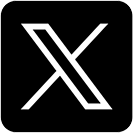

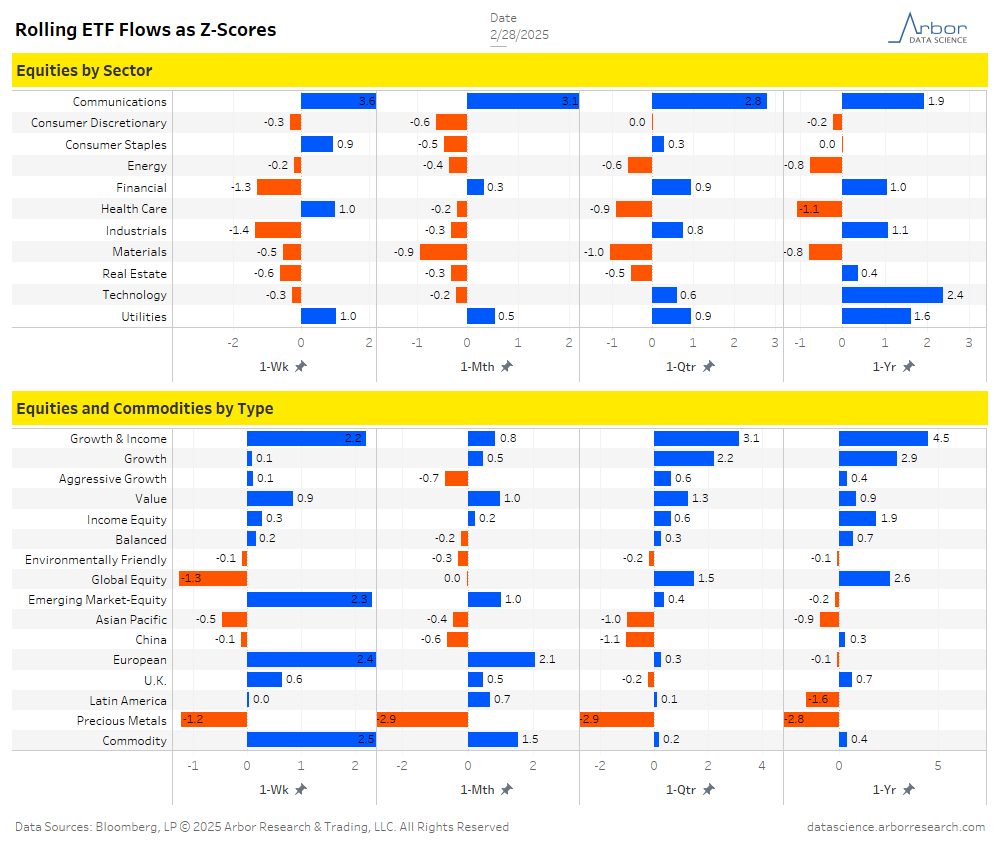

- The top two movers of the week were U.S. Large-cap ETFs and Consumer Cyclical Sectors ETFs for the week ended on 2/28/25.

- On a weekly basis, U.S. Large-cap ETFs had inflows of approximately $21.58 billion for the week ended 2/28/25, compared to inflows of $10.66 billion for the week ended on 2/21/25.

- On a weekly basis, Consumer Cyclical Sectors ETFs had outflows of approximately $4.15 billion for the week ended 2/28/25, compared to outflows of $0.93 billion for the week ended on 2/21/25.

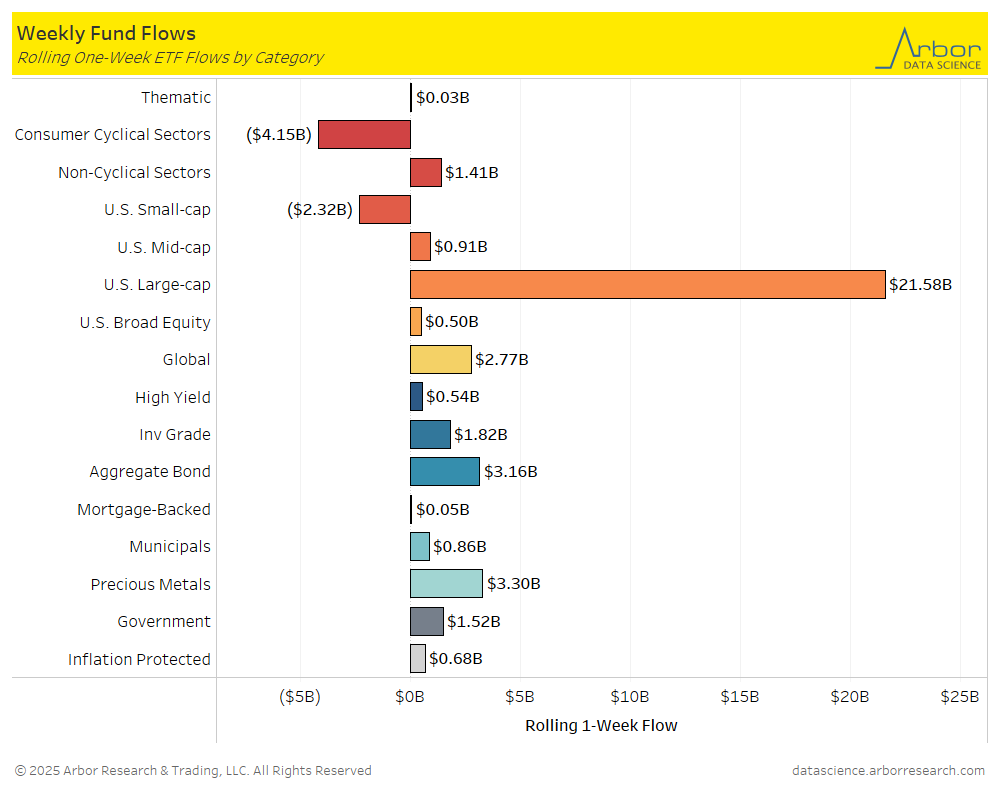

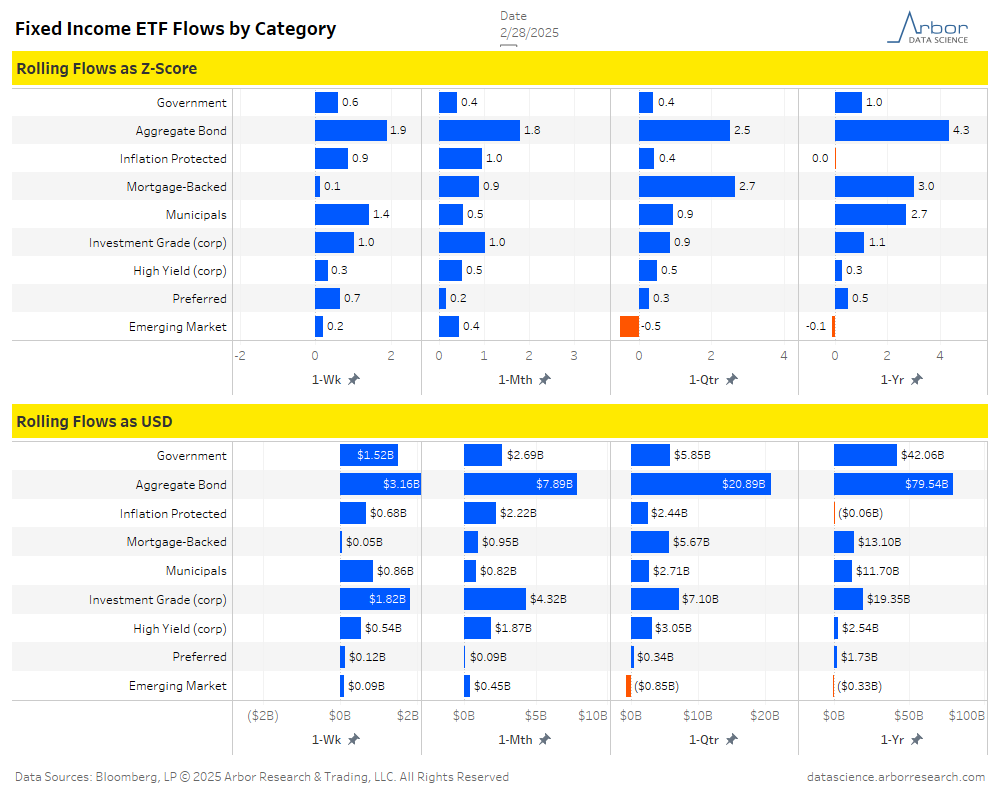

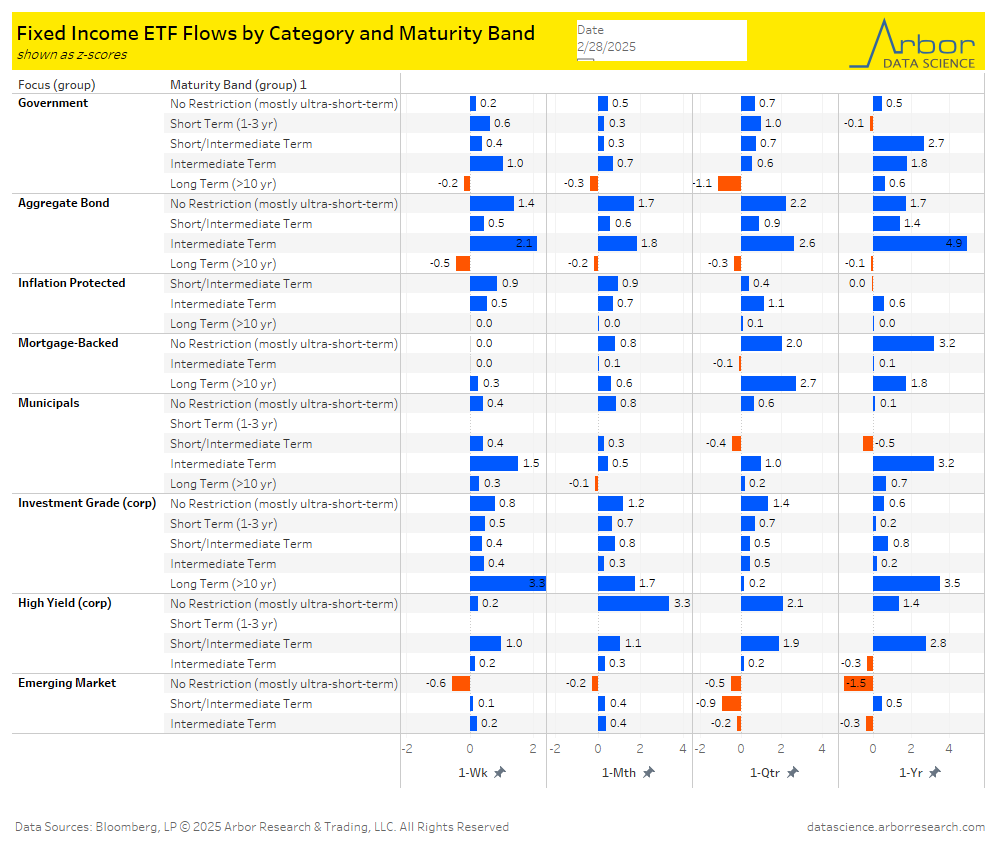

- Long Term (>10 yr) ETFs had outflows of $0.92 billion over the last week. The largest inflows were $1.73 billion in Intermediate Term (1-3 yr) ETFs over the same time period.

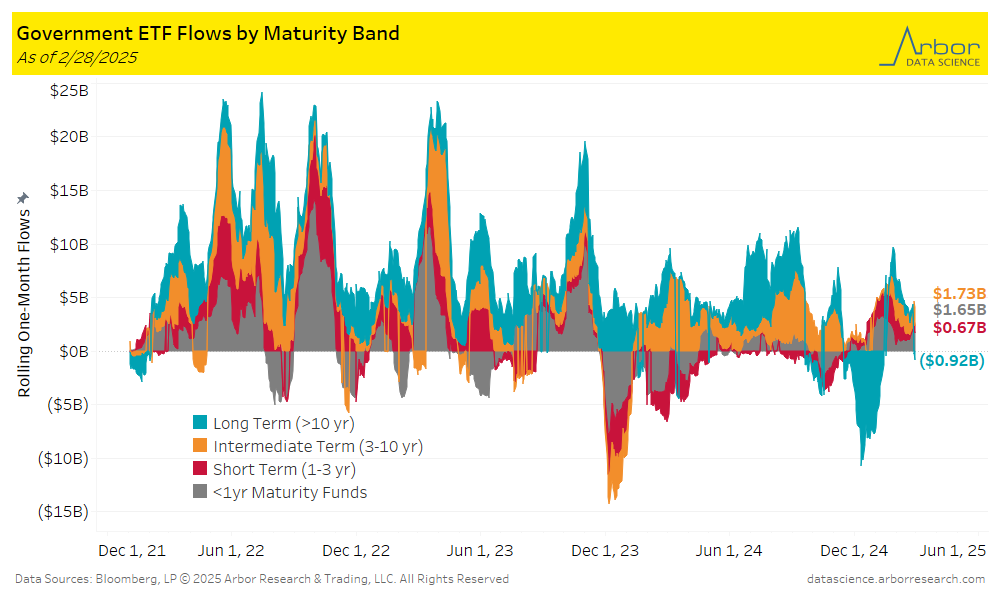

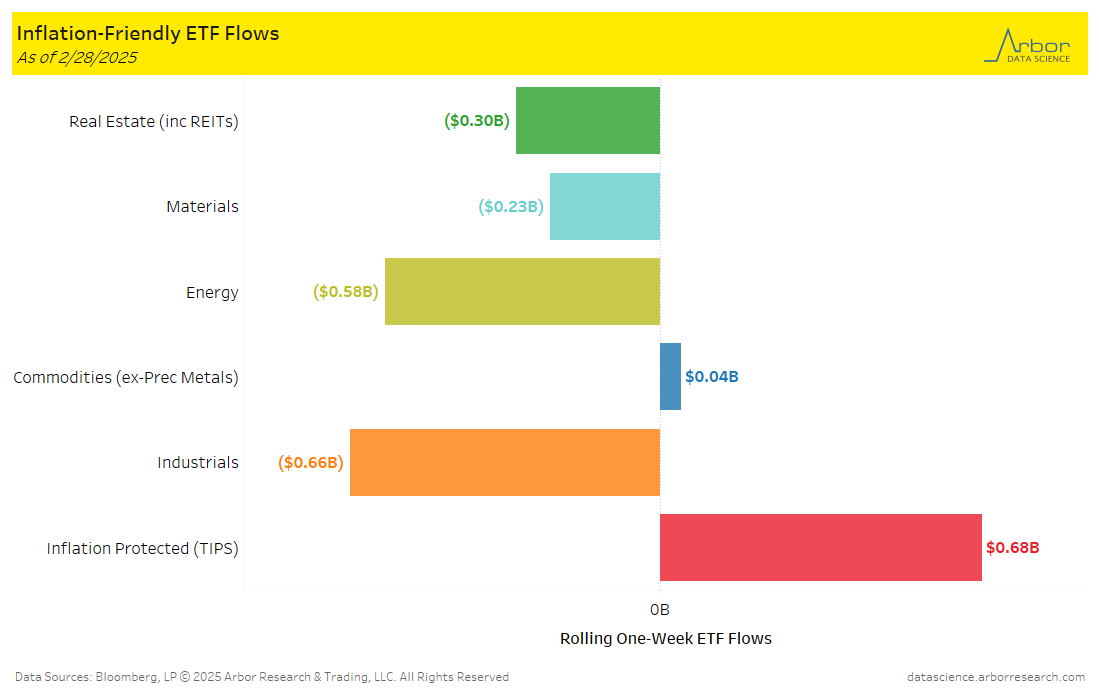

- Aggregate flows (black line in chart below) were negative for the week ended 2/28/25, with $1.05 billion of outflows. Industrials had the largest outflows for the week at $0.66 billion. Energy had the second largest outflows for the week at $0.58 billion.

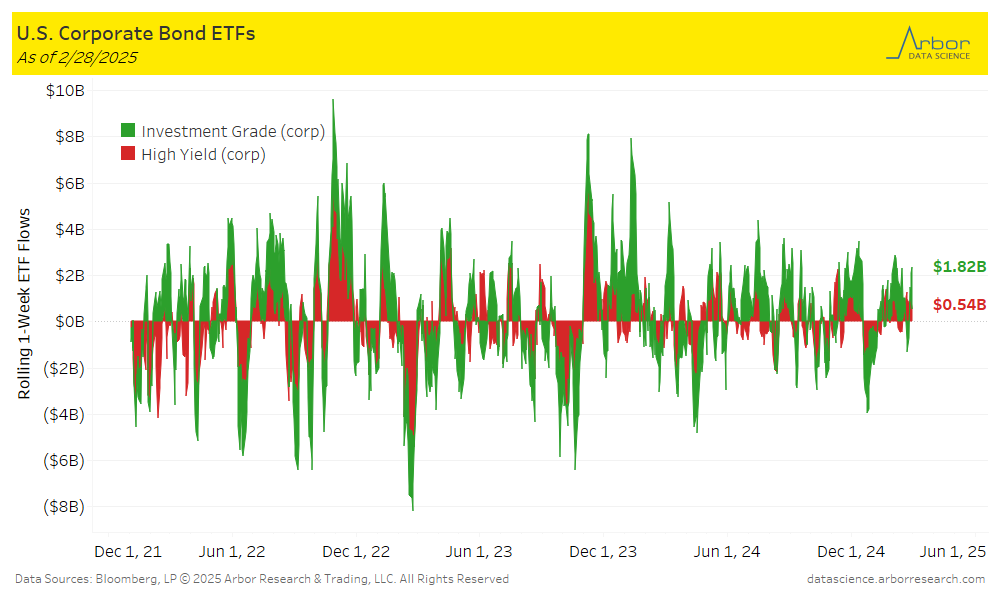

- Corporate bond ETFs were positive for the week ended 2/28/25, with investment-grade ETFs gaining $1.82 billion and high-yield ETFs gaining $0.54 billion.

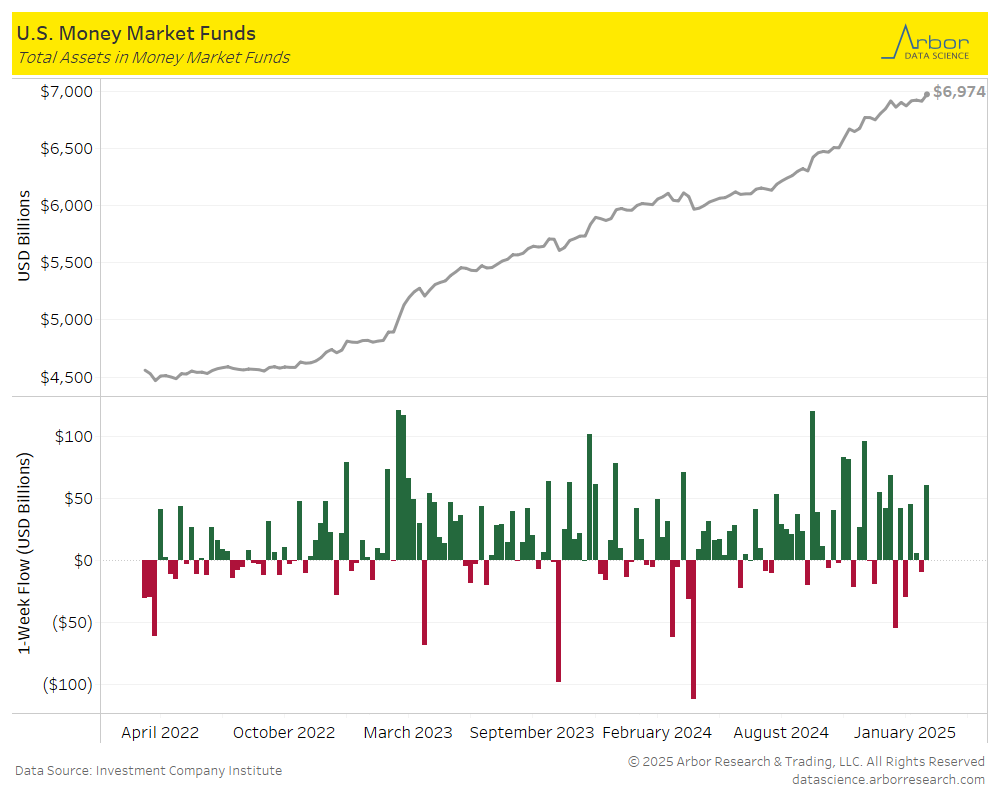

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $6.974 trillion in total assets on 2/26/25, compared to $6.9114 trillion the prior week.

Tables