Lithium in the News

- On 10/1/2025, The U.S. Department of Energy reported that it was taking a minority equity stake in Lithium Americas. This comes as the company is preparing to open its Thacker Pass Mine located in Nevada. Scheduled to begin operations near the end of 2027, the mine is projected to be the largest source of lithium in North America.

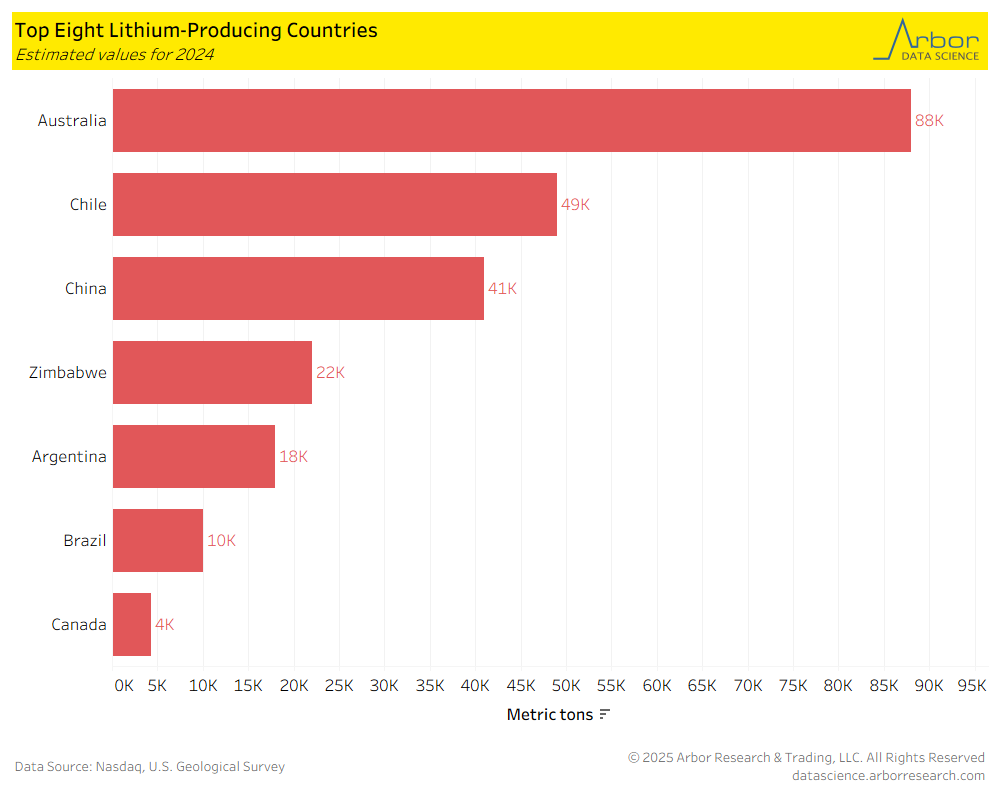

Lithium Production by Country

- According to estimates from the U.S. Geological Survey publish in January 2025, Australia produced approximately 88,000 metric tons of lithium in 2024. This was the most of any country in the world.

- Three of the top eight countries were located in South America. The continent is home to an area called the Lithium Triangle which is reported to hold half of the known global lithium.

Batteries Will Drive Lithium Demand in 2030

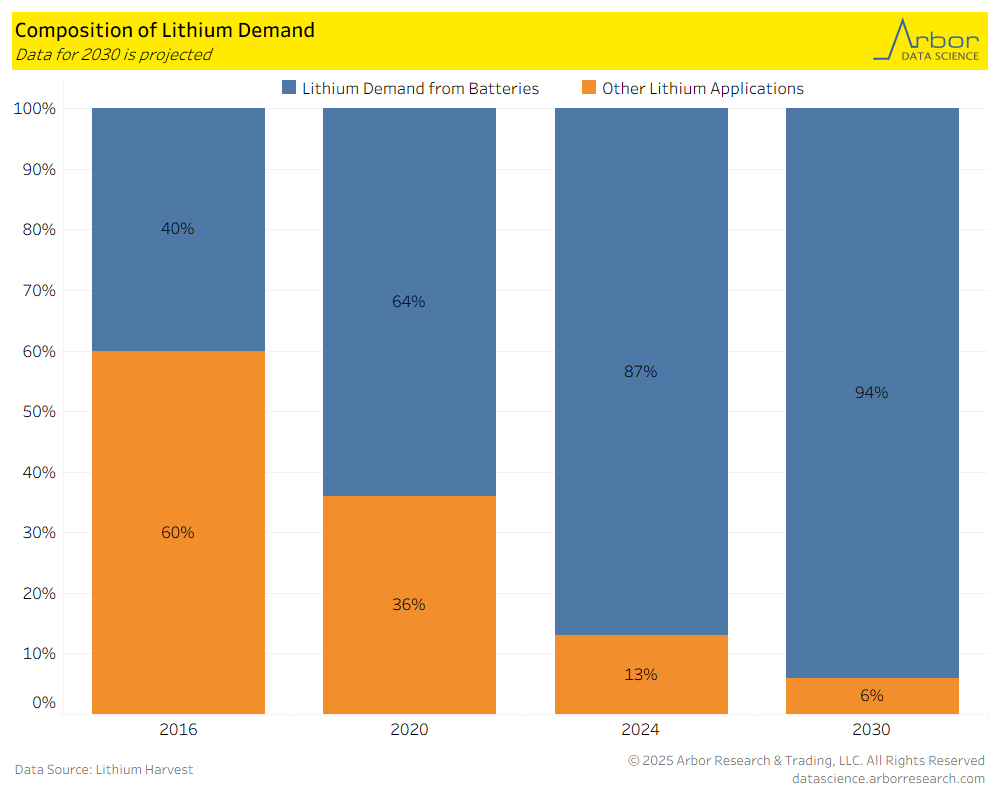

- Many everyday items, from cell phones to electric vehicles, use lithium-ion batteries for power. The increase in demand for these batteries could result in battery demand for lithium comprising 94% of all lithium demand by 2030.

- Only 40% of lithium demand was driven by batteries in 2016.

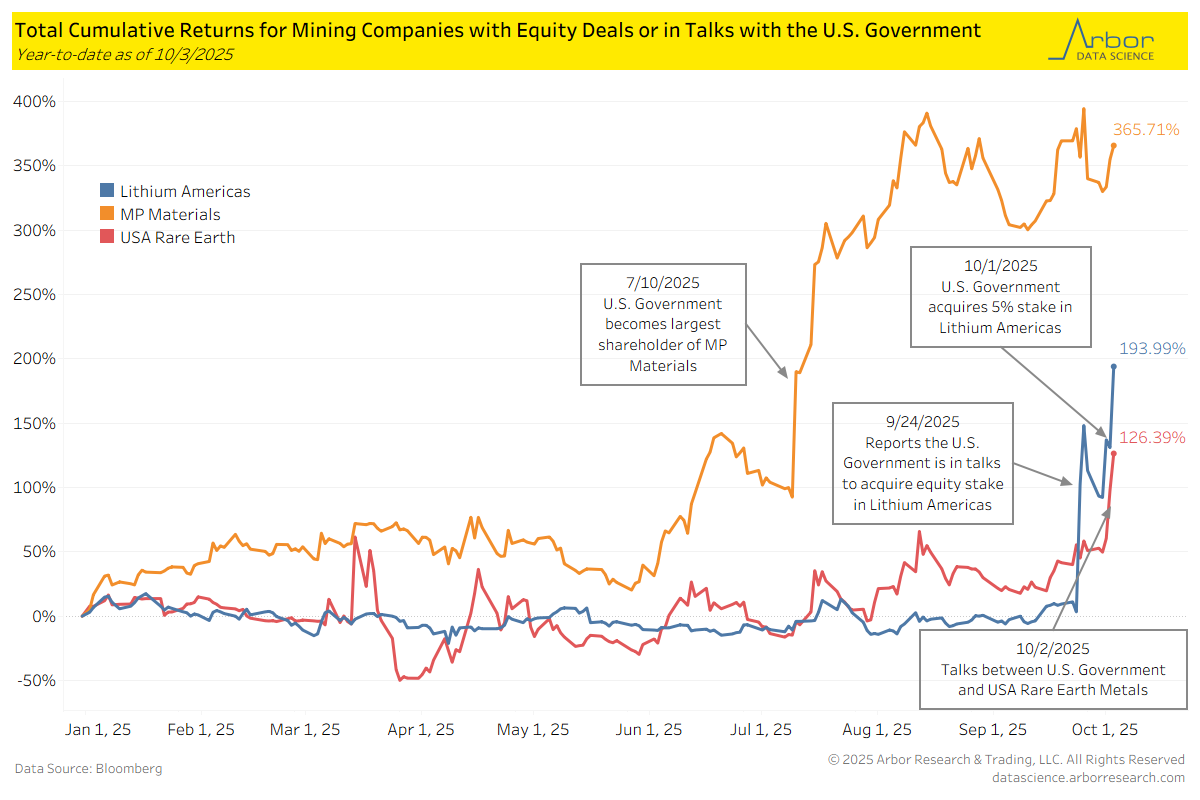

U.S. Government Backing Provides Boost to Mining Companies

- In addition to the equity stake in Lithium Americas, the U.S. Government also acquired an equity stake in MP Materials on 7/10/2025. The company, which is the largest U.S. miner of rare earth metals, jumped from year-to-date returns of 92.50% on 7/9/2025 to 189.94% after the announcement on 7/10/2025. As of 10/3/2025, the stock had year-to date returns of 365.71%.

- Year-to-date returns for Lithium America jumped from 3.37% on 9/23/2025 to 102.36% on 9/24/2025 after reports that the U.S. government was eyeing a stock in the company. It has year-to-date returns of 193.99% as of 10/3/2025.

- On 10/2/2025, the CEO of USA Rare Earth Metals confirmed talks between the company and the U.S. Government. As of 10/3/2025, their stock had year-to-date total returns of 126.39%

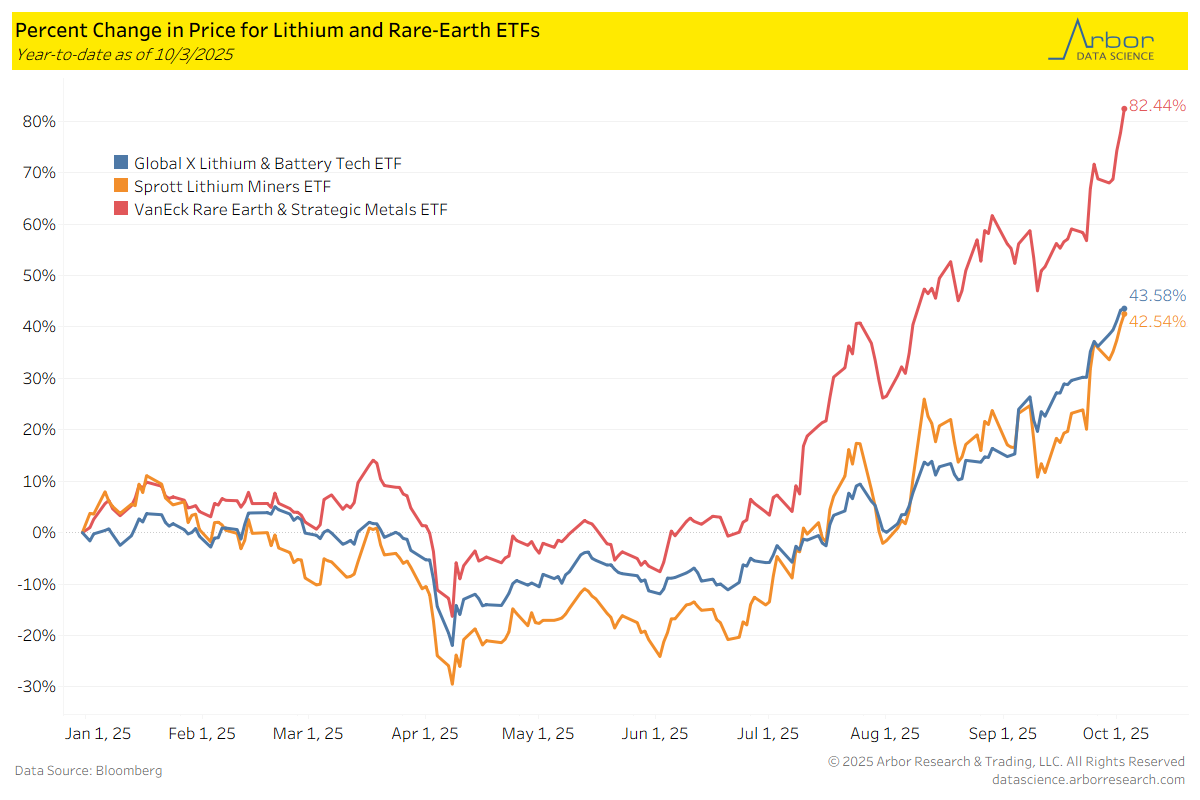

Rare Earth Metal ETF Price Changes Outpace Lithium ETFs

-

- The VenEck Rare Earth & Strategic Metals ETF (REMX) price had increased by 82.44% year-to-date as of 10/3/2025.

- The Global X Lithium & Battery Tech ETF (LIT) had a year-to-date price increase of 43.58% as of 10/3/2025, and the Sprott Lithium Miners ETF was just below it at 42.54%.

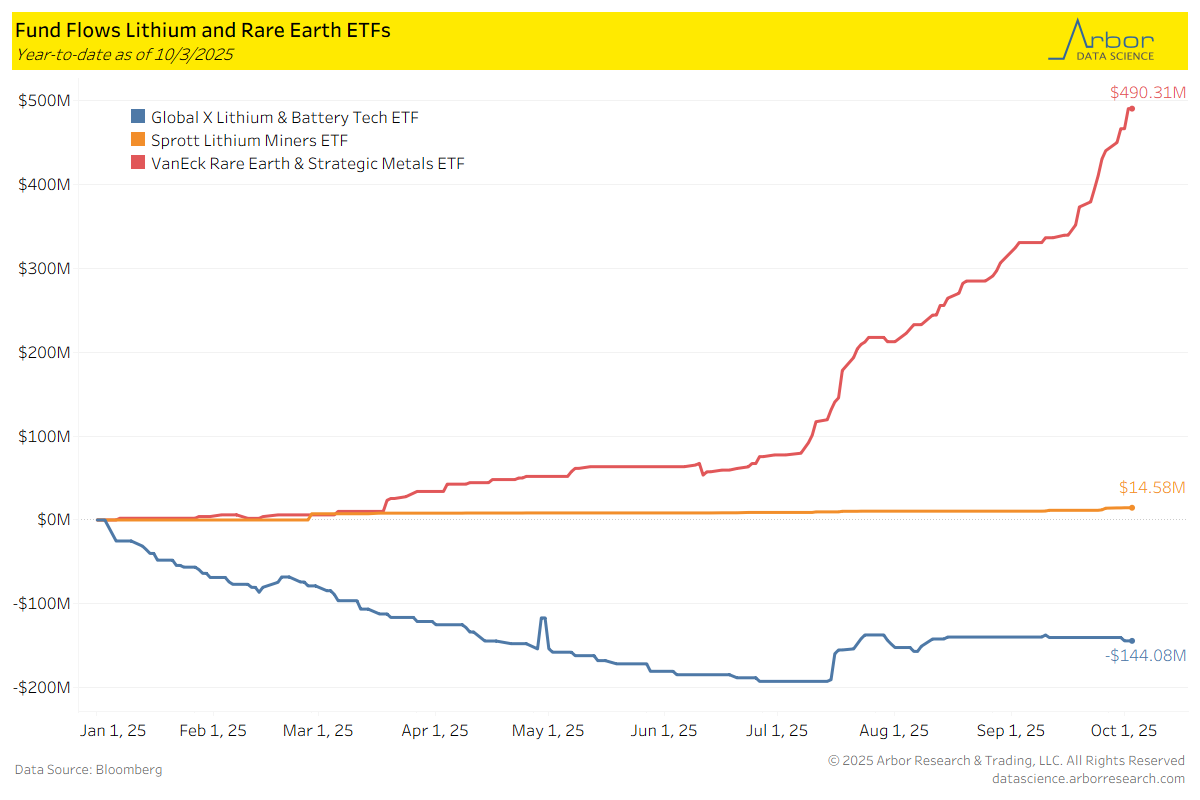

Funds Pile into Rare Earths and Leave Lithium

-

- The VanEck Rare Earth & Strategic Metals ETF has year-to-date inflows of $490.31 million compared to outflows of $144.08 million for the Global X Lithium & Battery Tech ETF.