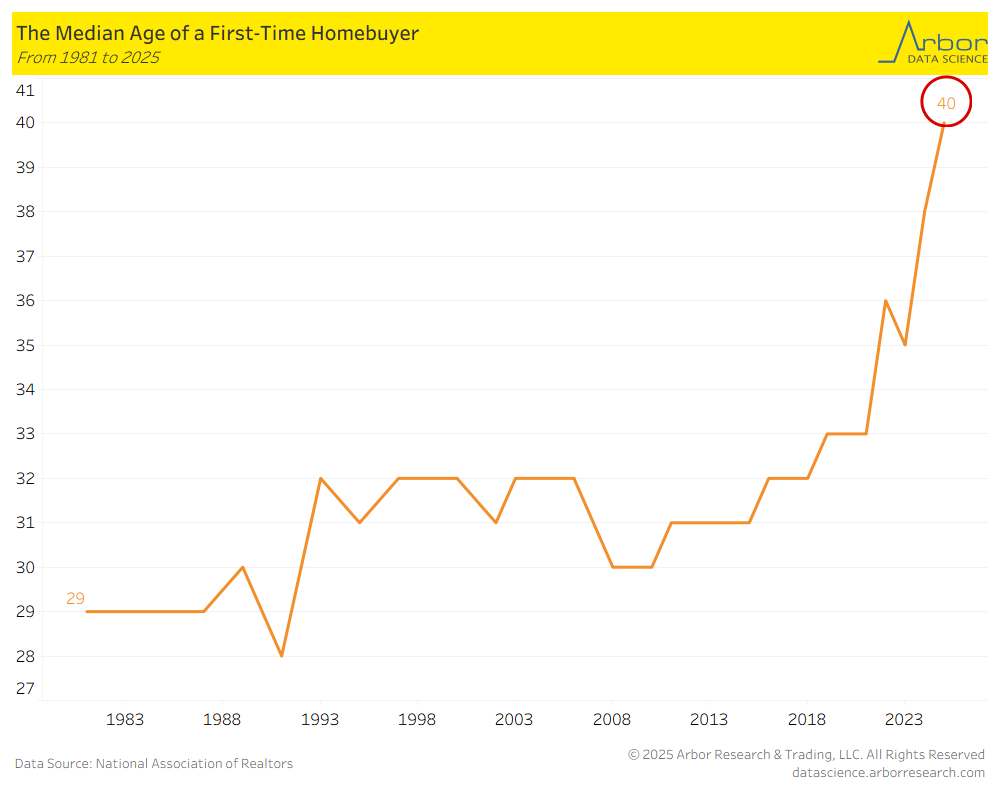

- Examining data provided by the National Association of Realtors, we found that the median age of first-time homebuyers has increased to 40 in 2025, compared to age 29 in 1981.

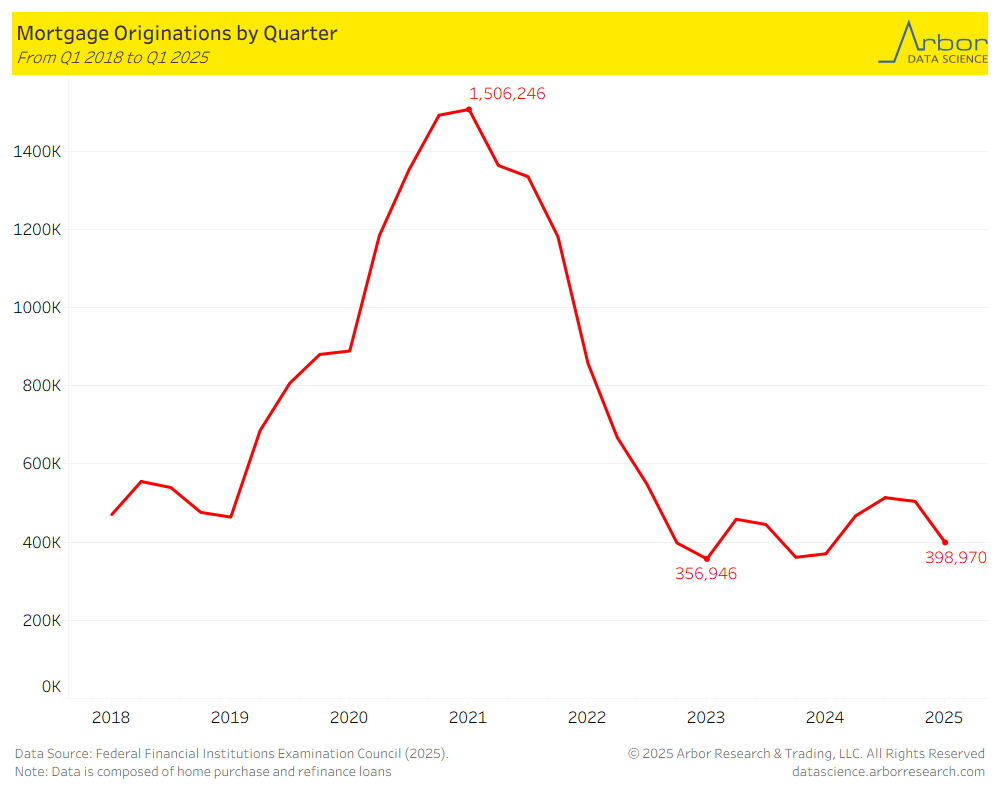

A Decline in Mortgage Originations in Q1 2025

- The number of mortgage originations from Q1 2018 to Q1 2025 is highlighted in the chart below. In Q1 2025, the number of mortgage originations declined to 398,970, down from the high at 1.51 million in Q1 2021.

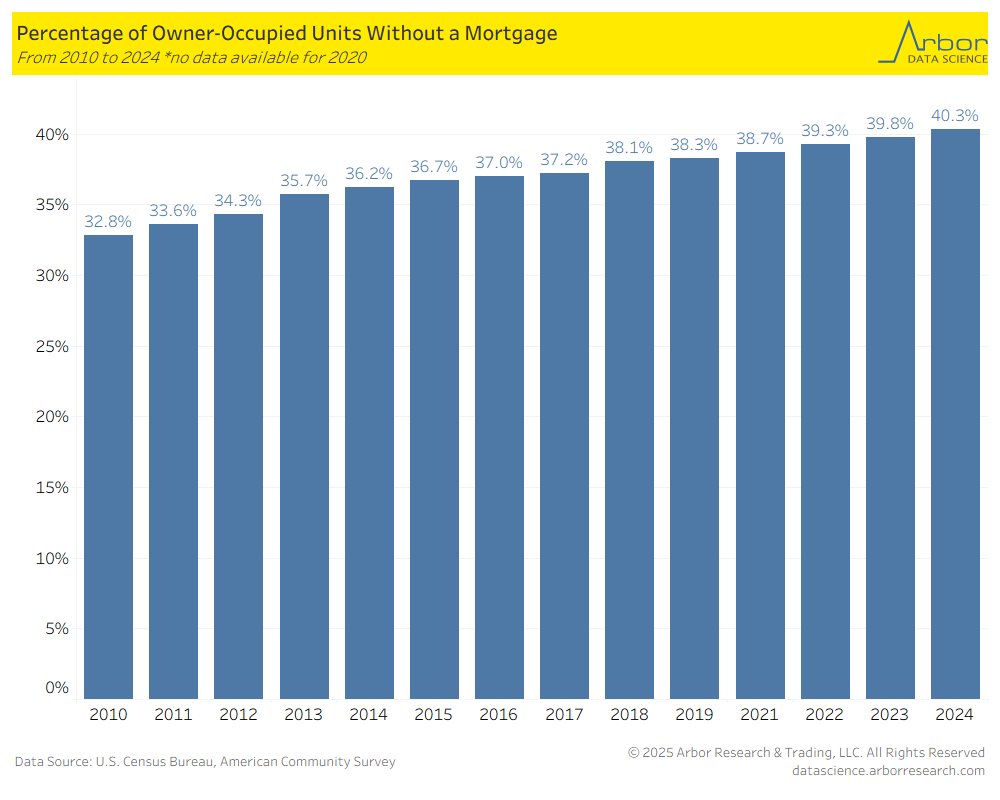

But, There is a Record High of Mortgage Free Homeowners

- In 2024, 40.3% of owner-occupied homes in the U.S. did not have a mortgage. The percentage of mortgage-free homes has continued to trend higher since 2010 when it was 32.8%.

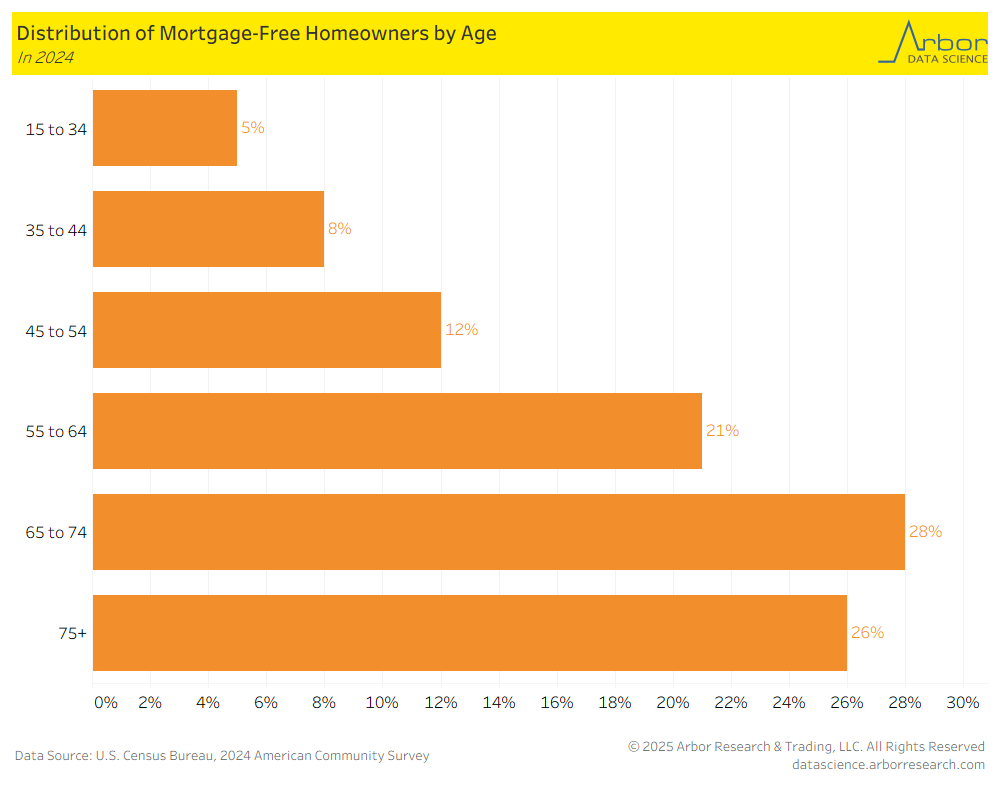

Mortgage Free Homeowners by Age Group

- The chart below outlines the distribution of mortgage free homeowners by age group in 2024.

- Age group 15 to 34: 5%

- Age group 35 to 44: 8%

- Age group 45 to 54: 12%

- Age group 55 to 64: 21%

- Age group 65 to 74: 48%

- Age group 75+: 26%

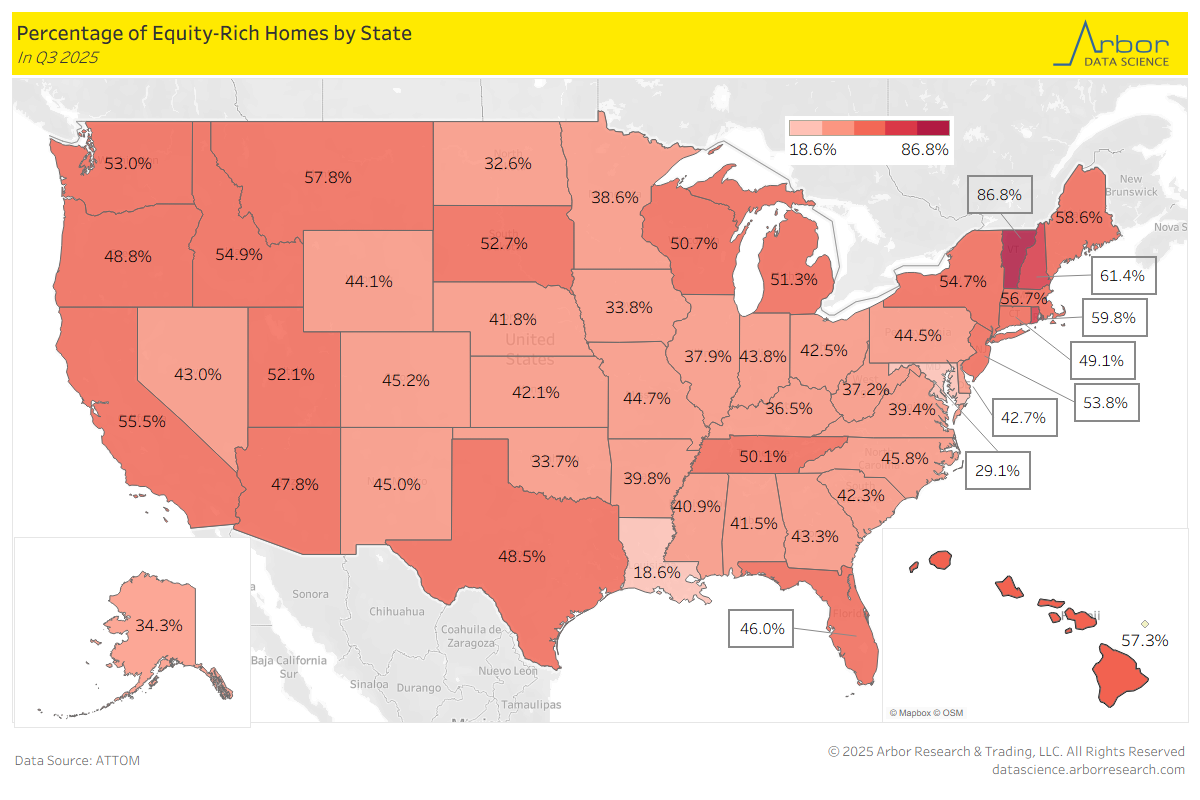

46.1% of U.S. Homeowners were Considered “Equity-Ruch”

- According to ATTOM, in Q3 2025 46.1% of mortgaged residential properties were “equity-rich”. This means the homeowner put 50% or more equity into their property, resulting in paying less on their mortgage than the value of their home.

- The states with the highest equity-rich states in Q3 2025 are outlined in the heatmap below. Vermont had the highest equity-rich rate at 86.8%, followed by New Hampshire at 61.4% and Rhode Island at 59.8%. Factors causing this could potentially include: a strong housing market and high home prices.

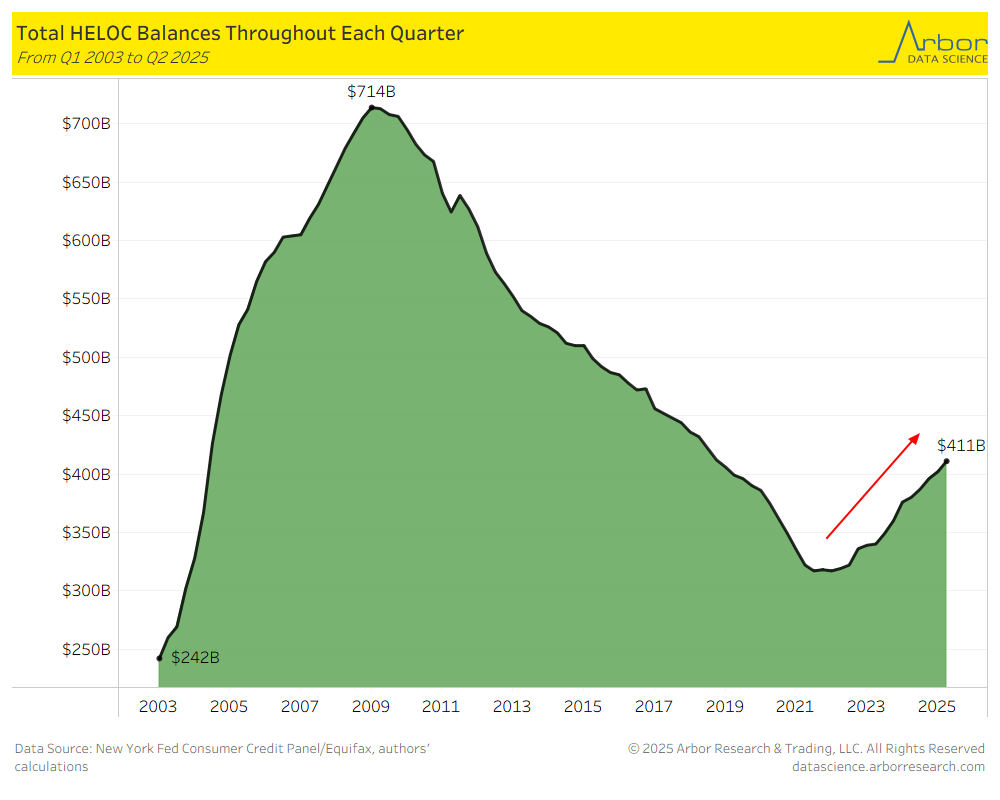

HELOC Balances Continue to Trend Upward

- After hitting a peak of $714 billion in Q1 2009, home equity line of credit (“HELOC”) balances were on a steady decline. For the past thirteen consecutive quarters, HELOC balances have trended higher, reaching $411 billion in Q2 2025. Our time period is from Q1 2003 to Q2 2025.