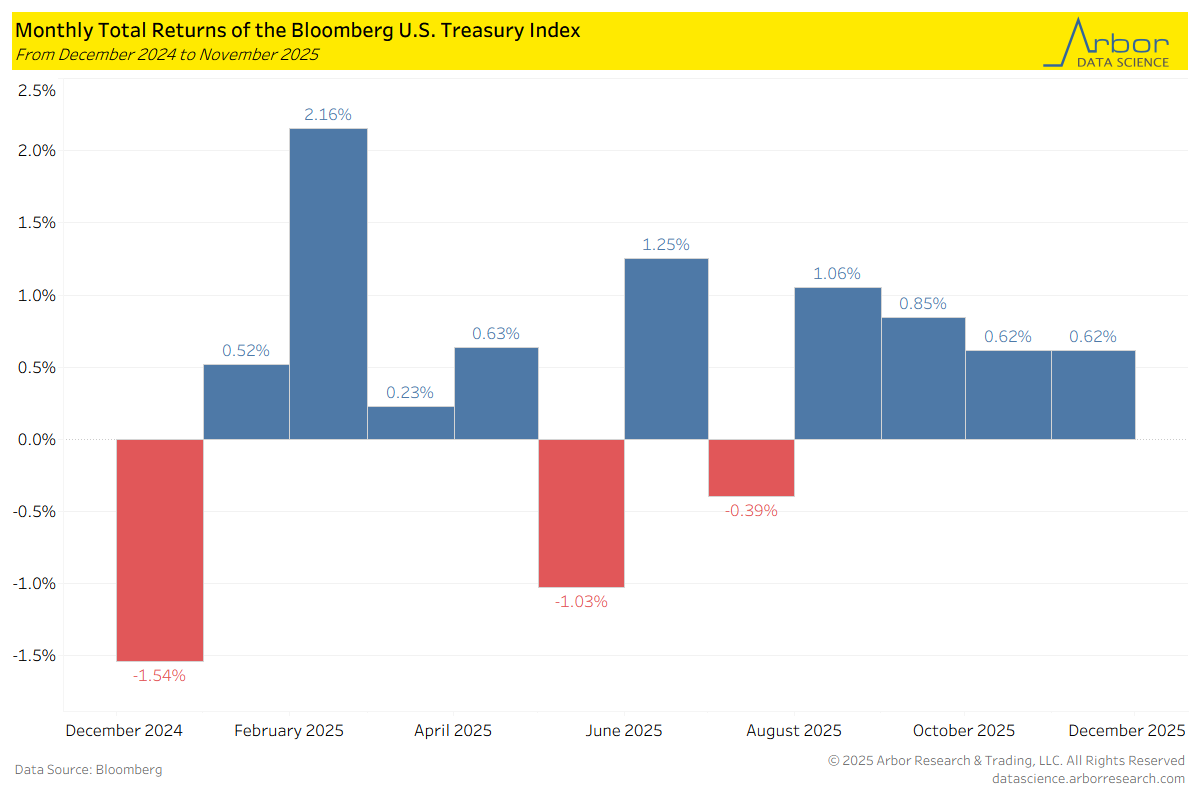

It has been quite a year. No matter the asset class, there has been plenty of volatility and difficulty. In some ways, this is a positive. Volatility leads to opportunity, and that is particularly true in fixed income. There were a few instances of drawdowns associated with fears of a positive growth shock, tariffs, and inflation. Those fears have broadly passed as the growth shock did not materialize, tariff effects have proven benign, and inflation appears to be contained (famous last words). At least measured by the US Agg, it has been a fairly good year to be allocated to fixed income. Even with the current fears around the lending to data centers and other AI centric investors, there has simply not been a meaningful pullback in Agg returns.

Notably, the US 10-year yield peaked early in the year and has been in a downtrend since then. That is somewhat surprising given the persistent headlines of stubborn inflation and volatile growth narratives. At different junctures of 2025, the narrative surrounding the US economy has been tariff induced inflation and recession or domestic boom from foreign investment or the death of American exceptionalism. Neither of those should have been overly positive for yields. But – in the end – it was not the end of American exceptionalism and the economy largely normalized.

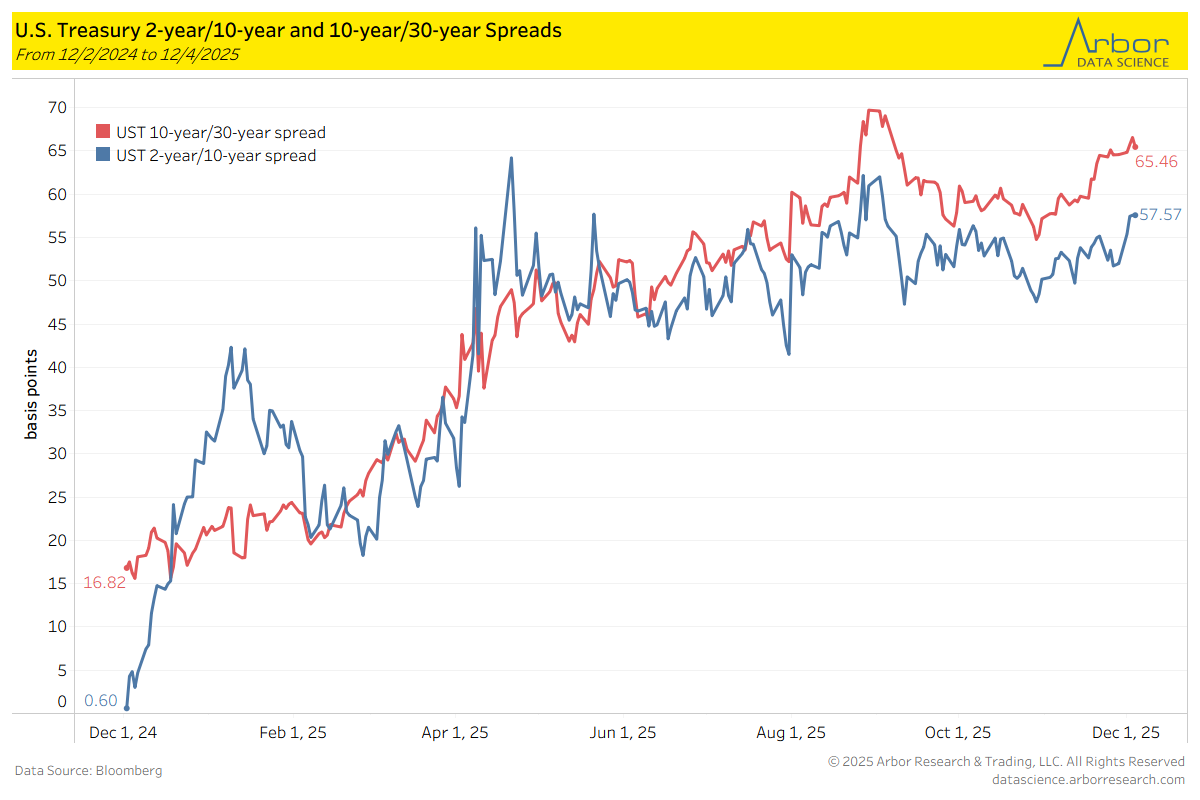

And the yield curve is sending a message also. Both the 2/10s and 10/30s spreads have steepened throughout the year. That is a sign of markets looking at an economy with a bit of an inflationary bent with continued growth. If there was a negative growth shock or expectation, the yield curve would be much flatter – reflecting a flight to safety mentality. The steeper curve (and steepening) is an indication of the market looking for a more “normal” economy in terms of both growth and inflation. Given the experience over the past 5 years, that would be a welcome development.

What does all of this mean? It means that – inspite the fears of tariffs, inflation, and growth (in both directions) – interest rates have told a consistent story. Don’t worry. Maybe that is one of the more important takeaways from 2025 – listen to the bond market. Ignore the noise.