There are many reasons for investors to be somewhat skeptical of putting money to work in the long end of the curve. The FOMC is under pressure to cut rates. That is not necessarily great for the long end. Inflation is not exactly running low, and the economy is not exactly broken. When it comes to yields, that is not a recipe for the long end rates to fall. The FOMC can do whatever it wants with the short end. If the economy is running hot and inflation is even marginally above target, the long end is not going to follow suit. It may even go in the other direction.

All of that is meant to point out that “alternative yield” is something to pay attention to in the near to medium future. There are places for investors to get the yield, but take a different type of risk. And Cat Bonds are top of the list. They provide a stated yield without the typical interest rate sensitivity. Instead, they have catastrophe risk. If a storm or other natural disaster strikes and triggers a payout, the bond loses value (potentially all of it). Otherwise, you get the yield. An investor swaps interest rate risk for event risk.

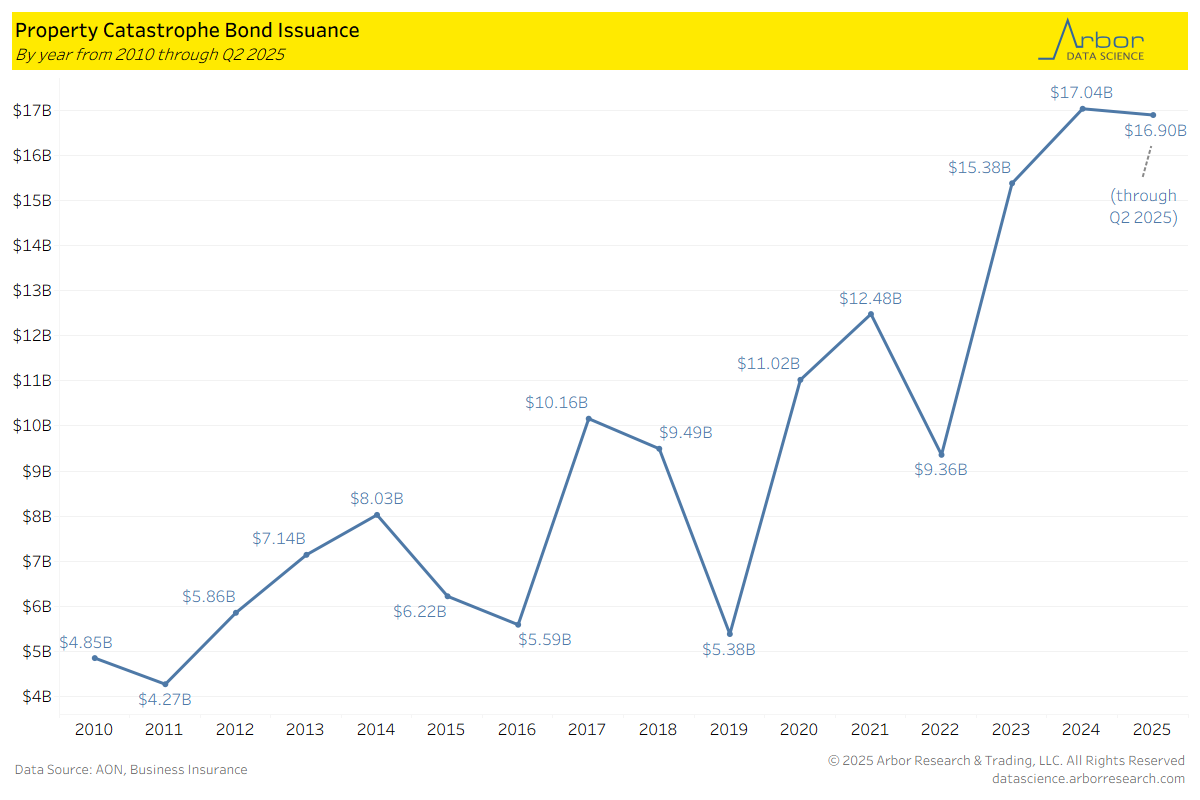

That might be part of the reason for the increasing amount of issuance of Cat Bonds. But there are reasons to do so from two sides. Investors looking for a different interest rate profile is one side of the coin. On the other side, there are insurers looking at increasing losses from catastrophes. They need to offload some of that risk, and investors are increasingly willing to underwrite it by buying the bonds.

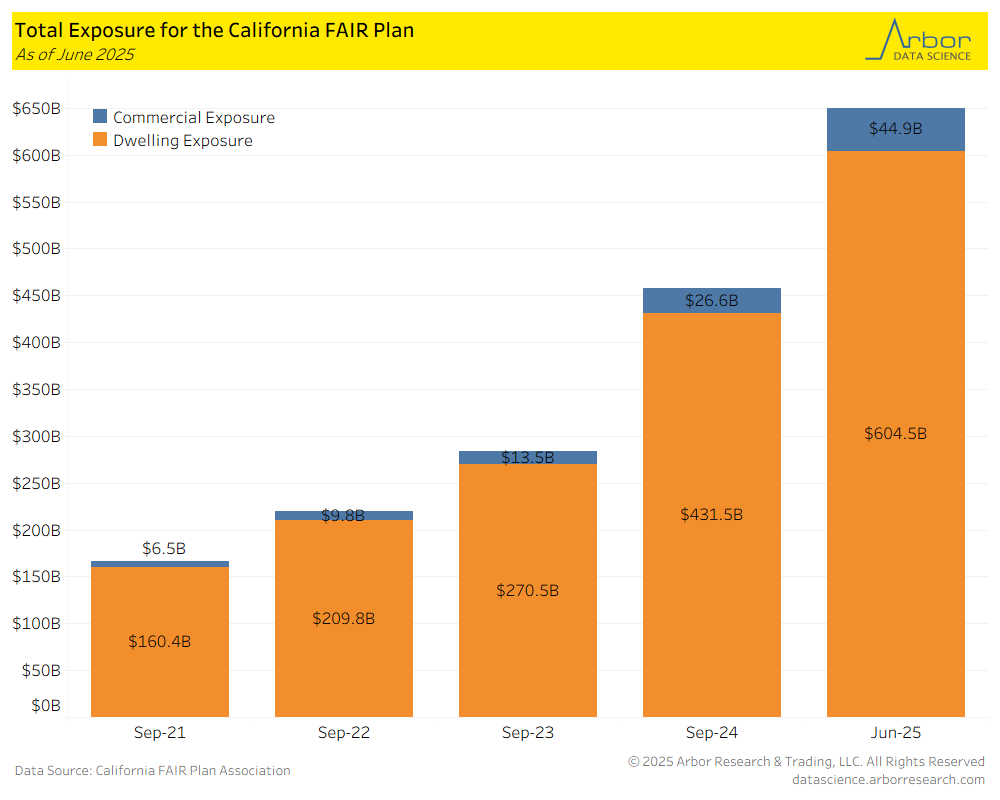

And there is a bit of a “upgrading of risk” happening too. Investors are unlikely to take a significant amount of fire risk in California. Insurance companies have shifted away from taking it. That combination – no one wanting the risk – forced the insurer of last resort (the state run FAIR plan) to step in and take it.

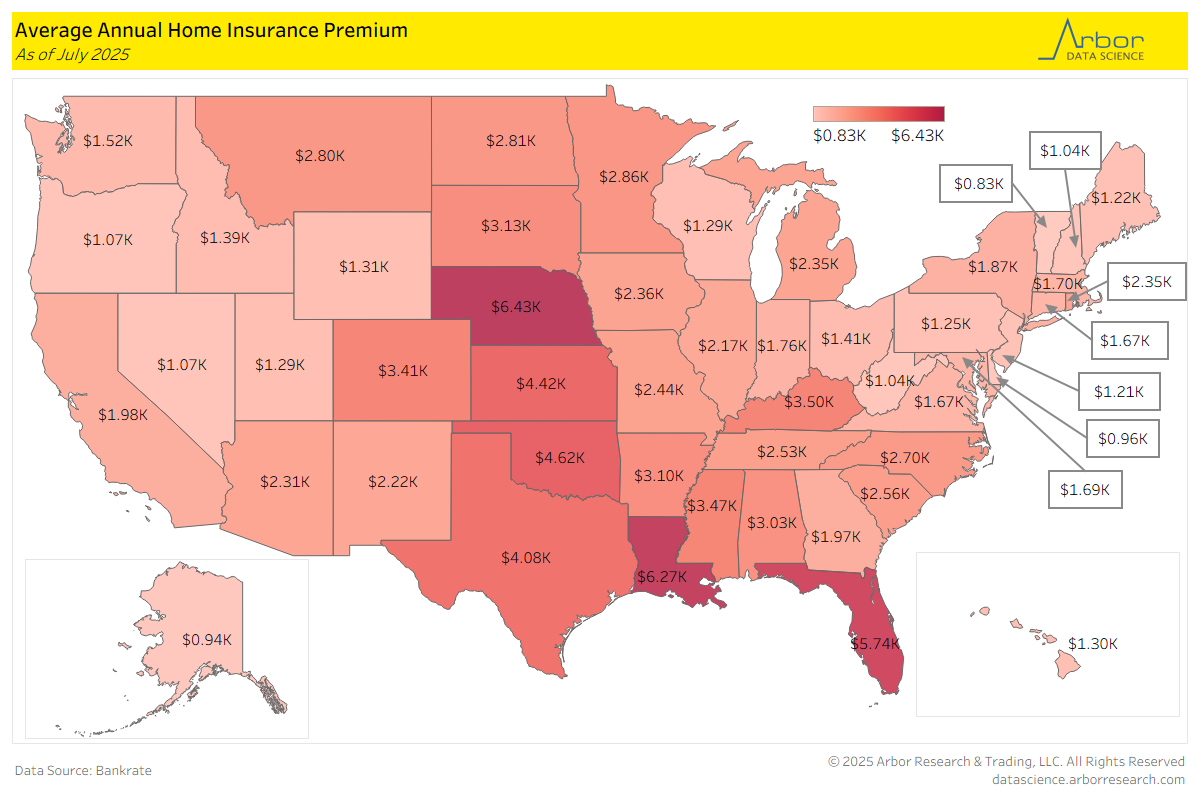

The broader picture is even more interesting. The states where the most catastrophes occur are indeed the ones paying the most for coverage. That makes sense. California is not among the most expensive on average, but that might be due to the government oversight (and the concomitant lack of want to operate there by insurance companies). Florida, Louisiana, Texas and the tornado prone areas of the Midwest are expensive, and areas where losses – when they happen – are large. This dynamic is not going to be lost on investors and insurers. Investors want differentiated return streams, but they do not want undue risk. Cat Bonds provide that exposure, and it is a place investors are flocking to in a era of uncertain rate policy.