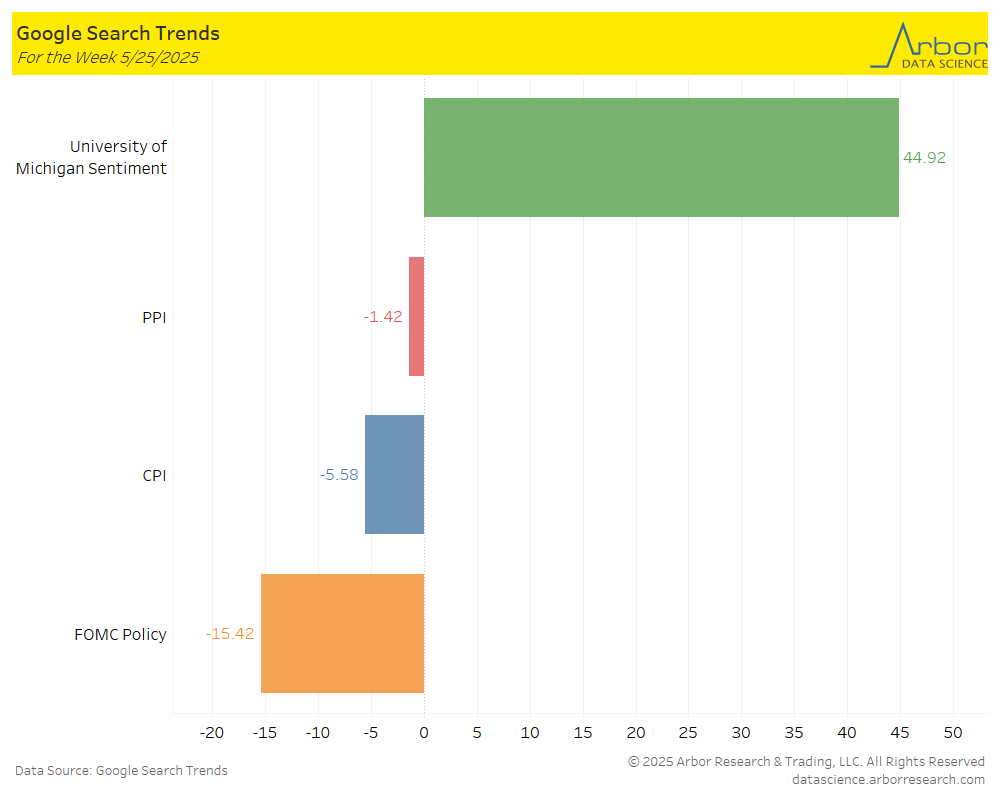

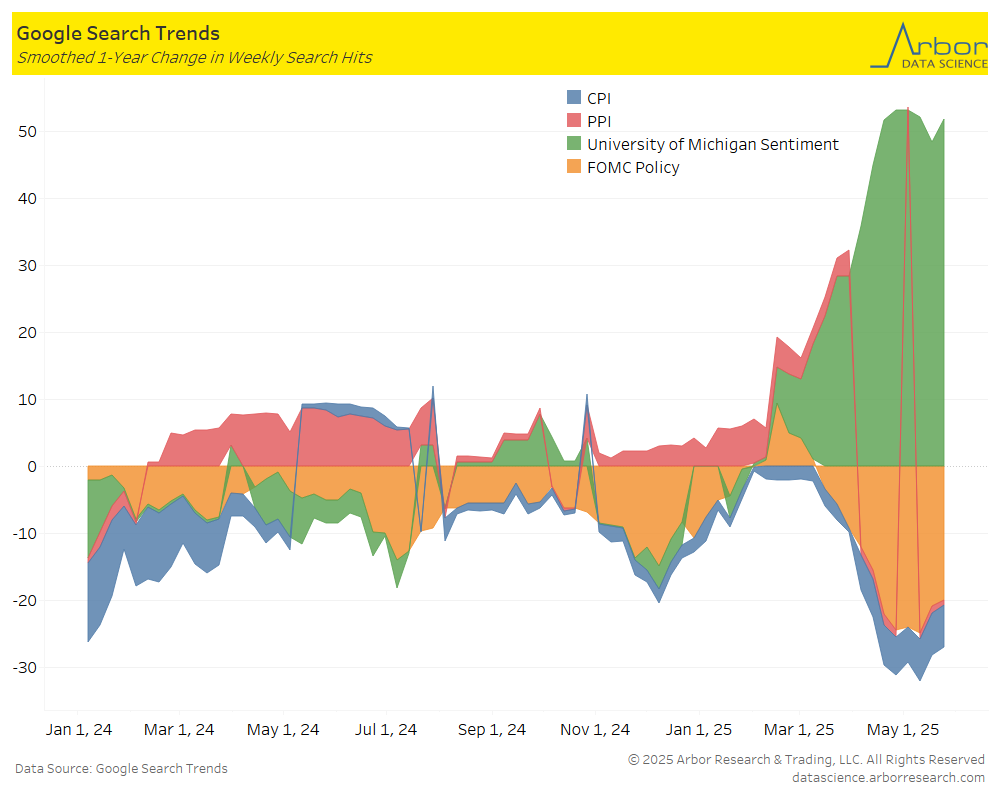

Google Search Trends

- We utilize Google Search Trends to gain insight on consumers’ interest on the following terms: University of Michigan Sentiment, Producer Price Index, Consumer Price Index, and FOMC Policy.

- For the week ending in 5/25/2025, the term University of Michigan had the only positive search interest at 44.92. Producer Price Index, Consumer Price Index and FOMC Policy all had negative search interest at -1.42,-5.58, and -15.42, respectively.