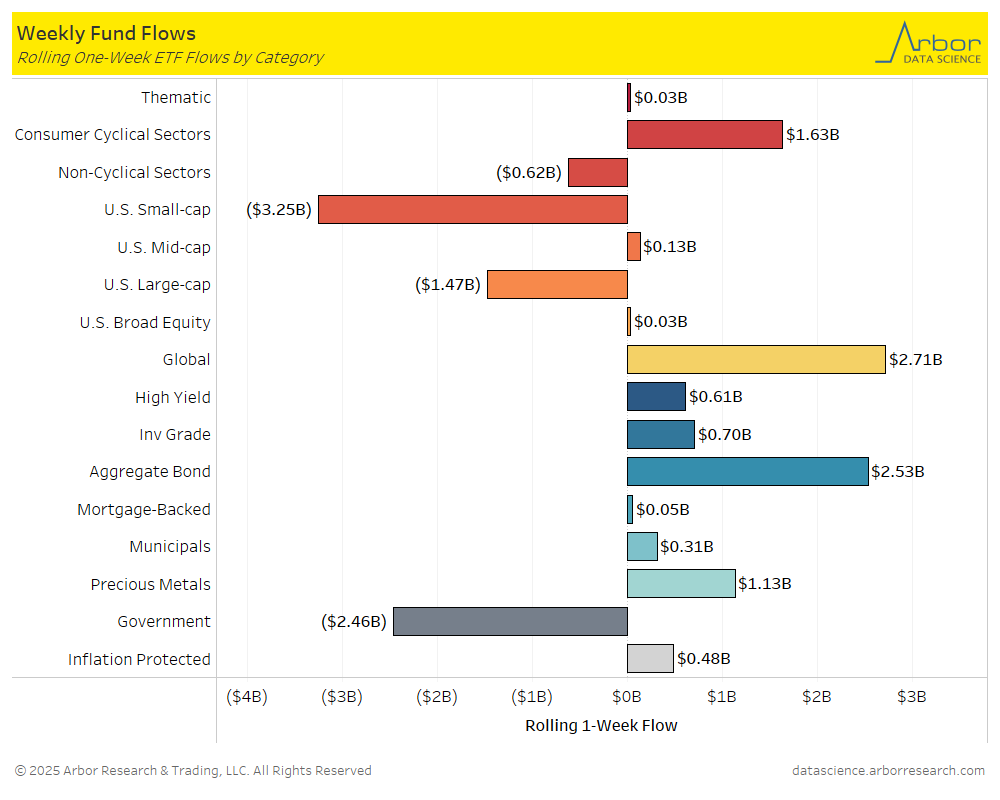

- The top two movers of the week were U.S. Large-cap ETFs and Government ETFs for the week ended on 5/30/25.

- On a weekly basis, U.S. Large-Cap ETFs had outflows of approximately $1.47 billion for the week ended 5/30/25, compared to outflows of $13.46 billion for the week ended on 5/23/25.

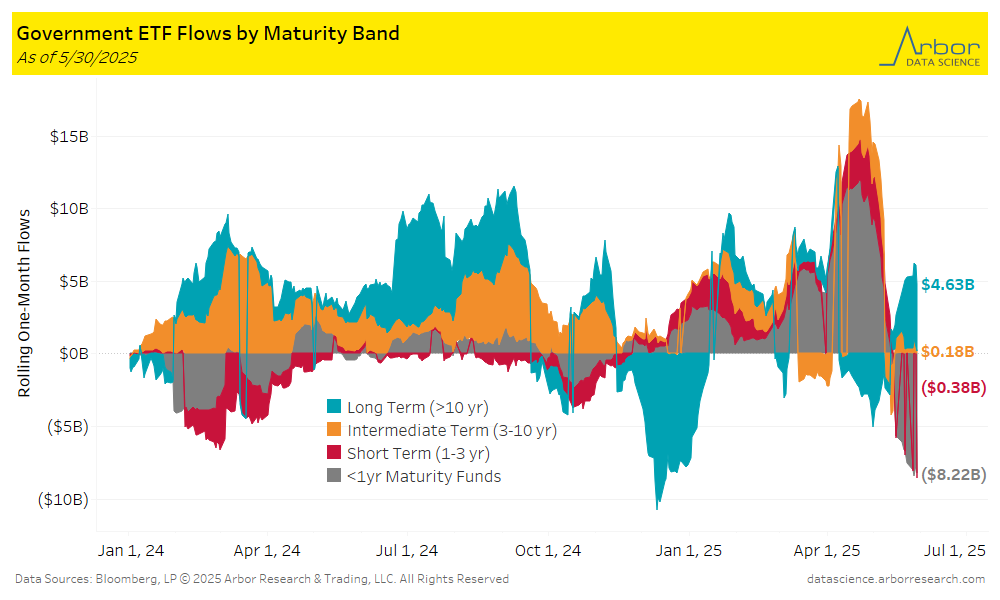

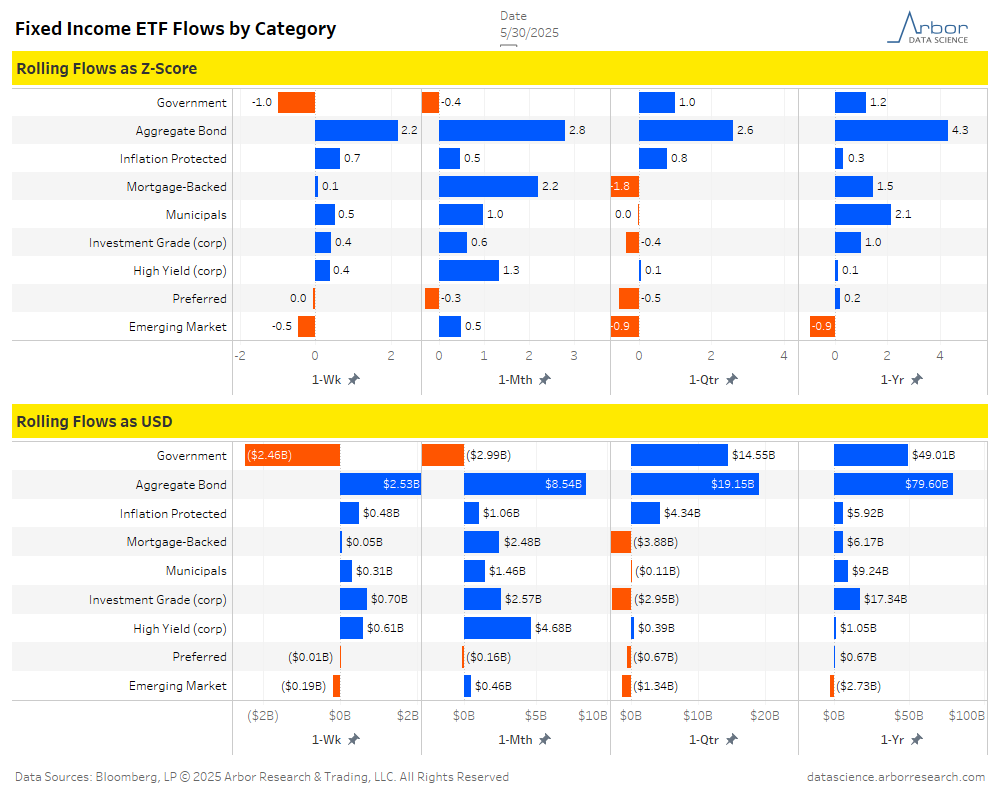

- On a weekly basis, Government ETFs had outflows of approximately $2.46 billon for the week ended 05/30/25, compared to inflows of $2.96 billion for the week ended on 5/23/25.

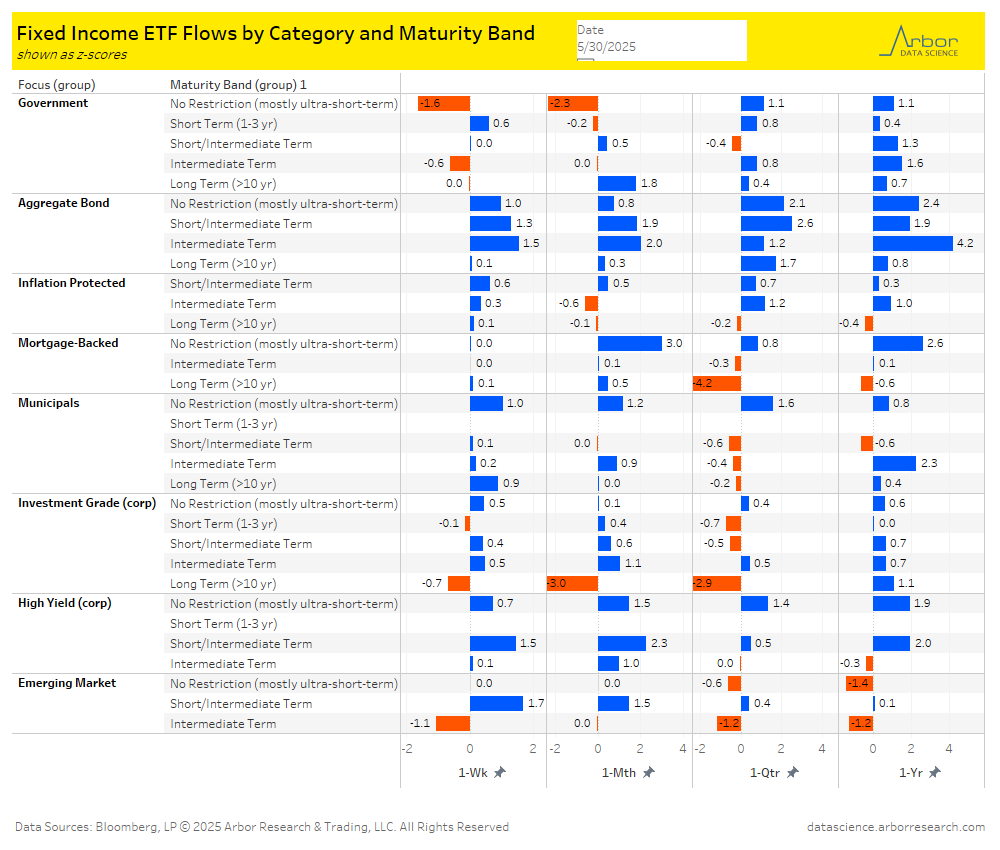

- Long Term (>10 yr) ETFs had inflows of $4.63 billion over the last week. The largest outflows were $8.22 billion in <1 year Maturity Fund ETFs over the same time period.

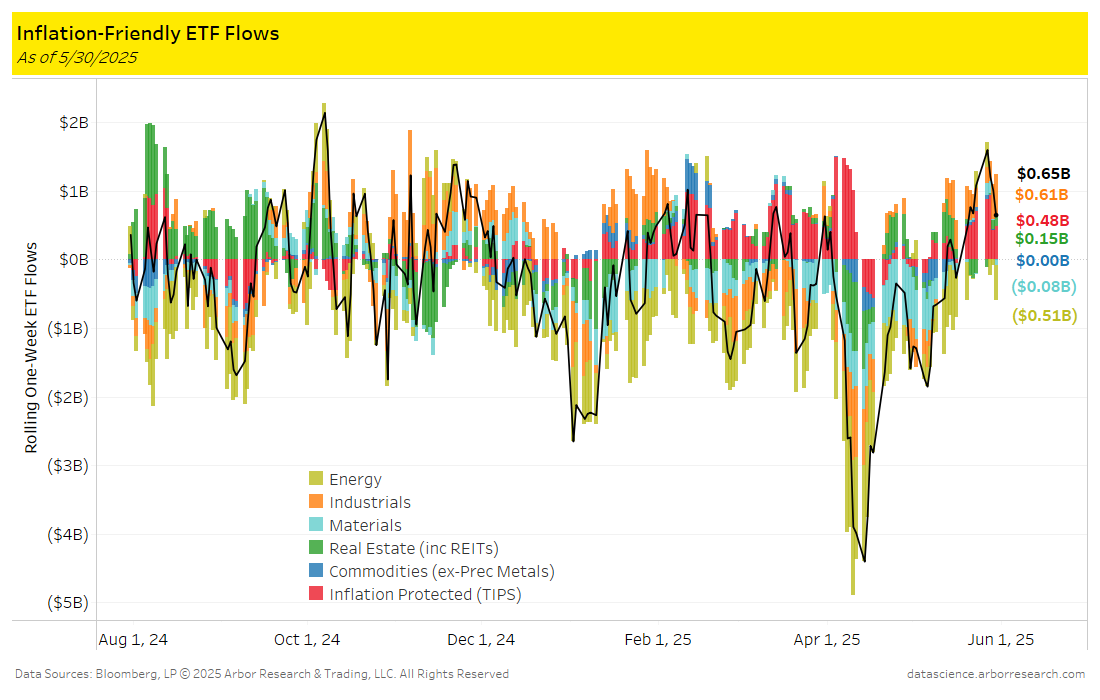

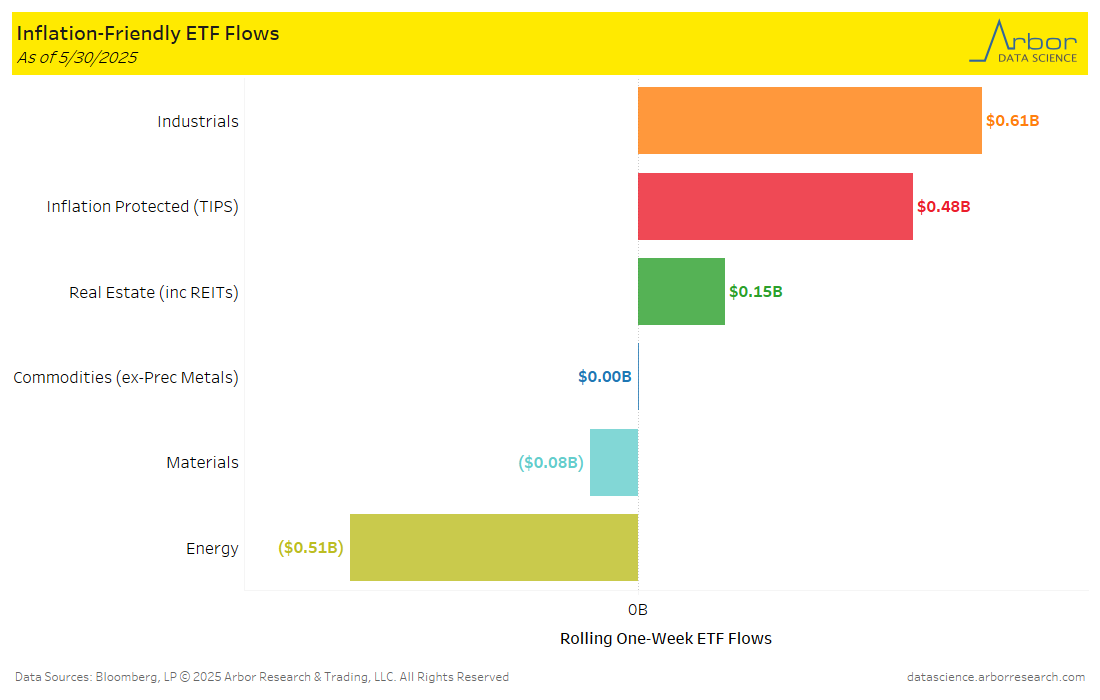

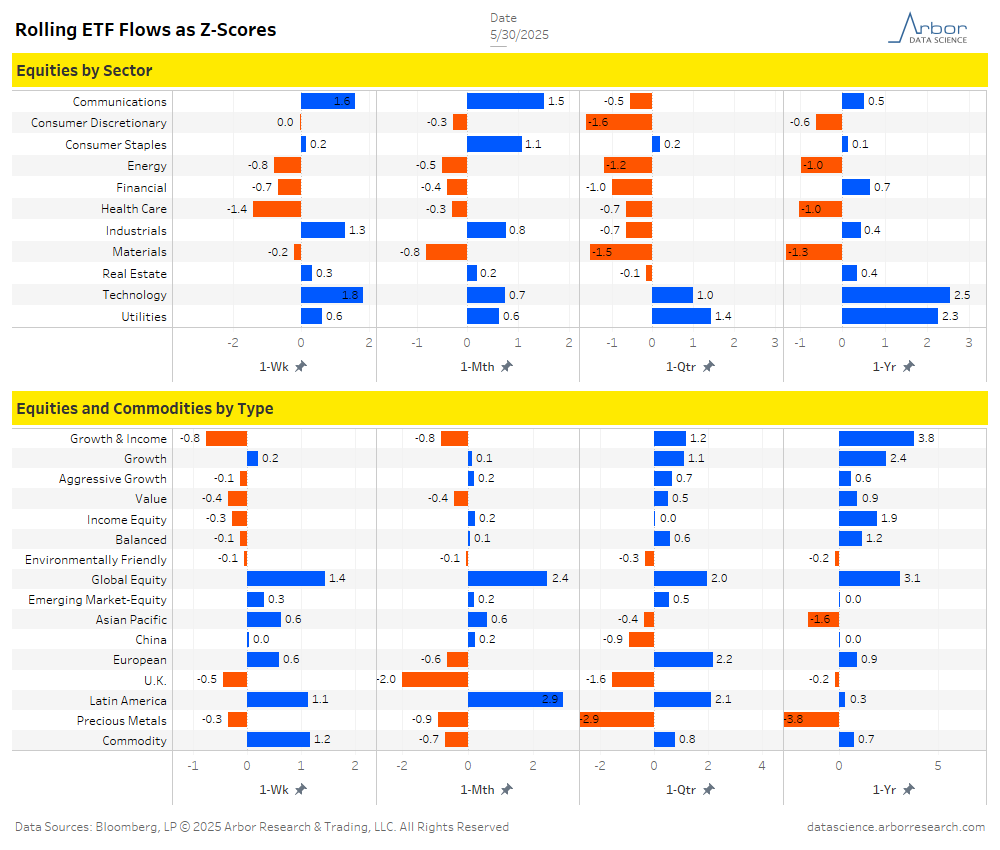

- Aggregate flows (black line in chart below) were positive for the week ended 5/30/25, with $0.65 billion of inflows. Industrials had the largest inflows for the week at $0.61 billion. Energy had the largest outflows at $0.51 billion.

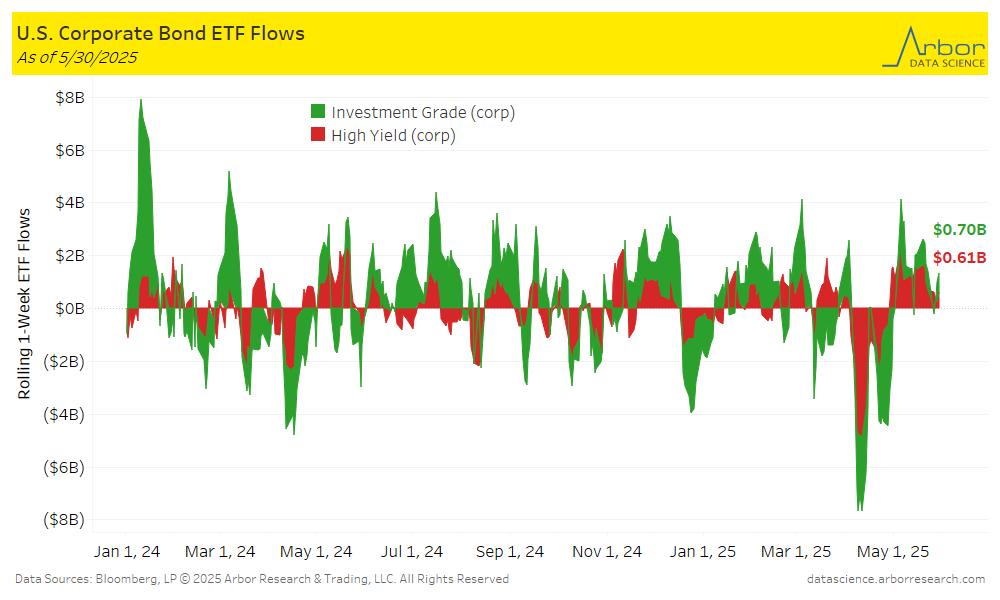

- Corporate bond ETFs were positive for the week ended 5/30/25, with Investment-Grade ETFs gaining $0.70 billion and High-Yield ETFs gaining $0.61 billion.

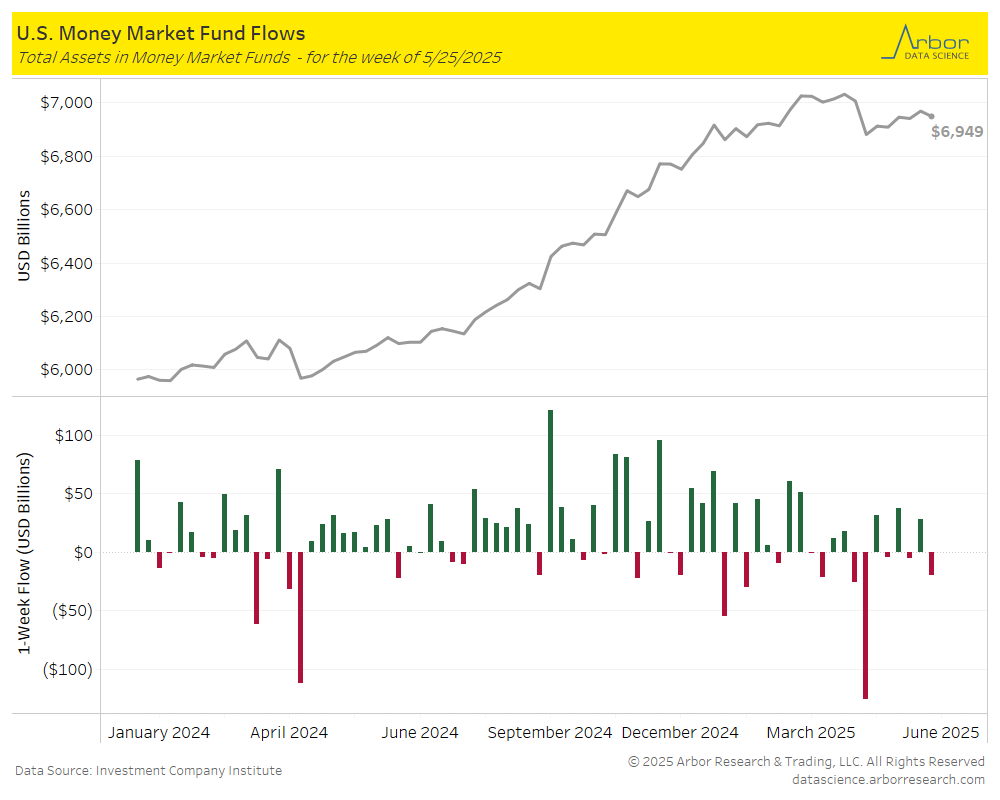

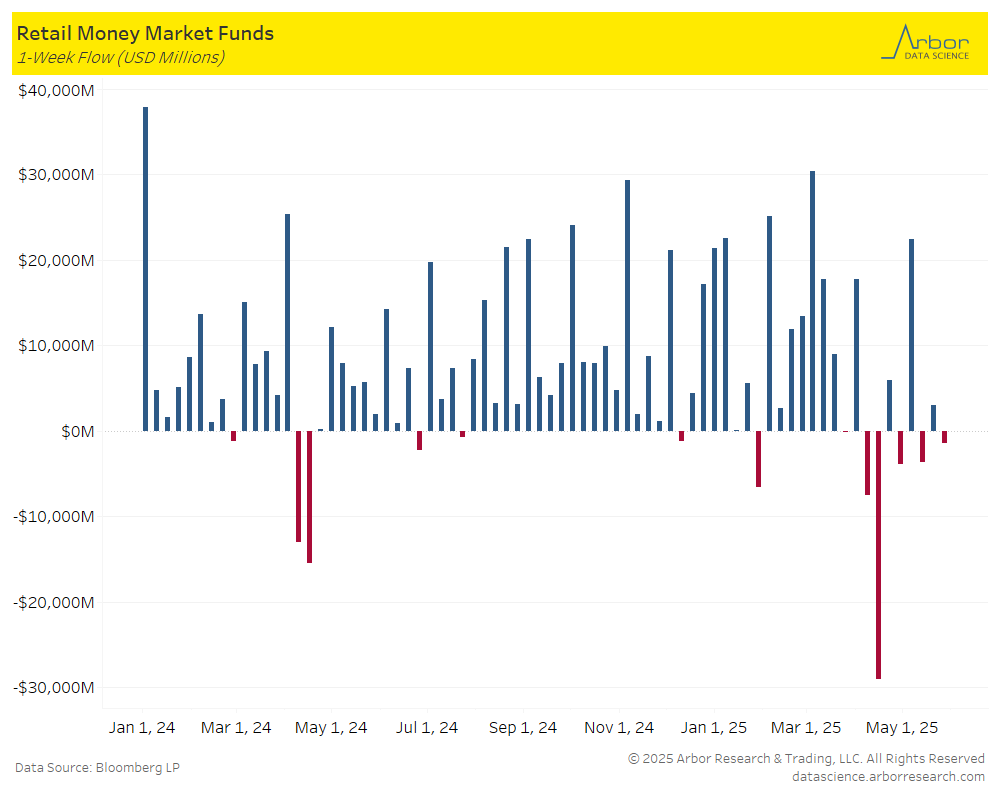

- The amount invested in Money-Market Mutual Funds (MMMFs) decreased to $6.949 trillion in total assets on 05/28/25, compared to $6.969 trillion the prior week.

Tables