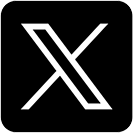

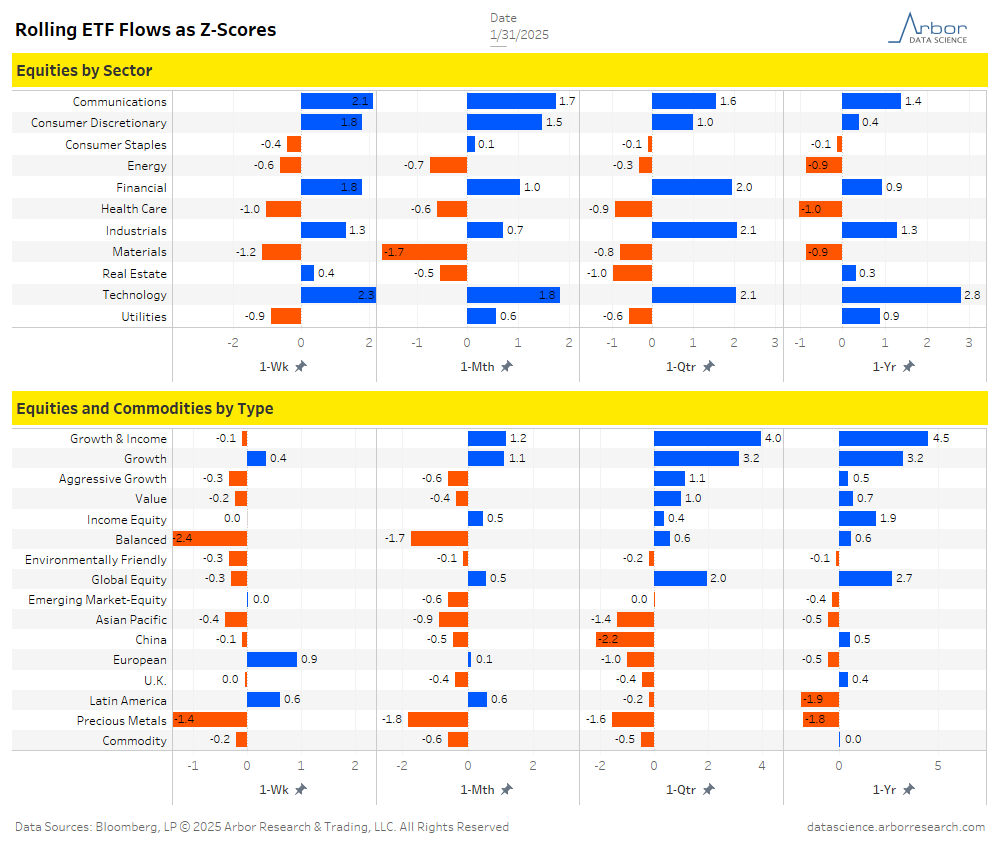

- The top two movers of the week were Consumer Cyclical Sectors ETFs and U.S. Large Cap ETFs for the week ended on 1/31/25.

- On a weekly basis, Consumer Cyclical Sectors ETFs had inflows of approximately $5.54 billion for the week ended 1/31/25, compared to inflows of $1.98 billion for the week ended on 1/24/25.

- On a weekly basis, U.S. Large Cap ETFs had outflows of approximately $3.04 billion for the week ended 1/31/25, compared to outflows of $0.19 billion for the week ended on 1/24/25.

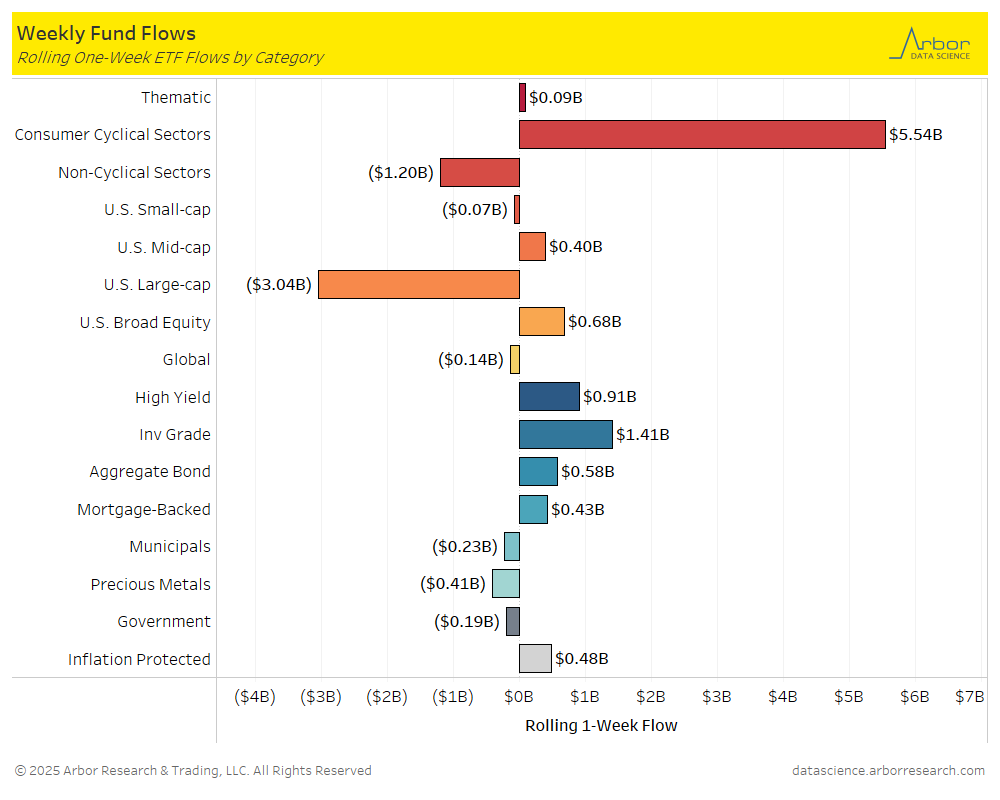

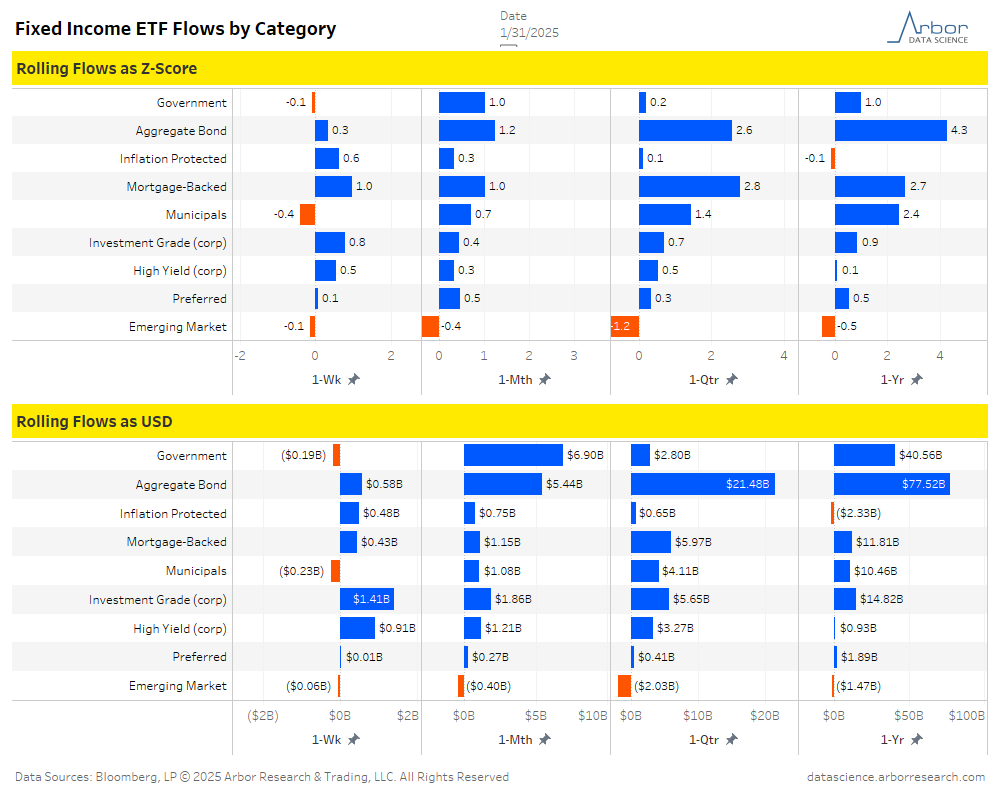

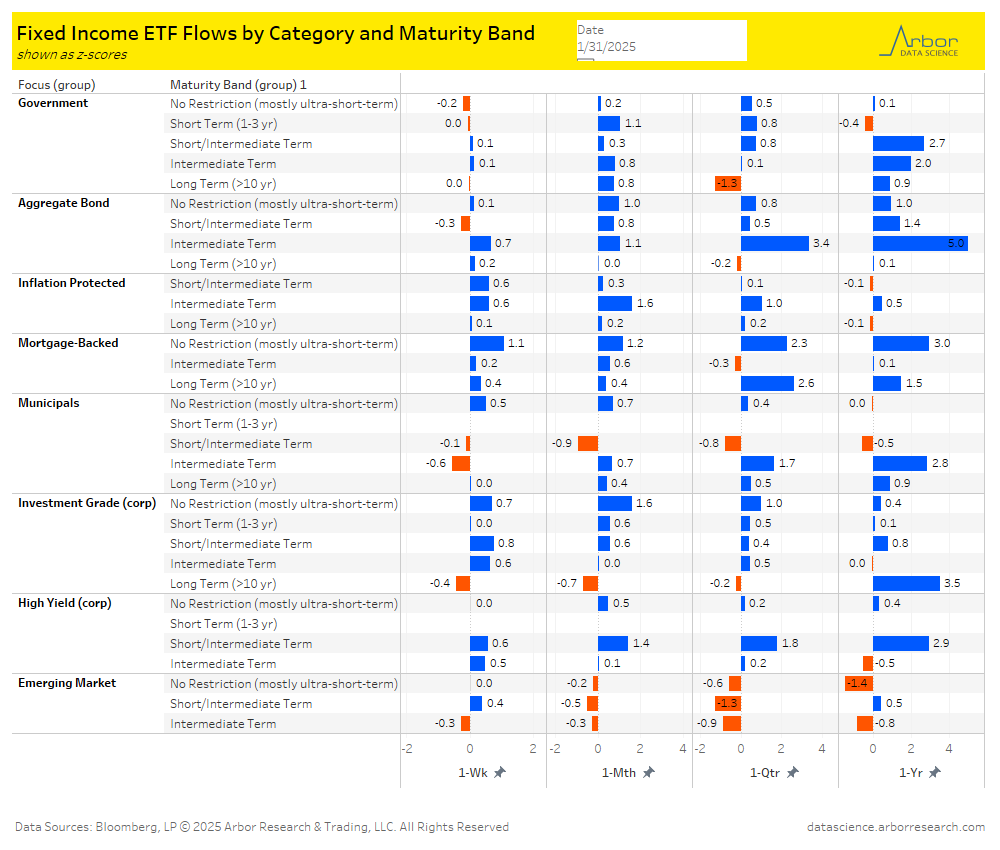

- Long Term (>10 yr) ETFs had inflows of $2.02 billion over the last week. The largest inflows were $2.19 billion in Short Term (1-3 yr) ETFs over the same time period.

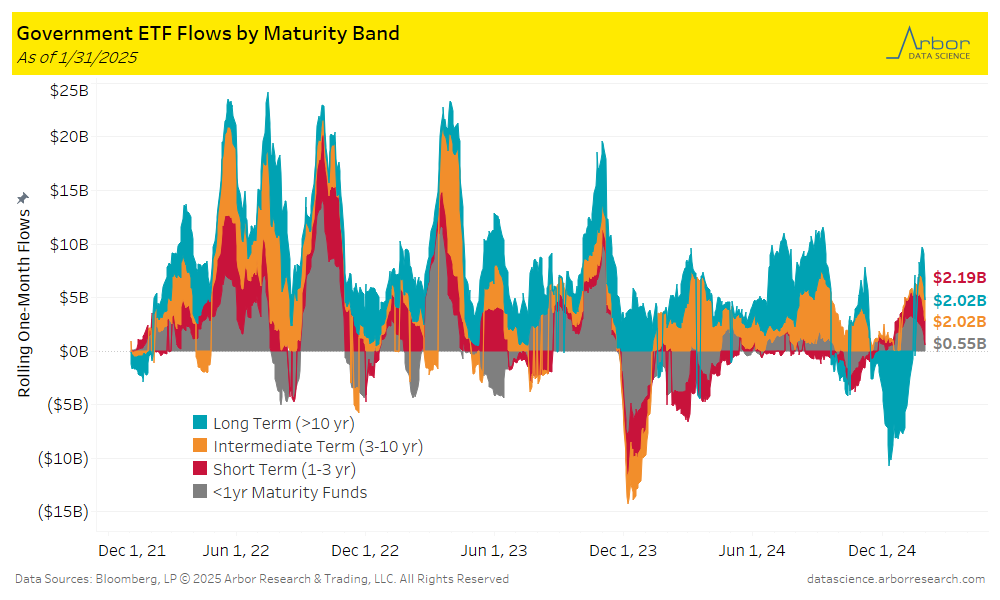

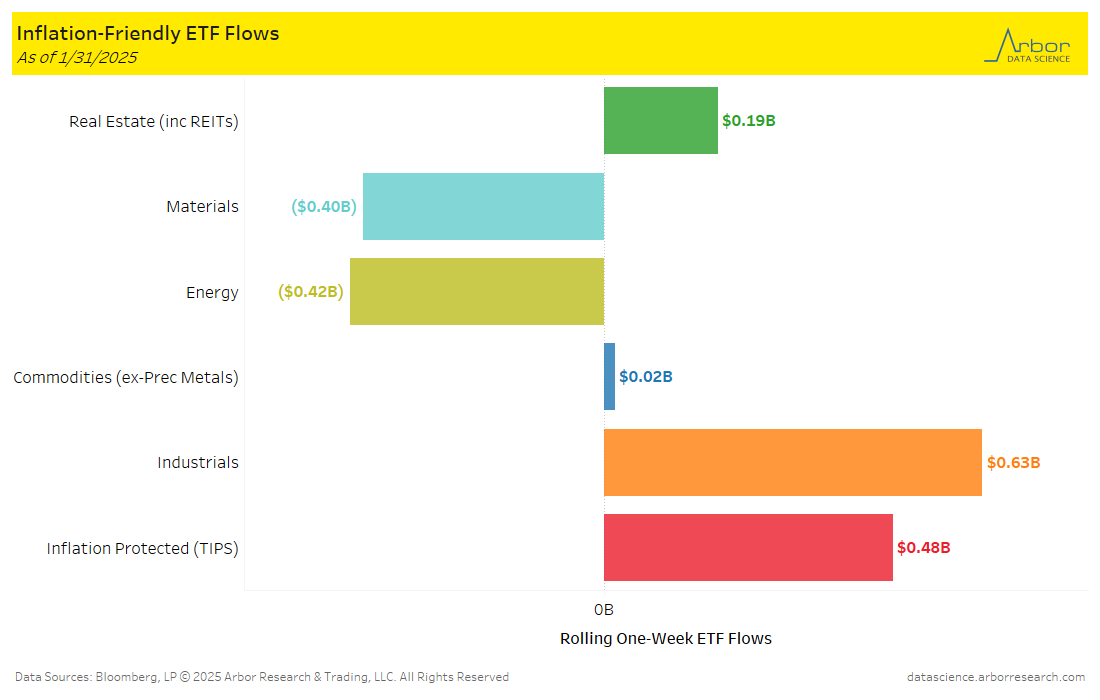

- Aggregate flows (black line in chart below) were positive for the week ended 1/31/25, with $0.50 billion of inflows. Industrial had the largest inflows for the week at $0.63 billion. Inflation Protected (TIPS) had the second largest inflows for the week at $0.48 billion.

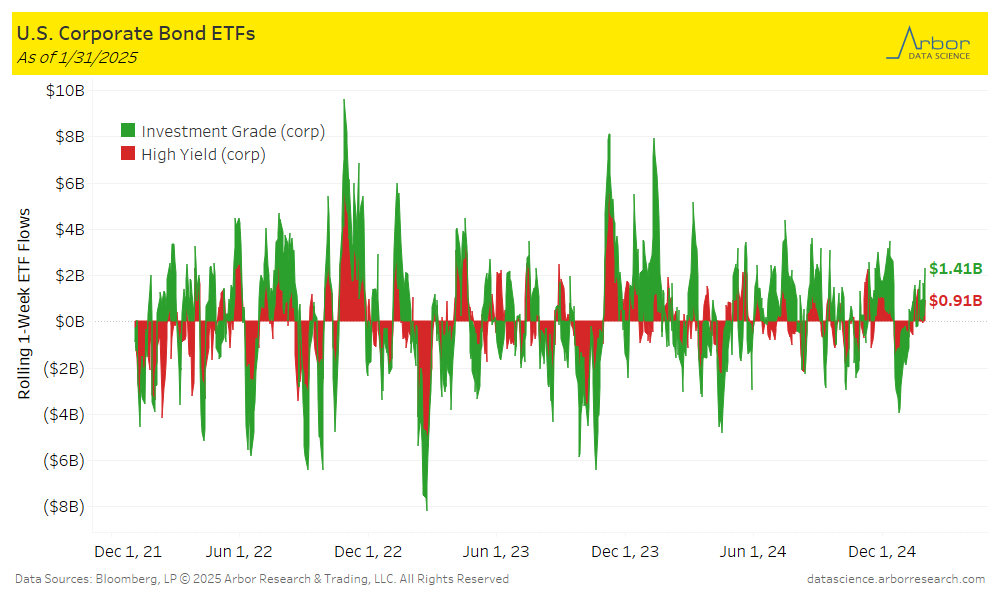

- Corporate bond ETFs were positive for the week ended 1/31/25, with investment-grade ETFs gaining $1.41 billion and high-yield ETFs gaining $0.91 billion.

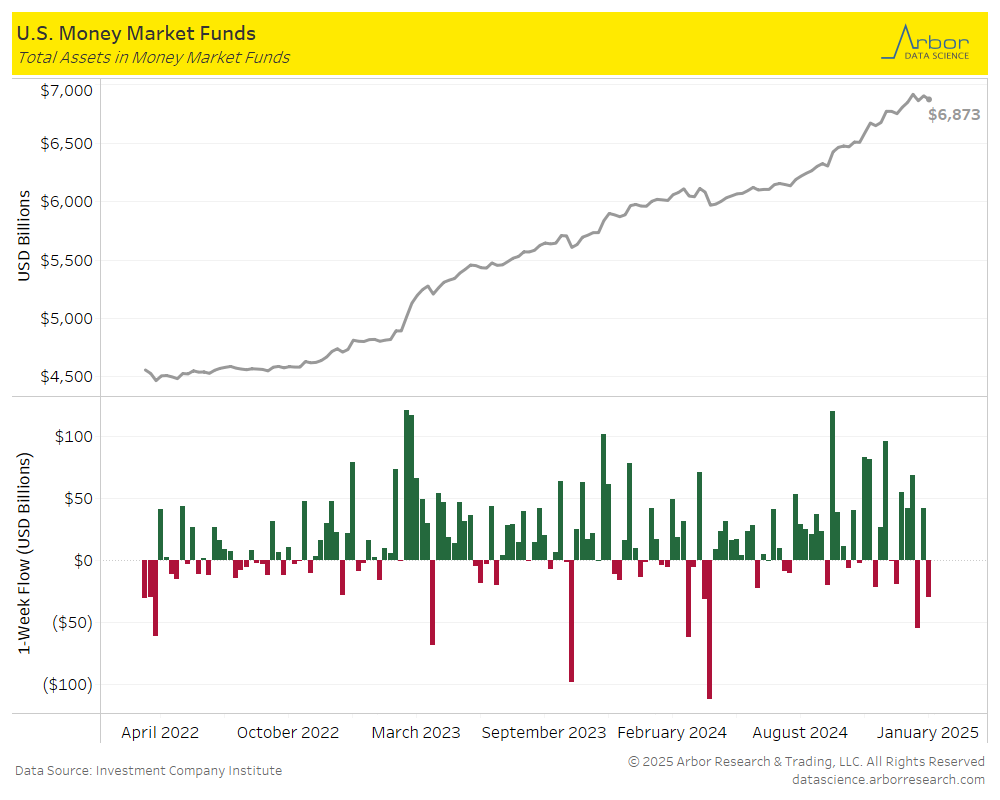

- The amount invested in Money-Market Mutual Funds (MMMFs) decreased to $6.873 trillion in total assets on 1/29/25, compared to $6.903 trillion the prior week.