- Of the 16 ETF categories charted below, 10 categories had net inflows for the week that ended on 10/31/2025.

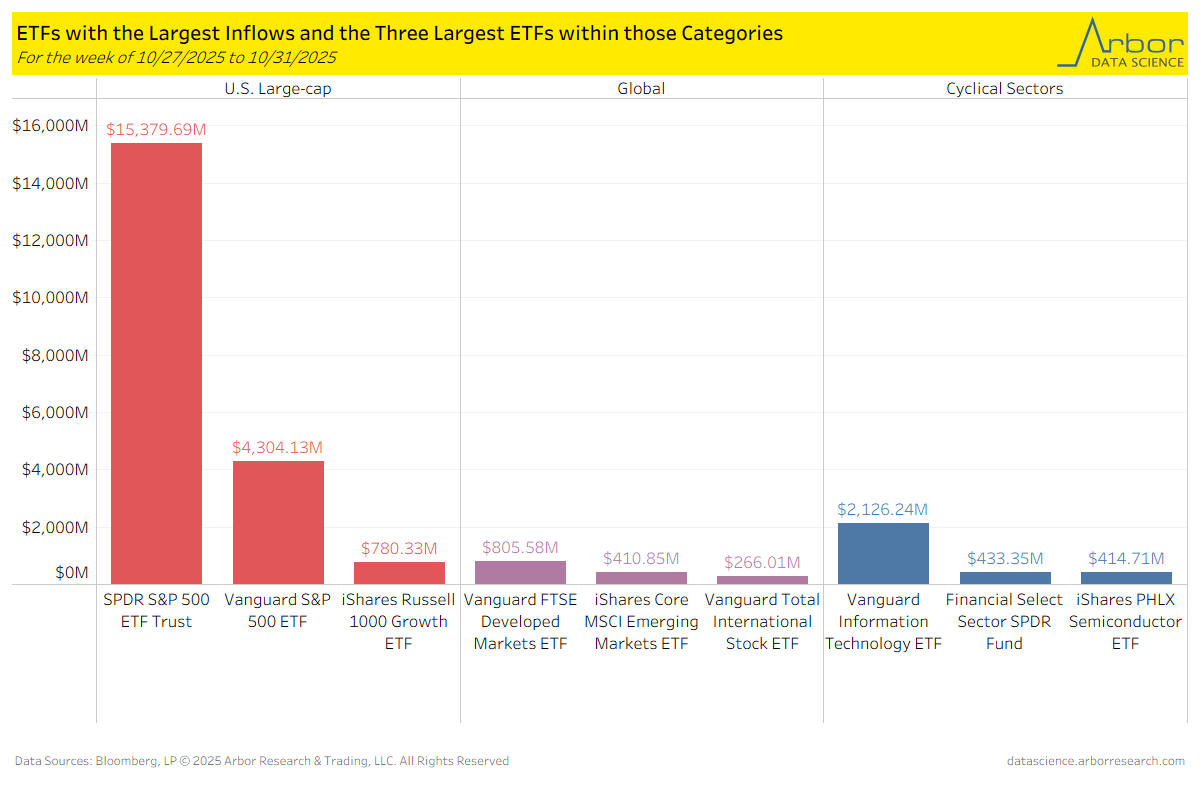

- The three ETF categories with the largest inflows for the week that ended on 10/31/2025 were U.S. Large-Cap ETFs at $23.13 billion, Global ETFs at $3.05 billion, and Consumer Cyclical Sectors at $1.84 billion.

- The ETF category with the largest outflow for the week that ended on 10/31/2025 was Precious Metals ETFs at $1.43 billion in outflows.

- Below, we highlight the three ETF categories with the largest inflows and the largest ETFs within those categories for the week of 10/27/2025 to 10/31/2025.

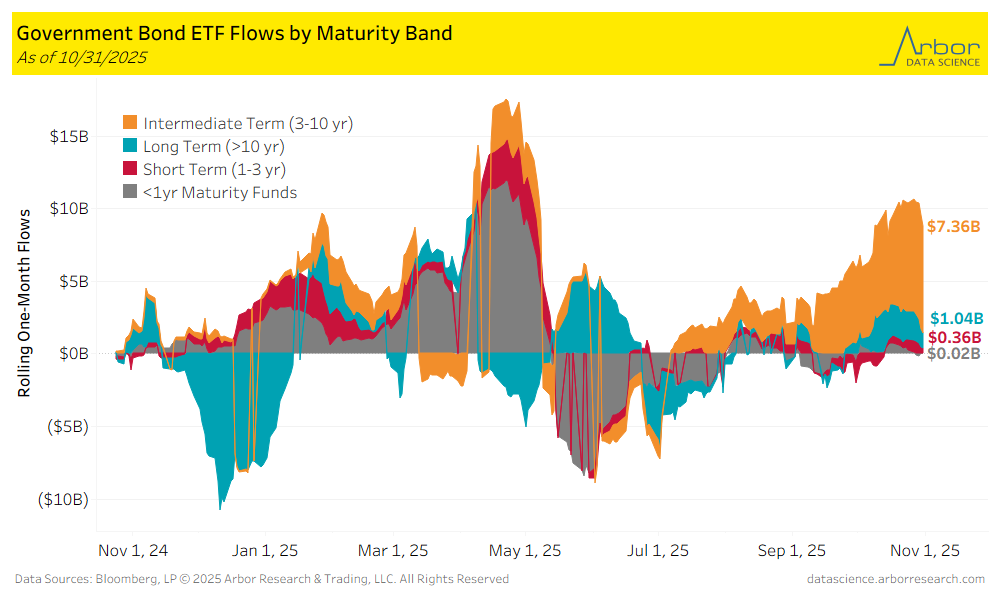

- Long Term (>10 yr) bond ETFs had inflows of $1.04 billion over the last week. The largest inflows were $7.36 billion in Intermediate Term (3-10 yr) ETFs.

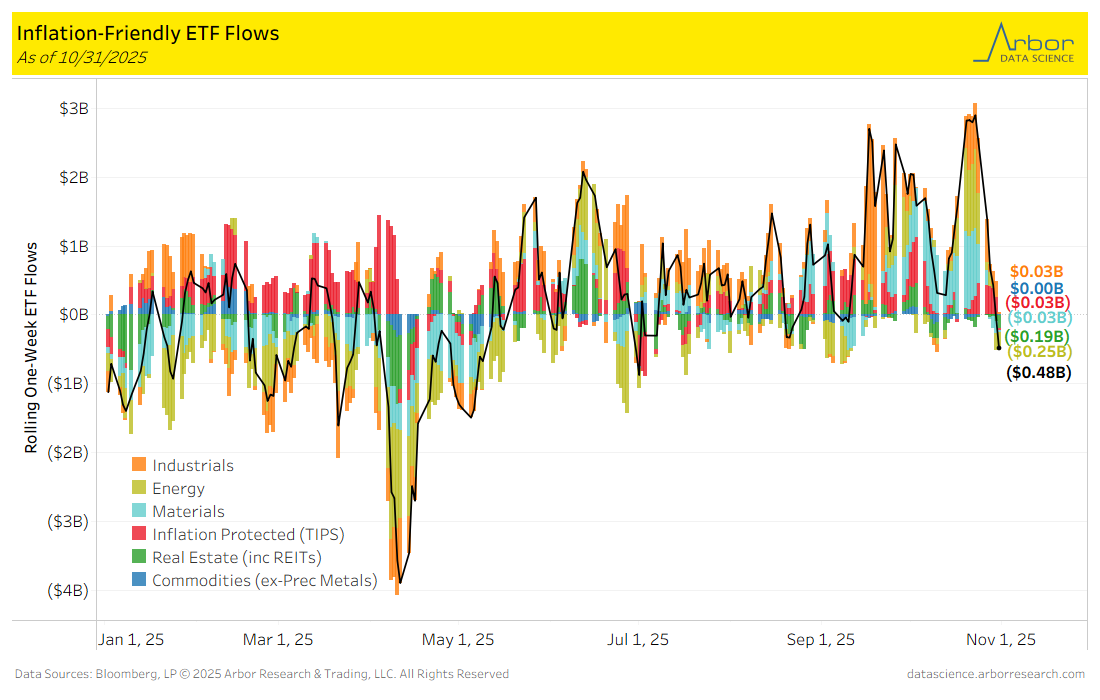

- Aggregate flows (black line in chart below) were negative for the week ended 10/31/25, with $0.48 billion of outflows. Energy had the largest outflows for the week at $0.25 billion.

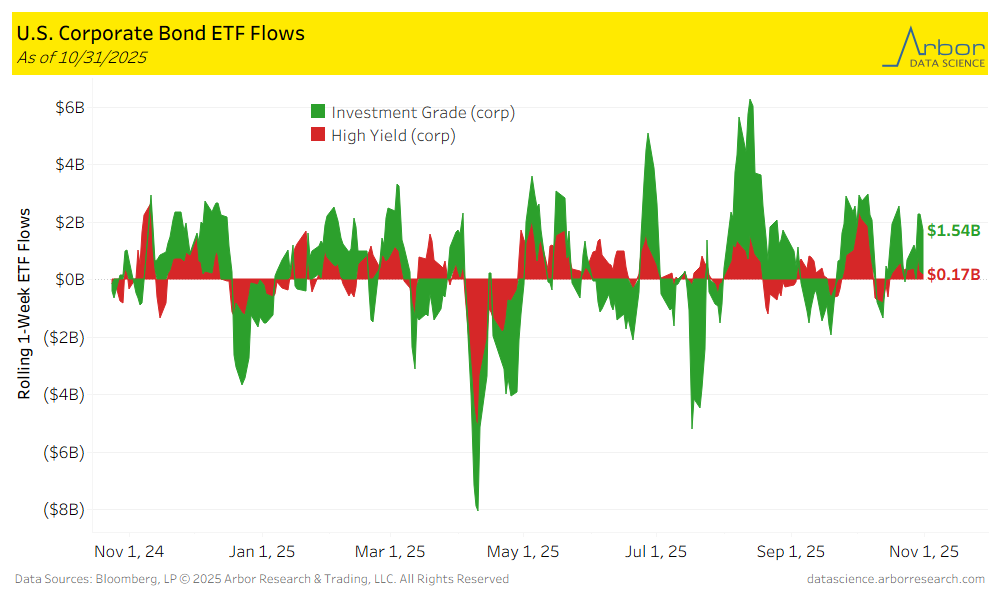

- Corporate bond ETF flows were positive for the week ended 10/31/25, with High-Yield ETFs gaining $0.17 billion and Investment-Grade ETFs gaining $1.54 billion.

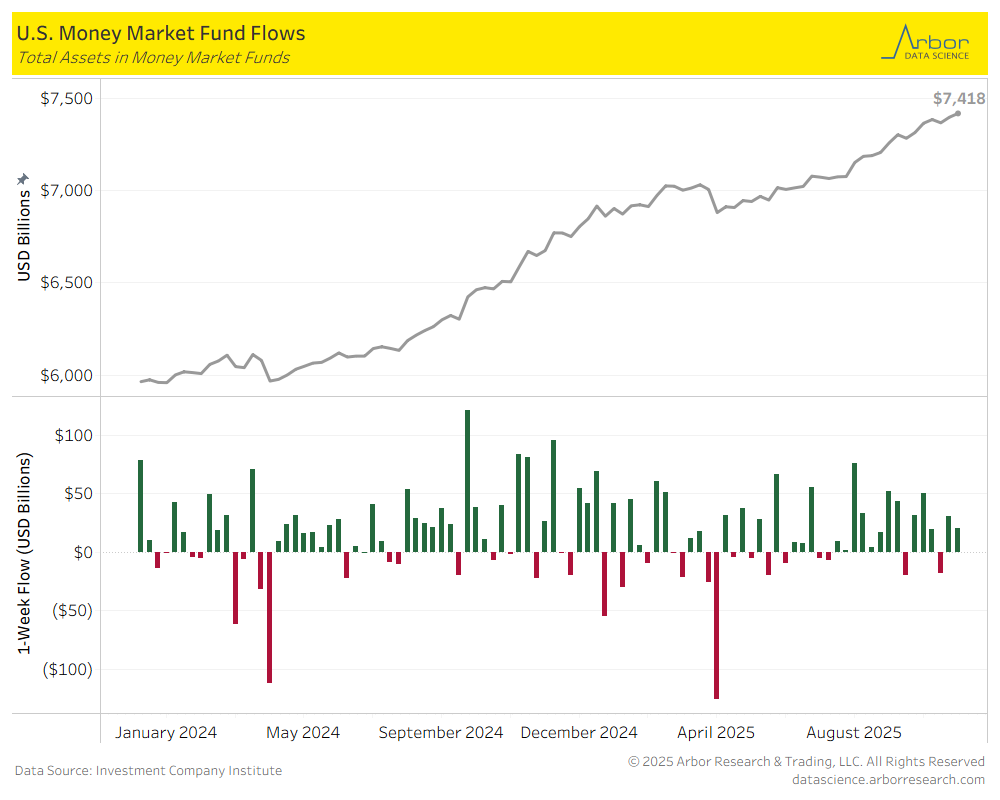

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $7.418 trillion in total assets on 10/29/2025, compared to $7.398 trillion in total assets on 10/22/2025.