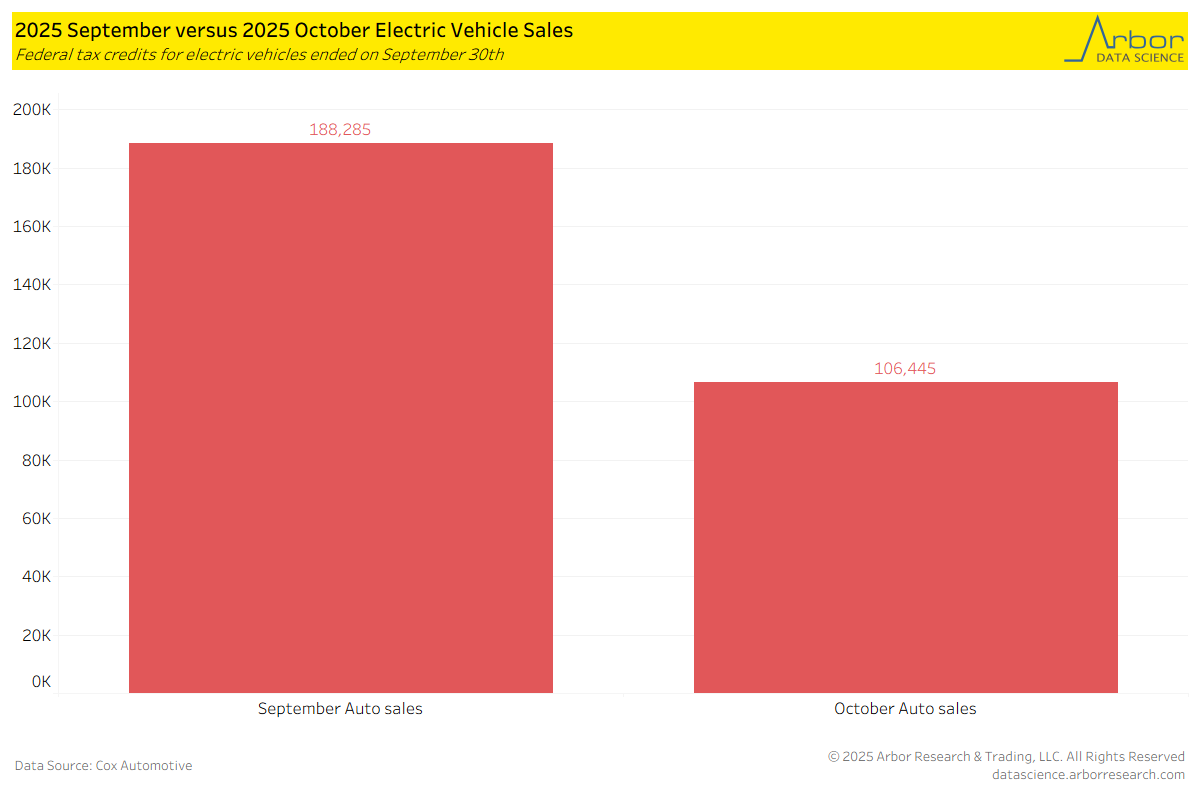

The Federal EV tax credit ($7,500 for new EVs, $4,000 for used EVs) ended on September 30, 2025. Congress passed the “One Big Beautiful Bill” in July, which gave buyers roughly 90 days to decide or not to buy an EV, which they did as September was a record month. However, October was a different story. U.S. EV sales collapsed from 188,285 in September 2025 to 106,445 in October 2025, as illustrated in the chart below.

That equated to a 43% month-over-month cratering. J.D. Power has it worse—they’re showing EV market share dropped from 12.9% to 5.0% in a single month. Last time EVs had 5% share was early 2022. Three years of growth, was neutralized to zero.

This news did not come as a surprise. The CEO of Ford called it months ago—when he said that he “wouldn’t be surprised” if the EV share got cut in half without the tax credit. He was right. Hyundai Ioniq 5 sales dropped 63% year-over-year in October. Kia EV6 down 71%. Even Ford’s Mach-E fell 12%, despite being one of the more resilient nameplates.

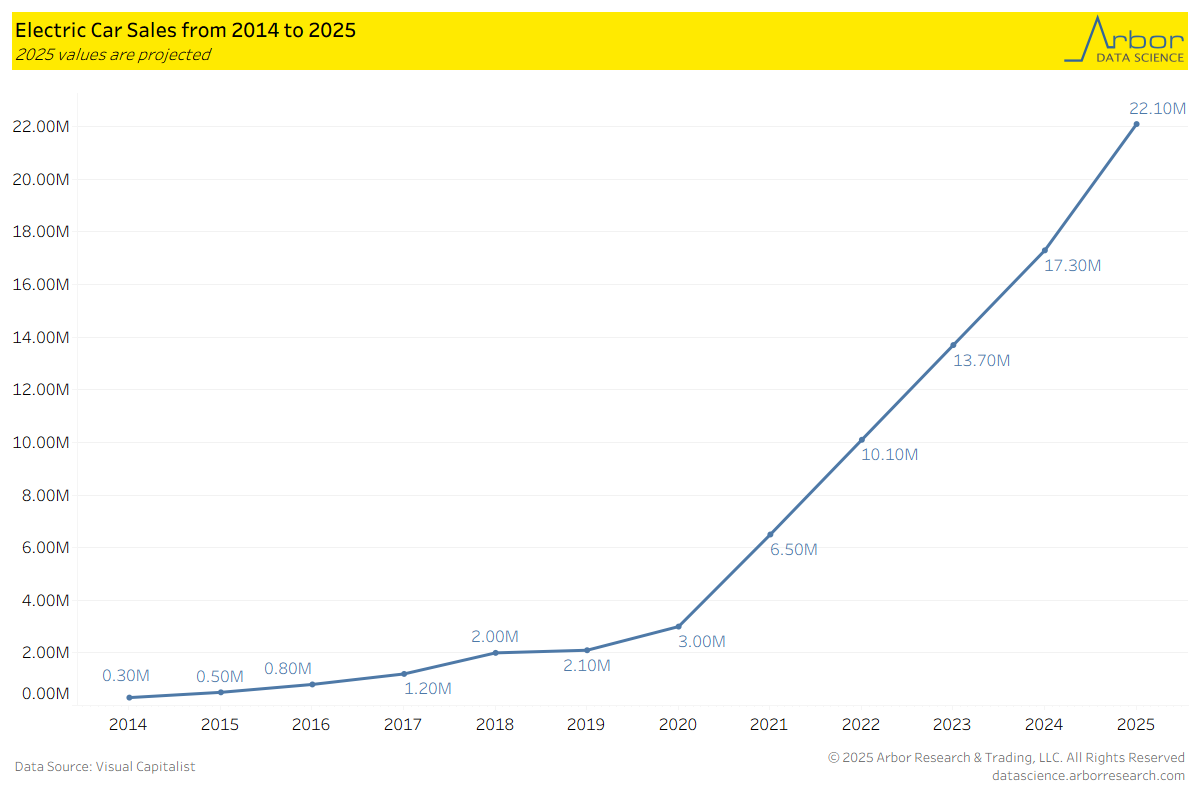

When you look at the global sales trajectory, the curve went vertical after 2020—from 3.00M to 6.50M, to 10.10M to 13.70M, to 17.30M to 22.10M. Growth hasn’t stopped globally. It just stopped being subsidized in the U.S.

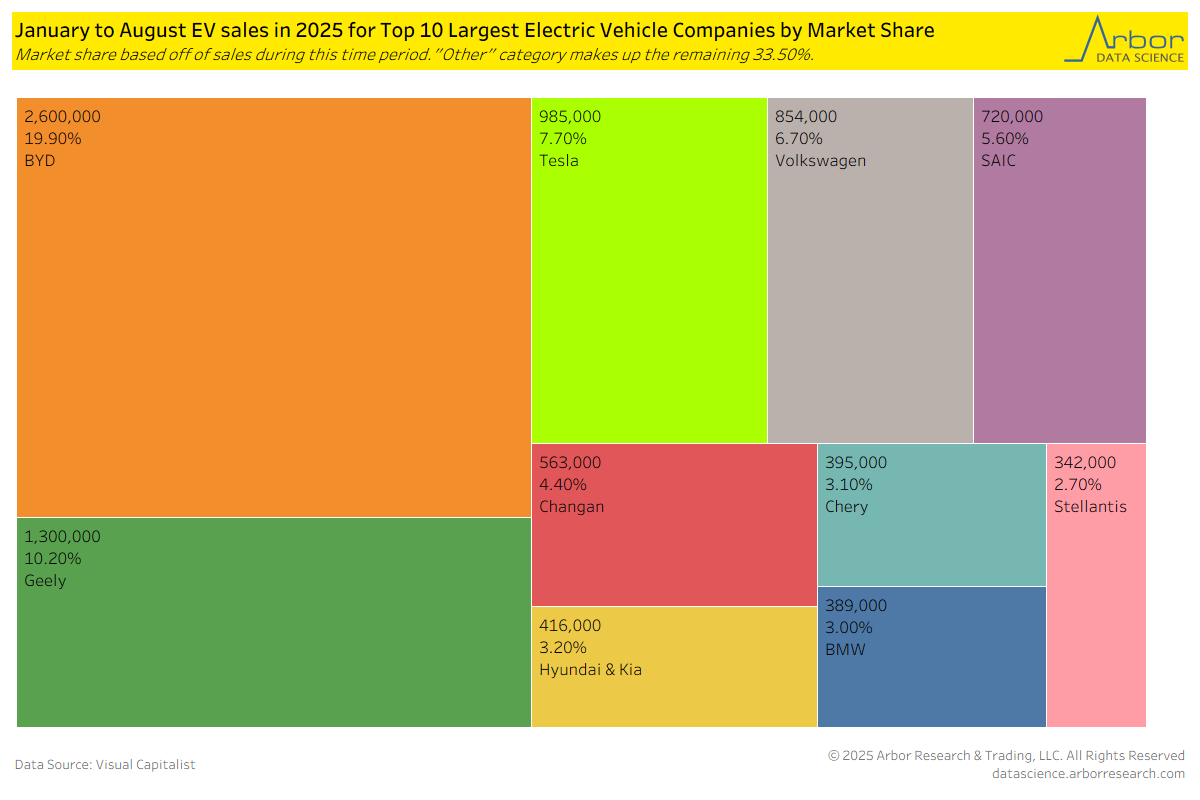

The market share chart tells the real story of who is winning this race. BYD had a 19.9% market share with 2.6 million units sold January through August. Geely was second at 10.2%. Tesla was at 7.7% with 985,000 units.

Five of the top ten EV makers globally are Chinese. Tesla fell out of the top 10 in China’s domestic NEV market in October—for the first time since August 2022. Their October China sales hit 26,006 units, which was the lowest since November 2022.

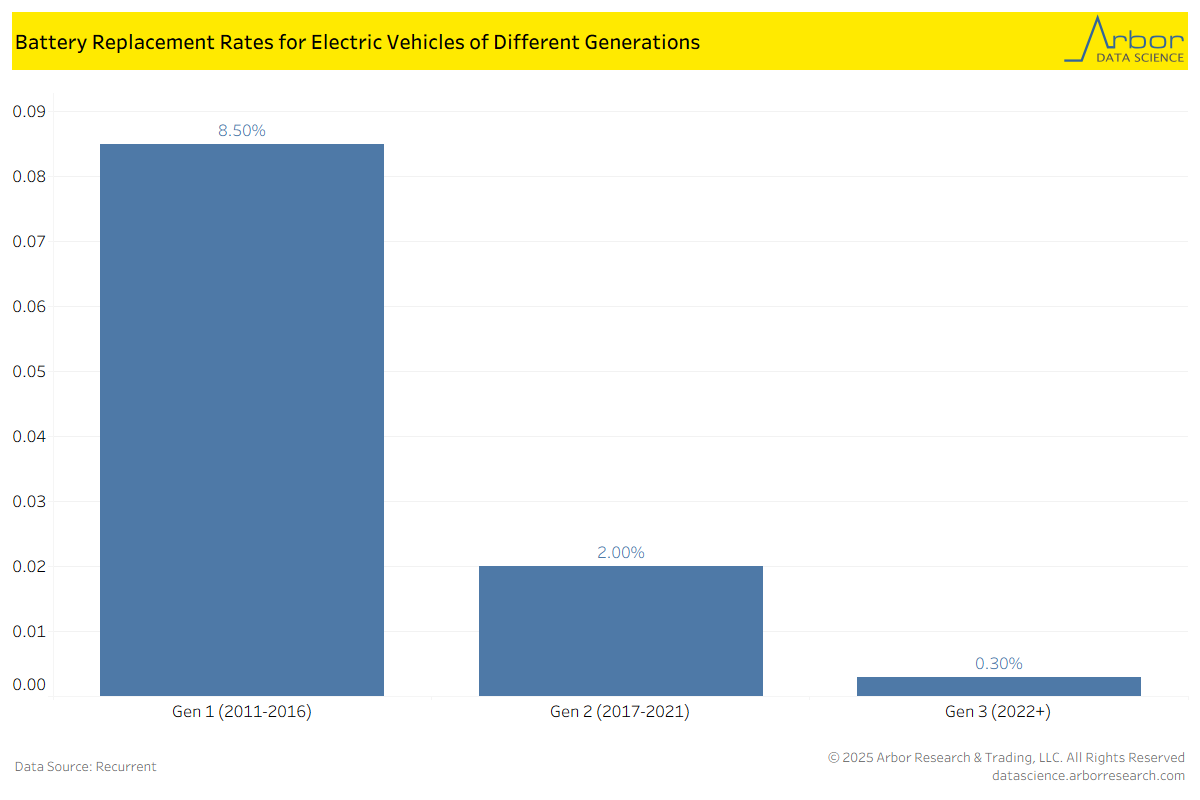

One thing the U.S. market has going for it is that battery reliability is dramatically improving. The fourth chart shows replacement rates by generation: Gen 1 vehicles (2011-2016) had an 8.50% battery replacement rate. Gen 2 (2017-2021) dropped to 2.00%. Gen 3 (2022+) is sitting at 0.30%. That’s almost a 30x improvement. The “batteries don’t last” argument is dead for newer vehicles.

But none of that helps near-term demand. Without the $7,500 credit, EV average transaction prices in October hit $59,125—roughly $9,400 above the industry average. Lease penetration dropped from 71% in September to 60% in October as the credit arbitrage disappeared. Affordability was always the core challenge with EVs. Now it’s worse.

Near-term, I’m bearish on the U.S. EV adoption curve. Without subsidies, the economics don’t work for mass market consumers. Hybrids are the real winner here—Hyundai’s hybrid sales surged 41% in October while their EV sales crashed 57%. That’s where the marginal buyer is going.

Long-term, the global EV story remains intact. China is going to keep building, keep innovating, keep dropping prices. European tariffs and U.S. 100% tariffs keep BYD out of Western markets for now, but that won’t last forever. When Chinese EVs eventually break through—whether via Mexico plants, regulatory changes, or whatever—it’s going to be a bloodbath for Western OEMs still trying to figure out how to build a profitable $30,000 EV. That is simply just the story with any electronic device. The same 4K TV that cost over $1,000 years ago is now mass produced by China for $250.

On the technicals, I don’t see too much. I thought the Rivian chart was interesting on my last update with near term support around the 13 area. However, now it seems a little bit pricey for the narrative. I do like Rivian over other EV’s though as they have good connections with companies like Amazon and the postal service on modernizing their delivery fleets.

Tesla could still be the near term layup. The fact that it is barely down from the October highs is insane to me. I’m bearish against that 460 area on a tactical basis.