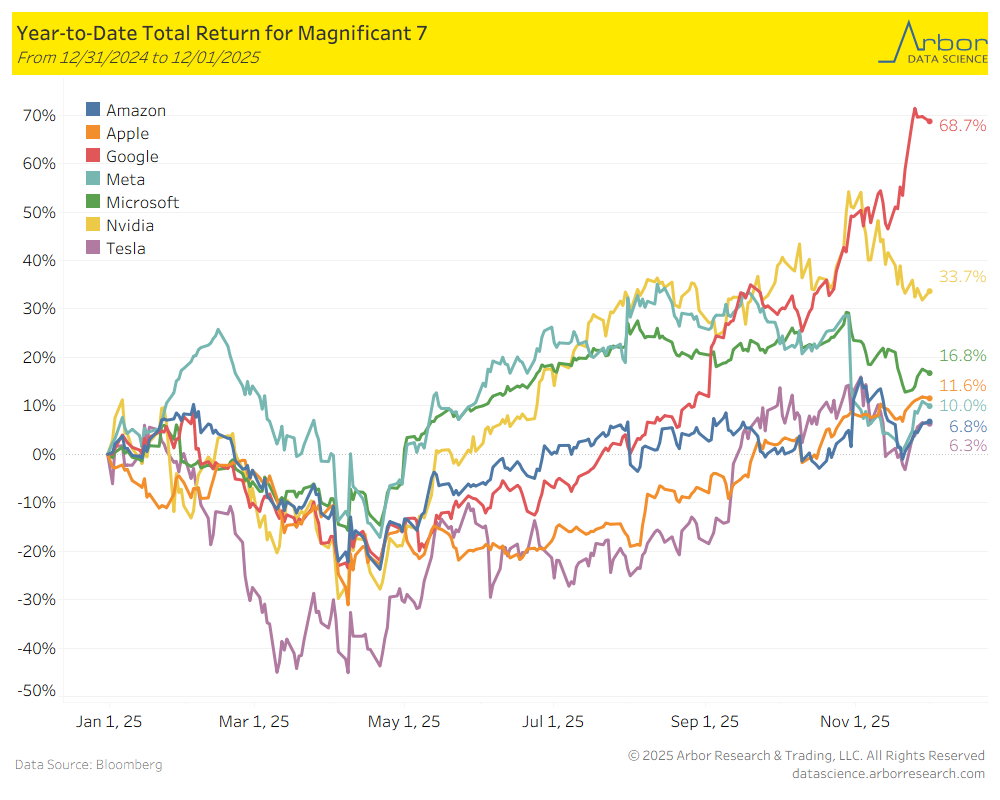

This year has been dominated by the Mag 7. To a degree, this makes sense. The AI boom has led to all sorts of permutations and opportunities. Sometimes, Nvidia is dominating the news cycle with projections of future demand. Othertimes, Alphabet is garnering the headlines with its Gemini product. Both companies have seen their stocks react positively and performance has been outstanding in 2025.

But outside of the top performers, the Mag 7 has not been a straight line up and to the right. Others have struggled to see their investments in AI infrastructure result in higher stock prices. In fact, only 3 of the Mag 7 have outperformed the S&P 500 this year.

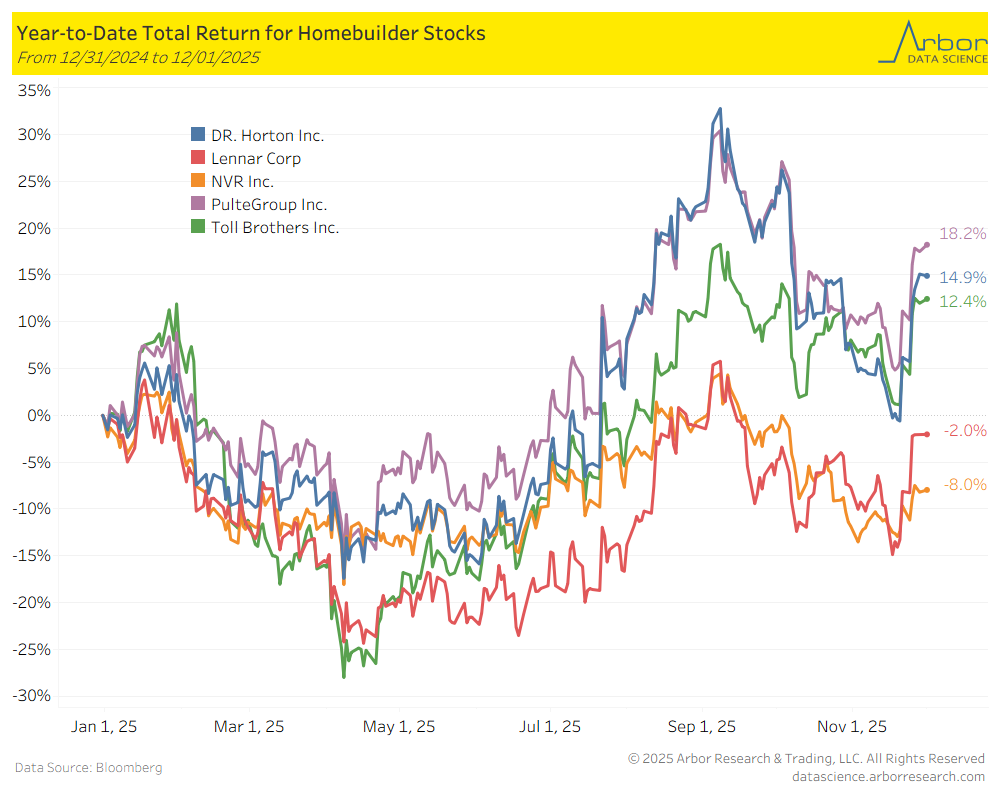

That helps to put into the perspective the “tale of two halves” for the the homebuilders. It was not a great start to the year for the group. Elevated interest rates weighing on home buyer confidence? Check. Tariffs on a significant amount of the inputs to build a structure? Check.

It was a perfect storm of sorts. Fast forward to mid year, and the narrative has begun to shift. Interest rates are beginning to come down a bit, and the tariff situation has relaxed a bit. Homebuilder stocks have started to perk up, even with a mixed outlook for 2026.

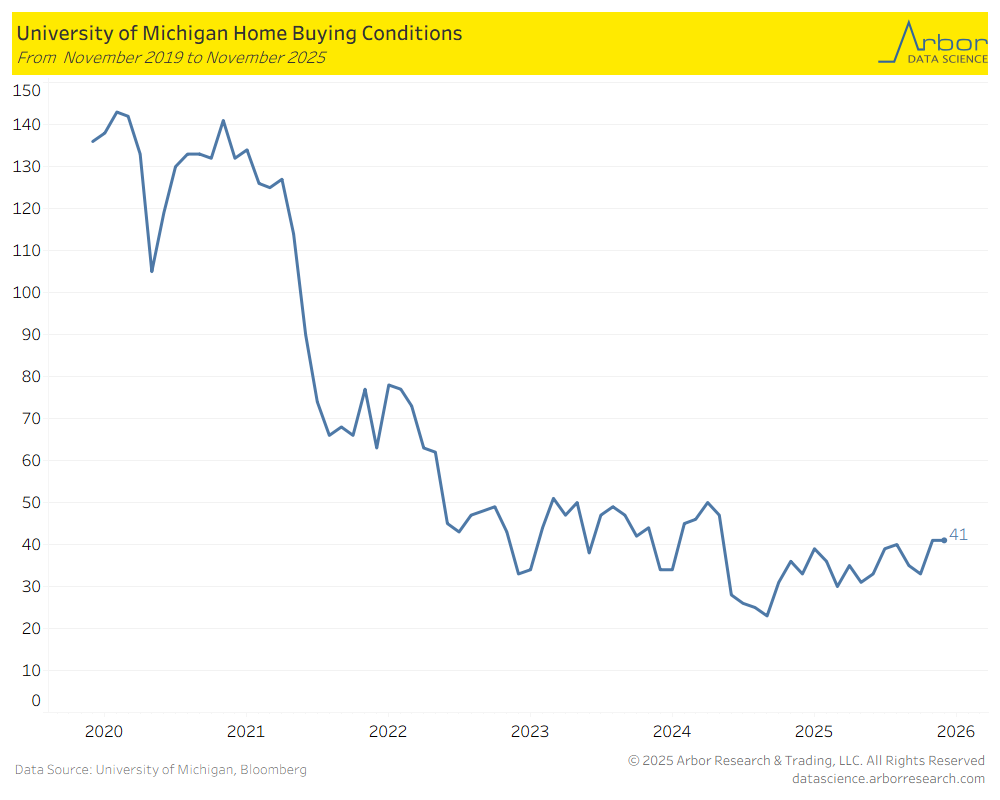

It is not as though the homebuilders have had an easy going backdrop. The homebuilders have been up against home buying conditions that have been bouncing around the post-Covid lows for the better part of 3 years. But, that is also (oddly) encouraging. If the homebuilders could survive and thrive in the environment of the past few years, it will be interesting to see how they can execute in the coming years.

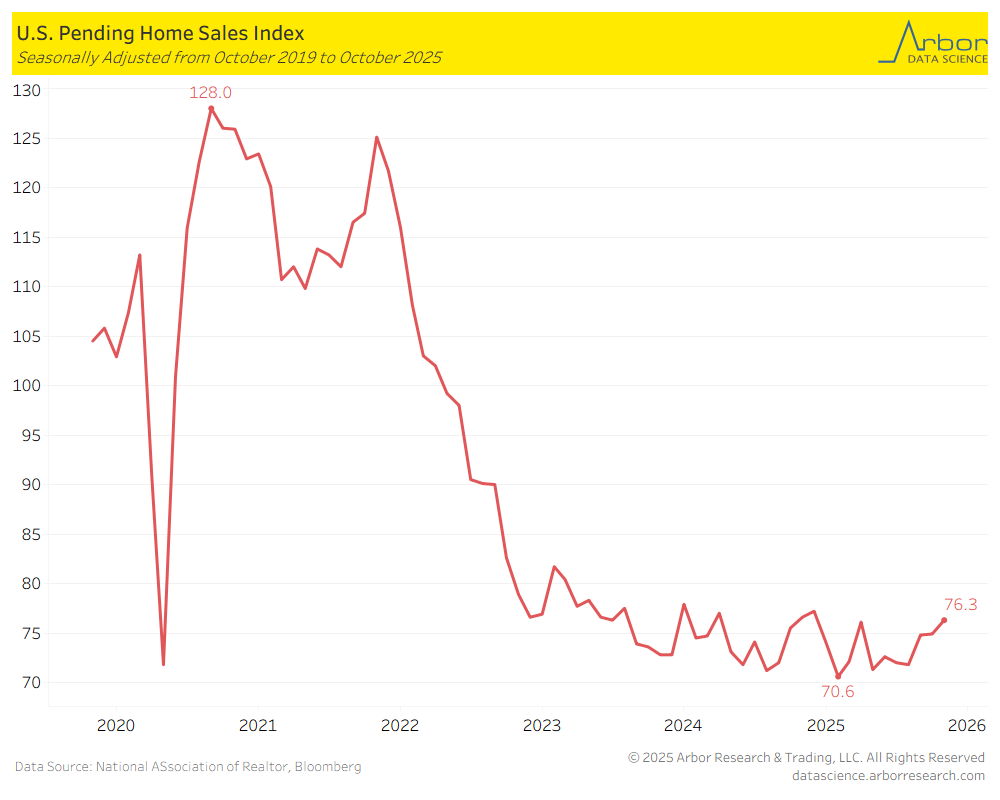

And, it is not as though consumers were saying one thing and doing another. Not only were consumers saying it was a bad time to buy, consumers were not buying homes. Again, this is not the worst thing for the future outlook. Bad conditions and fewer and fewer sales? Maybe that leads to pent up demand coming out of the wood work soon.

Homebuilders would welcome any signs of life. And signs of life could lead to an unexpected outcome. Homebuilders have defended their margins aggressively. If and when volumes come back, margins could surprise to the upside.

In some ways, the homebuilders are in a similar position as the Mag 7. Some are and will do exceptionally well through any environment. Others will find themselves on the wrong foot. But, both should be on investors radars as we approach 2026. Maybe it will be the year of the Homebuilder 5.