The US economy is a behemoth. That makes it a difficult thing to parse. But there are a couple of things of particular importance to understand. Namely, the trajectory of the US consumer and US fiscal policy. And, there are certain times when they interact with different segments of the economy and in different ways. What is interesting about the current US economy (that is seemingly overlooked too often) is how those two are interacting currently, and will continue to interact in the future.

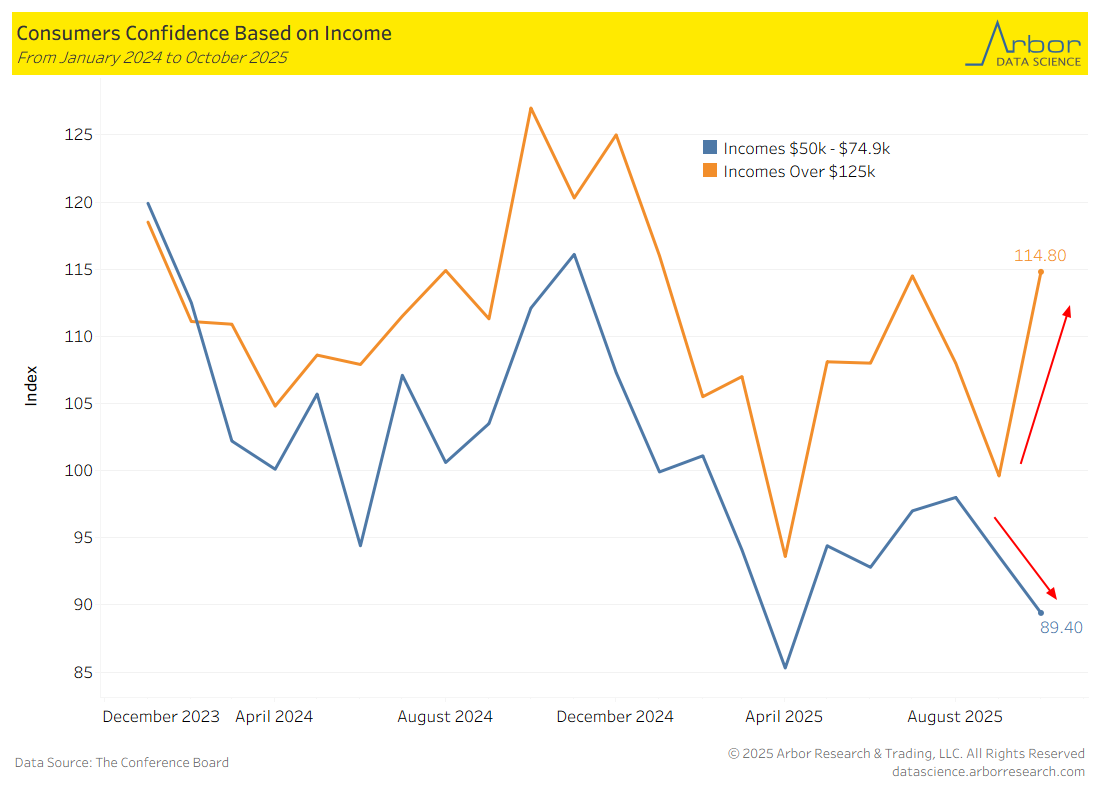

Currently, there is a radical bifurcation between those with elevated incomes and everyone else. Those with higher incomes view the current state of the economy as radically different from those with lower incomes. That should not be taken as a shock. The “One Big Beautiful Bill” had several things that would provide tailwinds to higher income earners going forward. Global equity markets are doing well, and the labor market has yet to crack in any meaningful way. For higher income earners, that is going to spur stronger confidence and keep consumption patterns intact.

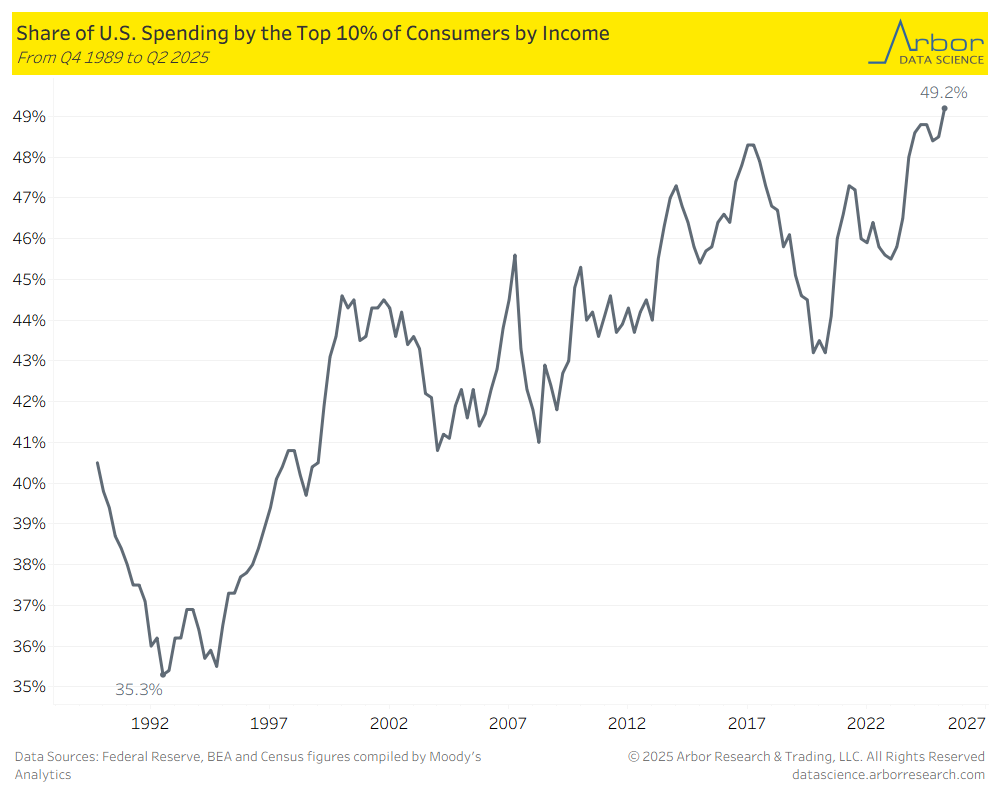

That helps to explain the persistent “share gains” of the top spenders. When you have fiscal policy, equity markets, and a decent macro backdrop coming together, you are going to get the top earners and spenders dominating the consumption metrics in larger and larger numbers. Of course, this is not a straightforward thing for the US economy. Concentration in spending at the top puts the US economy at increasing risk of an asset market shock spilling into the real economy.

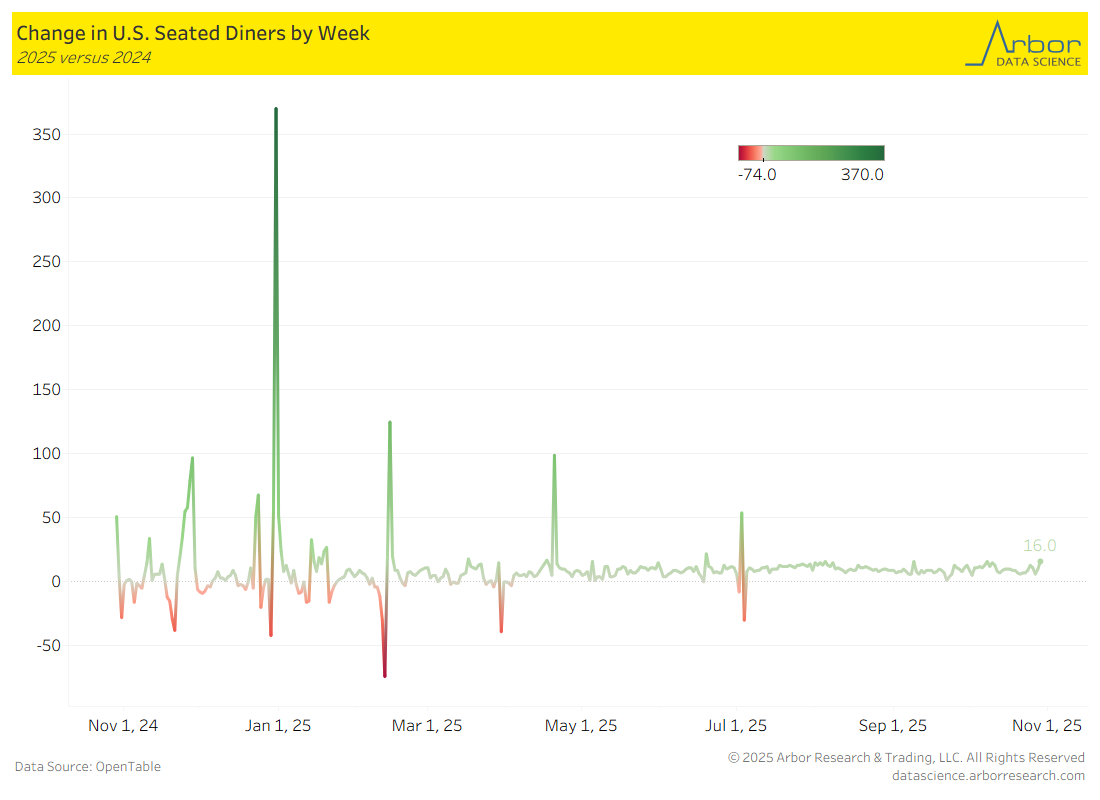

For all the commentary on a weakening consumer, there is no shortage of people willing to go out to eat. Stripping out the oddities around calendar shifts and the like, there are still people going and sitting at restaurants. In fact – according to OpenTable – the demand for eating out has been steady to higher. Simply, those with higher incomes are not slowing down.

So, while it is tempting to be negative on the consumer and the economy. The narrative does not hold when digging into who is spending and how much. There is certainly pressure at the lower end. But there does not appear to be much – if any – at the higher end. That matters. And it should not be overlooked. The US economy will continue to be fine. Until the higher income consumers decide the party is over, the party will continue.