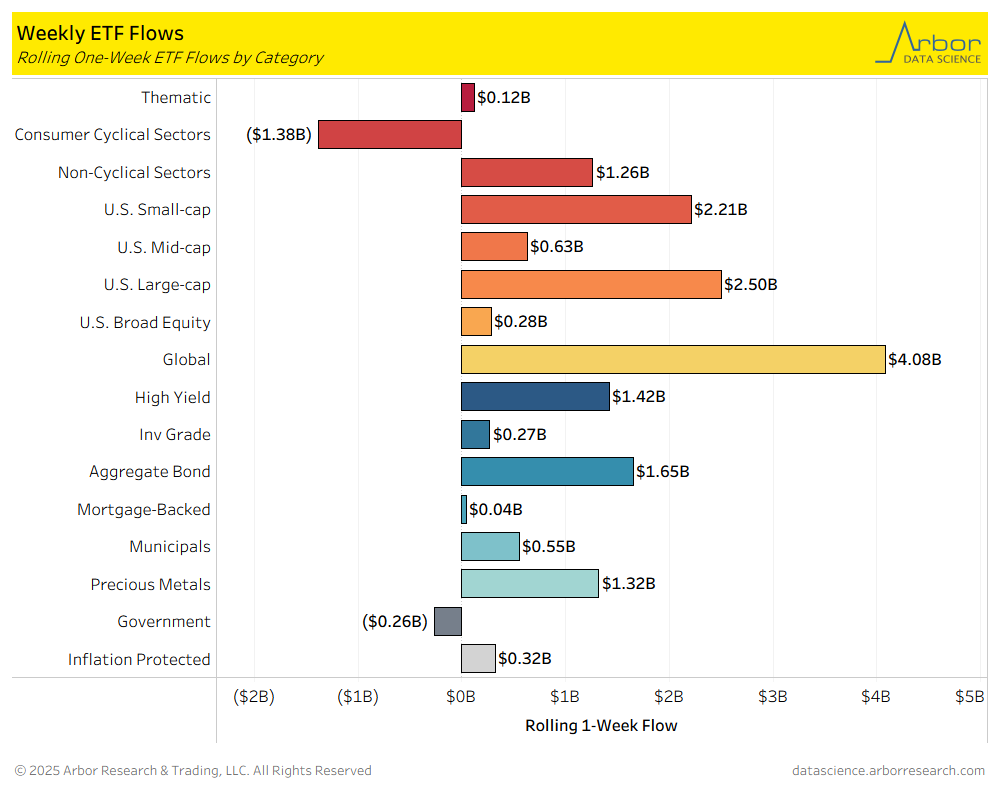

- Of the 16 ETF categories charted below, 14 categories had net inflows for the week that ended on 11/28/2025.

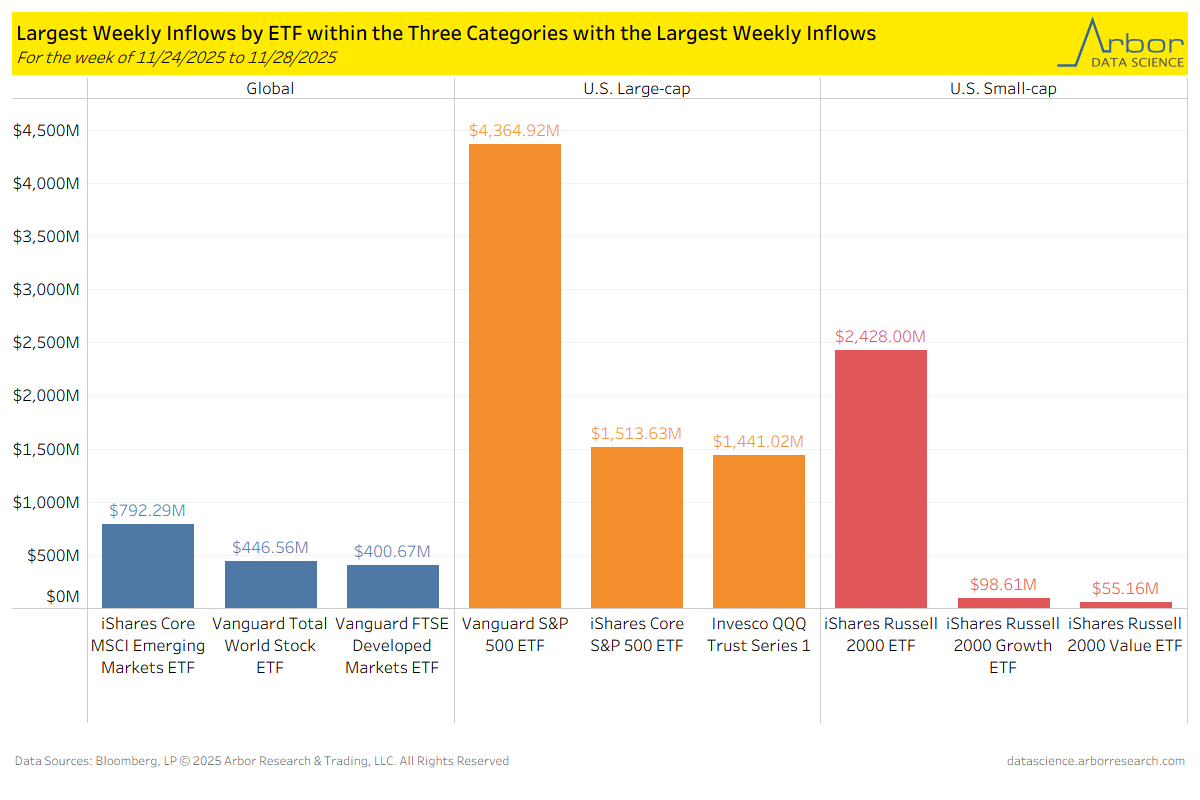

- The three ETF categories with the largest inflows for the week that ended on 11/28/2025 were Global ETFs at $4.08 billion, U.S. Large-cap ETFs at $2.50 billion, and U.S. Small-cap ETFs at $2.21 billion.

- The ETF category with the largest outflow for the week that ended on 11/28/2025 was Consumer Cyclical Sectors ETFs at $1.38 billion in outflows.

- Below, we highlight the three ETF categories with the largest inflows and the ETFs within those categories for the week of 11/24/2025 to 11/28/2025.

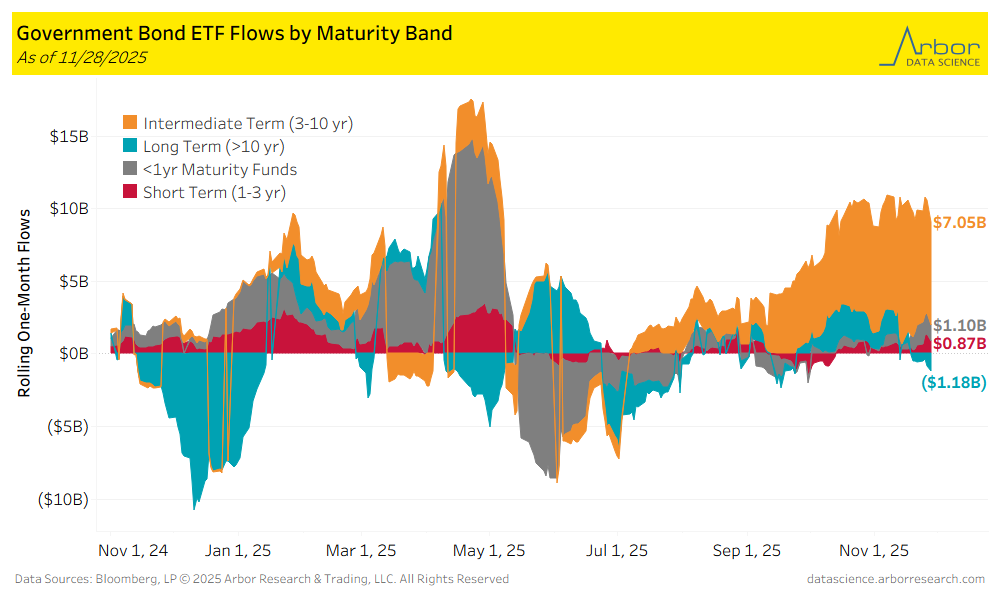

- Long Term (>10 yr) bond ETFs had outflows of $1.18 billion over the last week. The largest inflows were $7.05 billion in Intermediate Term (3-10 yr) ETFs.

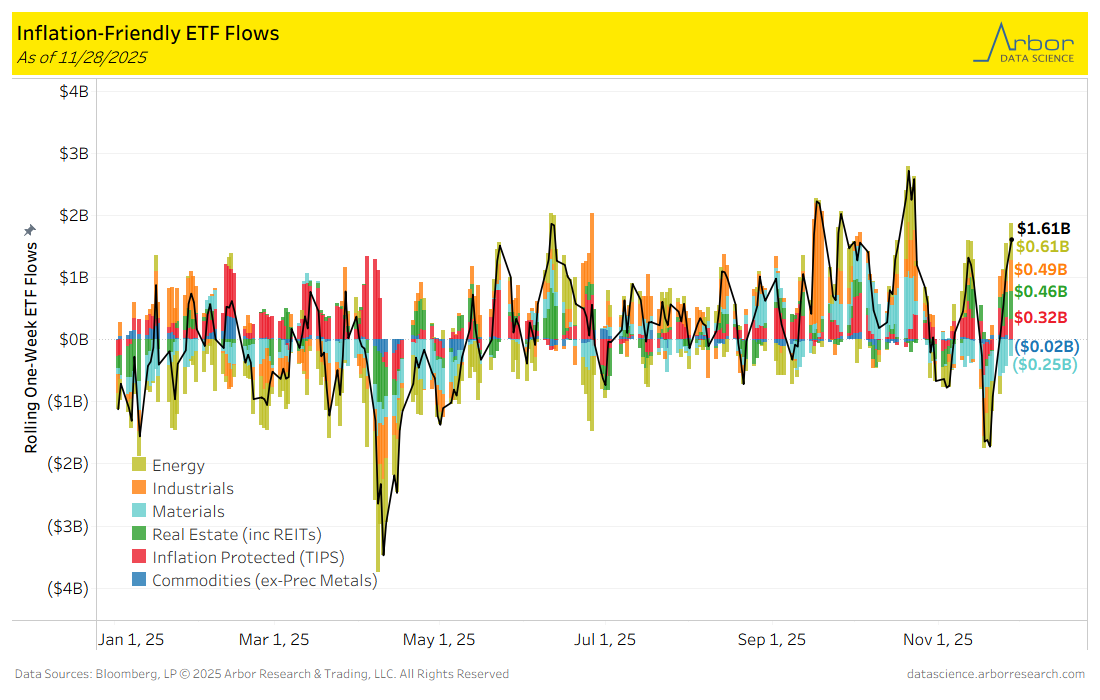

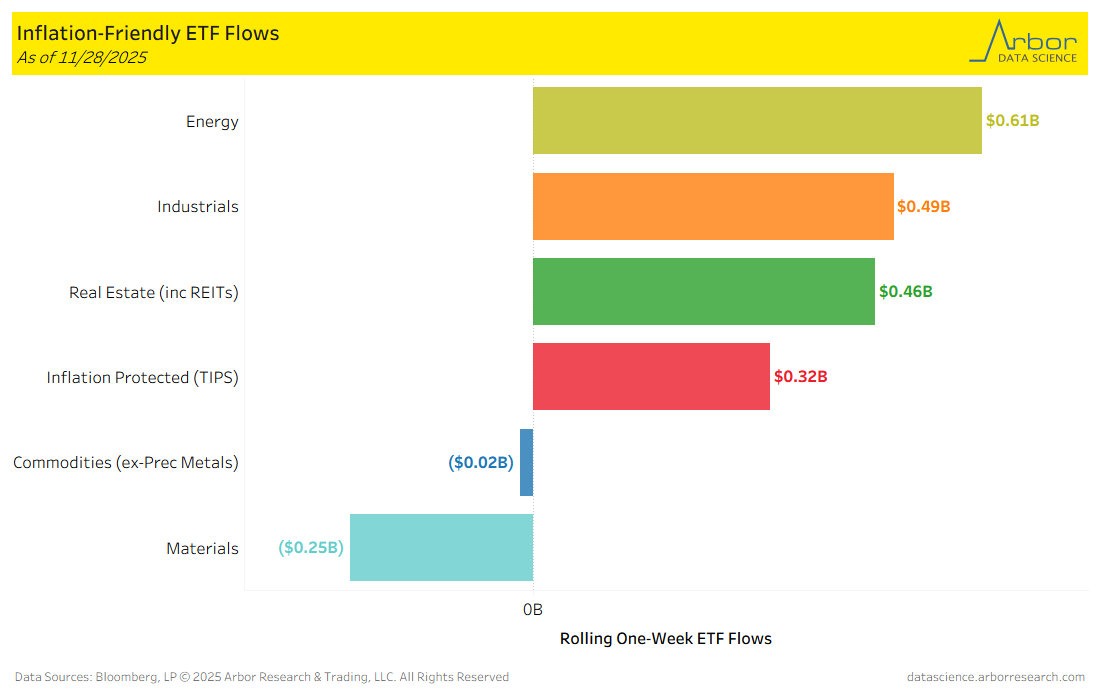

- Turning to inflation-friendly ETFs, aggregate flows (black line in chart below) were positive for the week ended 11/28/2025, with $1.61 billion of inflows. Energy had the largest inflow for the week at $0.61 billion.

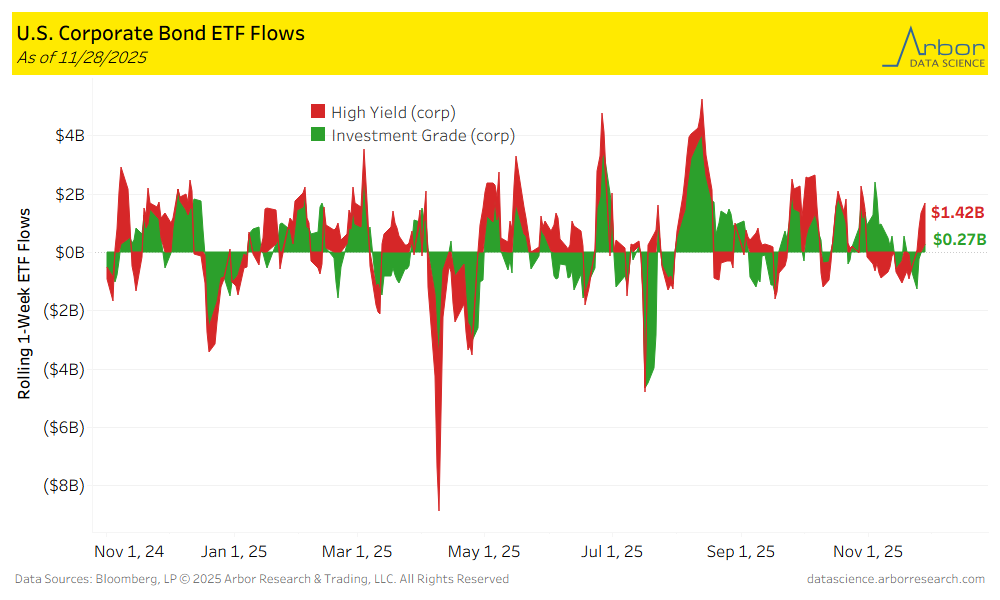

- Corporate bond ETF flows were positive for the week ended 11/28/2025, with High-Yield ETFs gaining $1.42 billion and Investment-Grade ETFs gaining $0.27 billion.

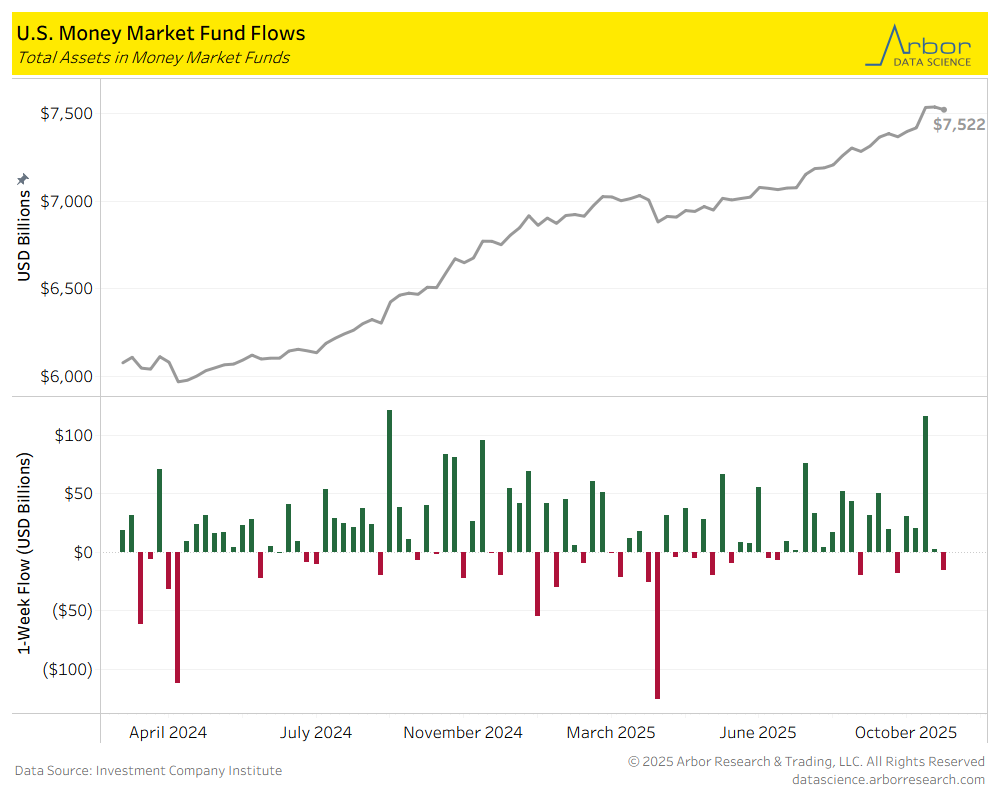

- The amount invested in Money-Market Mutual Funds (MMMFs) decreased to $7.522 trillion in total assets on 11/19/2025, compared to $7.536 trillion in total assets on 11/12/2025.