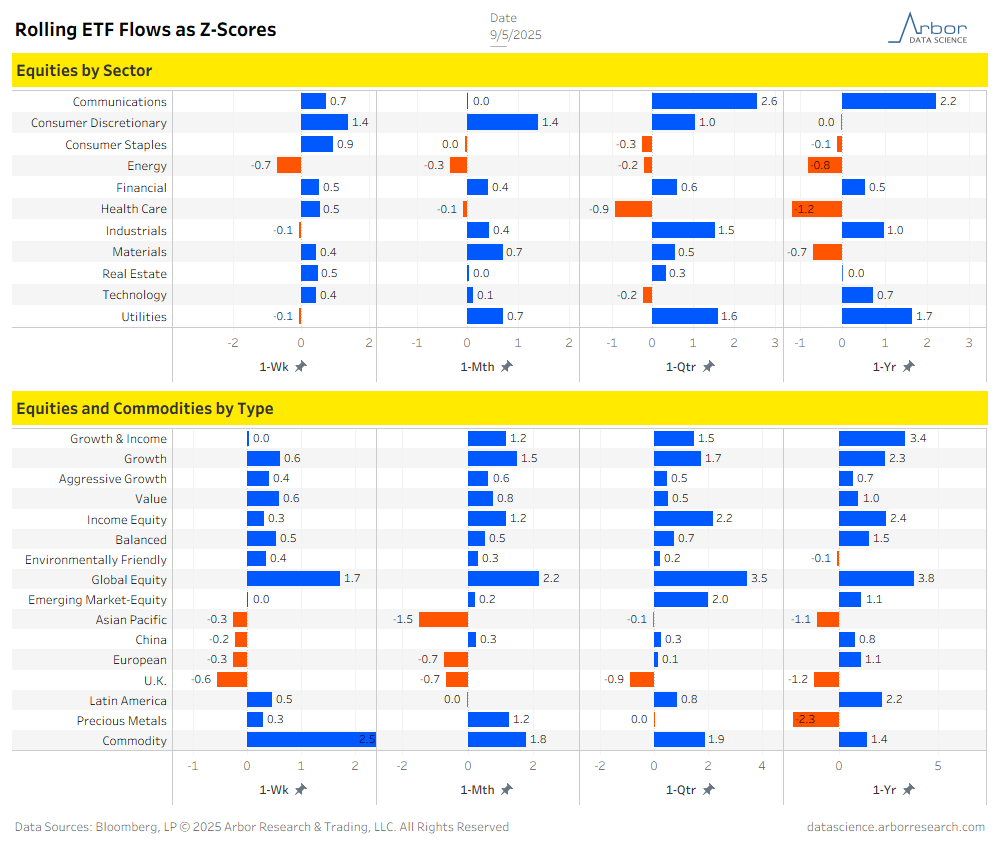

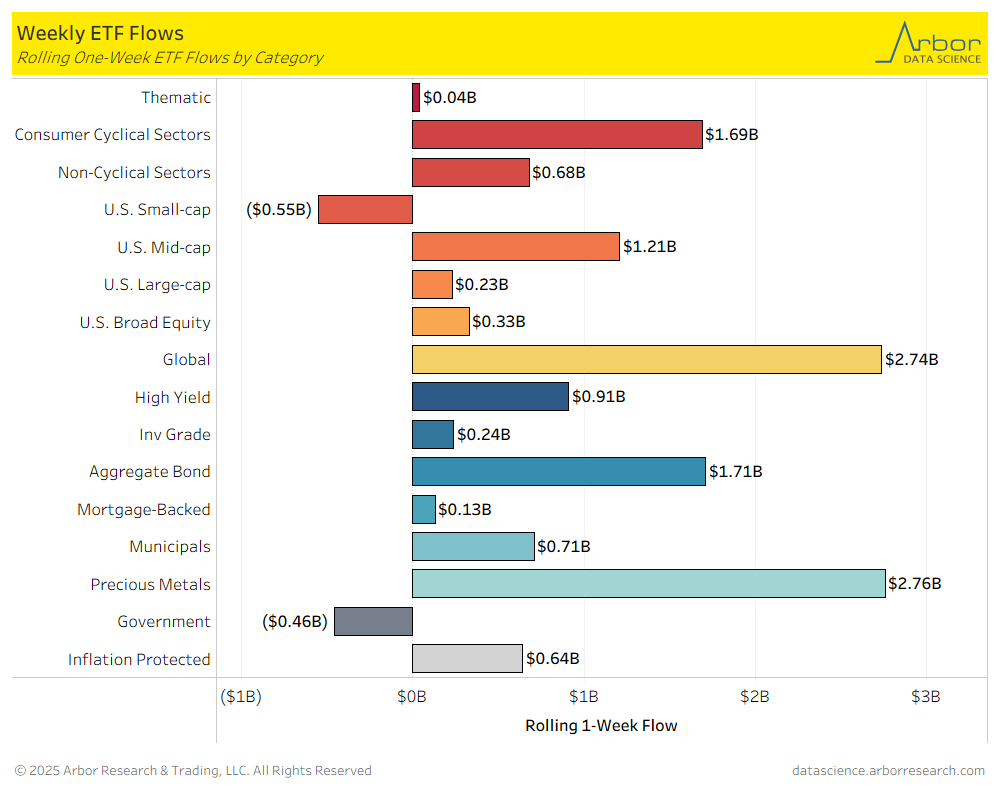

- Of the 16 ETF categories charted below, 14 categories had net inflows for the week that ended on 9/05/2025.

- The two ETF categories with the largest inflows for the week that ended on 9/05/2025 were Precious Metal ETFs, at $2.76 billion in inflows, and Global ETFs, at $2.74 billion in inflows.

- The ETF category with the largest outflow for the week that ended on 9/05/2025 was U.S. Small Cap ETFs at $0.55 billion in outflows.

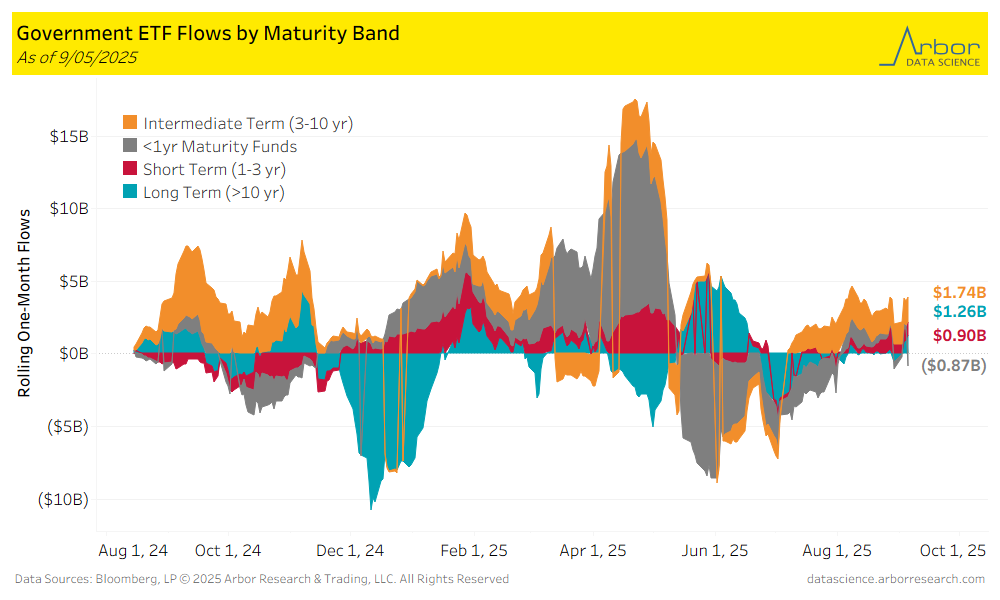

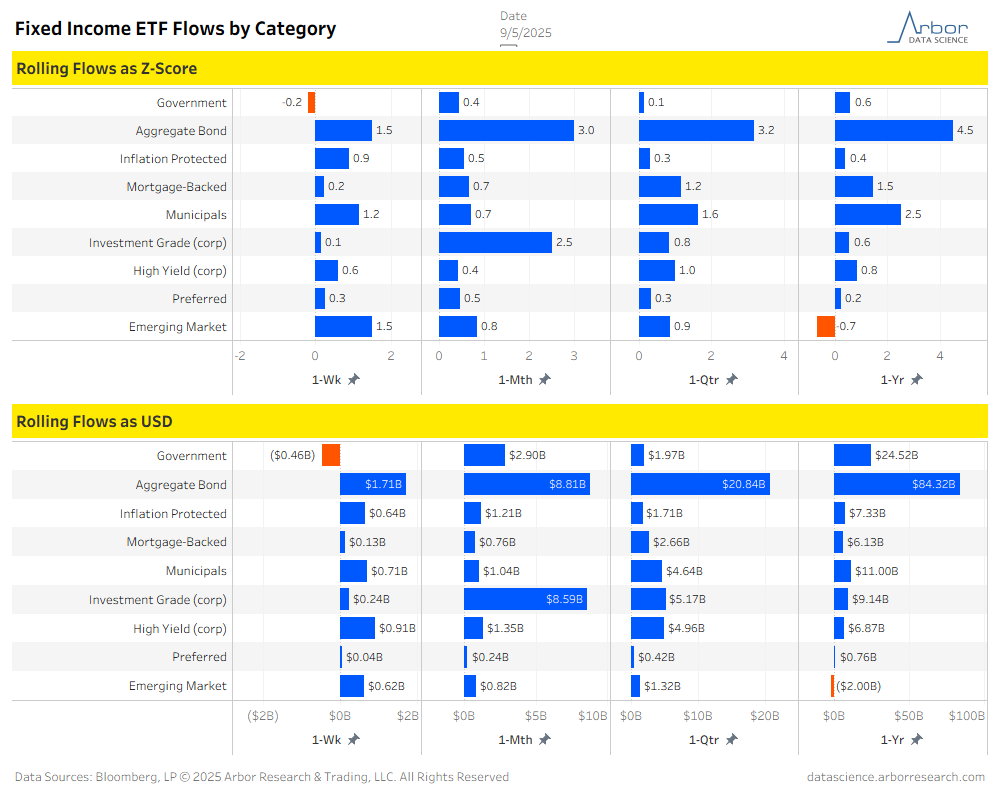

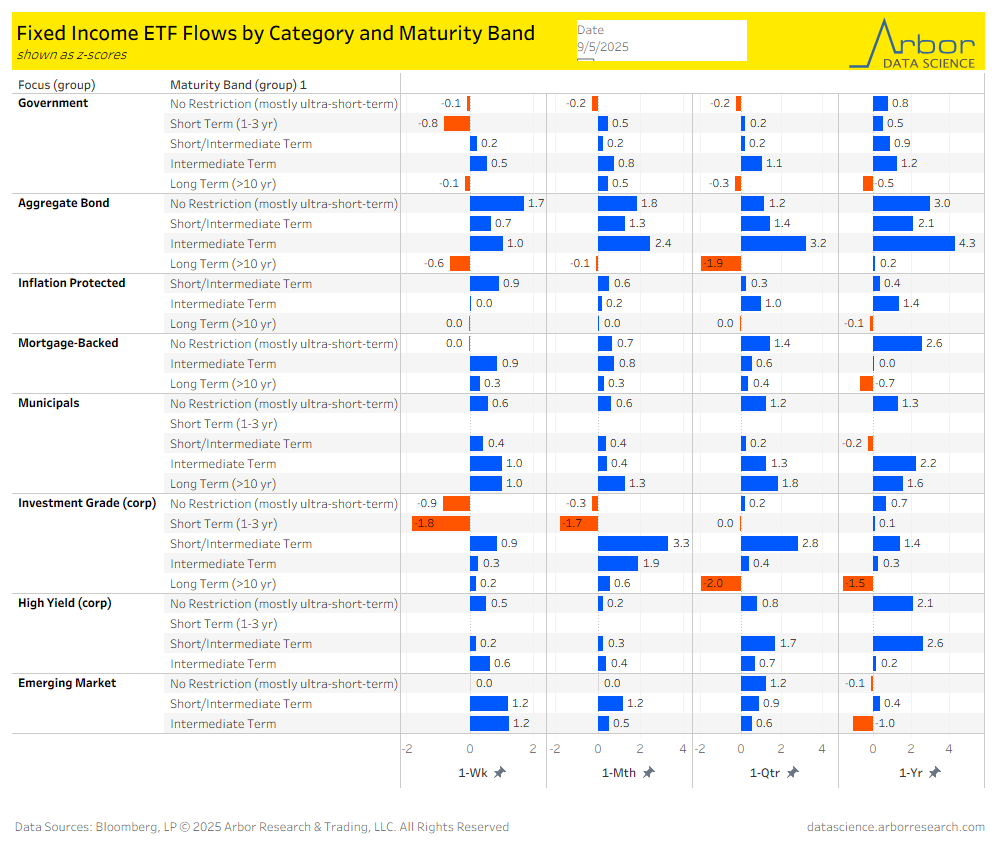

- Long Term (>10 yr) ETFs had outflows of $1.26 billion over the last week. The largest inflows were $1.74 billion in Intermediate Term (3-10 yr) ETFs, followed by $0.90 billion inflows in Short Term (1-3 yr) ETFs over the same time period.

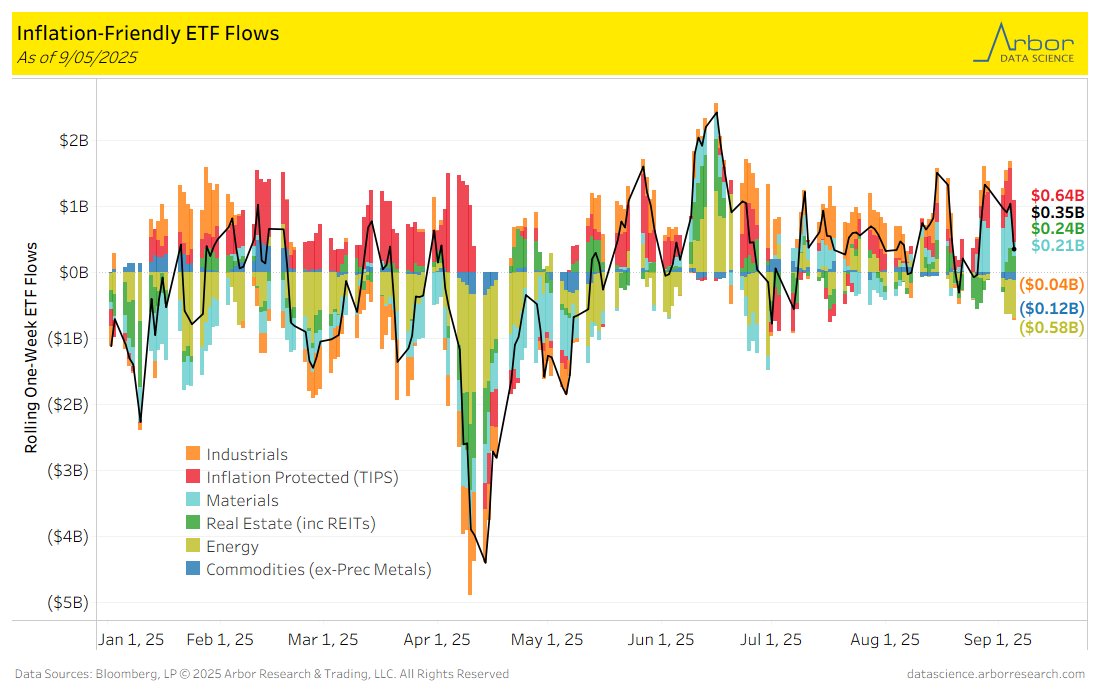

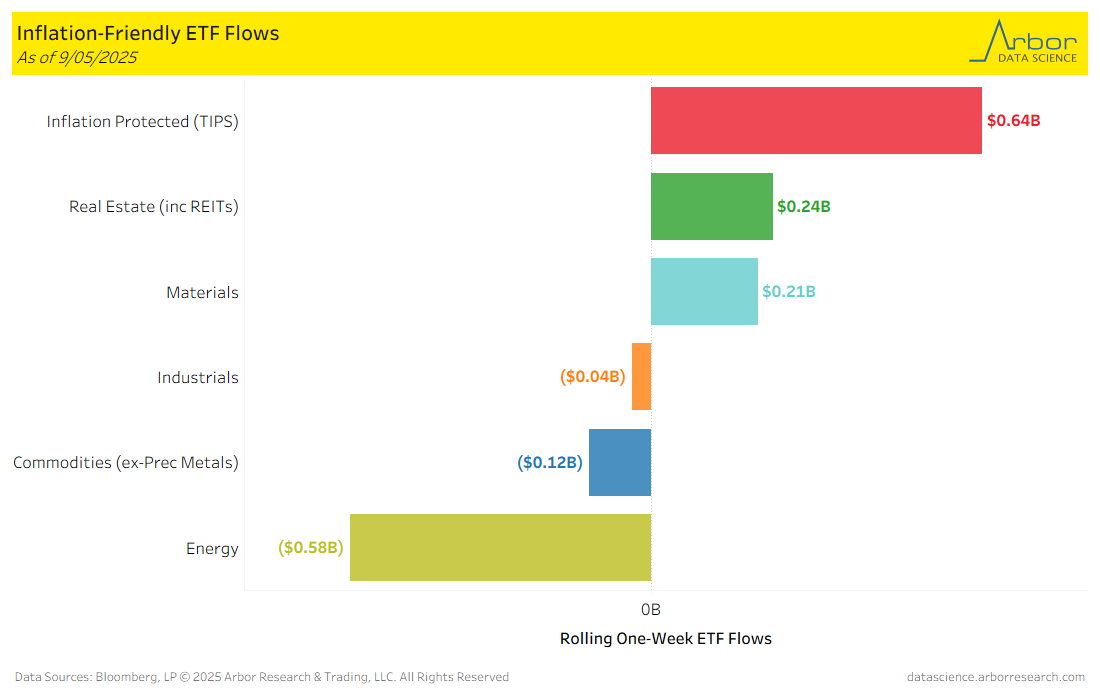

- Aggregate flows (black line in chart below) were positive for the week ended 9/05/25, with $0.35 billion of inflows. Inflation Protected (TIPS) had the largest inflows for the week at $0.64 billion. Energy had the largest outflows at $0.58 billion.

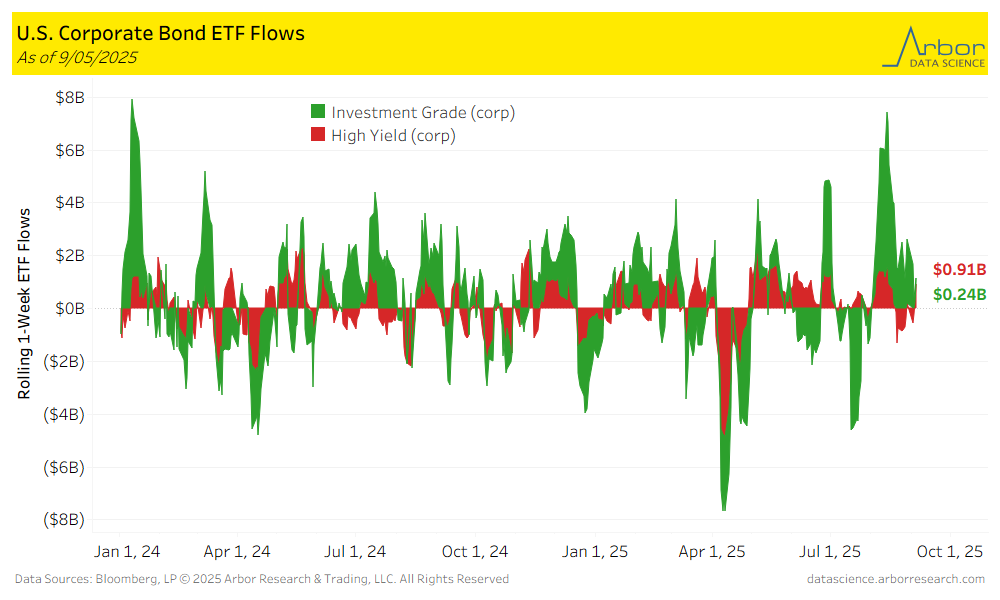

- Corporate bond ETFs were positive for the week ended 9/05/25, with High-Yield ETFs gaining $0.91 billion and Investment-Grade ETFs gaining $0.24 billion.

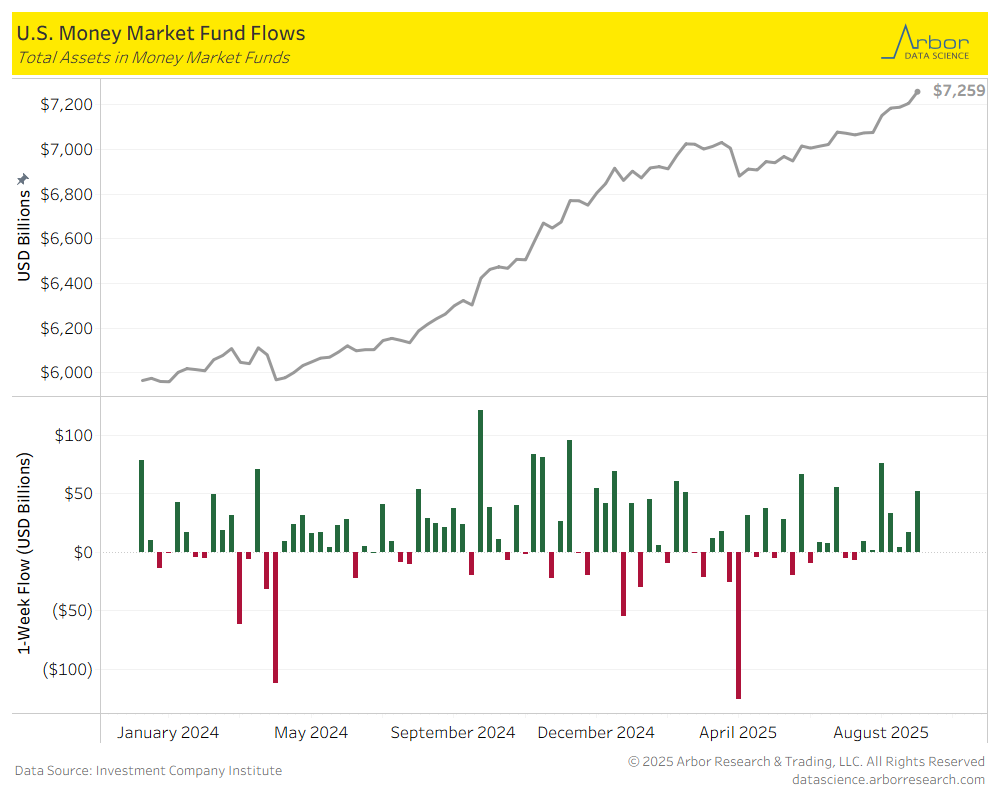

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $7.259 trillion in total assets on 9/03/2025, compared to $7.207 trillion in total assets on 8/27/25.

Tables