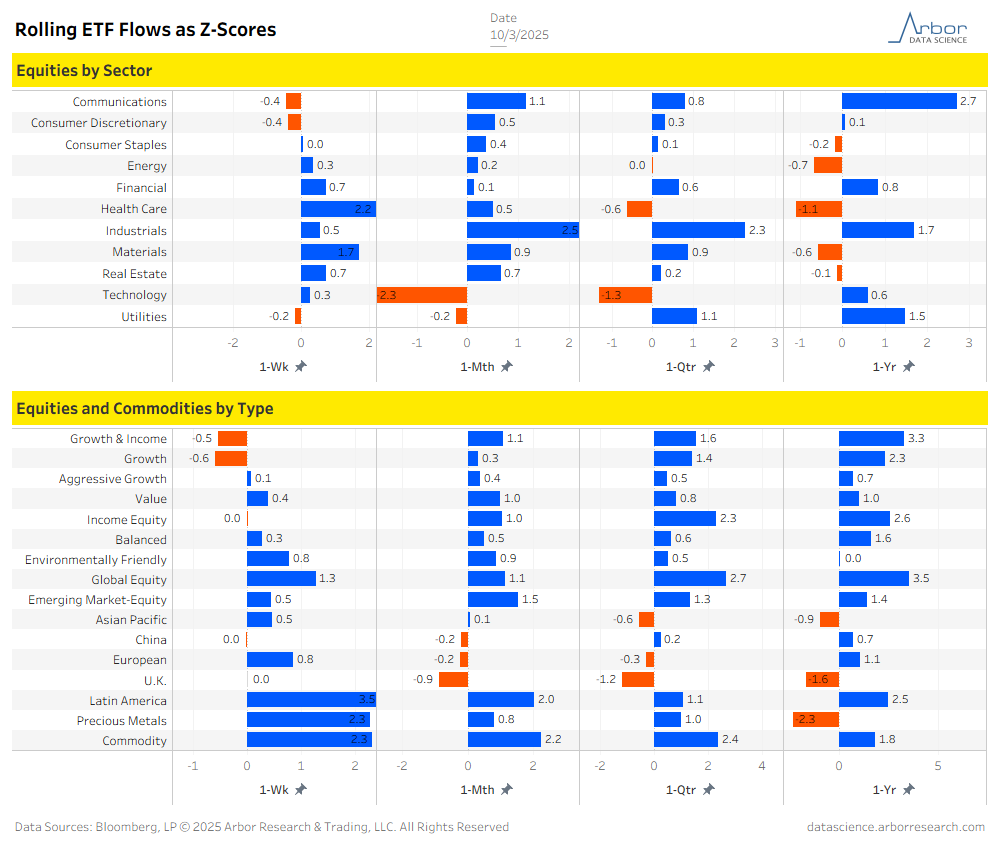

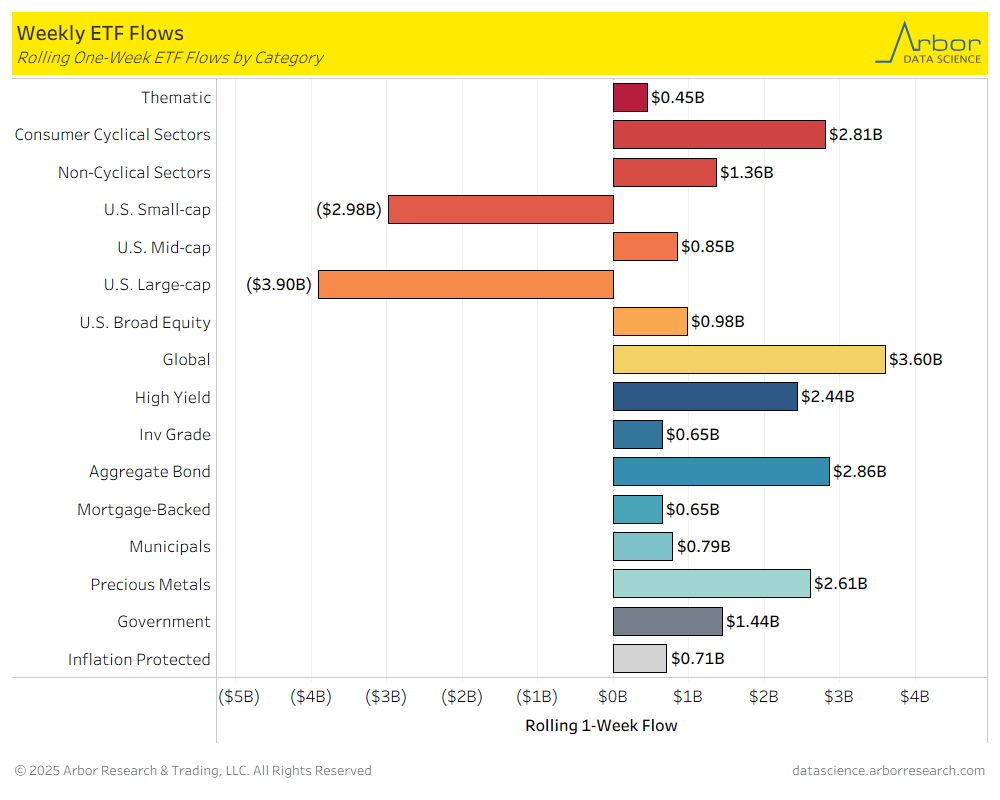

- Of the 16 ETF categories charted below, 14 categories had net inflows for the week that ended on 10/3/2025.

- The two ETF categories with the largest inflows for the week that ended on 10/3/2025 were Global ETFs at $3.60 billion, and Aggregate Bond ETFs, at $2.86 billion.

- The ETF category with the largest outflow for the week that ended on 10/3/2025 was U.S. Large Cap ETFs at $3.90 billion in outflows.

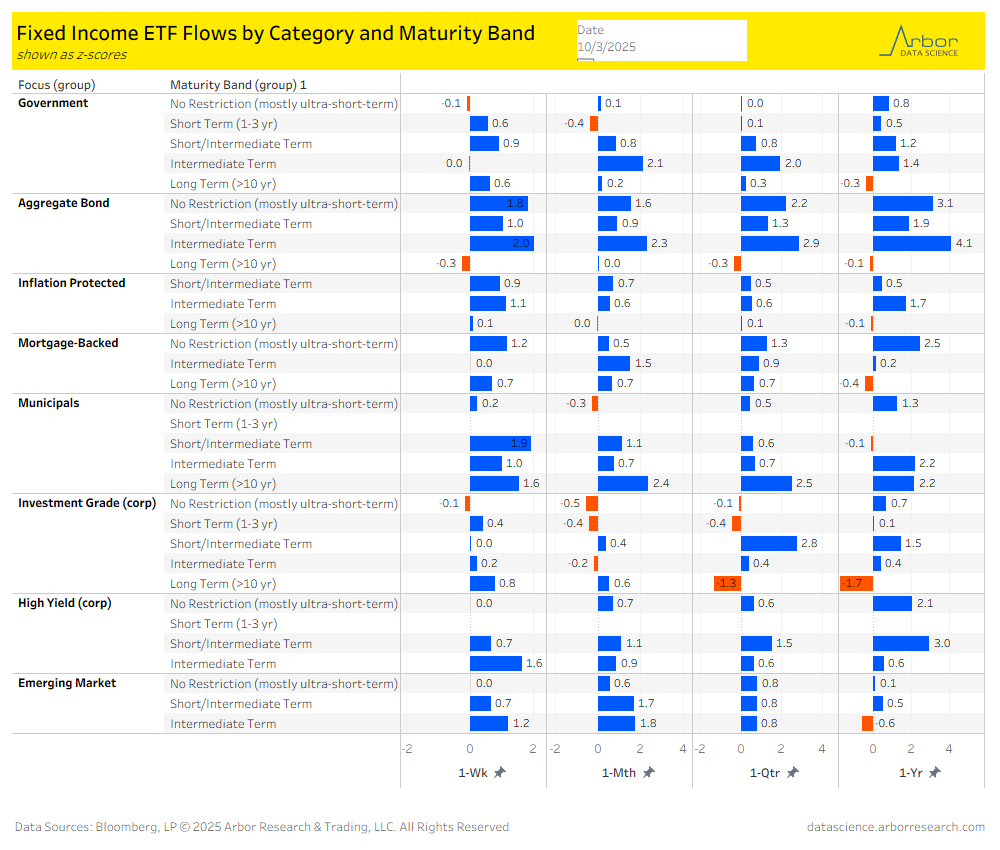

- Long Term (>10 yr) bond ETFs had inflows of $0.56 billion over the last week. The largest inflows were $4.92 billion in Intermediate Term (3-10 yr) ETFs.

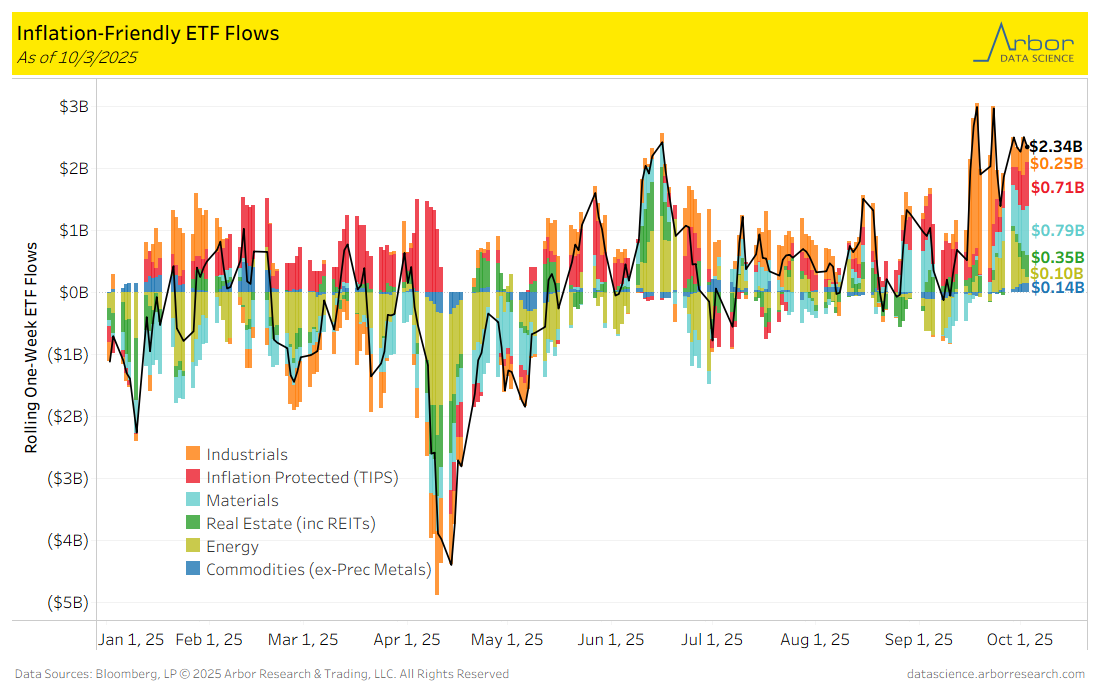

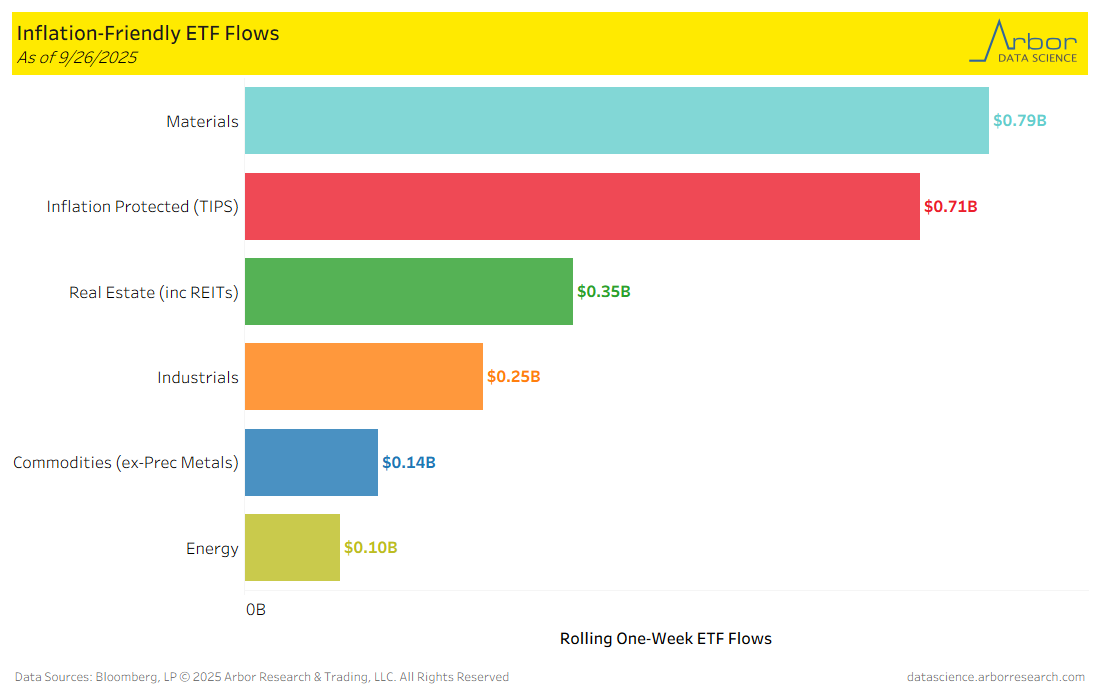

- Aggregate flows (black line in chart below) were positive for the week ended 10/3/25, with $2.43 billion of inflows. Materials had the largest inflows for the week at $0.79 billion.

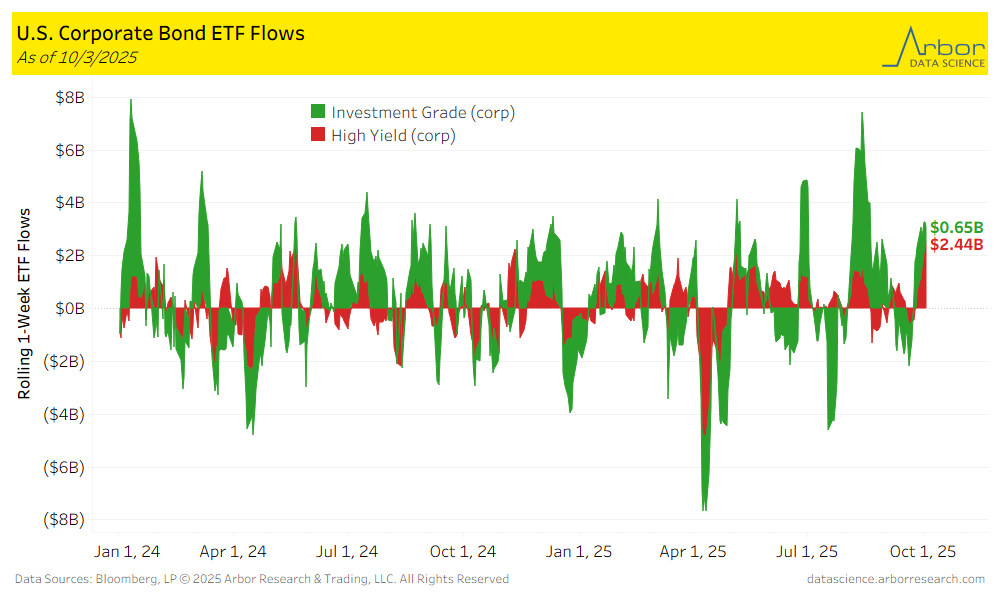

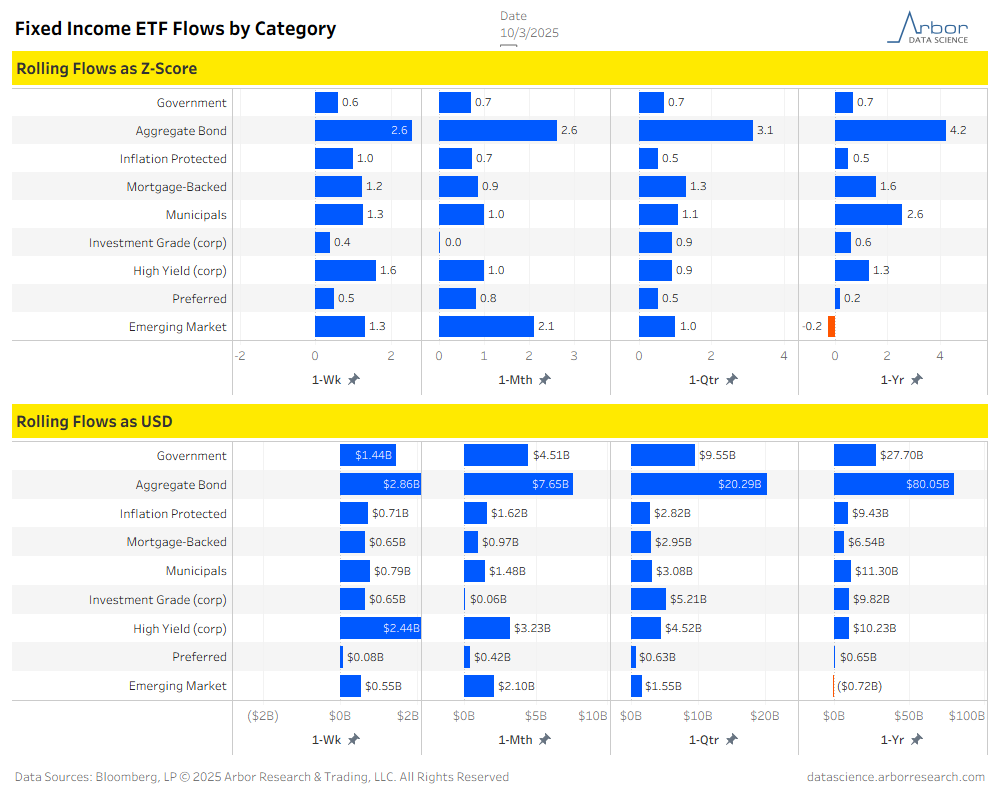

- Corporate bond ETF flows were positive for the week ended 10/3/25, with High-Yield ETFs gaining $2.44 billion and Investment-Grade ETFs gaining $0.65 billion.

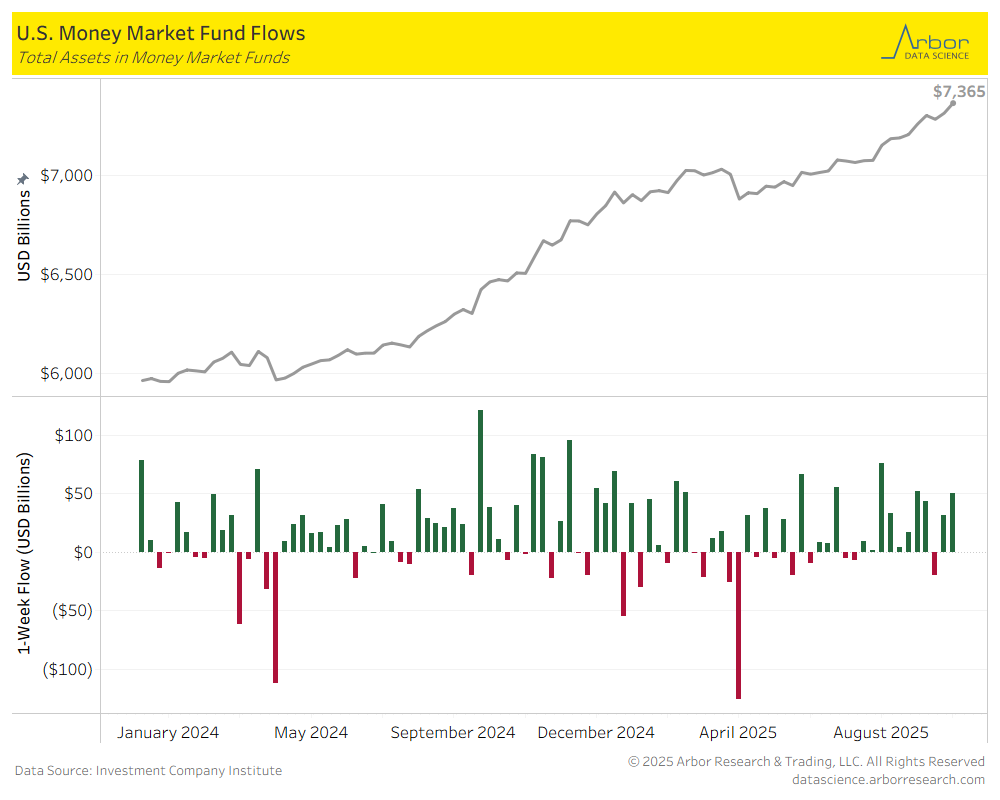

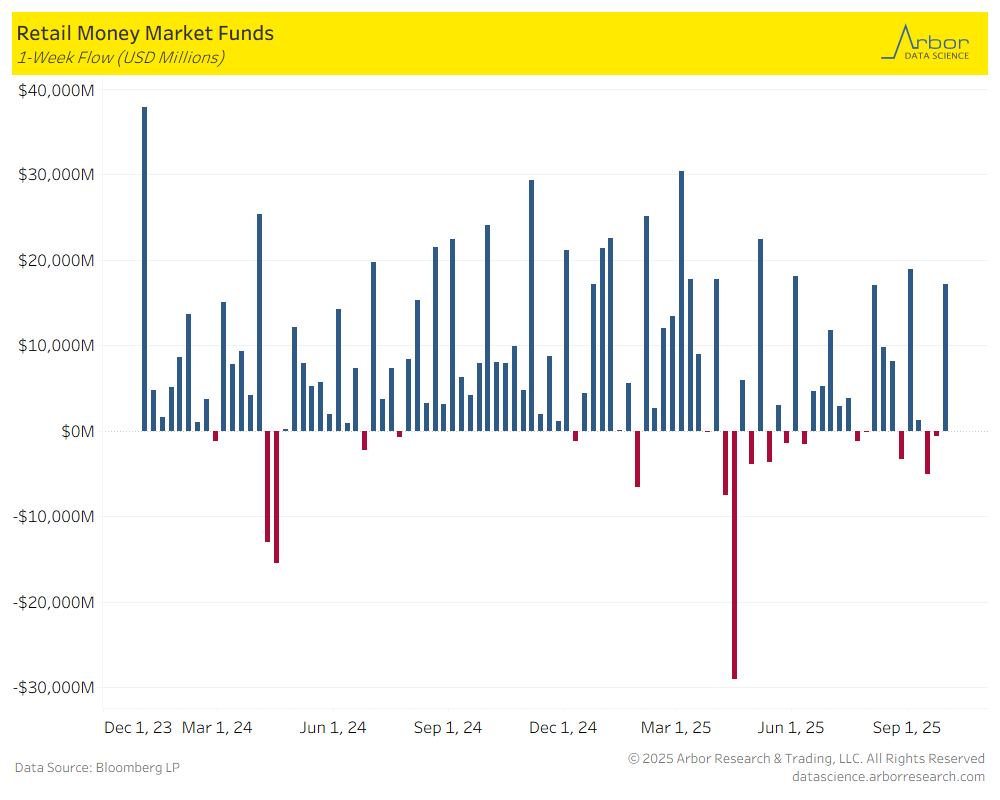

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $7.365 trillion in total assets on 10/1/2025, compared to $7.315 trillion in total assets on 9/24/25.

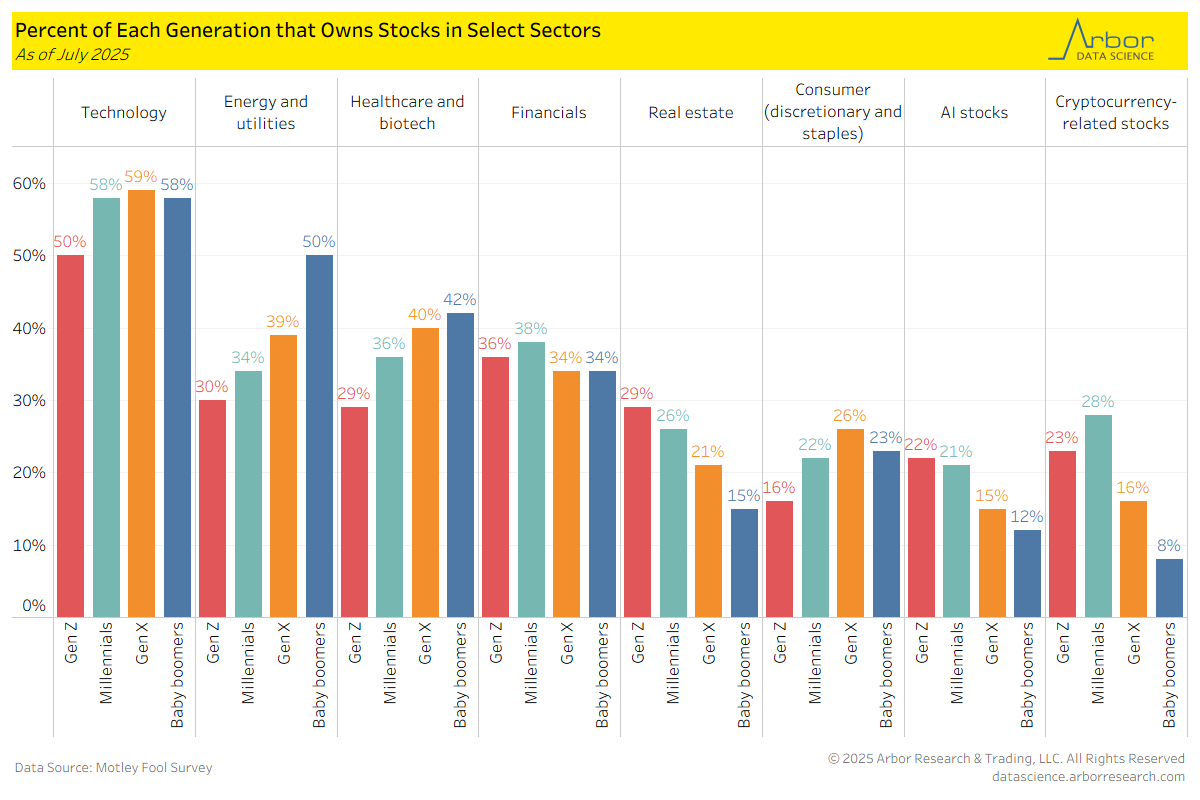

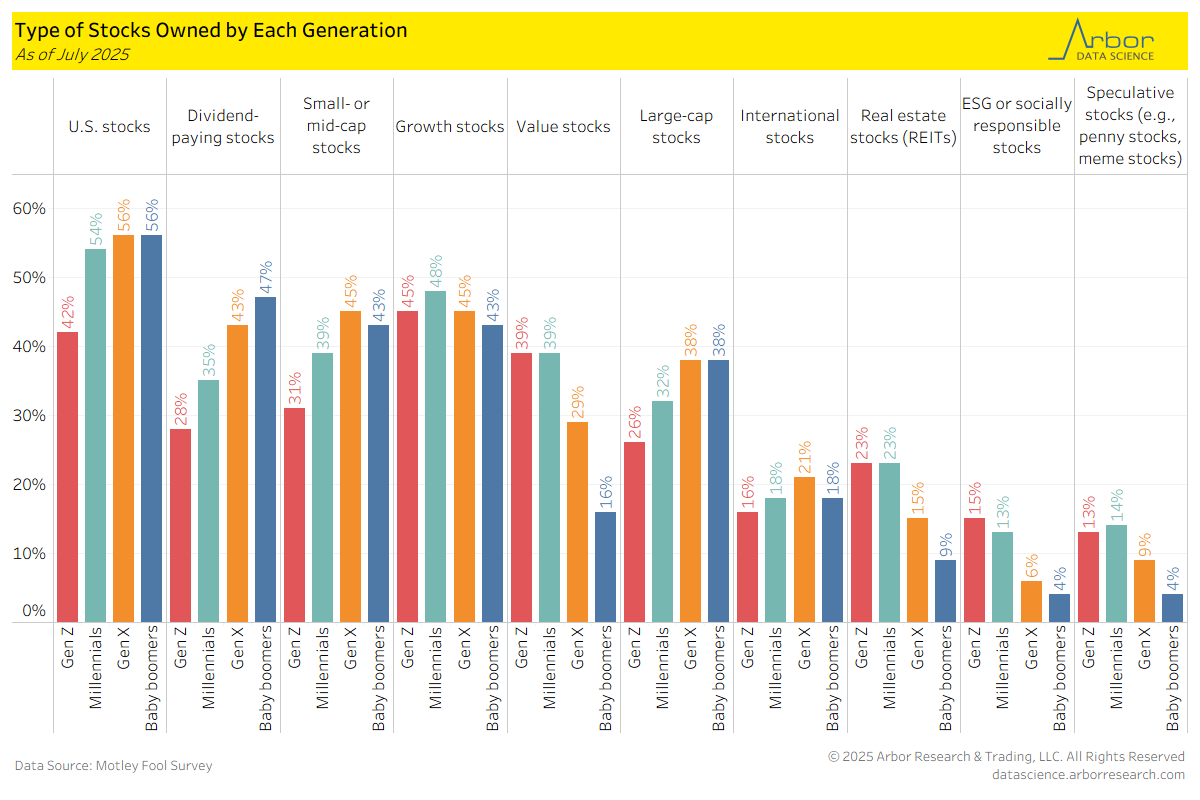

Examining Stock Investment by Generation

Tables