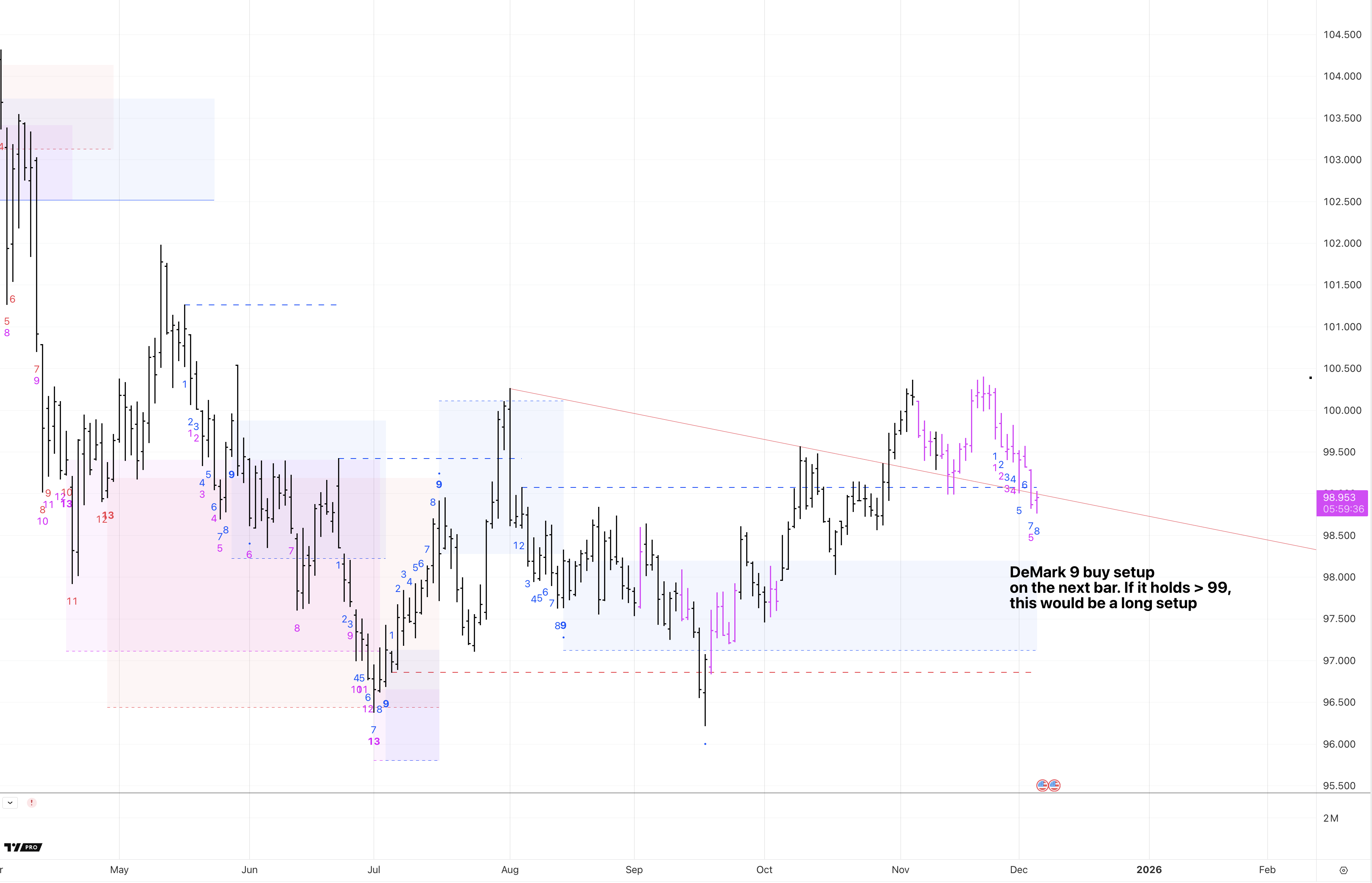

Trading the dollar now has been very tricky. It has been trading between 96 and (at the November highs) around 100, since the Spring. The index briefly crossed above the 200-day moving average for the first time since March, and then immediately rolled over. I would describe this as classic failed breakout behavior.

The setup here is messy. You have the longest government shutdown in U.S. history (43 days: October 1st to November 12th) which created a data blackout that blinded the Fed. You also have rate cut uncertainty with Powell explicitly saying December is “far from a foregone conclusion.” Finally, labor data is coming in now that the government has reopened—and it does not look too good.

ADP showed a 32,000 decline in private sector jobs for November, which was a third monthly drop in the last four months. Challenger layoffs climbed to 71,321 in November, which was the highest for that month since 2022. Year-to-date layoffs are now at 1.17 million, the highest since 2020.

The tariff situation adds another layer of complexity. The average applied U.S. tariff rate is now around 17.9% as of September—which is the highest since the 1930s. The Supreme Court heard oral arguments on November 5th on whether Trump’s IEEPA tariffs are legal or not. Lower courts already ruled them unconstitutional, but they remain in effect pending appeal. If SCOTUS upholds the lower court rulings, a big chunk of tariff revenue disappears and the administration has to find a different authority.

On the technical side, I am seeing a potential retest of a small breakout if the index can hold above 99 here. We have a DeMark 9 buy setup that is close to the TDST breakout line and trend line. The highlighted pink bars are an entropy calculation utilizing a hurst exponent which let’s us know if chaotic regimes are in place, which it is indicating now. The gist is that you typically have explosive moves one way or the other, hence why I would not be in a rush to do anything until you get price confirmation higher for a long trade.

Tariffs should theoretically strengthen the dollar—you are taxing imports, which reduces demand for foreign goods and therefore foreign currency. Rate differentials still favor the dollar versus Europe and Japan in theory. But the gap is narrowing. ECB will likely keep cutting. BoJ is signaling incoming rate hikes—Ueda’s comments moved the yen meaningfully last week.

Tariffs should theoretically strengthen the dollar—you are taxing imports, which reduces demand for foreign goods and therefore foreign currency. Rate differentials still favor the dollar versus Europe and Japan in theory. But, the gap is narrowing. ECB will likely keep cutting. BoJ is signaling incoming rate hikes, and Ueda’s comments moved the yen meaningfully last week.