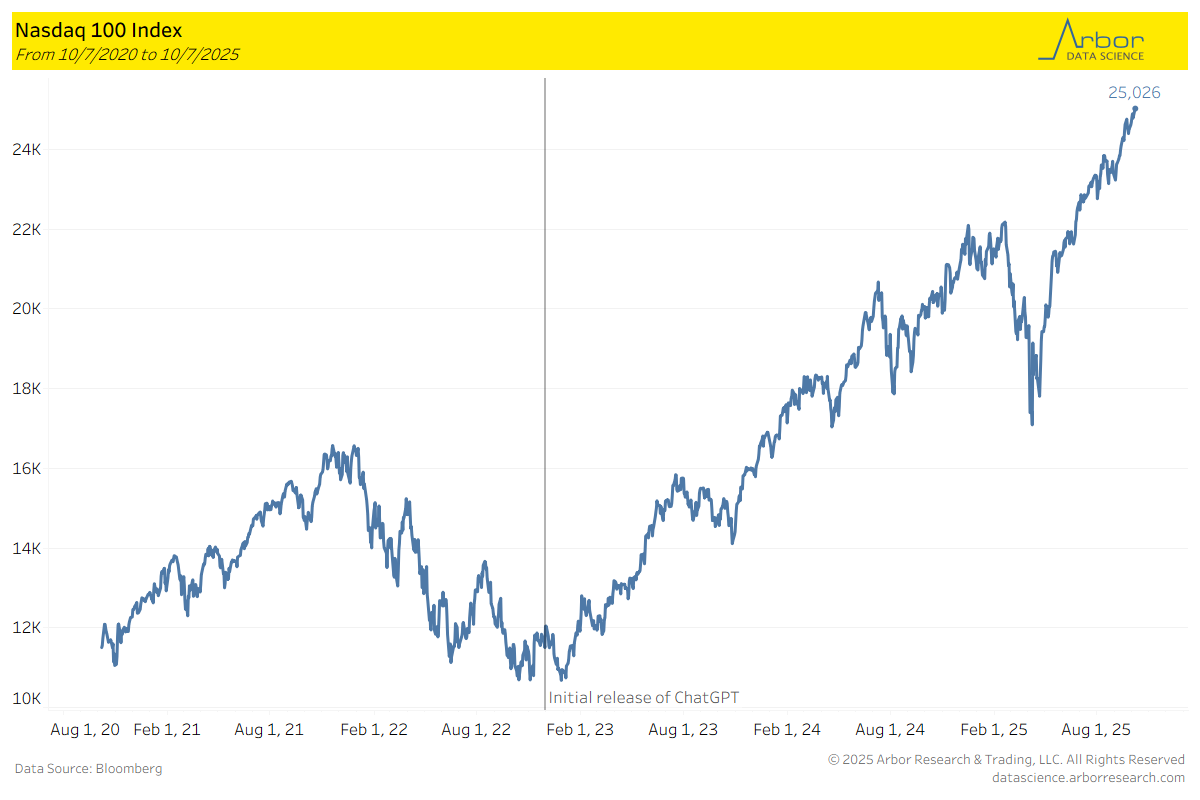

Since the advent of Large Language Models (“LLMs”), AI has been on the forefront of investors’ minds. This is true when it comes to capital expenditures and growth. Since ChatGPT was launched, AI related names have accounted for 75% of equity market returns. At the same time, the K-shaped economy continues to form a “capital” K. From my perspective, it seems that the gains in the tech market over the last few weeks have been driven by news about circular funding. The problem with these circular deals is that they can obscure real demand and inflate the actual value of chips and cloud services. News was released on 10/7/2025 that Oracle’s margins were extremely slim on the AI cloud segment, so slim that they actually lost more than $100 million net.

I’m really not one for bubble calling, since buy-and-hold in America has been one of the greatest ideas since the advent of capitalism. In fact, even if you thought we were in a bubble, the capital gains and taxes that one might pay to take the gains is usually offset by the gains in the following years. So, it’s often not economical for long-term investors to exit the market. Nevertheless, in echos of the dot-com boom, it illustrates how companies have funded their own clients to report higher growth. This is starting to become apparent in the current tech market.

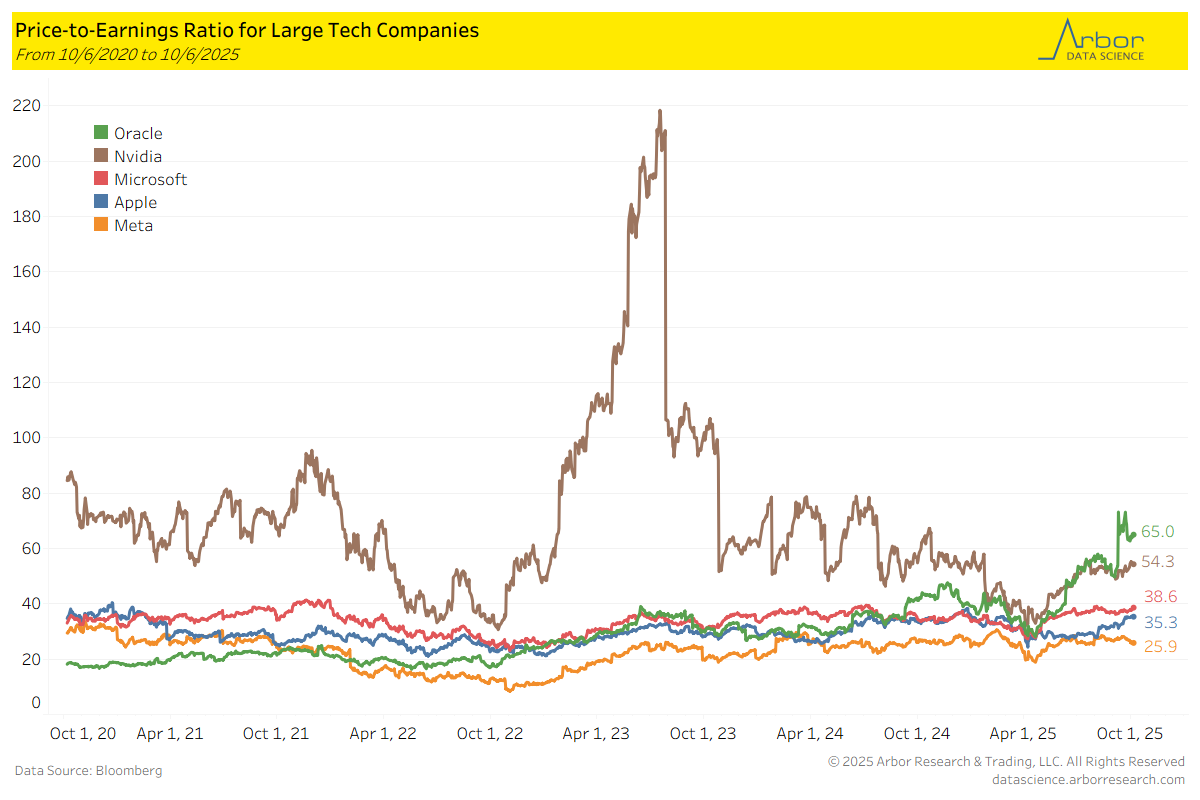

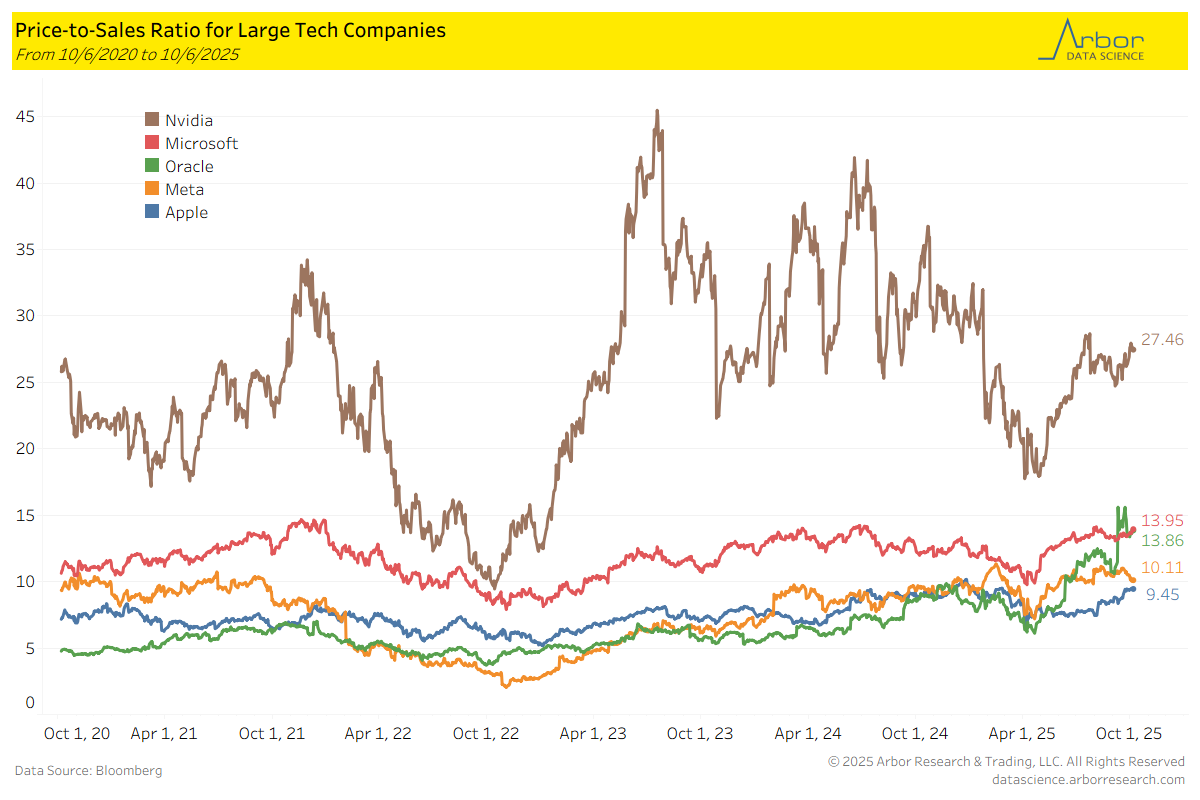

Without earnings growth from AI, we are starting to see valuations like price-to-earnings and price-to-sales become stretched for the big tech names.

I’ve attached a weekly DeMark chart of QQQ which shows a combo 13 and 9 setup completing last week. I’ll be watching closely, but things like staples have gotten left by the wayside and are outperforming today even when tech is down a decent clip. My thought here is that it is reasonable to be defensive on big tech while being okay with underperforming if the money grab continues. However, if this Oracle news ends up being a red flag for the entire market, it might have been the nail in the coffin, at least short term until valuations come back to more reasonable levels.