Everything was going great. Then it wasn’t. That is the easiest way to describe the homebuilders. Higher rates? That was not an issue. In fact, it was a tailwind. Existing homeowners did not have an incentive to list their homes for sale. They have very low mortgage rates and do not typically want to step up their costs for a new or different home. Higher labor and materials costs? Those could be passed on to the home buyer. And they were. Simply, the old correlations of higher rates hurting homebuilders did not hold.

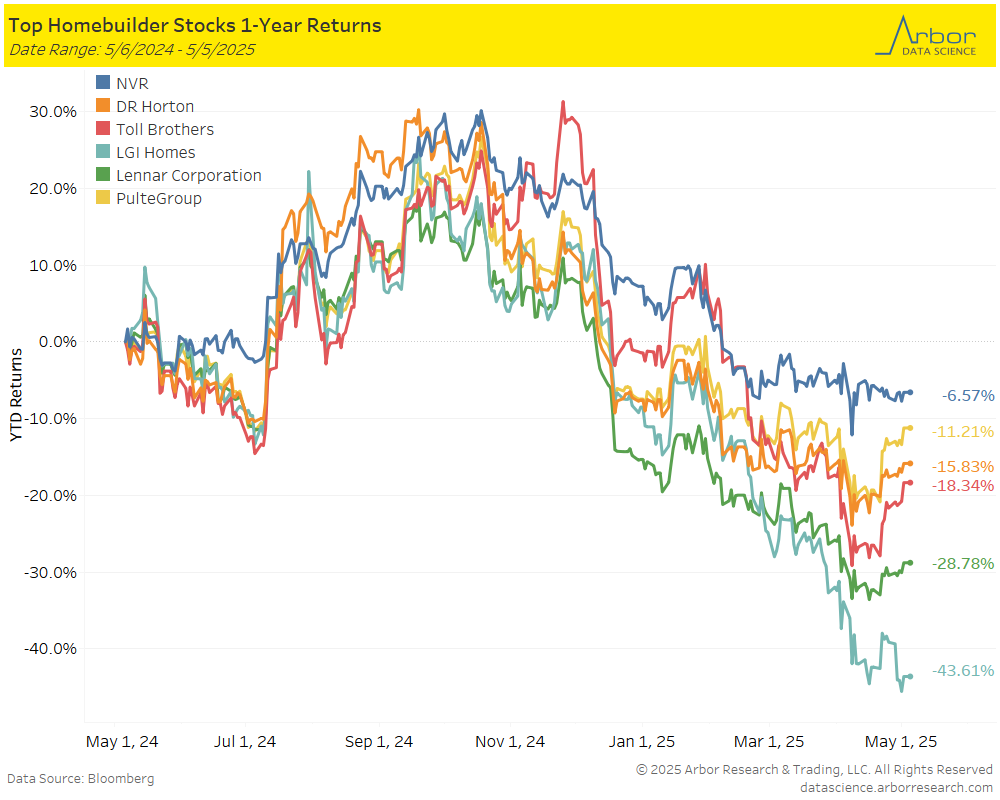

These were powerful tailwinds for the industry. And they took advantage of it. That has changed. Labor costs do not appear to be waning or returning to the old dynamics. Material costs have been volatile – to say the least – and there is less room to pass that on. Interest rates are too high to allow the homebuilders to continue to push these on to the buyer. Equity markets have taken note.

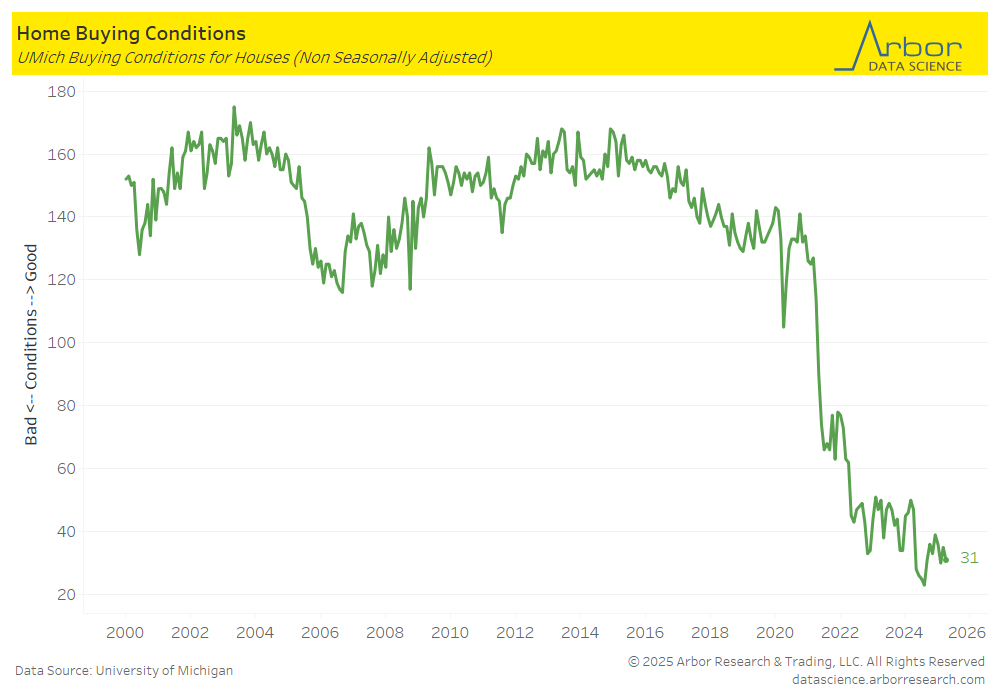

The other – harder to quantify – issue is consumer sentiment. When consumers do not feel confident, they tend to sit still. It is similar to being sick. Not dead and buried. But not wanting to do much and not willing to really contemplate it. That is where the consumer is now. High interest rates and a few years of elevated inflation on everything else has taken its toll. It is not a new phenomenon that consumers do not find it to be a great time to buy. That happened during the Covid inflation and the corresponding surge in rates.

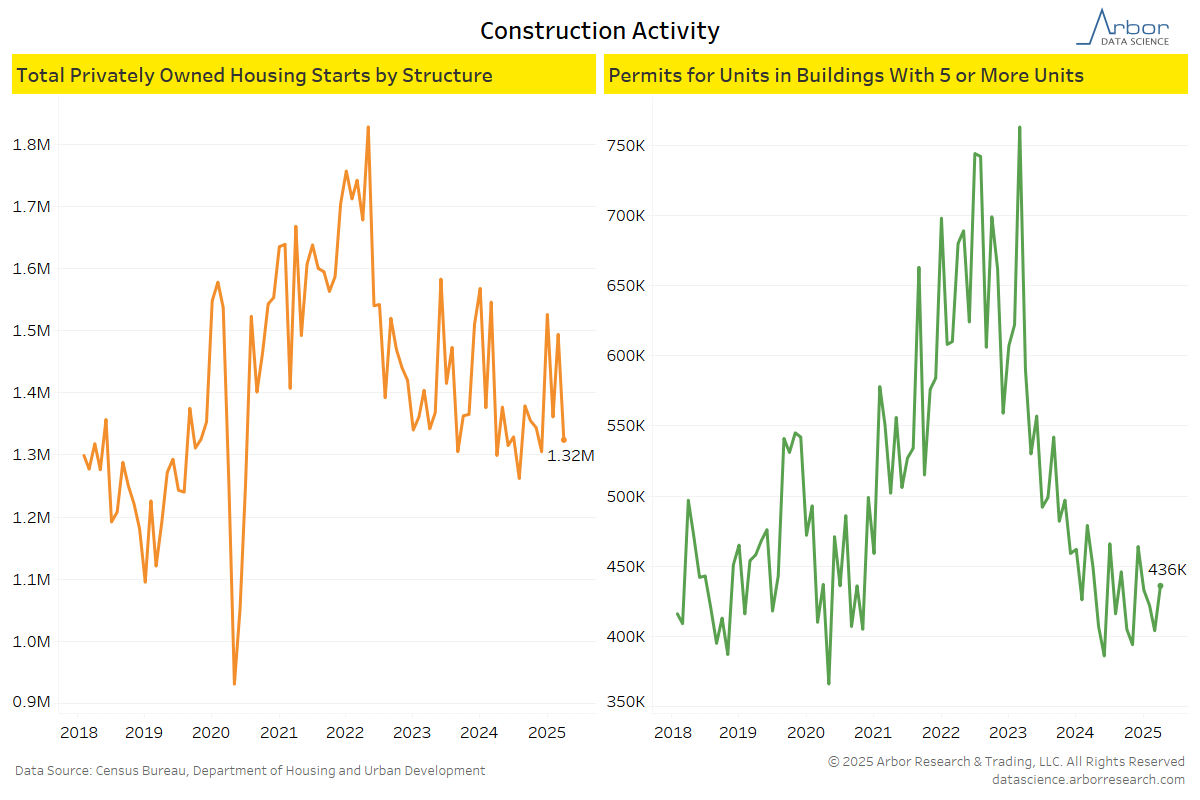

There is an odd part of the analysis though. Construction has collapsed. But only from the post-Covid oddities. Starts are actually still higher than the pre-Covid years, and it is mostly driven by the single family side of the equation. Multi-family is not seeing the same love by any stretch of the imagination.

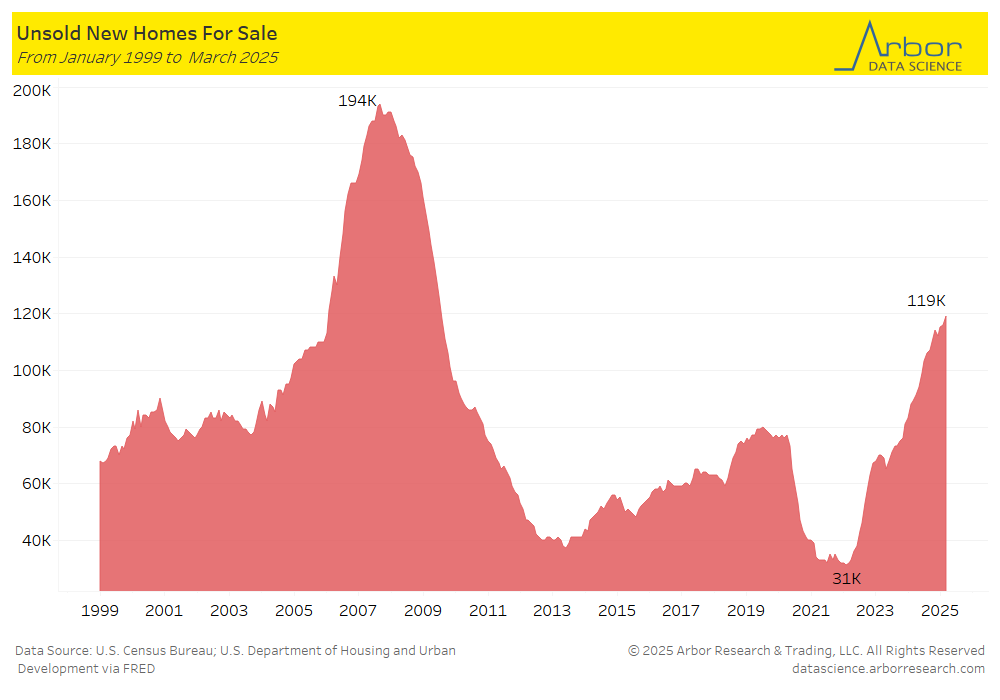

And there is a bit of a pull and tug here. There is less of a want to buy a house when rents are declining. It creates a strange dynamic where rents are going down or at least stabilizing in most markets but housing prices are not. That is a product of a lack of existing homes on market and interest rates. The dynamic is unlikely to deteriorate in the near-term.

What does this all mean for the homebuilders? The best case scenario for them is elevated rates and a better economy. The worst case is lower rates and an economy that booms without much inflation pressure. In many ways, they are the perfect avenue for expressing a view on the economy.