Supply and Demand for Platinum

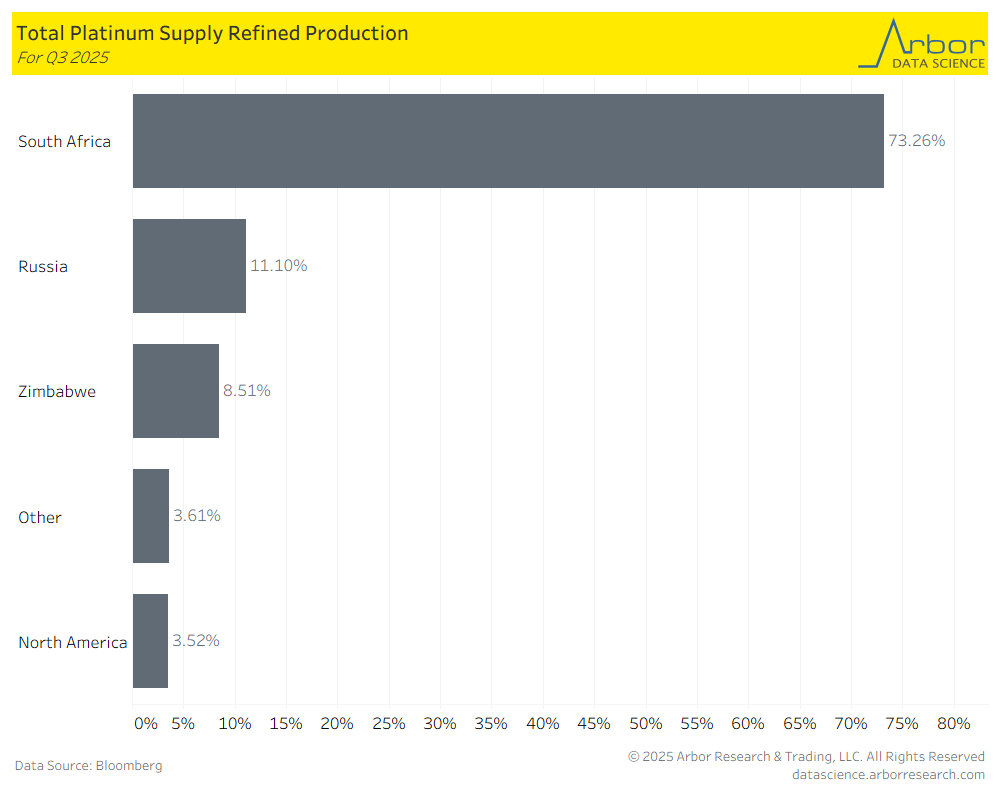

- The total supply of refined platinum is outlined by country in the chart below for Q3 2025. As of Q3 2025, South Africa had the largest supply of refined platinum at 73.26%, followed by Russia at 11.10%, Zimbabwe at 8.5%, Other 3.6% and North America at 3.52%.

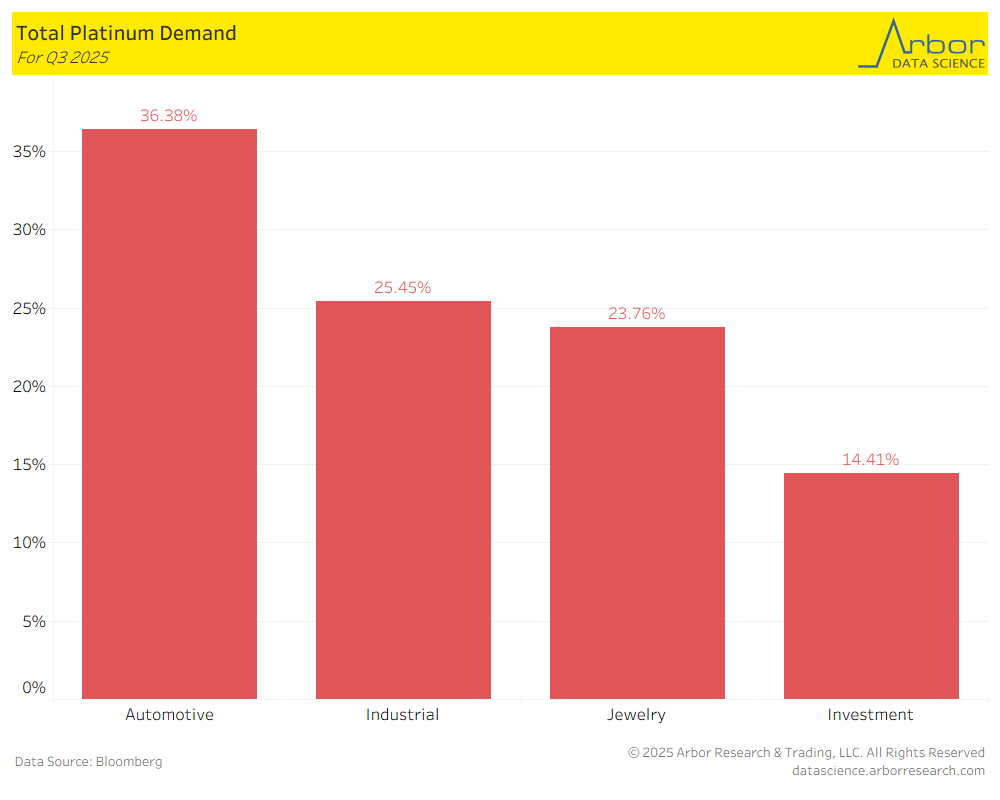

- Automotives had the largest platinum demand in Q3 2025 at 36.38%, followed by Industrial at 25.45%, Jewelry at 23.76%, and Investment at 14.41%.

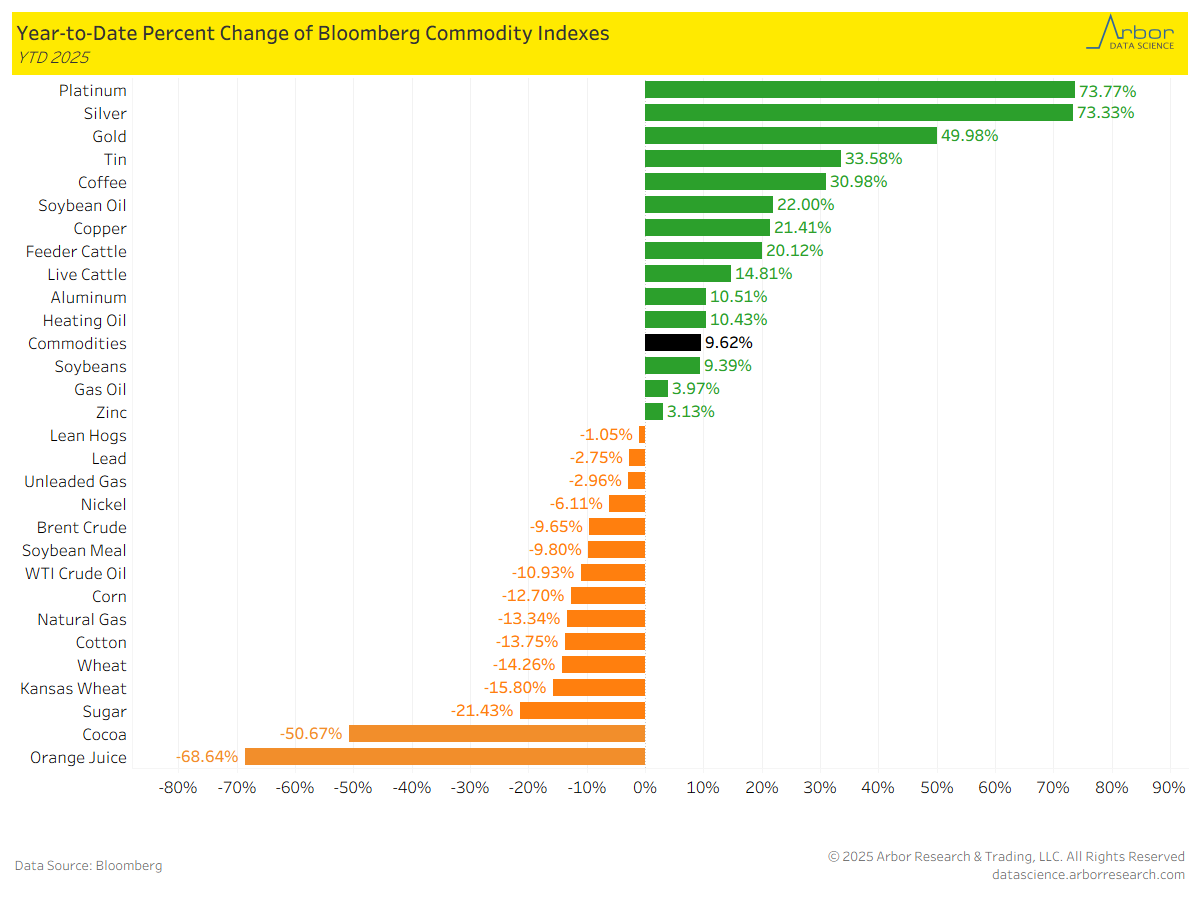

- Bloomberg’s Commodity Index, which is calculated on an excess return basis and reflects commodity futures price movements, was up 9.62% on a year-to-date (YTD) basis as of 11/28/25.

- YTD returns for commodities are shown in the chart below. Platinum has the highest YTD return at 73.77%, followed by Silver at 73.33% and Gold at 33.58%.

- Orange Juice had the largest decrease, with a YTD return of -68.54%, followed by Cocoa at -50.67%.

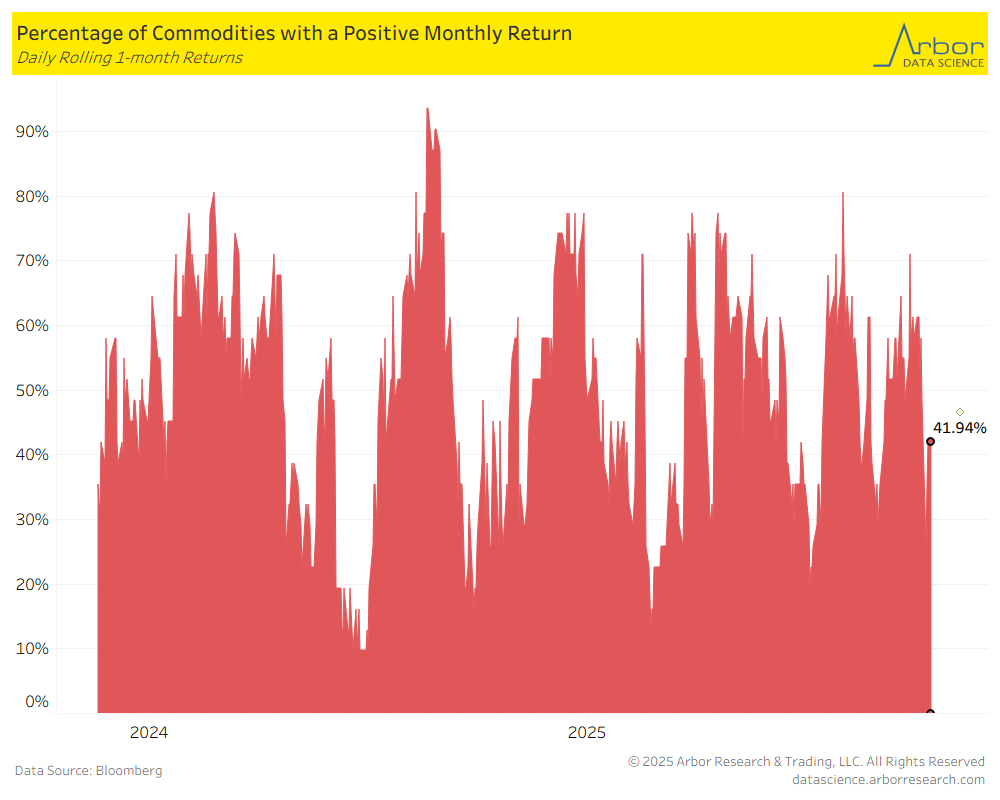

- The percentage of all commodities with a positive monthly return was 41.94% on 11/28/25.

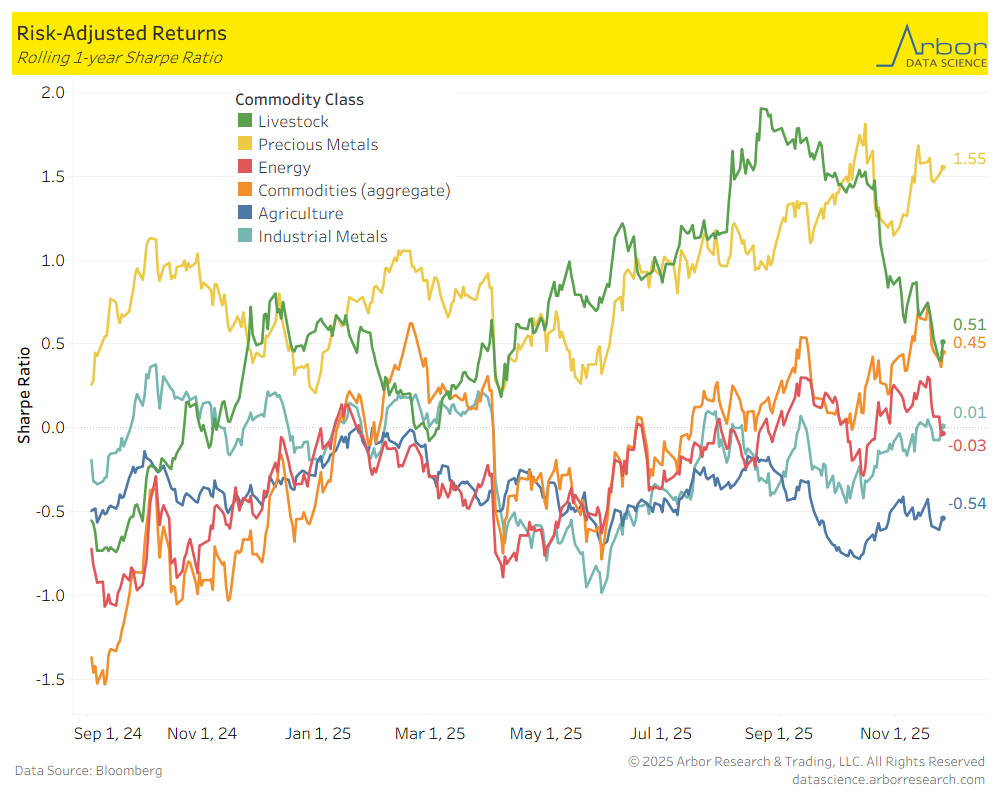

- The final chart outlines the a rolling 1-year aggregate Sharpe ratio for commodities from 9/3/2024 to 11/26/2025.

- Precious Metals had the largest Sharpe ratio at 1.55, followed by Livestock at 0.51. The largest negative Sharpe ratio was Agriculture at -0.54 and Energy at -0.03.