As battery demand, technology and global tensions increase — lithium stands out as an element that is entangled in all three of these categories. Typically, when people think of lithium, they think of batteries. As the world continues to combat escalations between superpowers, we have to remember that lithium is an important resource in the military space. Everything from lithium deuteride, a key material in the fusion stage of thermonuclear weapons, to UAV technology and lightweight alloys are affected. As electrification and advanced weaponry become central to modern military strategy, countries are investing heavily in securing lithium supply chains. In fact, China just announced that they are curbing exports.

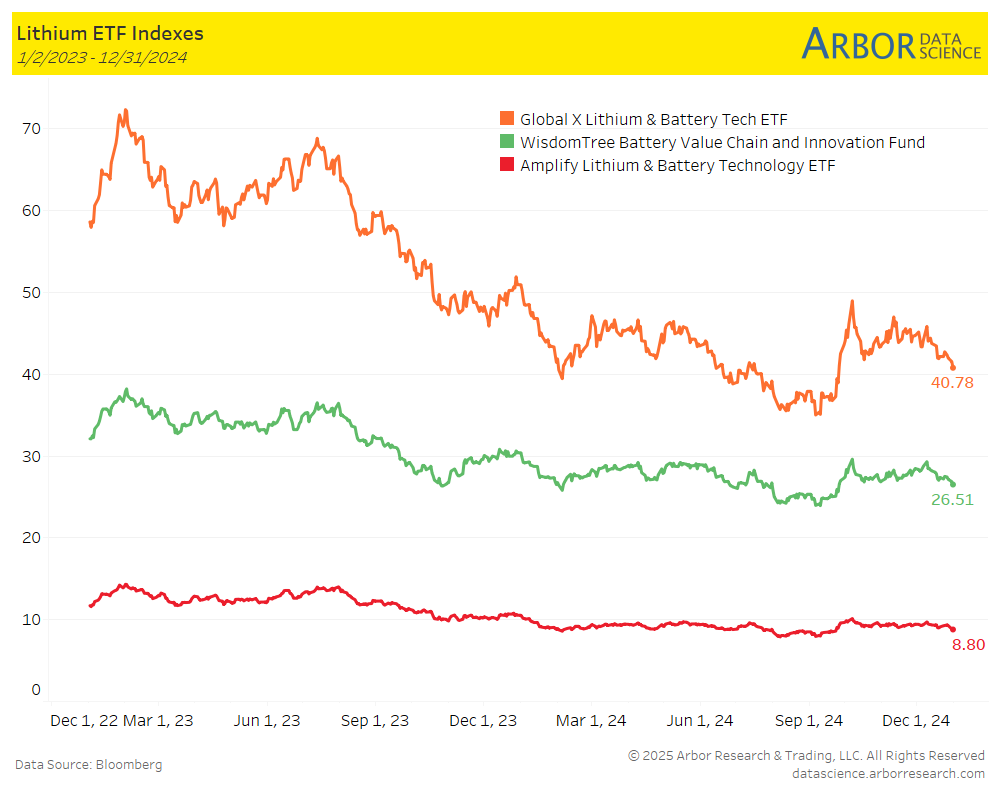

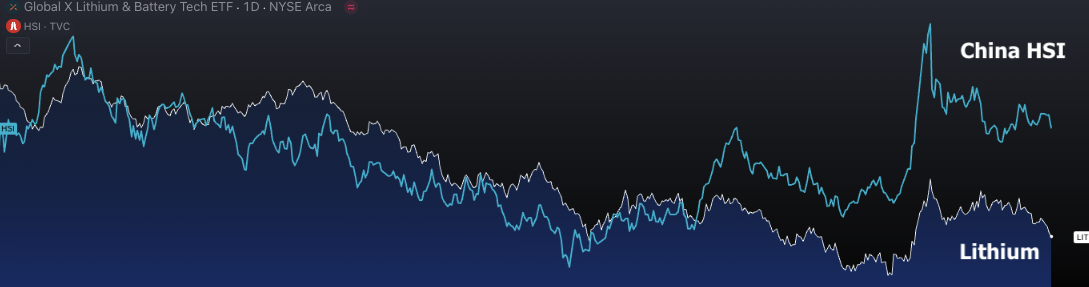

The performance of lithium as a commodity has been lackluster. Mostly trading down and sideways since the big “tech-commodity” boom of 2021. However, with demand still hot, it’s no surprise that the correlation between lithium and China-based indices are almost 100% at the moment.

Here is a chart of the relationship between LIT and HSI.

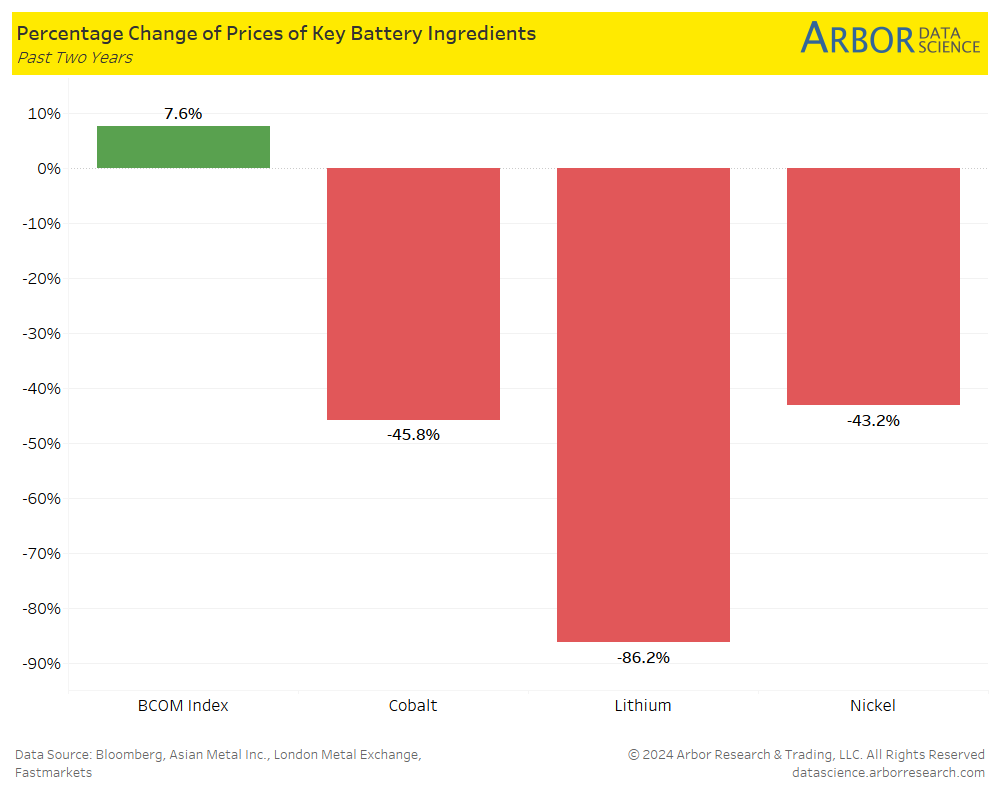

Also, please note how battery technology has done relative to commodities. The Bloomberg commodity index is up marginally over the last two years while cobalt, lithium and nickel are all down big.

On the technical front, it appears that lithium is still in a bear market. I don’t see anything on the DeMark counts on any time frame which would indicate a reversal is coming. The RSI is starting to get oversold and there are some active countdowns on the emerging markets space. However, we would need to see the dollar start to reverse. In short, it might still be too early for lithium but I would keep an eye on China and the dollar as proxies and we will re-evaluate after these downside countdowns will complete.