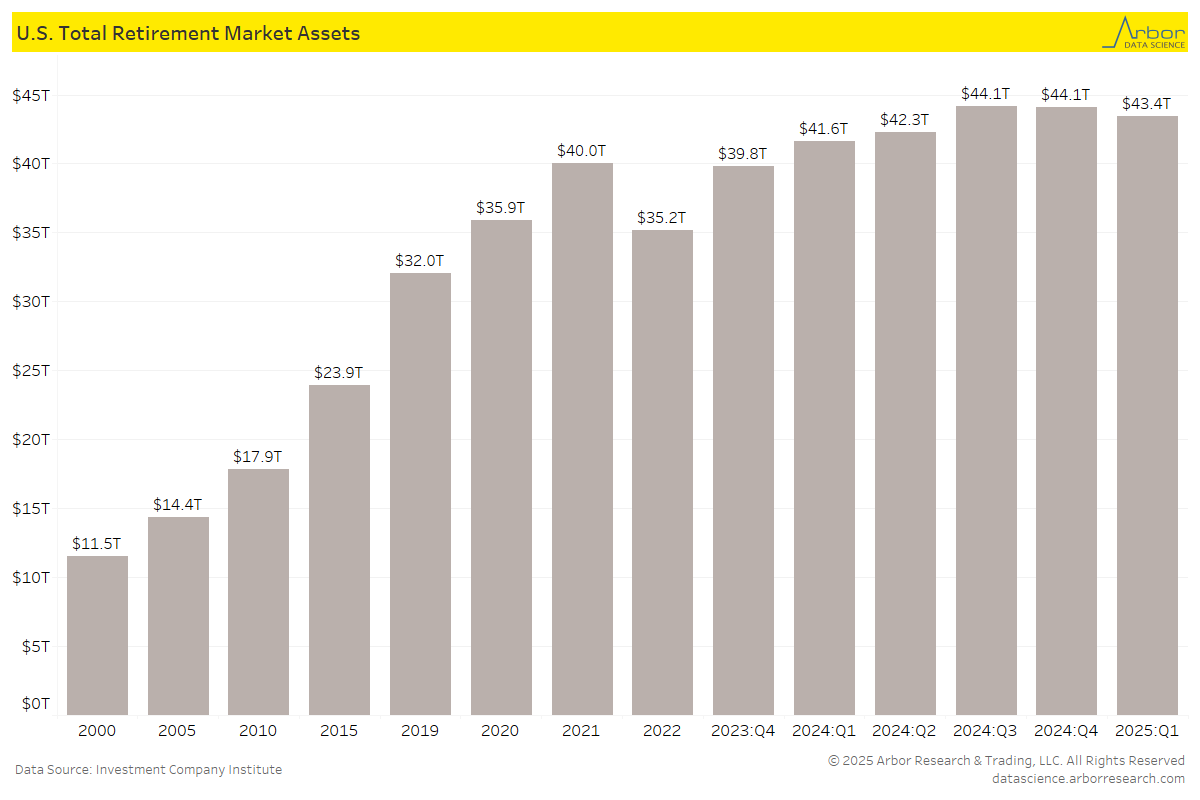

U.S. Total Retirement Assets Declined in Q1 2025

- According to Investment Company Institute, Total Retirement Market Assets were $43.4 trillion in Q1 2025, down from $44.1 trillion in Q4 2024 and Q3 2024. Retirement assets accounted for 34% of all U.S. household financial assets in Q1 2025.

401(k) Plan Assets & IRA Market Assets

401(k) Plan Assets & IRA Market Assets

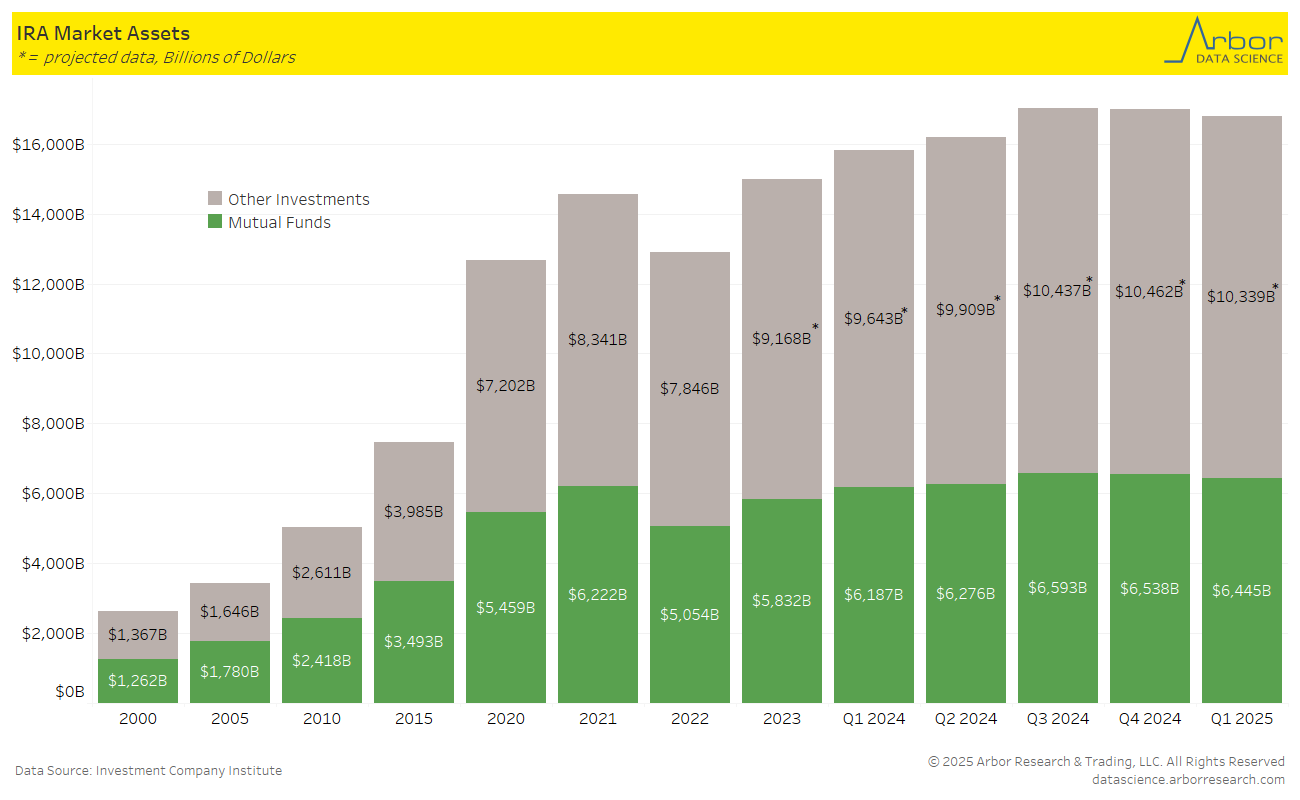

- The following two charts outline 401(k) Plan Assets and IRA Market Assets of Mutual Funds and Other Investments in Q4 2024, as reported by Investment Company Institute.

- 401(k) Plan Assets decreased to $8.705 trillion in Q1 2025 (including $5.34 trillion invested in mutual funds and $3.36 trillion invested in other investments).

- IRA Market Assets slightly decreased to $16.78 trillion in Q1 2025 from $17.00 trillion in Q4 2024. 38% (or $6.4 trillion) was invested in mutual funds and $3.7 trillion was invested in other investments. For comparison, IRA Market Assets in Q1 2024 totaled $15.83 trillion.

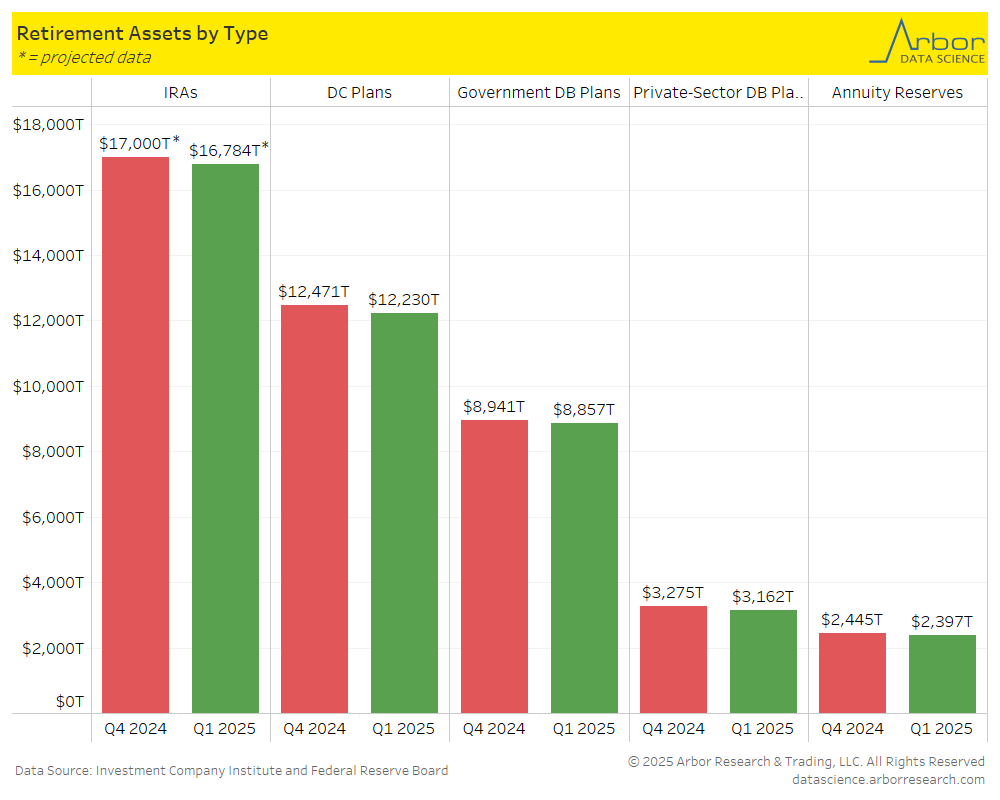

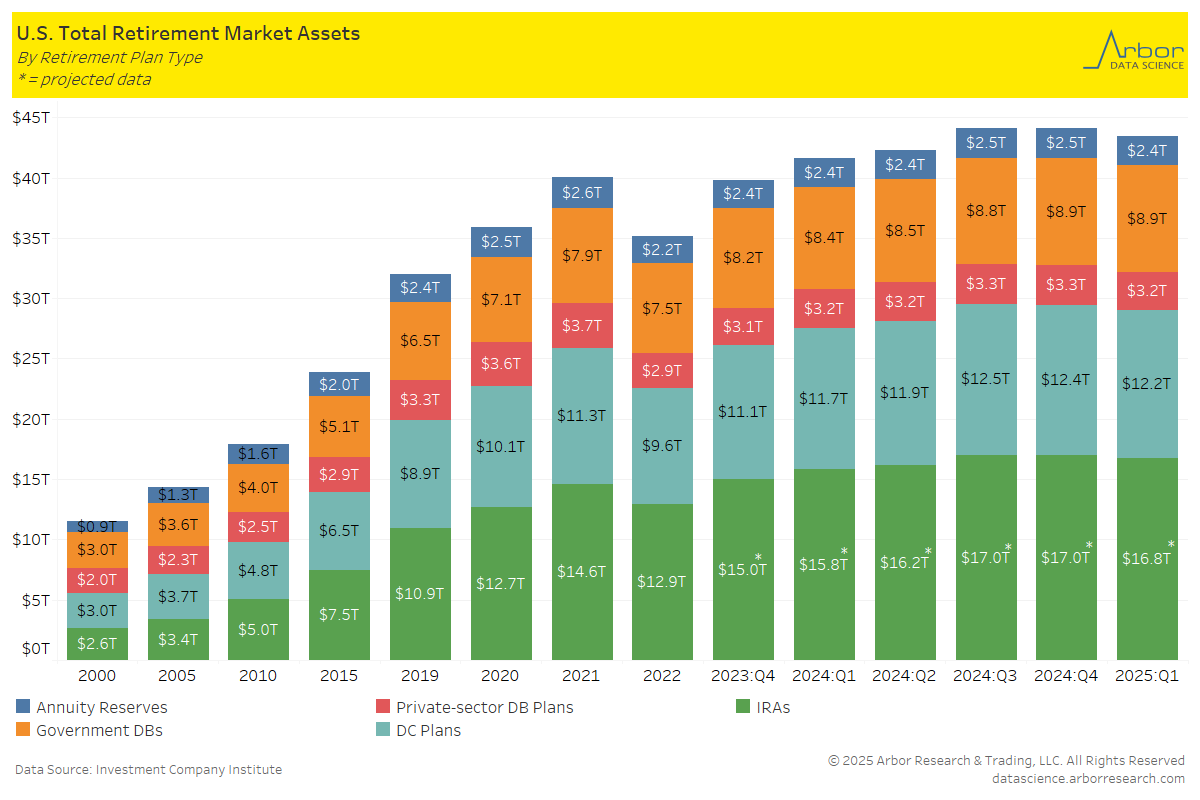

Retirement Accounts by Type

- Retirement assets had the largest composition in IRAs, at $16.78 trillion in Q1 2025, down from $17.00 trillion in Q4 2024, followed by Defined Contribution (“DC”) Plans at $12.23 trillion in Q1 2025, down from $12.47 trillion in Q4 2024.

%20Assets.png)