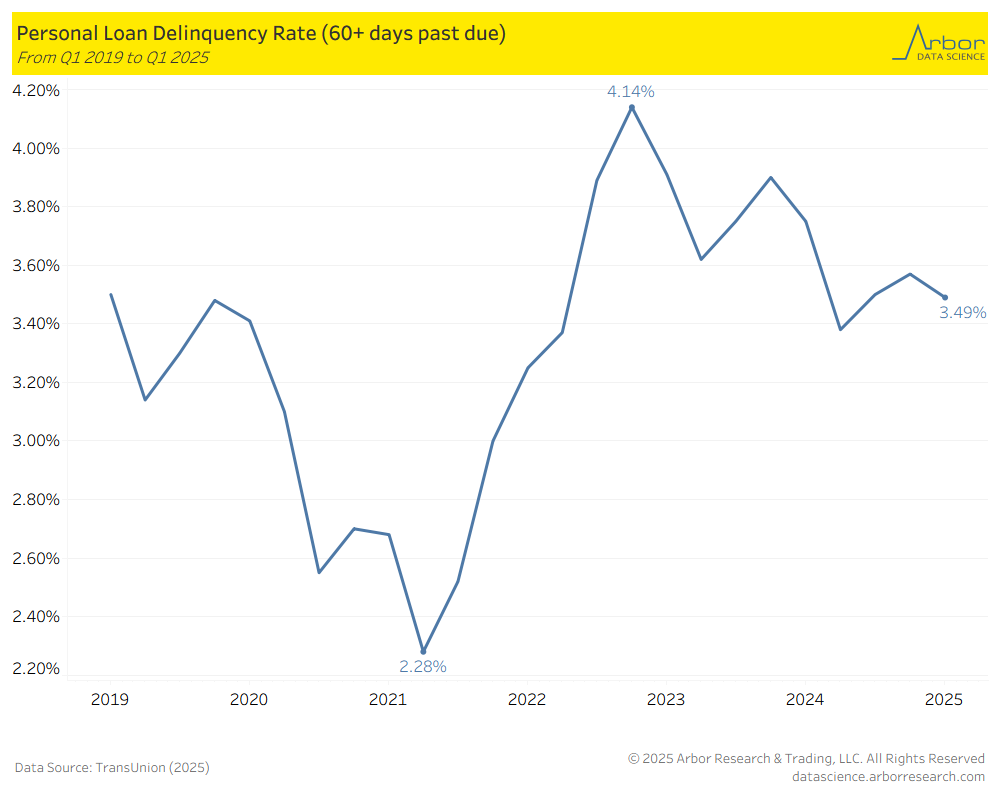

- According to LendingTree, in Q1 2025 3.49% of all personal loan accounts were 60 or more days past due.

- For perspective, delinquency rates were the lowest during the time period of Q3 2020 to Q2 2022. This was during the government stimulus check relief program. Delinquency rates hit a low of 2.28% in Q2 2021, then increased up to 4.17% in Q4 2022.

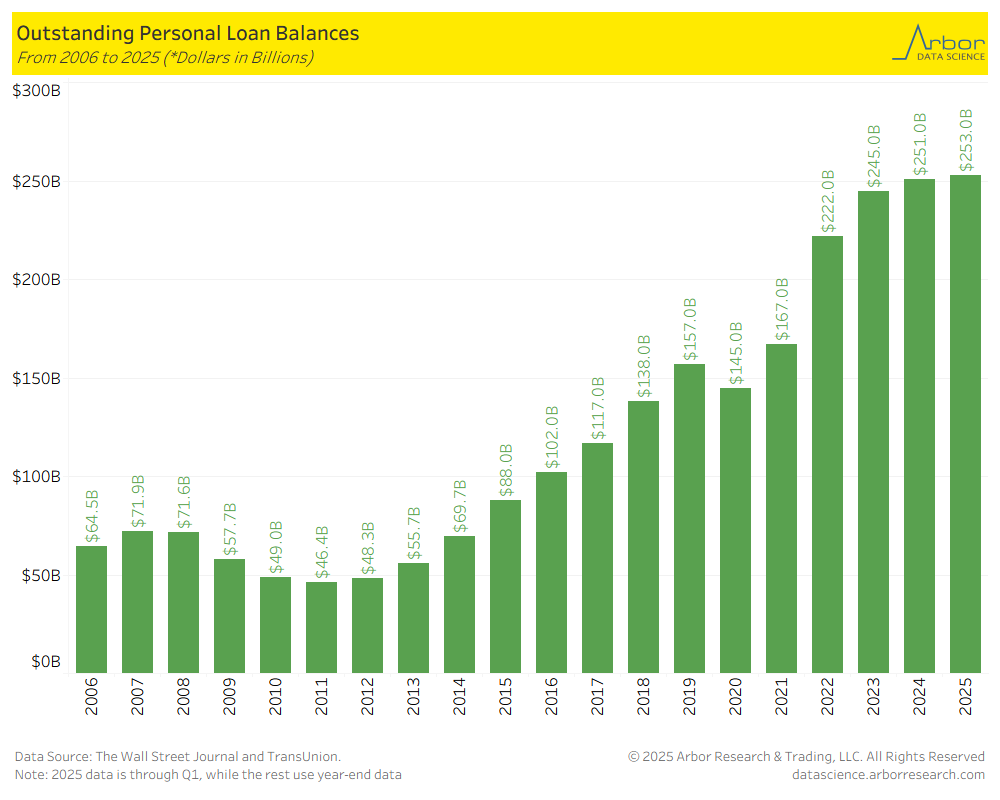

- The chart below outlines the outstanding personal loan balances from 2006 to 2025. In 2025, the balance was $253 billion, the highest amount of personal debt for the time period.

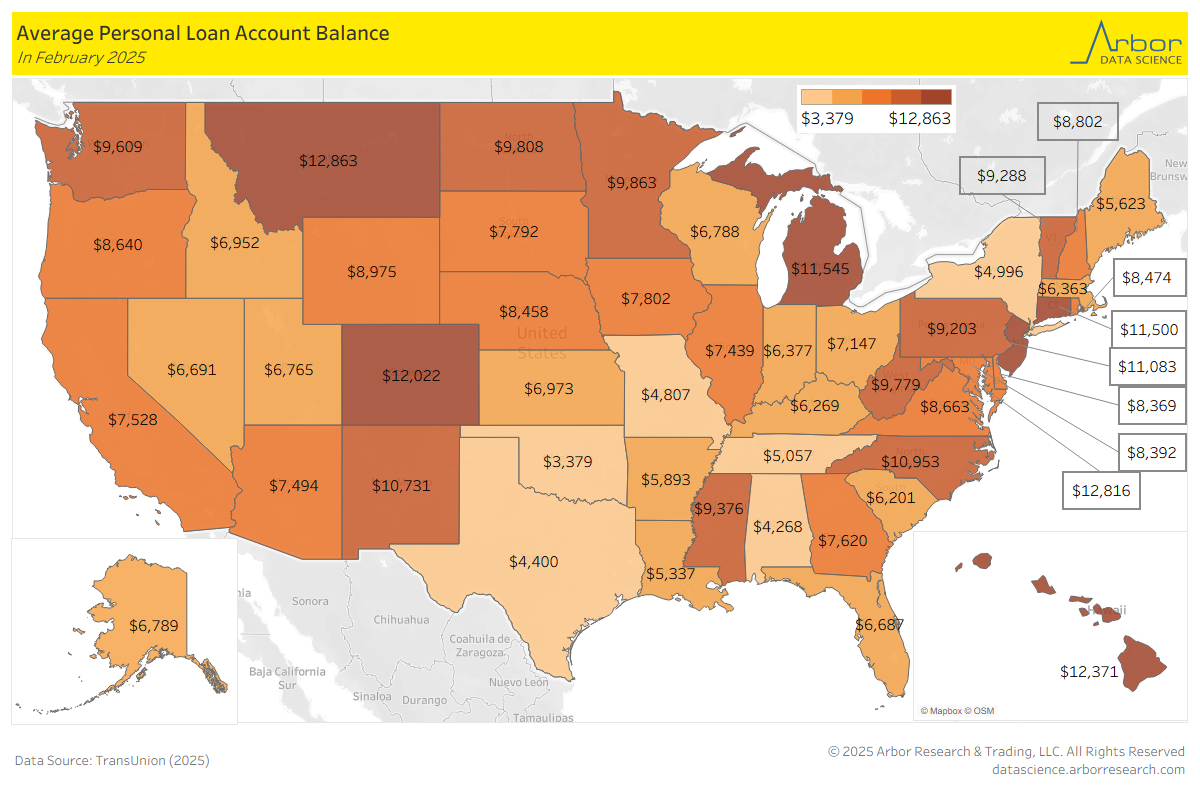

- The heatmap below outlines the average personal loan balances in February 2025.

- The states with the highest average account balance were: Montana at $12,863, followed by Washington D.C. at $12,816 and Hawaii at $12,371.

- The states with the lowest average account balance were: Oklahoma at $3,379, followed by Alabama at $4,268 and Texas at $4,400.

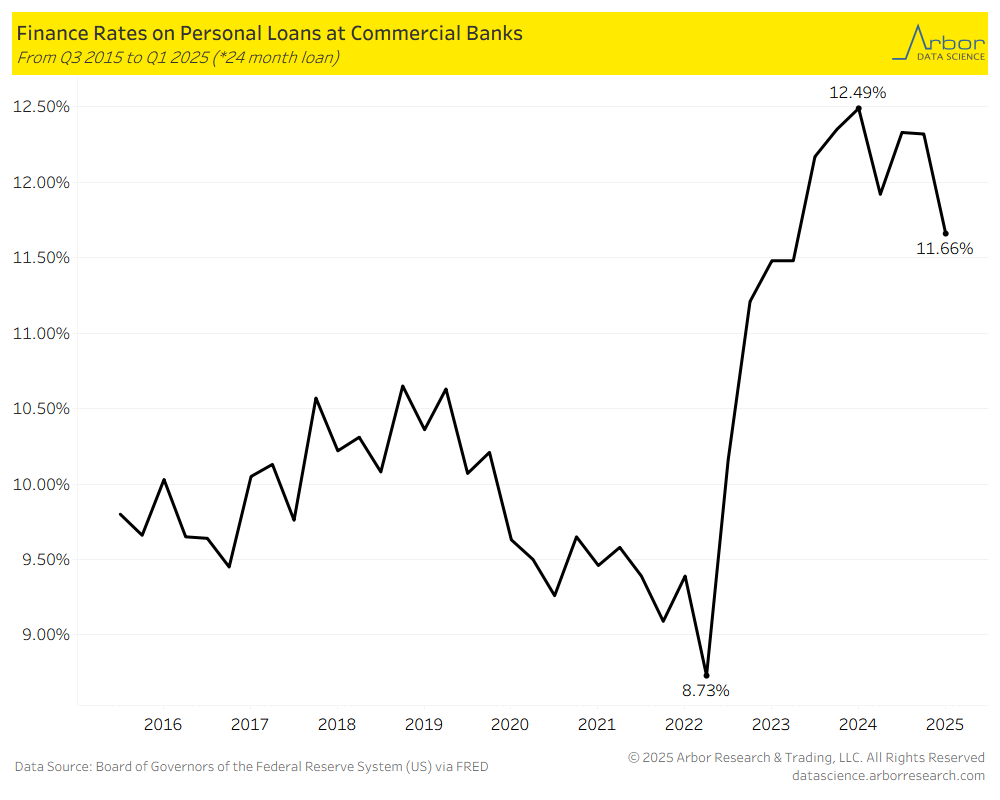

- The interest rates on 24 month personal loans were at 11.66% in Q1 2025, down from a year ago at 12.49% in Q1 2024.

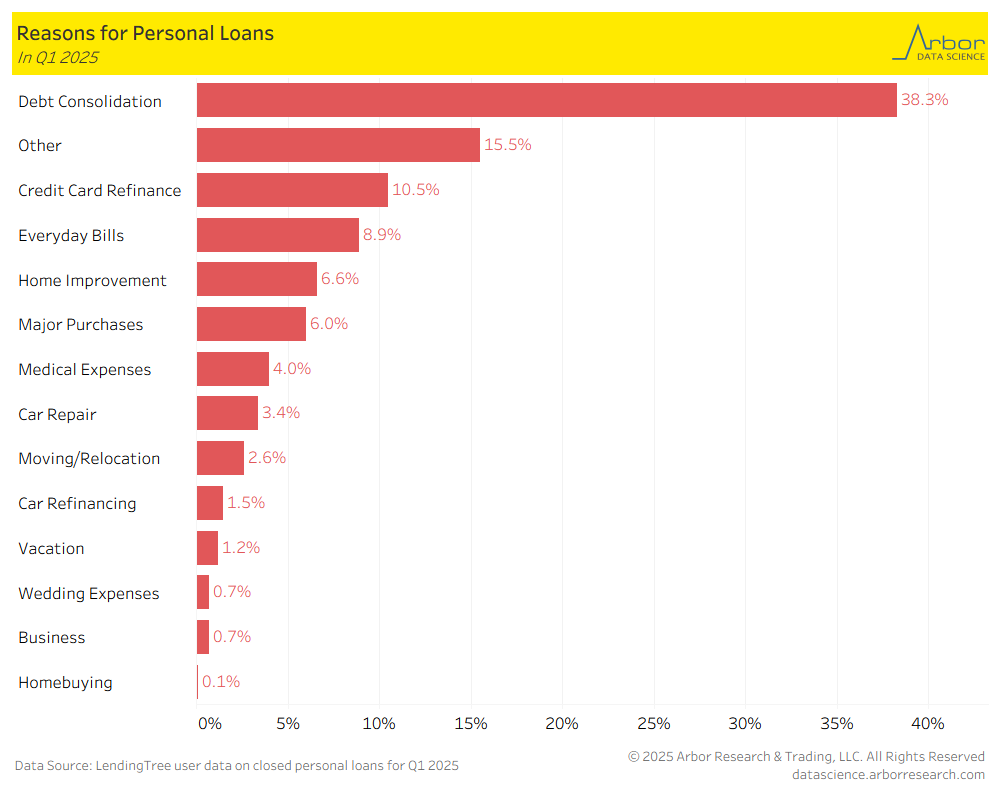

- The most popular reason that consumers borrow via personal loans was Debt Consolidation at 38.3%.

Consumers Owe $253 billion of Personal Loan Debt

Personal Loan Balances by State

Rates on Personal Loans Decreased in Q1 2025

38.3% of Borrowers take Personal Loans to Pay off Debt