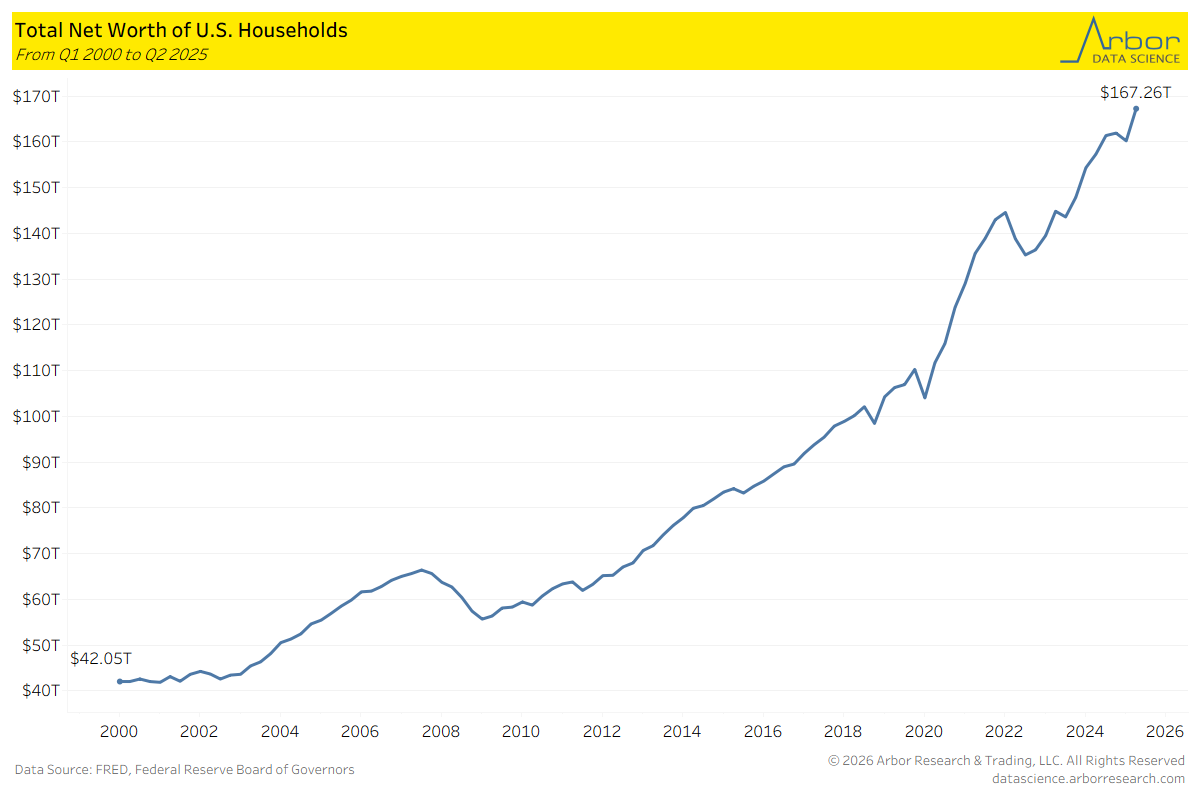

As the new year begins, it is important for those of us who call the U.S. home to recognize the continued growth of wealth held by U.S. households. While there are always things to nitpick or complain about, from the increased price of every day essentials to tech gadgets like smart phones turning from perks to necessities to function in daily life, those aggravations are only part of the story. Since the start of the 21st century, the net worth of U.S. households has increased by almost 300%. As of Q2 2025, the total net worth of all U.S. households was $167.26 trillion.

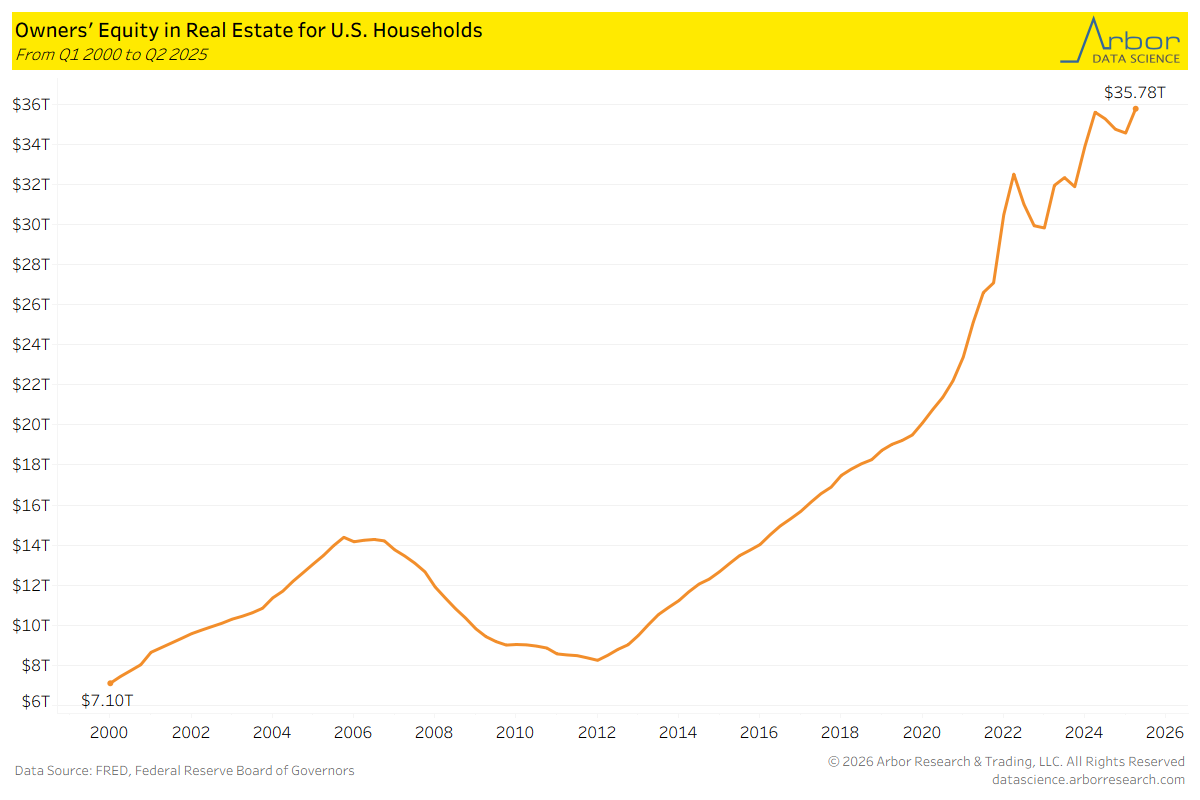

The housing market has been a key driver of this wealth increase, specifically after the recovery from the Great Financial Crisis in the early 2010s. The most recent data available from the Federal Reserve illustrates that U.S households had $35.78 trillion worth of equity in real estate, specifically homes, as of Q2 2025. This is up almost $30 trillion from the $7.10 trillion worth of homes in Q1 2000.

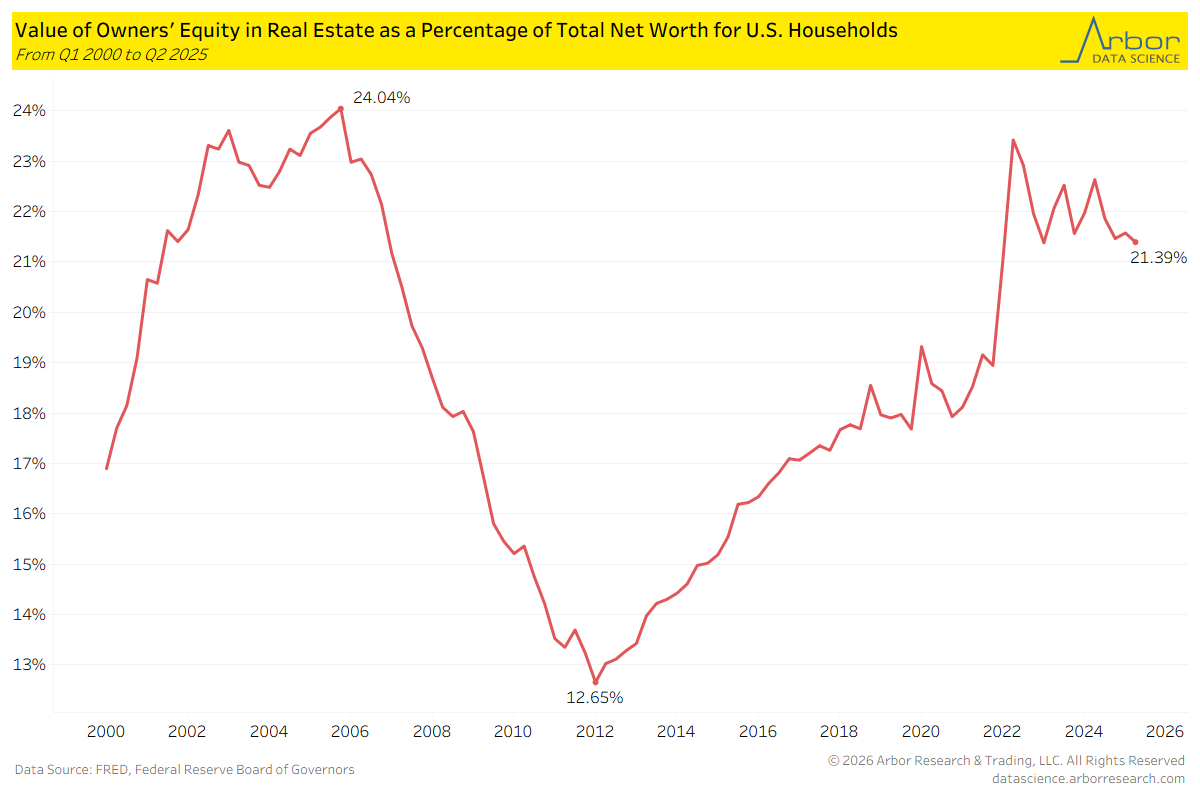

However, the rapid wealth brought on by owning a home seems to have slowed down over the past three years. As of Q2 2025, the value of U.S. households’ equity in real estate comprised 21.39% of their total net worth. This is almost double the 21st century low of 12.65% that was recorded in Q1 2012 as the economy recovered from the housing bubble, yet still below the 24.04% from Q4 2005 before many knew a bubble was forming.

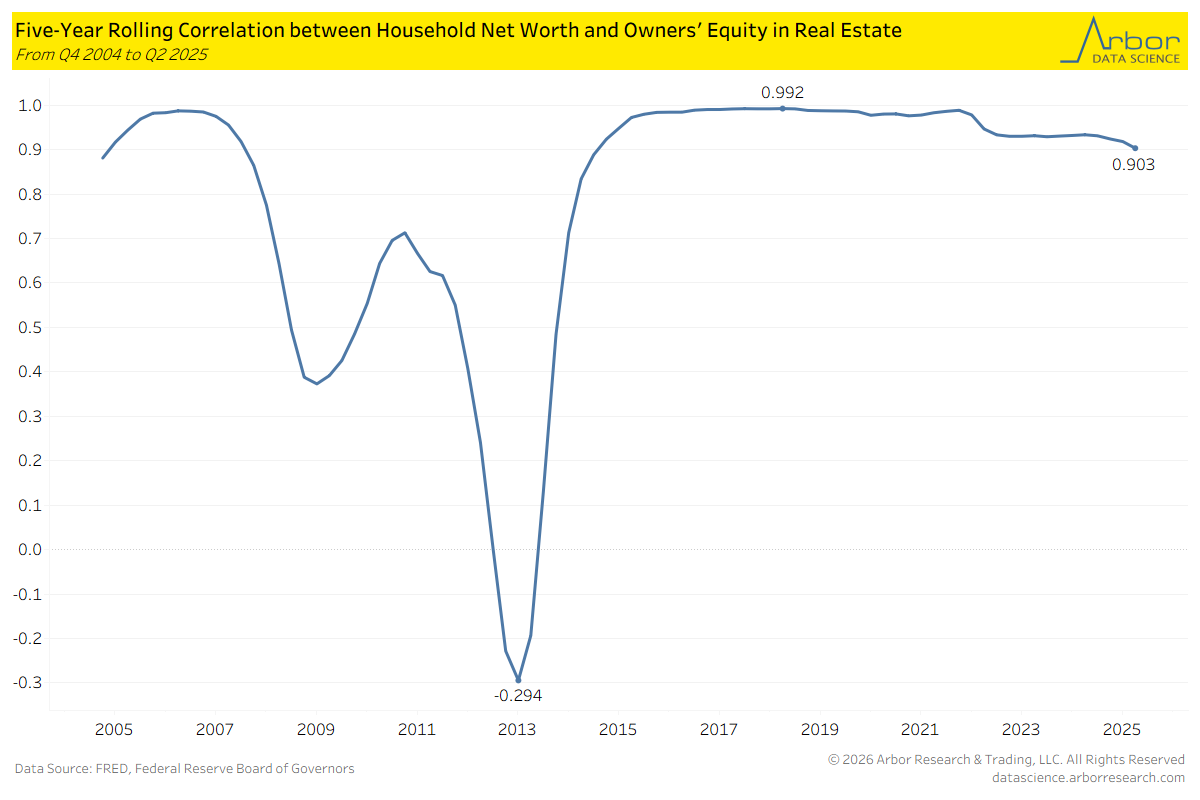

One way to explore this developing disconnect is examine the correlation between real estate equity and total net worth or U.S. households. This correlation took a negative turn as the housing crisis played out from 2007 to 2014. Then, from Q2 2015 to Q4 2021, the five-year rolling correlation stayed between a range of 0.97 and 0.99 as both home values and household net worth increased hand-in-hand. Although no where near as severe as the drop in correlation during the late 2000s, the correlation has gradually decreased over the past 13 quarters. While it is household net worth and real estate values are still highly correlated, there could be a new trend emerging.

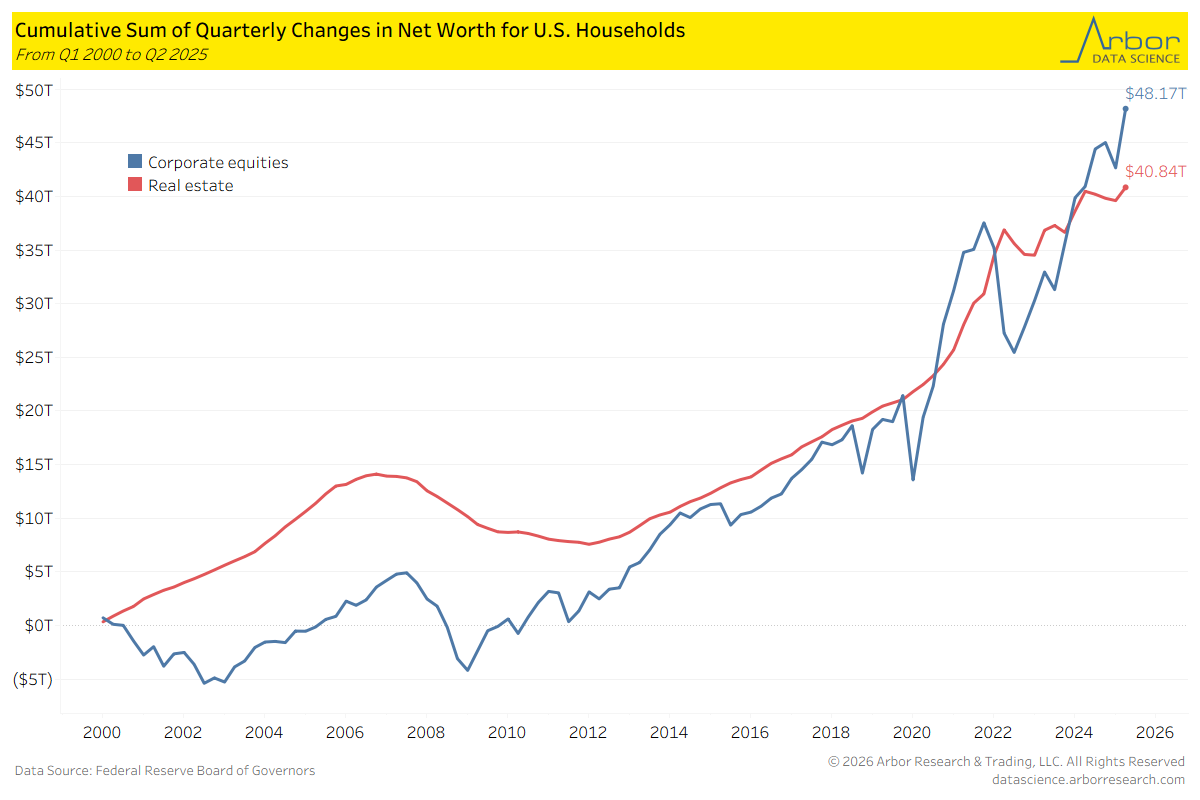

The key culprit between this new disconnect has been the large gains of the stock market since 2025, as 2025 marked the third consecutive year in which the S&P 500 had gains of at least 15%. To help illustrate this fact, we calculated a running sum of the quarterly changes to the net worth of U.S. households from Q1 2000 to Q2 2025 coming from corporate equities and owner-occupied real estate. Of the 84 quarters from Q1 2000 to Q4 2020, real estate had a larger cumulative contribution to net worth in all but three of those quarters. In the 18 quarters since, corporate equities have had the higher cumulative contribution in 10 of the quarters. With anaylsts across the board projecting another steady to solid year for the U.S. equities, in combination with the housing market cooling in certain areas of the country, stocks may extend their lead over real estate in terms of contributions to the U.S. household net worth.