Because this is the first time I’m covering quantum computing, here’s a brief primer on the underlying technology: Unlike classical computing, which relies on binary bits that flip between 0 and 1, quantum computing harnesses qubits that can exist in superposition—multiple states simultaneously—allowing them to process vast combinations of possibilities in parallel. This enables exponentially faster computations for certain complex tasks, like molecular simulations or optimization problems, where classical systems hit hard limits.

Today’s big news in quantum is that the Department Of Energy has announced that they will fund $625,000,000 over 5 years into renewing all five of the National Quantum Research centers. The most important distinction here versus other recent headlines from the government when it comes to investing in our tech sector, is that this does not benefit any private company directly. However, there could be significant industry collaborations that stem from this investment in the future, most likely for IBM and NVIDIA.

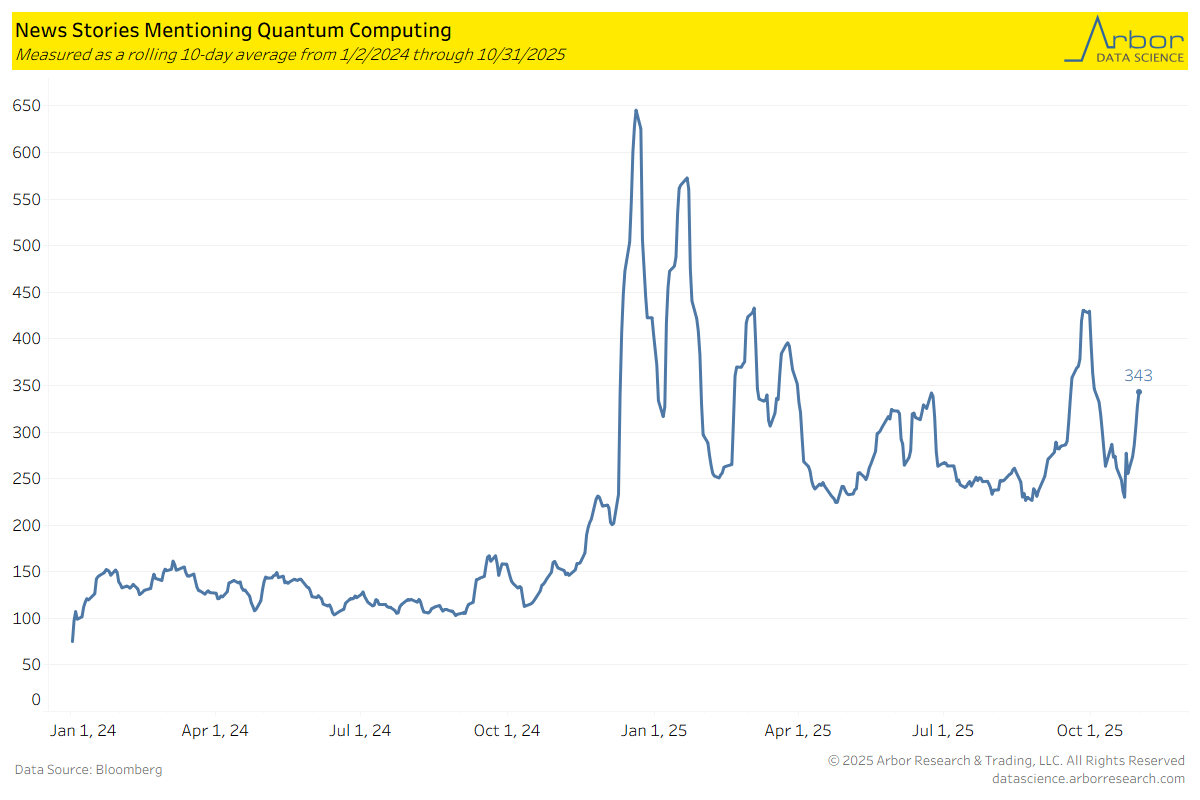

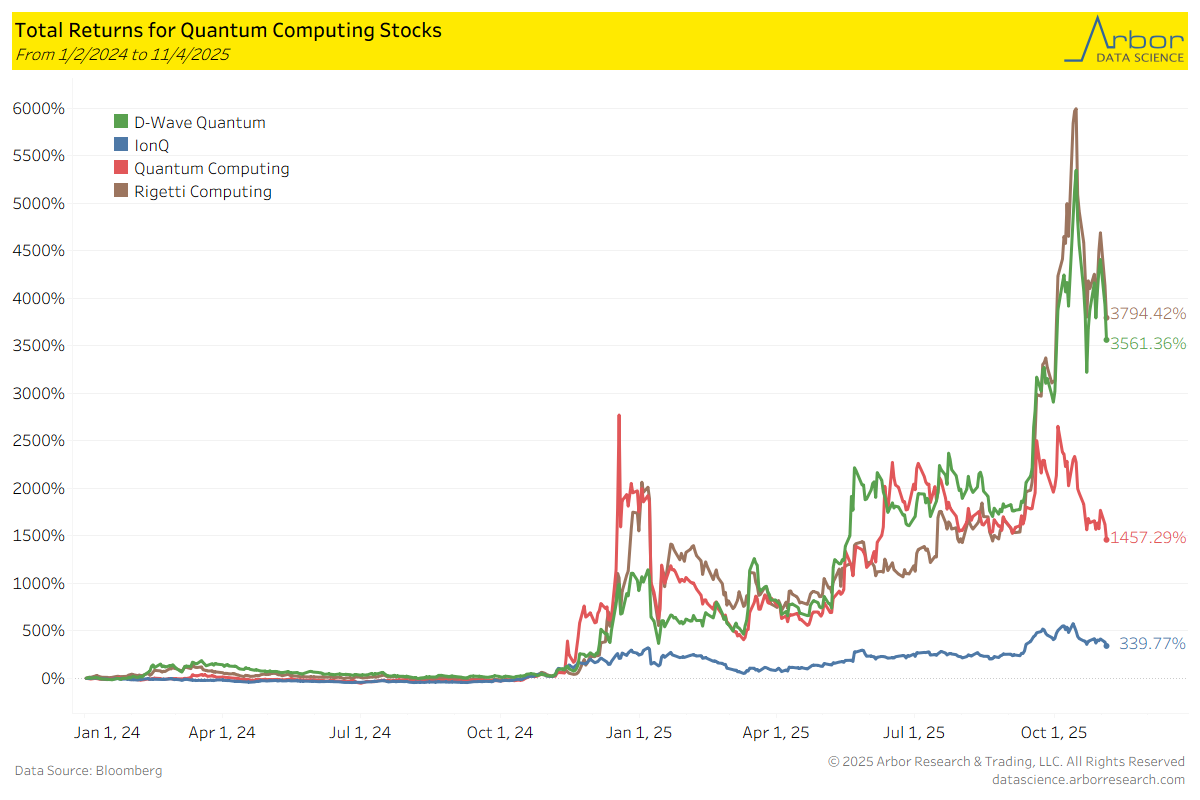

Quantum names have absolutely skyrocketed the past two years, some of these names are up almost 4000%. We have seen a sharp pullback recently in the last few sessions after reality has started to set in. Unfortunately, a lot of these valuations are simply not feasible based on current limitations and the scale of quantum. IonQ trading a $21billion dollar market cap on $52mm in trailing 12mo revenue (a price to sales of 250x) is objectively insane.

Furthermore, companies like IBM and Microsoft have a strong advantage in quantum computing, thanks to their long history of research, large cloud systems, and combined classical-quantum setups that smaller specialized firms can’t easily match—while NVIDIA, a leader in AI hardware, is increasing its role to connect quantum simulations with everyday applications. Last week, IBM made progress by running quantum error-correction algorithms on standard AMD chips, which cuts the high costs of building reliable systems and supports their 2029 Quantum Starling plan to reach over 100,000 logical qubits for practical uses in drug discovery and new materials. Microsoft is focusing on topological qubits, which can fix errors on their own using special material properties, to develop systems with a million qubits by the early 2030s; they already offer Azure Quantum pilots that work well with business tools for tasks like optimization and secure encryption.

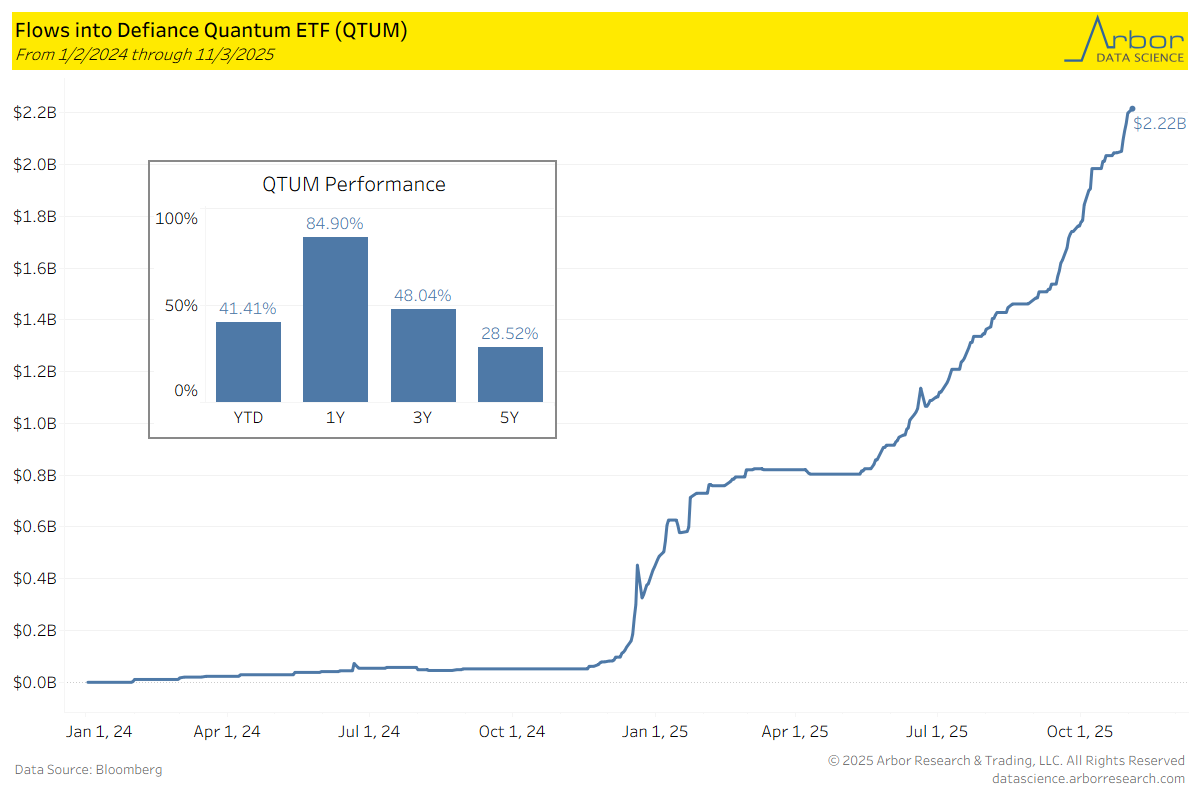

Flows into the the ETF of Quantum names have soared over 2 billion this year alone.

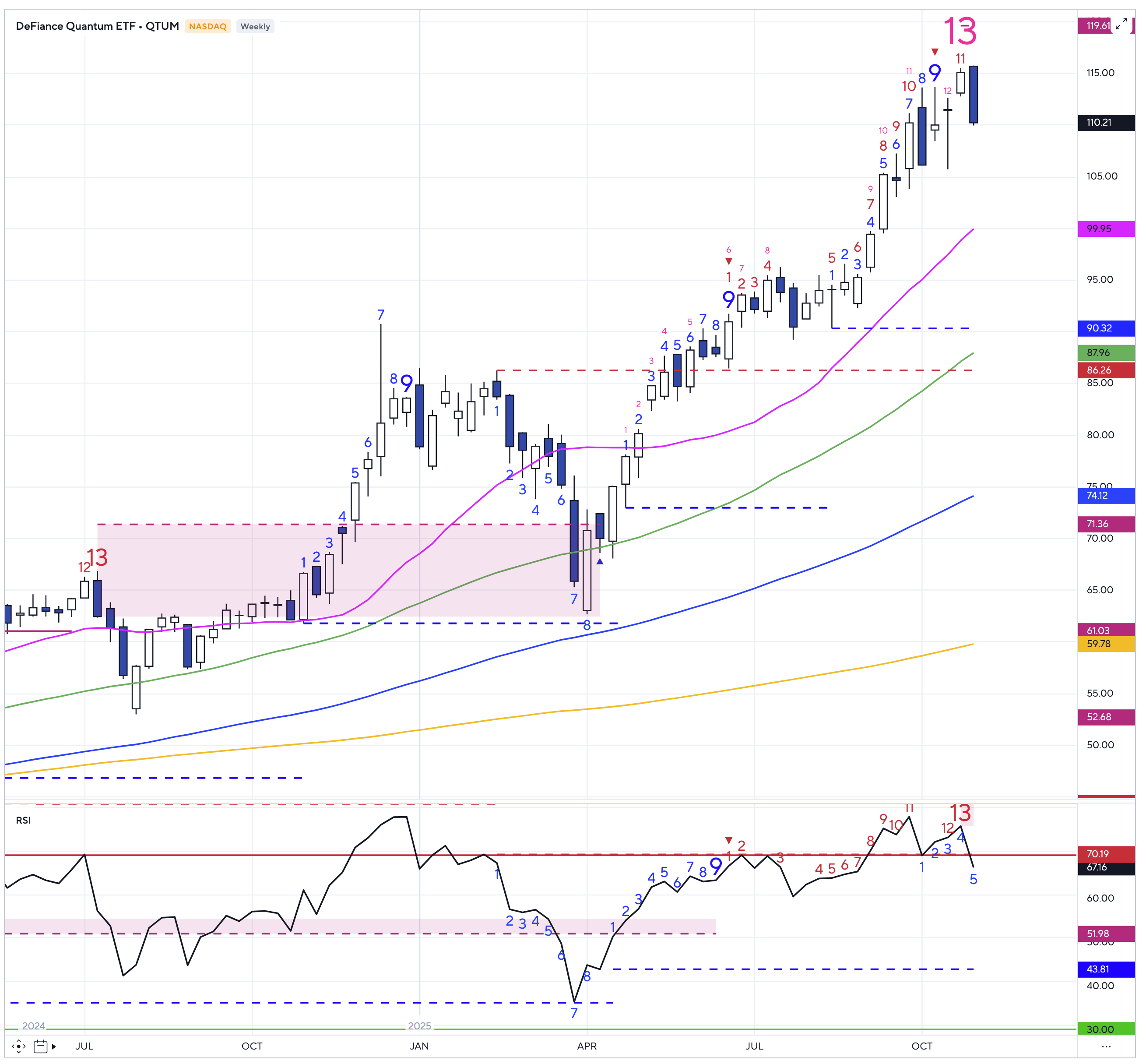

The technical side is very clear to me: massive weekly exhaustion count on the weekly chart of QTUM coupled with a fundamental overvaluation. I’m going to be legging into some kind of put structure on my end trying to capture downside volatility into year end and Q1 ’26.