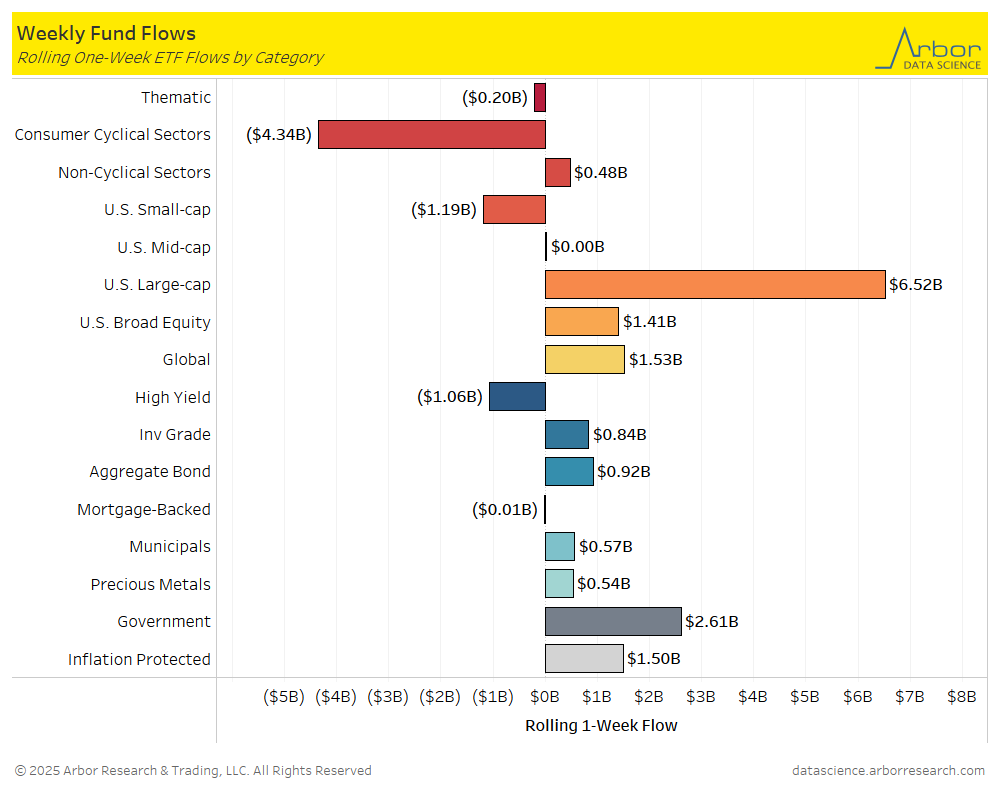

- The top two movers of the week were U.S. Large-cap ETFs and U.S. Mid-cap ETFs for the week ended on 4/04/25.

- On a weekly basis, U.S. Large-cap ETFs had inflows of approximately $6.52 billion for the week ended 4/04/25, compared to outflows of $0.89 billion for the week ended on 3/28/25.

- On a weekly basis, US Mid Cap ETFs were flat for the week ended 4/04/25, compared to outflows of $4.70 billion for the week ended on 3/28/25.

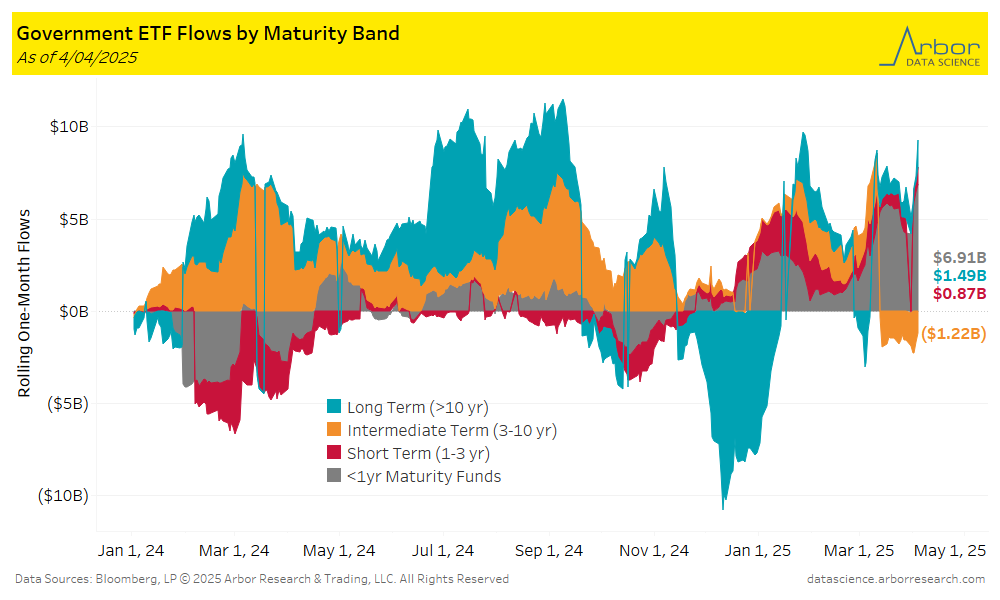

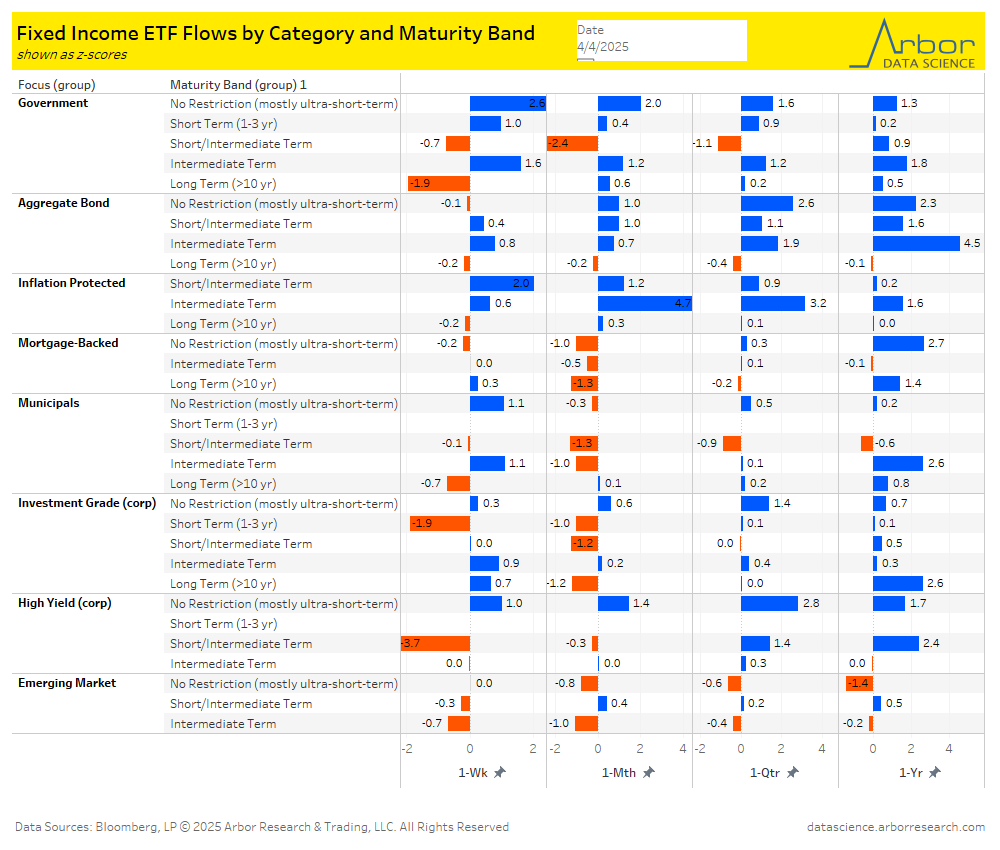

- Long Term (>10 yr) ETFs had inflows of $1.49 billion over the last week. The largest inflows were $6.91 billion in <1 year Maturity Fund ETFs over the same time period.

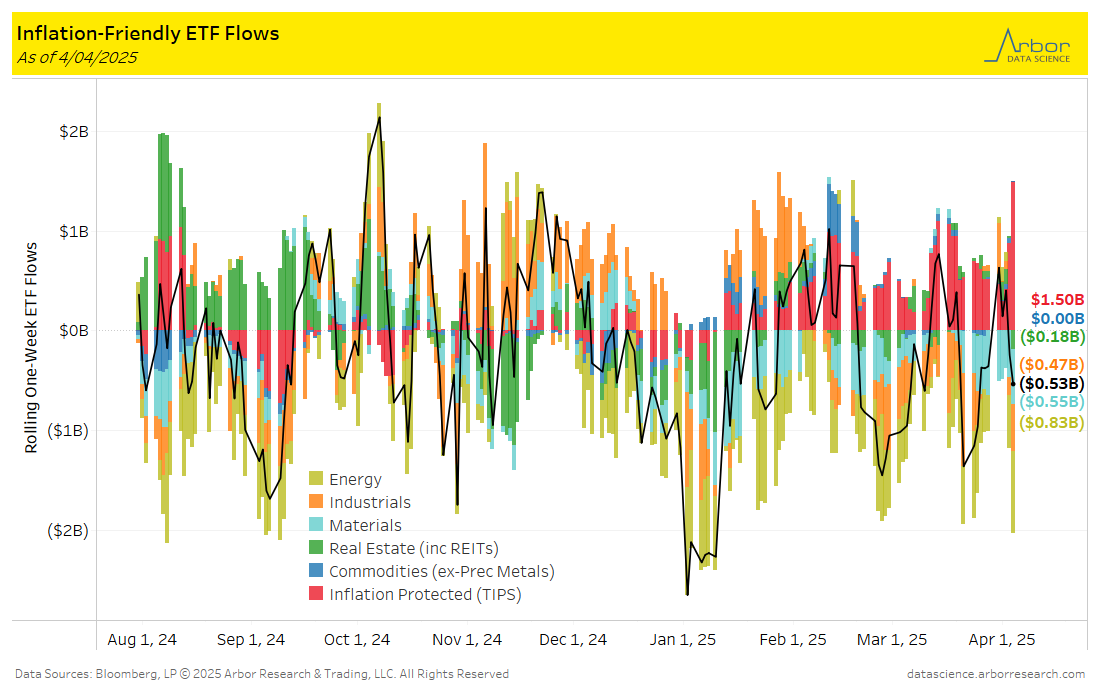

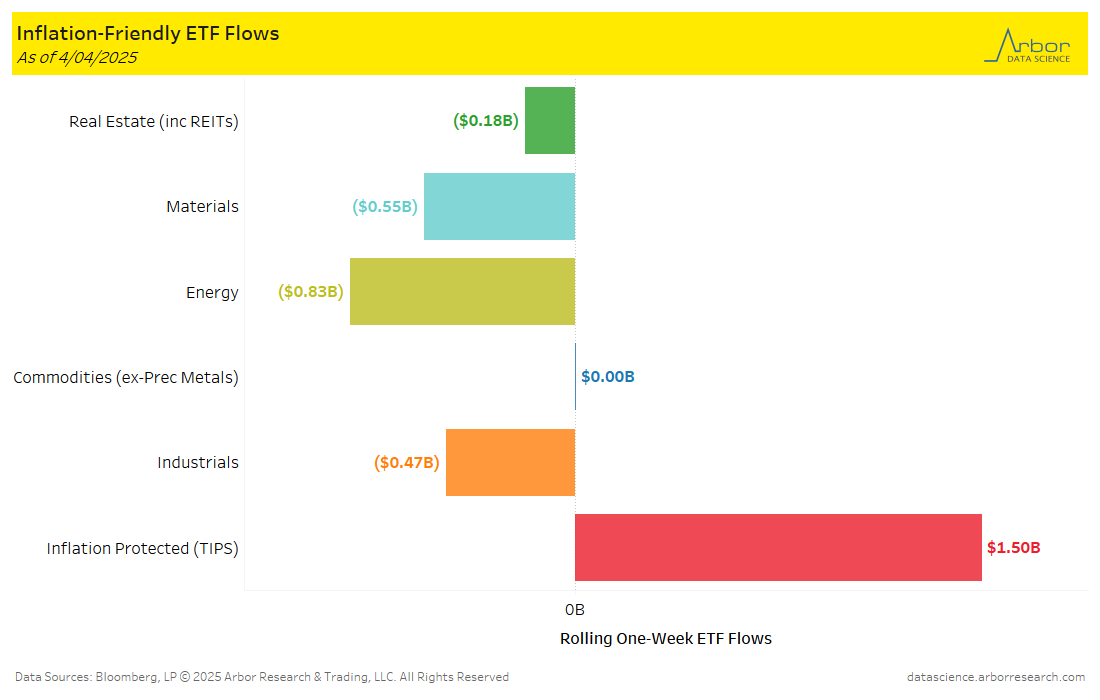

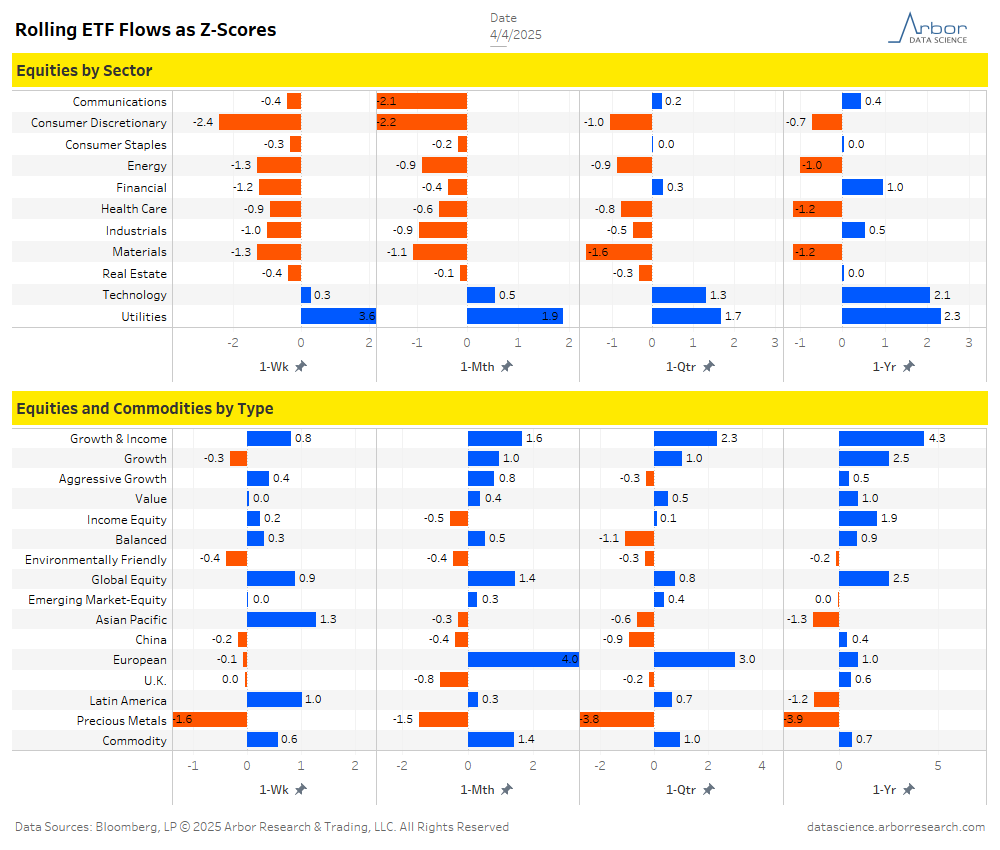

- Aggregate flows (black line in chart below) were negative for the week ended 4/04/25, with $0.53 billion of outflows. Energy had the largest outflows for the week at $0.83 billion. Materials had the second largest outflows for the week at $0.55 billion.

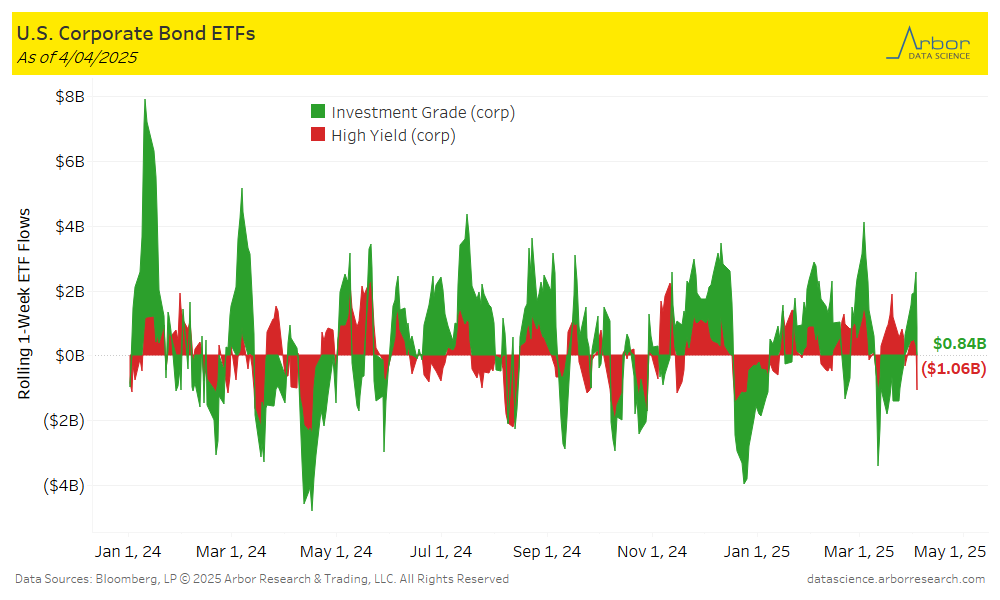

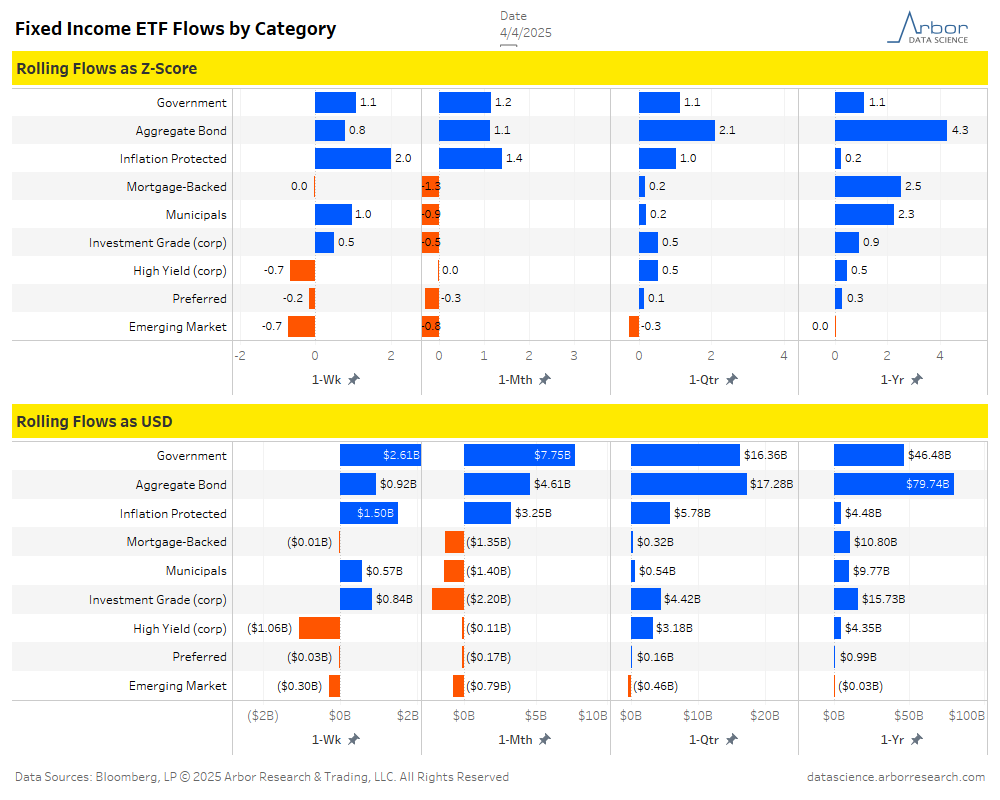

- Corporate bond ETFs were mixed for the week ended 4/04/25, with Investment-Grade ETFs gaining $0.84 billion and High-Yield ETFs losing $1.06 billion.

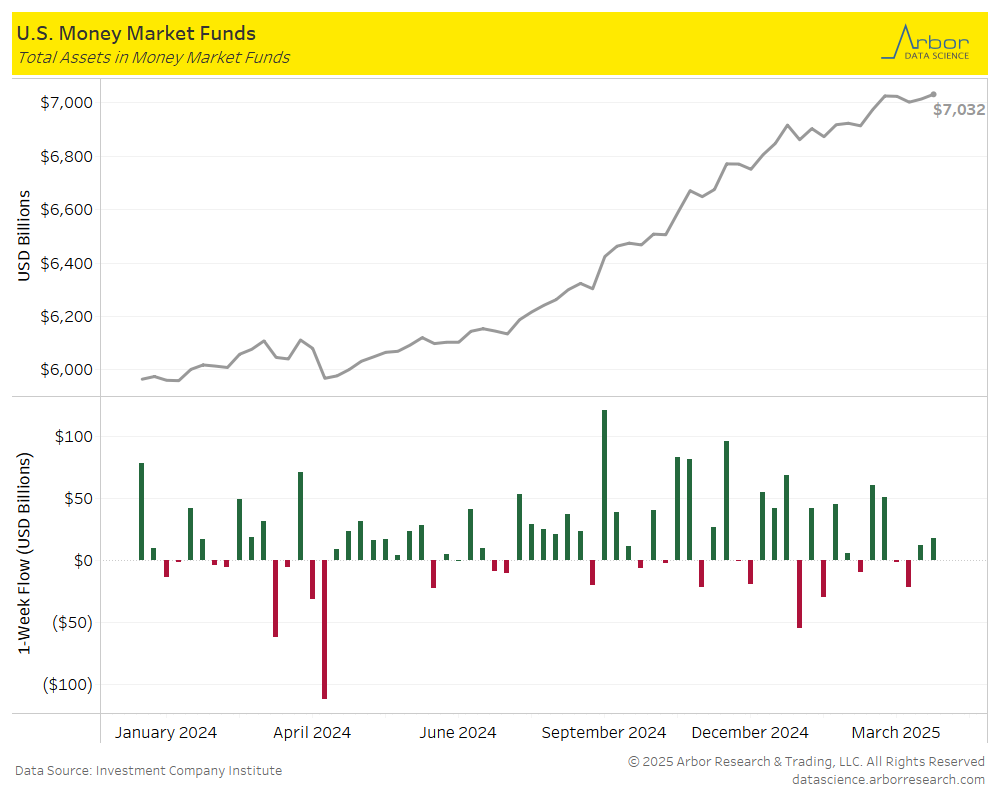

- The amount invested in Money-Market Mutual Funds (MMMFs) increased to $7.032 trillion in total assets on 4/02/25, compared to $7.014 trillion the prior week.

Tables