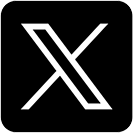

How long does $1 million and Social Security benefits last in retirement?

- The heatmap below outlines the average number of years $1 million along with Social Security benefits are projected to last by state, utilizing data from GOBankingRates. They compiled their data from the U.S. Census American Community Survey, Missouri’s Economic and Research and Information Center and the BLS Consumer Expenditure Survey.

- According to GOBankingRates, a retirement nest egg of $1 million (+ Social Security benefits) would be depleted in less than a 20 year period in Massachusetts (19 years), California (16 years) and Hawaii (12 years).

- It would last the longest in West Virginia (89 years) and Mississippi (at 87 years).

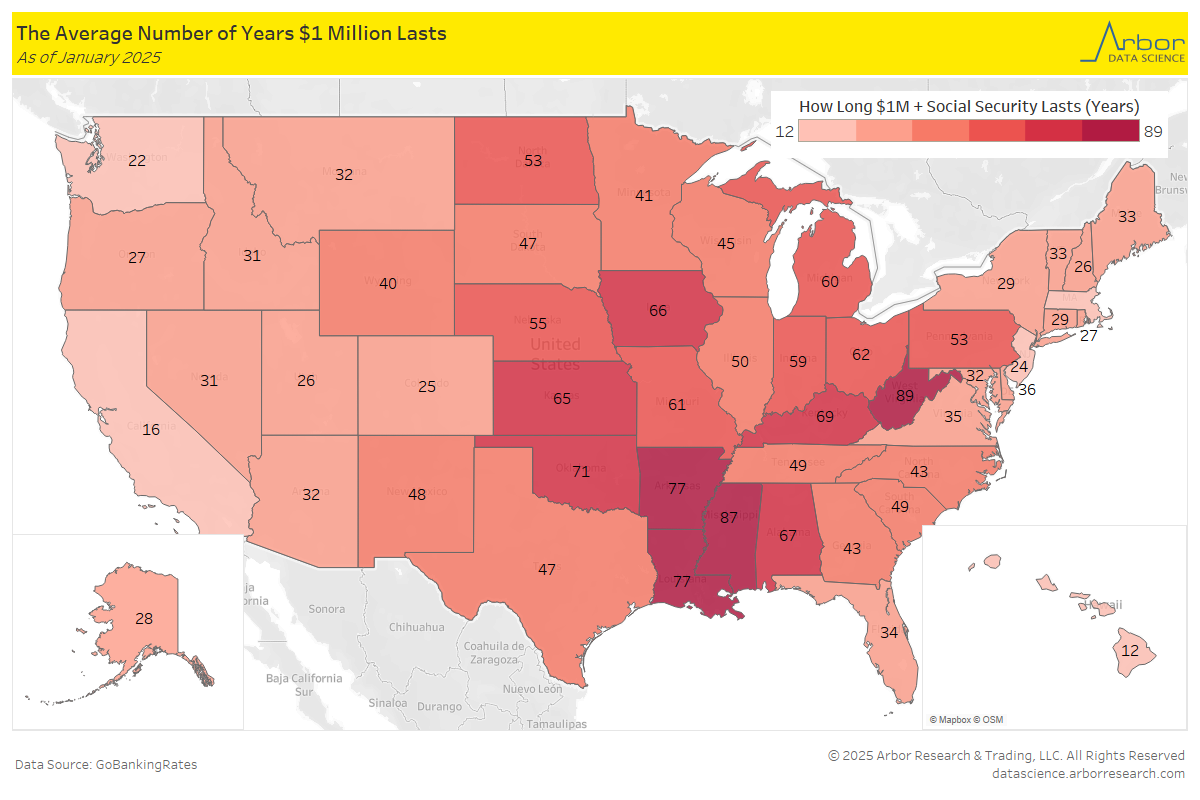

The Share of U.S. Wealth for the Top 1% Continues to Climb

- The Share of Total U.S. Net Worth held by the Top 1% is outlined in the chart below from Q3 1989 to Q3 2024.

- In Q3 2024, the Share of Total Net Worth held by the Top 1% was 30.8%, slightly below the peak at 31.0% in Q4 2021. For perspective, the low for the time period shown below, was 22.5% in Q3 1990.

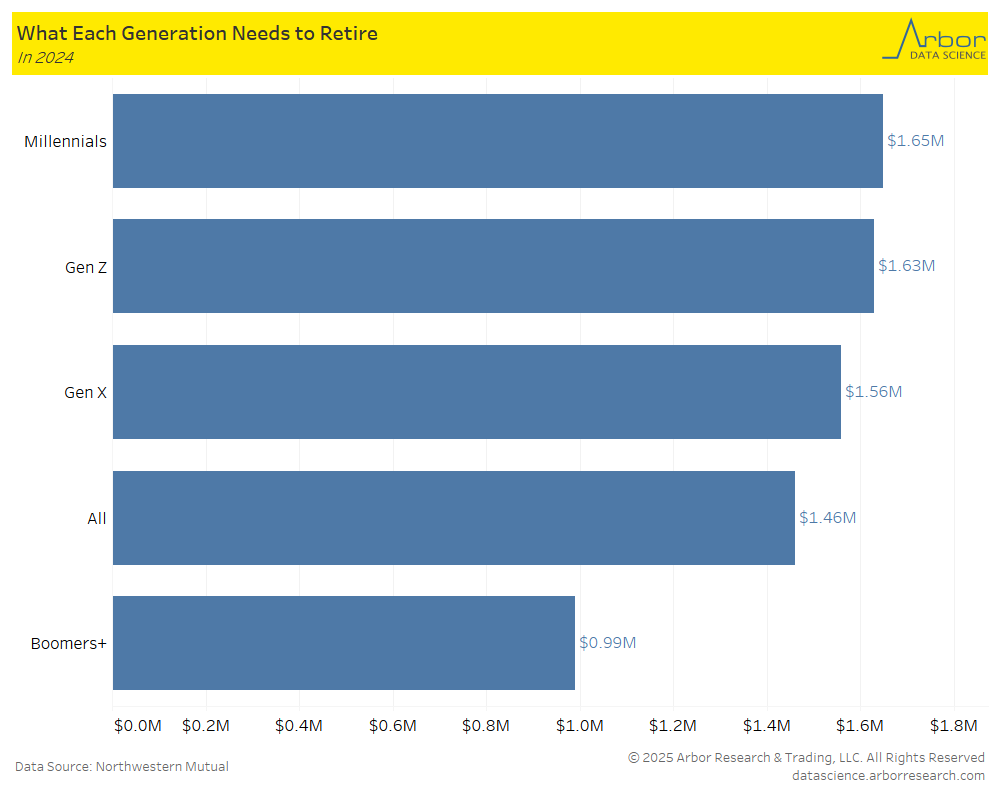

The Amount Needed for Retirement by Generation

- According to a study from Northwestern Mutual, the chart below highlights the amount needed retire in 2024 by generation.

- Millennials are projected to need $1.65 million, while Gen Z is projected to need $1.63 million.

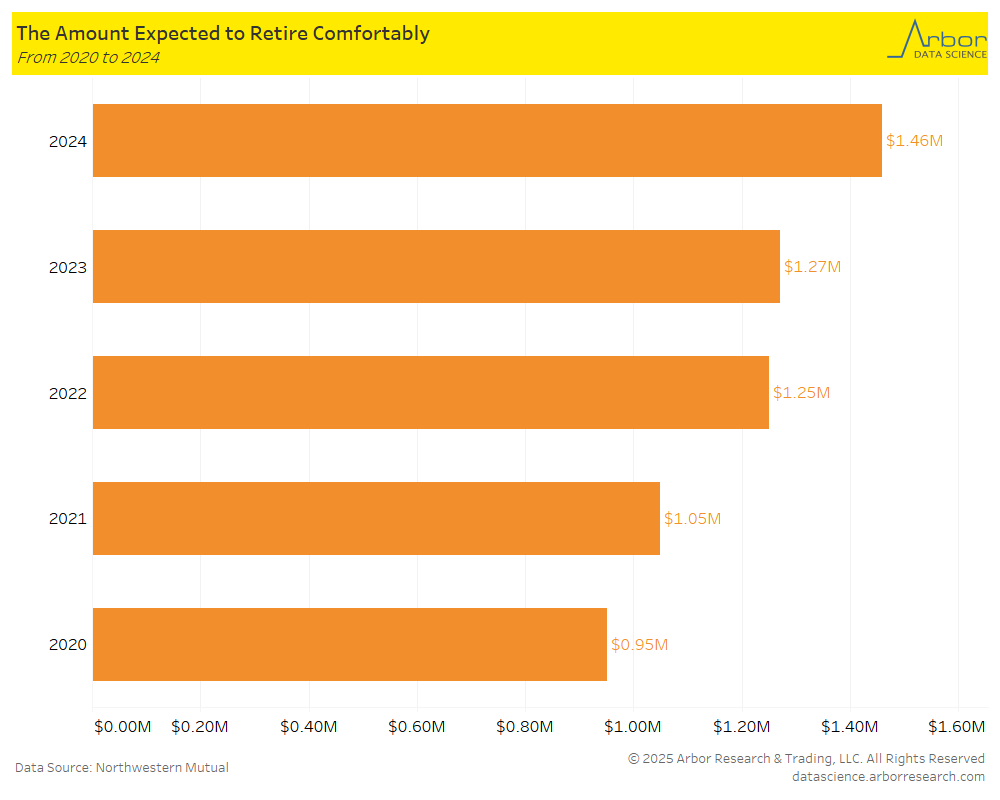

- In the same Northwestern Mutual study, U.S. adults responded that they needed $1.46 million to be able to retire comfortably in 2024, compared to a response of $951,000 in 2020.