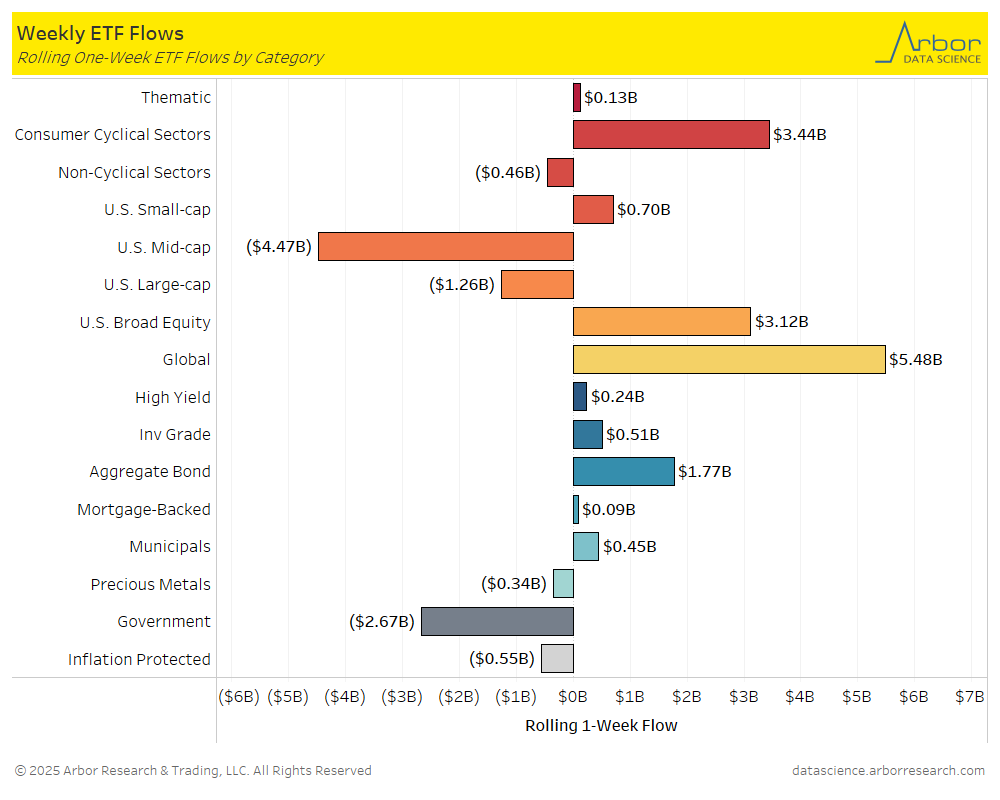

- The top two movers of the week were U.S. Large-cap ETFs and U.S. Broad Equity ETFs for the week ended on 7/03/25.

- On a weekly basis, U.S. Large-Cap ETFs had outflows of approximately $1.26 billion for the week ended 7/03/25, compared to inflows of $13.28 billion for the week ended on 6/27/25.

- On a weekly basis, U.S. Broad Equity ETFs had inflows of approximately $3.12 billon for the week ended 7/03/25, compared to outflows of $2.55 billion for the week ended on 6/27/25.

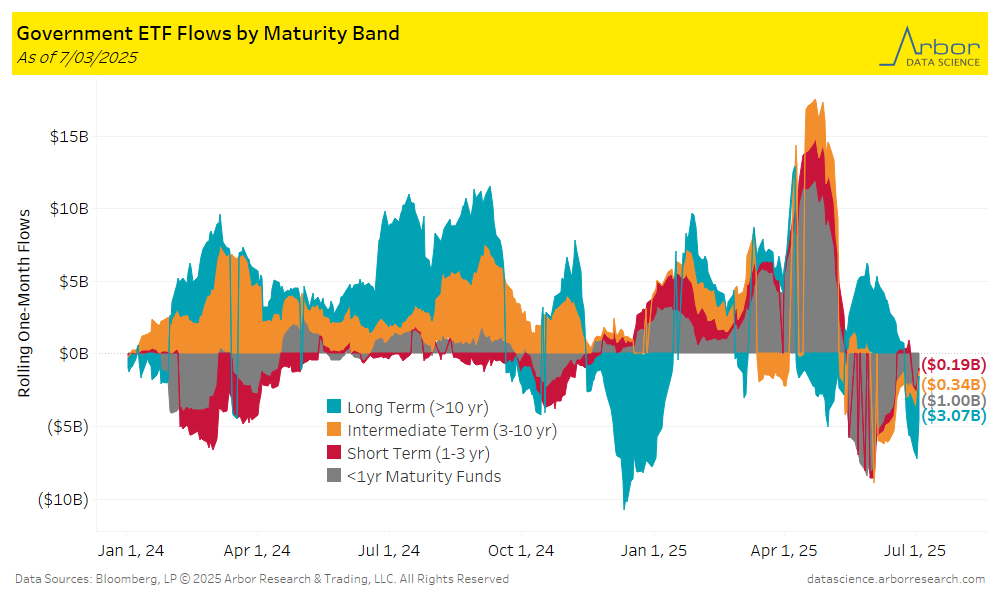

- Long Term (>10 yr) ETFs had outflows of $3.07 billion over the last week. The second largest outflows were $1.00 billion in <1 year Maturity Fund ETFs over the same time period.

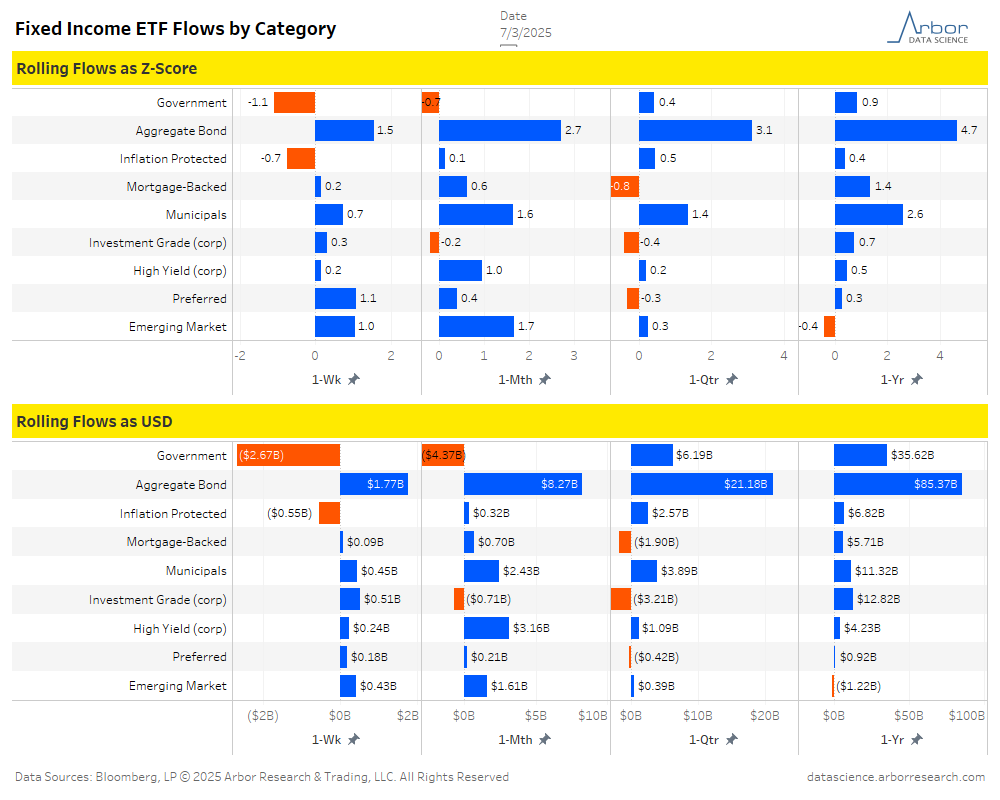

- Aggregate flows (black line in chart below) were negative for the week ended 7/03/25, with $0.07 billion of outflows. Industrials had the largest inflows for the week at $0.27 billion. Inflation Protected (TIPS) had the largest outflows at $0.55 billion.

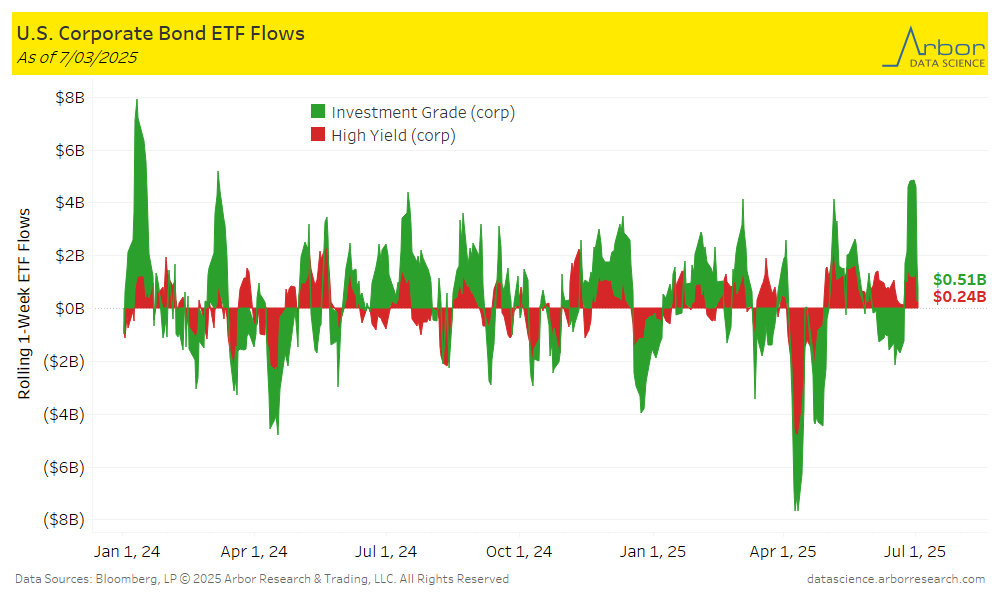

- Corporate bond ETFs were positive for the week ended 7/03/25, with Investment-Grade ETFs gaining $0.51 billion and High-Yield ETFs gaining $0.24 billion.

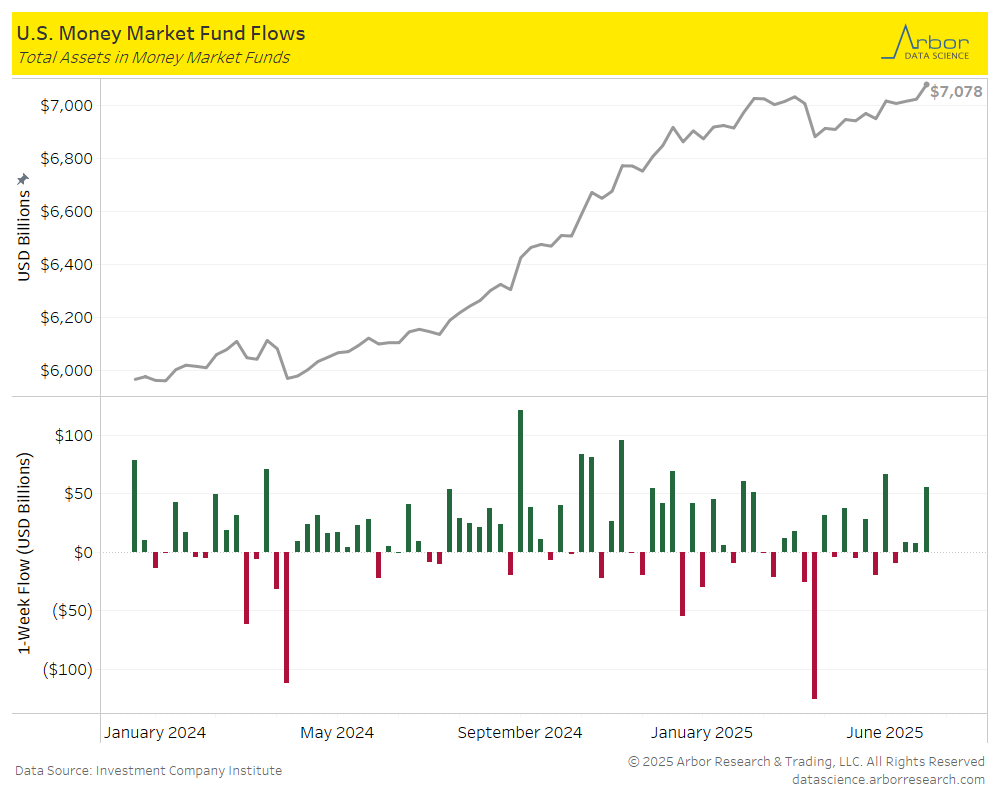

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $7.078 trillion in total assets on 7/02/2025, compared to $7.023 trillion in total assets on 6/27/25.

Tables

.png)

.png)

.png)