U.S. Retirement Assets

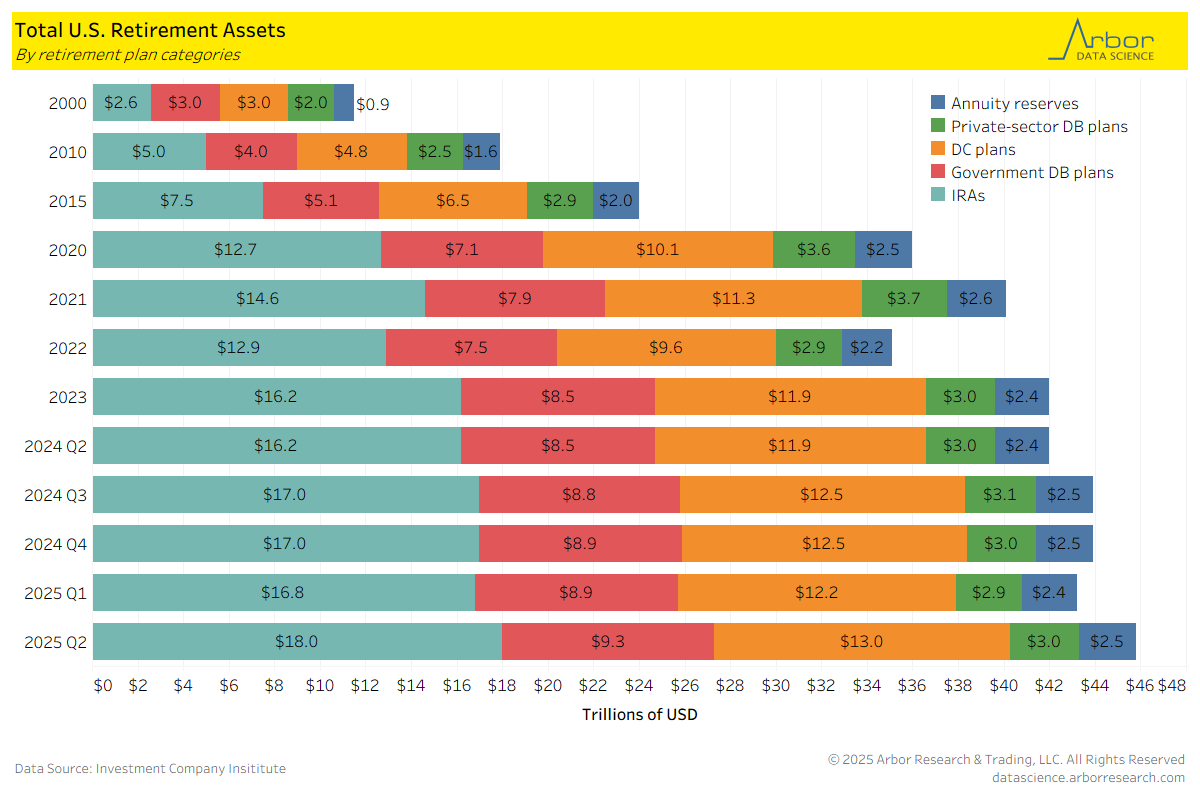

- According to the Investment Company Insititute, U.S. retirement assets were approximately $91.6 trillion in Q2 2025. This was an increase of approximately $5 trillion from Q1 2025. All five of the plan categories increased in market value in Q2 2025 to Q1 2025.

- IRAs comprised the largest share of these assets. The market value of IRAs increased from $16.8 trillion in Q1 2025 to $18.0 trillion in Q2 2025.

- Defined contribution plans had a value of $13.0 trillion in Q2 2025, up from $12.2 trillion in Q1 2025.

Search Interest for Retirement Terms

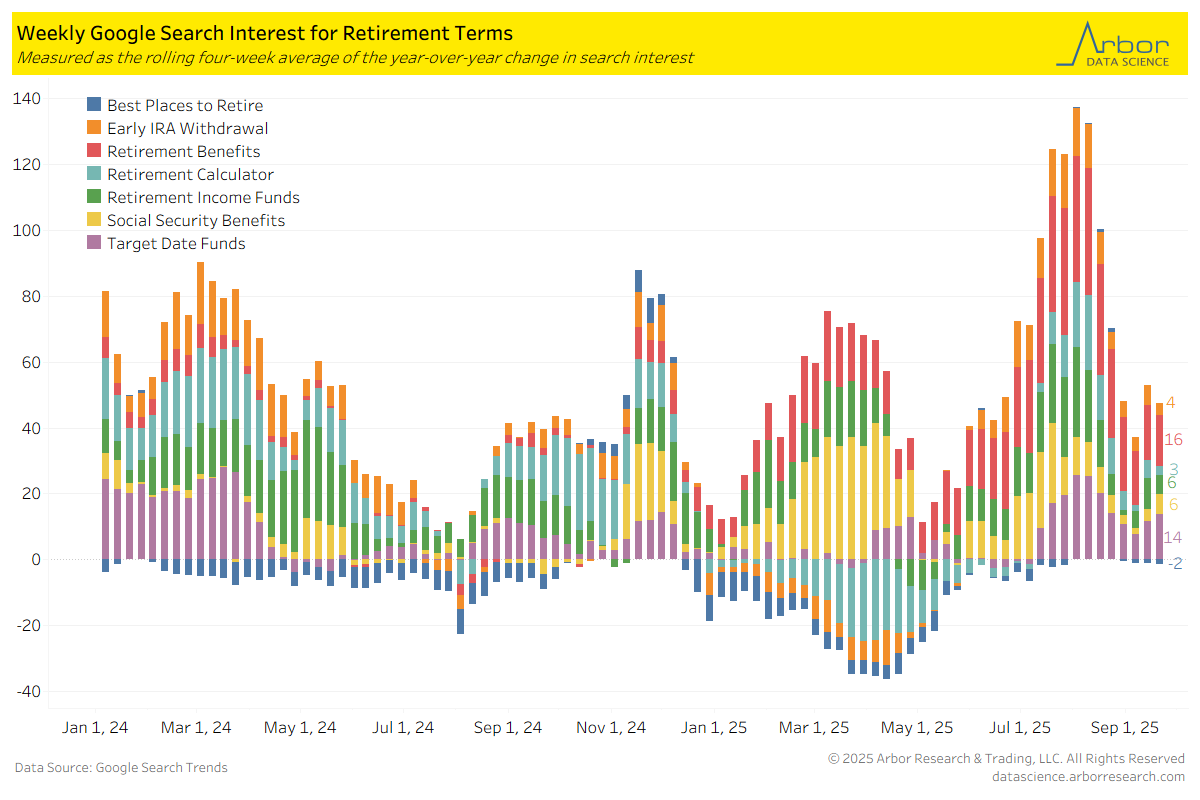

- The terms “retirement benefits” and “target date funds” had the highest rolling four-week average of the year-over-year change in search interest.

- The rolling average of the year-over-year change was -2 for searches for “best places to retire,” which was the only term with a negative value.

Gen X Worries the Most About Their Retirement Savings

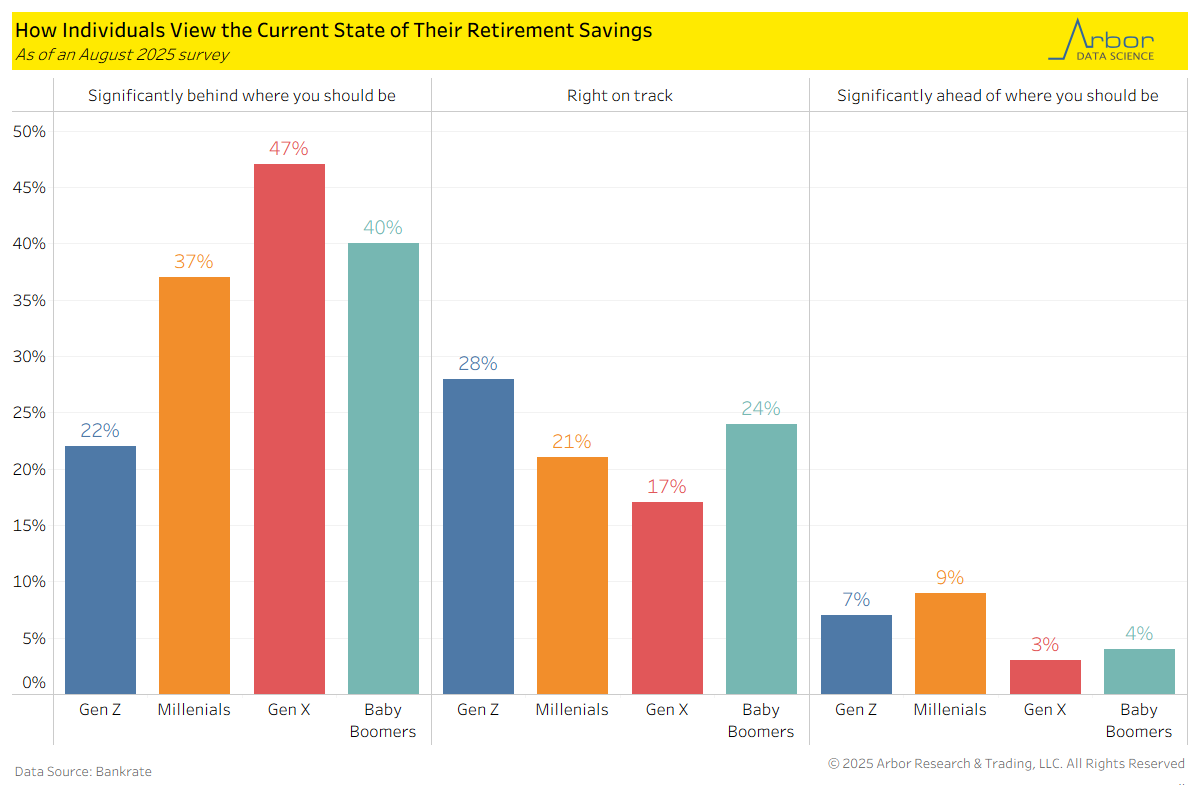

- Data from a Bankrate survey conducted in August 2025, 47% of Gen X felt significantly behind on their retirement savings, the most pessimistic of the four generations. In addition, only 17% of Gen X felt on track with their savings, which was the lowest of any generation.

- Millenials, at 9%, were most optimistic about being ahead of where they need to be for retirement savings.

Almost a Fifth of Each Generation is Not Saving for Retirement

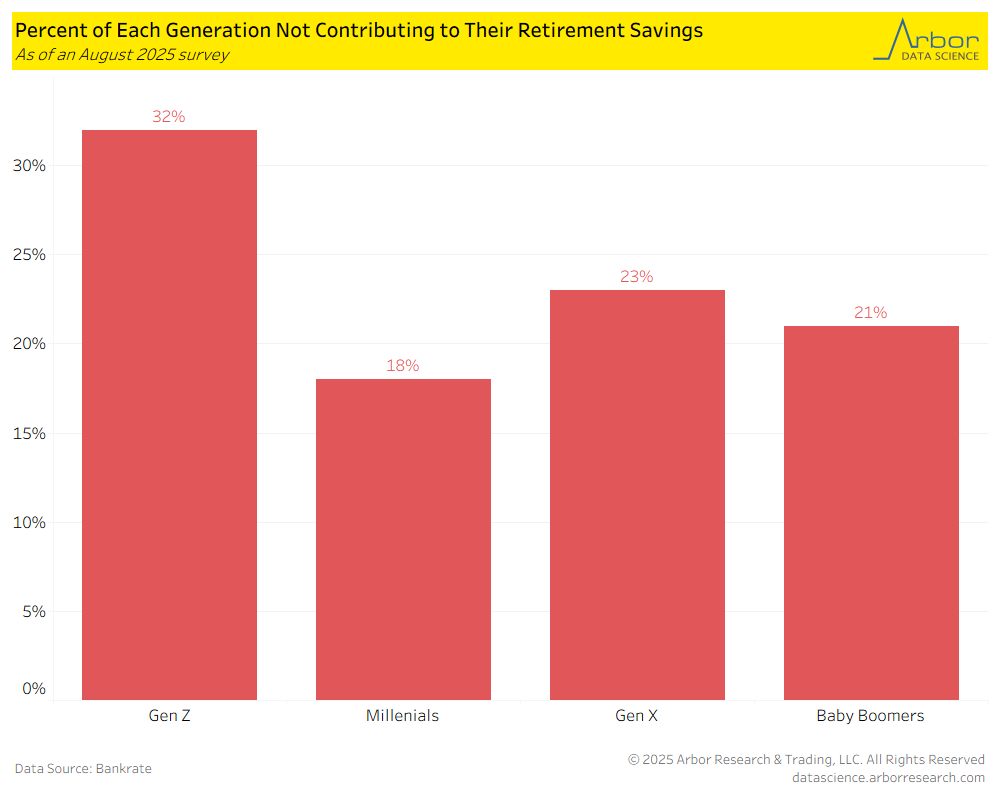

- Utilizing data from the same survey conducted in August 2025, 32% of Gen Z reported that that had not contributed to their retirement savings, the highest of the four generations.

- There were 18% of Millenials that had not contributed to retirement savings, the lowest of the four generations.

- Despite approaching or being at retirement age, 23% of Gen X and 21% of Baby Boomers had not contributed to to their retirement savings.